Summary:

- Rocket Lab is establishing itself as a leader in the space industry, differentiating from competitors and becoming the number 2 player behind SpaceX.

- The stock price is expected to rise from $5 to $15 by the end of 2025 as the company increases launch cadence, introduces the Neutron launch vehicle, expands revenue, and delivers key government contracts.

- Factors that could disrupt this thesis include launch delays, the unprofitable nature of the space industry, and potential delays in the Neutron launch.

BlackJack3D

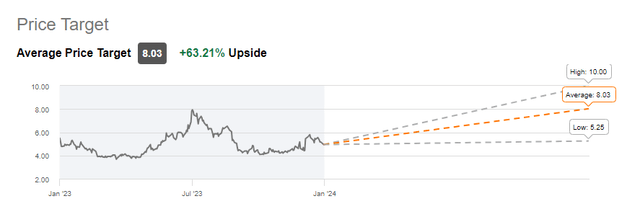

Rocket Lab (NASDAQ:RKLB) continues to establish itself as a leader in space launch and systems, differentiating itself from launch focused competitors like Astra, Relativity and United Launch Alliance. Wall Street analysts see the stock rising to $8.03 in the next twelve months. I personally have confidence that the stock price will at least triple from $5 to $15 over the next 24 months, increasing their market cap from $2.5b today, to $7.5b. This move will be underpinned as the company executes its strategy by: increasing launch cadence of Electron, introduces Neutron, their medium sized launch vehicle and expands revenue to $400m in FY2024 and $600-700m in FY2025.

Company Overview

Established in 2006, Rocket Lab has grown over the years into an end to end space company. End to end meaning Rocket lab has the capability to create spacecraft and spacecraft solutions by providing whole satellites, satellite subsystems, launch capability, onboard software and flight management. Rocket Lab’s wholly owned subsidiary SolAero is one of the premier satellite solar companies in the world. The company’s small launch vehicle, Electron, has launched over 40 times since 2017 and the company will debut their medium launch vehicle, Neutron, in the next 12 months. The company went public via SPAC in August 2021 via Vector Acquisition corp.

Several Simple Reasons I’m Bullish

There are several announcements that have come to light over the past six months at Rocket Lab that really have me fired up. These announcements and accomplishments will in turn drive the top and bottom line for the company over the next 24 months.

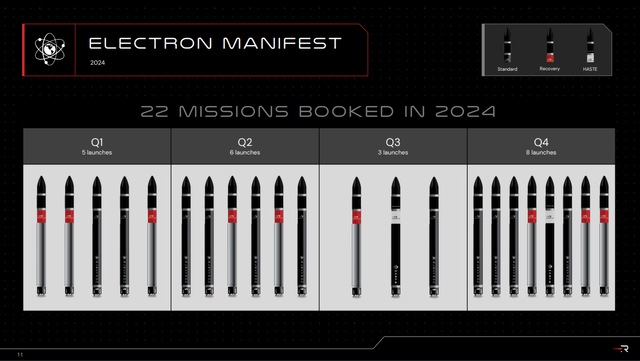

Firstly, the Electron rocket launched over ten times in 2023, making it the second most launched US vehicle 5 years in a row. The company anticipates doubling its launch cadence from the ten launches in 2023 to over twenty in 2024. During the 3Q 2023 earnings call, Peter Beck, the Founder and CEO, eased investors with a preview for 1Q 24 earnings and also the entire flight manifest for Electron in 2024. Electron now has three pads to launch from, two in New Zealand and one in Wallops Island, Virginia. Increased cadence is something I can get used to as a shareholder and avid supporter of space exploration.

