Summary:

- Rocket Lab’s 2023 earnings show strong growth, with a record 25 launch deals signed and a launch contract backlog exceeding $1 billion.

- Despite positive results, investors have concerns about the safety and profitability of Rocket Lab’s Electron launch business.

- The company is under pressure to launch its Neutron rocket by December 2024 to compete with other legacy launch providers.

Phil Walter/Getty Images News

Rocket Lab (NASDAQ:RKLB) announced its financial results for the year 2023 last week, which already showed high volatility after the immediate sell-off of more than 6% on the trading day following the earnings announcement. At first glance, the earnings results are not bad, but still cause some investors concerns. While we think the company will be under immense pressure until the end of 2024 because of different factors that we will dive into, our conviction is still with the company based on its fundamental and the fact that it is the second-most launcher in the US, as analyzed in our previous coverage.

2023 Earnings: There are hiccups, but the growth is still strong

- Record 25 launch deals signed a year across Electron and HASTE

- Launch contract backlog exceeds $1 billion, doubled compared with last year

- Awarded a $515 million contract from the Space Development Agency

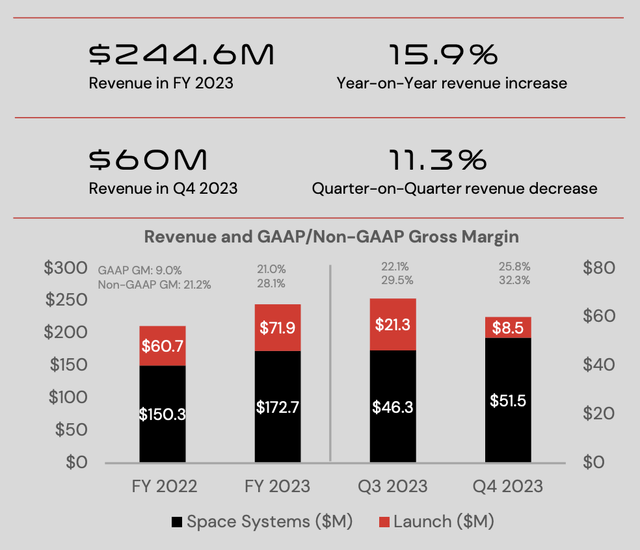

- 16% revenue growth year-over-year in Q4 even after a halt for almost 3 months

- Full-year loss, at $182.6 million, widened compared with last year due to more investment in Neutron

- Total cash and marketable securities dropped more than 48% than last year, primarily due to the continuous investment in Neutron; However, the company is still in a financially healthy state with a current ratio of 2.13

- Operating cash flow consistent with last year’s, with the company securing an additional loan to prepare for the intensive Neutron development in the coming year, offsetting the total cash outflow in FY2023

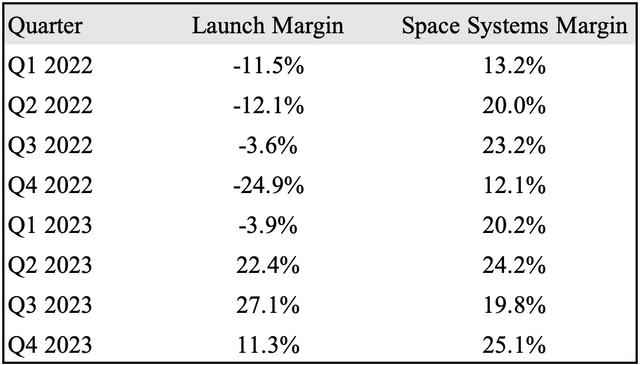

By the time my first analysis on the company was published, Rocket Lab’s launching business is still in single-digit negative gross margin. However, the company has turned it around and achieved a mid-twenty gross margin for the segment, with a target for next year at 50%. This year, we see the benefits of product diversification, with the company managing to hedge the loss in the launch service business with the high-margin space systems business, which accounts for 85% of the revenue this quarter. This is a very positive picture of a very successful strategy of the management.

Despite the good news, what’s wrong?

As an investor of Rocket Lab myself, I am happy to see where the company is at now. But why did it drop immediately following the earnings? In my opinion, there are several factors that people still worried about.

First, is Electron still a safe business?

By safe, it can mean the launch successful rate and if the failure in September 2023 and the underlying causes will happen again. My answer is no. Using risk management terms, Rocket Lab has encountered an unlikely event as described in the Swiss Cheese Model. This means that each step in a launch mission has its unique set of weak points just like the holes on every individual slice of cheese. Going through a hole does not mean it will go through another hole on another slice – and the occurrence of a mission failure is like having “overlapping holes”, which is a very low chance. This briefly described Rocket Lab’s issue in ripple voltage, the concentration of helium and nitrogen, and subsequently “electrical arc” which is very, very unlikely to happen.

But as shared in the previous earnings call, in the 7 weeks after the incident, the team in Rocket Labs has delved into more than 12,000 data channels and conducted extensive analysis of the mission’s manufacturing, test, and flight data. And rest assured, the company will not stop there at “finding out the cause” but at “solving the problem”, according to Peter Beck, the CEO.

But being safe to launch does not mean it is safe for Rocket Lab as a company to rely its business on, since the profit margin is still low in this business segment, and only by having a larger, more efficient launch vehicle can it compete with the new entrants such as Relativity and Firefly Space, and ultimately SpaceX. This brings us to the second question.