2024 Electron Launch Manifest (3Q Earnings Report)

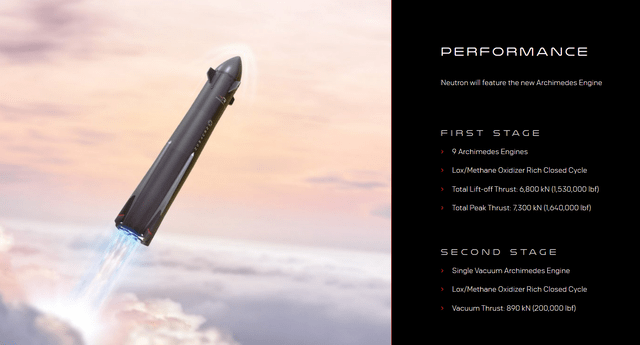

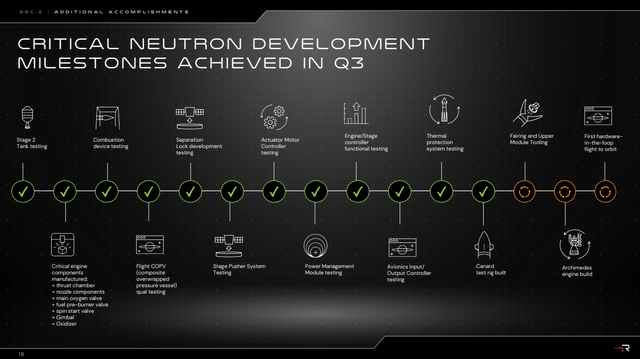

Coupling the increased launch cadence of their small launch Electron rocket, Rocket Lab announced part of their capital raise from their listing in 2021 would go towards a medium launch vehicle that will compete with SpaceX’s Falcon 9 rocket. Neutron, originally planned for first launch by year end 2024, has ongoing speculation that there will be delays. That said, recent graphics have appeared that testing remains on track. The key remaining item to test is the Neutron’s Archimedes engine in 1H 2024 and the rest of the testing should go swimmingly. Recent interviews with Beck give me confidence that Neutron will have their first launch by YE2024 or 1Q 2025. The Neutron increases payload to lower earth orbit by 40x compared to the Electron rocket (13,000 kg vs. 300 kg)

Neutron Rocket & Specs (Rocket Lab Website)

In early 2022, MDA subcontracted out the design and build of 17 spacecraft for Apple’s large Globalstar contract. The design will include solar panels, software, and reaction wheels all manufactured by Rocket Lab wholly owned subsidiaries. The first of these satellite deliveries is expected in 1Q2024 (noted in 3Q23 earnings call). Globalstar is expected to launch the satellites by year end 2025 and once in orbit be controlled and monitored by Rocket Lab’s Satellite Operations Control Center in Denver, Colorado. Next time, I anticipate that Globalstar will come to Rocket Lab themselves rather than get it subcontracted out through Canada’s MDA.

Over the past 12 months, Rocket Lab has been given two government contracts by both the Space Force and the Department of Defense. In my opinion, these two contracts are the beginning of a new era for Rocket Lab as the government continues to lean on it for delivery.

In June 2023, Rocket Lab launched its first HASTE (Hypersonic Accelerator Suborbital Test Electron) mission from Wallops Island, Virginia. HASTE is a modified Electron rocket that is suited for sub-orbital launches which increase payloads from 300kg to 700kg, which may be crucial for suborbital or hypersonic flights. Coupled with the Space Force’s Space Development Agency (SDA) contract, Rocket Lab’s first Defensive prime contract to develop 18 Transport Satellites worth $515m. Two absolutely massive contracts, and Rocket Lab knocked it out the park.

The confidence I get from the $515m SDA contract is immense, satellites are expected to launch in 2027 and monitored with Rocket Lab software until 2030 or beyond. To me this means the government has done its due diligence and has confidence that Rocket Lab has a financial framework to withstand the test of time between now and 2030.

And lastly, there are a number of bankruptcies, near bankruptcies and companies transitioning business models away from launch or space systems. Firstly, Rocket Lab took advantage of the Virgin Orbit bankruptcy in early 2023 by buying a California warehouse and other manufacturing assets for pennies on the dollar. Other companies like Astra and Velo3D continue to have financial struggles and are either diluting shareholders for capital to stay alive or are writing convertible loans to keep the company afloat. Other companies have spent billions of dollars in an attempt to launch a single rocket (Relativity) and are now in development of an untested rocket, leaving them way behind Rocket Lab.

Let’s Get To The Numbers

Rocket Lab market capitalization currently trades at a Price to Sales of approximately 10x its 2023 revenue of $240-$250m. With the quality and nature of the contracts Rocket Lab is receiving (DoD and SDA), I anticipate the P/S to stay at 10 or slightly increase over time. Thus as revenue increases to closer to $400m in 2024, and $600m-$700m in 2025, I anticipate the market cap to track closer to $6-7bn before P/S expansion, which is close to the $7.5bn market cap, or $15 stock price target I have for YE 2025.

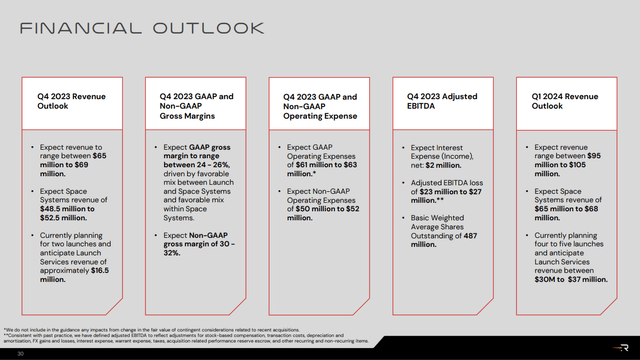

4Q 2023 Estimates and 1Q2024 Estimates (3Q Earnings Report)

For context, SpaceX valuations circulated in 2022/2023 at north of $100bn, has had recent rounds at $150bn+, all the while 2022 revenue was just below $5bn. Thus SpaceX’s P/S as leader in the space was in the realm of 20-30x price to sales. Rocket Lab is several years behind SpaceX when it comes to launch and space systems (Starlink), and RL has much to execute on before being listed in the same league as SpaceX, thus a 10x multiple seems reasonable for now and may expand as it executes.

Below I note a few areas where I think P/S can start to expand beyond 10x:

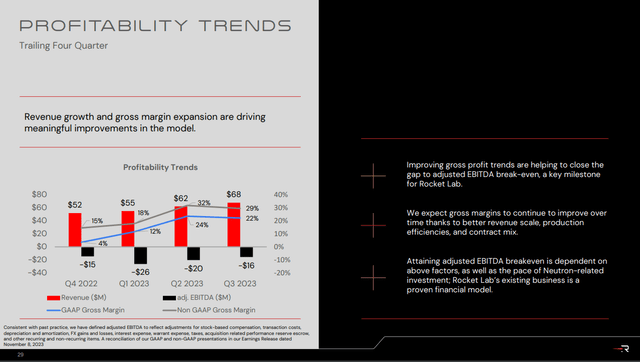

Expanding Gross Margins: Adam Spice noted that gross margins are continuing to trend in the right direction over the trailing twelve months, meaning for every dollar in revenue, the company is realizing a higher gross profit. This is a catalyst to drive price to sales north of 10x. In recent quarters, Spice commented space systems gross margins have grown beyond 30% and he has not seen a contract below 30% in some time. In the same breath he noted the increase in launch margins closer to 50% as Electron reaches 6 launches/quarter and with hull and engine reusability.

This has driven margins on a GAAP basis from low single digits just a year ago (4Q2022) to 22% in the 3rd quarter and driving to mid-20% margins in 4Q.

TTM Profitability Trend (3Q Earnings Report)

Upcoming Neutron Contracts: While no Neutron contracts have been disclosed to the public as of yet, Spice has been quoted stating the initial price tag for Neutron launches on the order of $50m-$55m, which is 18-25% cheaper than the SpaceX Falcon 9 ($67m/launch). The ambition for Neutron is full reusability between 10-20 times per vehicle and gross margins on the order of 50%. In a few short years as the cadence of Neutron increases to 1-2x/month, the vehicle will be a $0.5bn-$1bn/year revenue driver for the company. And once again putting another catalyst to put a premium on the P/S of Rocket Lab.