Second, when is Neutron ready?

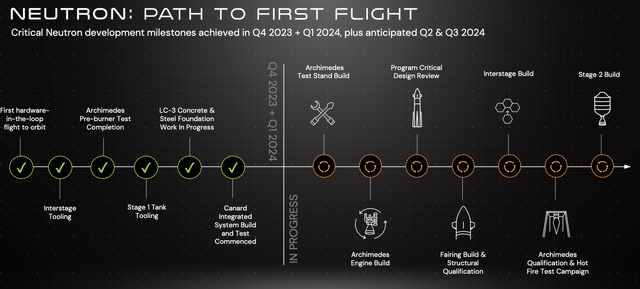

…so many engineers are sleeping under their desks at the moment to just push so hard to try and get that vehicle to the pad – Peter Beck, CEO

Who does not think the earlier Neutron is in the market, the better it is for Rocket Lab? But the reality is, the company has a deadline to catch. As required by the Space Force’s National Space Security (“NSSL”) Launch Phase 3, the new rocket companies like Rocket Lab can compete with the legacy launch providers like SpaceX and Lockheed. One of the most important criteria for being eligible for the contract is that the company needs to have a “credible path” to be able to launch by December 15, 2024 – this is the hard deadline that Rocket Lab needs to catch.

The management said that if the launch vehicle can be “on the pad”, it will be an unbelievable achievement. Regardless of what “on the pad” means here, be it “launching on the pad”, “displaying on the pad” or “testing on the pad”, the company is under immense pressure. But on the flip side, the wait for Neutron, a more profitable and scalable business is over – and when investors realize this, the company will be valued with a premium. But is that easy?

Third, being a competitive contender, there are other pressures

A day before Rocket Lab’s earnings, Defense One reported that the company would not be ready for launch quoting insider congress members. And a few days after the earnings, TechCrunch further leaked a congression memo about an internal discussion on Rocket Lab’s potential inability to deliver. Where are this pressure from? I will not talk rumors here, but here is one guess.

It is a reasonable assumption that being a competitive new contender in the market, you face a lot of pressure from existing providers. And this is not any free market, this is a market where many existing players have been doing business with the Space Force or Air Force for many years. As such, investors of Rocket Lab please brace for impacts.

Enough words, tell me how much Rocket Lab is worth

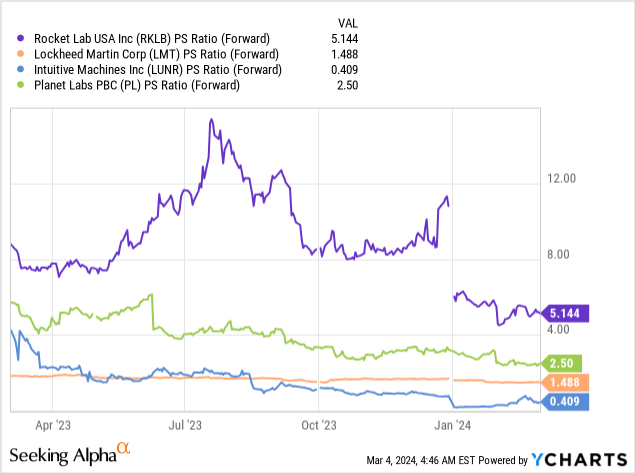

Firstly, I like comparing SpaceX and Rocket Lab. SpaceX is now worth $180 billion with its overall $9 billion revenue, nearly half of it is from the 96 launches and another half from Starlink.

With our estimation for Rocket Lab in 2026 having close to 30 Electron launches (a moderate increase from the current planned 22 for 2024 from the two launch complexes), 3 Neutron launches (With the company comparing Neutron with Falcon 9, SpaceX had launched 3 Falcon 9 in the third year of successful launch), and the space systems business, the company will generate $0.8 – 0.9 billion in businesses. Using the same valuation multiple of SpaceX, this will give the company around $18 in valuation. This is the bull case since SpaceX is a company with a valuation premium, similar to other Elon Musk’s companies.

Secondly, using the same revenue (i.e. sales) forecast, the base case which is the industry average of a 3x P/S ratio, the target price is at around $6. This is the base case because the peers compared are either established companies with very stable business and moderate growth (i.e. Lockheed Martin), companies without clear revenue projection (i.e. Intuitive Machine), or satellite companies which are software businesses.

Investment risks

I see Rocket Lab as a high risk high return business, as for all space businesses. Therefore, there are certain risks that investors need to pay attention to: 1) Electron may fail for any mission and will cause detrimental valuation impacts like its last fail, and Neutron, even on the pad, may fail for a couple of times just like what SpaceX did with Starship and its early days; 2) The space business is highly dependent on government contracts, and Rocket Lab may not only compete in the technology edge, but on lobbying and influence within the government; 3) Funding risks affect the company as much as other tech companies and a financing round will cause a deep drop.

Conclusion

I am a deep believer in Rocket Lab and a Strong Buy rating is given because the company has strong technology and fundamentals – and with the development of Neutron, the company will be able to improve its profitability and market share. However, it is almost certain that in the short-term trading point of view, the company will face a lot of volatility with more scrutiny and potential rumors about the company’s progress.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.