Drive towards profitability: As gross margins reach their expected long term levels and as YoY revenue grows by 60% from 2023 to 2024 and by 50-75% from 2024 to 2025 and research and development costs come down to support Neutron start-up costs, I anticipate the company to start generating positive adjusted ops cash in the 4th quarter of 2024 or 1H 2025. (Adjusted meaning less the $10m/qtr in share based compensation)

How Does Wall Street And Seeking Alpha View The Stock?

I align well with Street and Seeking Alpha analysts on my buy rating for Rocket Lab. While I have a 24 month price target on the stock, I stand with the $8-10 upper end price target the Street has on the stock. This price increase represents a minimum 60% return in the stock price over the next 12 months.

Peer Analysts on Seeking Alpha currently rate Rocket Lab a 4.2 out of 5, which signals between a buy and strong buy for the stock. SA analysts have 5 buy recommendations on the stock in the last 90 days and 1 strong buy.

Wall Street analysts currently rate Rocket Lab a 4.3 out of 5, with 5 strong buy recommendations within the last 90 days, 2 buy recommendations and one hold recommendation

Wall Street 12-mo Price Target (Seeking Alpha)

What Might Disrupt My Thesis?

There are several areas where I see risks that can throw off my analysis for Rocket Lab in the next 12 to 24 months and impact my $15 price target for YE2025.

Firstly, Rocket Lab has observed launch delays in the past due to weather and customer preparedness. Discussions during the 3Q 2023 earnings Q&A posed if RL was prepared to fill voids for such customer delays in the 22 launches scheduled on the manifest for 2024, and feedback from management was positive. That said, while planning may eliminate some delays, I anticipate doubling the cadence from 2023 will be a tall task and I anticipate total launches for the year to be under 20.

Second, while Rocket Lab has been making strides to increase gross profit margin for their launch and space systems business (closing in on 30% GM on an adj Non-GAAP basis), space is a historically unprofitable business. In the sector, many companies go bankrupt and/or put a drag on industry valuations. Even if Rocket Lab is a diamond in the rough, I anticipate there will be a drag on the stock price due to the industry it is in. For now, Rocket Lab is not valued at a premium like SpaceX, and until Rocket Lab reaches EBITDA break even or even cash flow break even, the fear of bankruptcy or diluting shareholders to make up capital shortfalls will always be in the back of people’s minds. I believe this will happen regardless of whether or not Rocket Lab is in better shape than most of its peers in the industry.

Third, the rumors around Neutron launch delays need to be addressed in the 4Q earnings call in February. There were several key deliverables missed in 3Q 2023 that were vital to moving forward with testing in 4Q 2023. Any delays will push Neutron launch into 2Q2025 or 2H2025 to this will impact the first awarding of Neutron contracts and push movement of the stock price into 2026 or beyond.

3Q23 Neutron Testing (3Q Earnings Report)

Conclusion

Rocket Lab is establishing itself as a leader in the space industry, differentiating from other small and medium competitors and developing into the number 2 player in the space behind SpaceX. The stock price will rise from $5 today to $15 by year end 2025 as the company demonstrates an increased Electron launch cadence, Neutron launch, revenue expansion and key government contracts with the Space Force and Department of Defense. Financially, Rocket Lab’s market capitalization is expected to increase substantially, driven by rising revenues coupled with an expanding price to sales (10x+) as catalysts like improving gross margins and upcoming Neutron contracts are realized. While my views on Rocket Lab price targets are optimistic, it does not seem to vary much from Wall Street expectations. Looking through Seeking Alpha, it is reassuring to see other Seeking Alpha articles share similar sentiment that I do about Rocket Lab’s future. My optimistic views on the $15 price target may be hindered by potential launch delays in both Electron and Neutron as well as the historically unprofitable nature of the space industry. Regardless, the next 24 months for the company will be really exciting to watch!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RKLB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.