Summary:

- We rated Rocket Lab a ‘Strong Buy’ in January due to the company’s sizable backlog, progress on Neutron, and potential ‘space economy’ upside.

- Today, the company continues to execute, and we like management’s freshly articulated strategic aim for the company – to get into space services.

- While the valuation is speculative, we think it’s worth taking a shot on this competent team and impressive track record.

- We re-iterate our rating on RKLB as a ‘Strong Buy’.

Fertnig

In January of this year, we wrote an article about Rocket Lab (NASDAQ:RKLB) where we rated the company a ‘Strong Buy‘.

At the time, the company’s backlog was gaining strength, liquidity looked solid, and a lot of progress was being made on Neutron, the company’s re-usable launch vehicle (which is set to debut sometime in 2025).

While the company is commonly thought of amongst investors as a ‘little brother’ to competitor SpaceX (SPACE), it is still the second-most important space company in the United States, which is potentially a very profitable position to be in.

When we wrote the article, RKLB was trading at roughly ~$2.5 billion in market cap, which, given the opportunity, we thought looked very attractive.

Since then, shares are up considerably, outperforming the S&P 500 by nearly 3x:

In the interim, the company has released two more earnings reports and a slew of updates about progress on Electron, Neutron, and the Space Systems business, which we wanted to touch on in this article.

Management also released a soft update to RKLB’s strategic vision that we’re really excited about.

Today, we’ll be analyzing recent developments in RKLB’s business – including this new strategic focus – and we’ll explain why we’re still hyper-bullish on this up-and-coming end-to-end space company.

Sound good? Let’s dive in.

Rocket Lab’s Financials

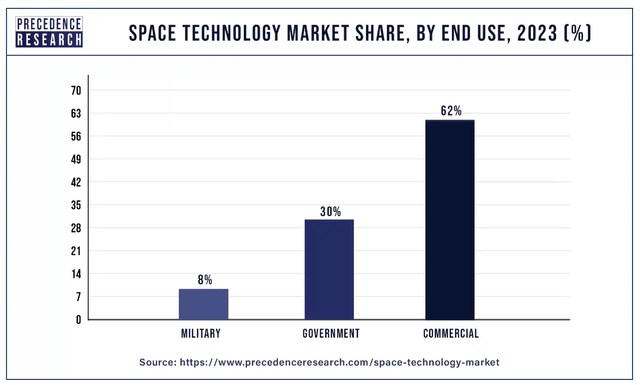

Any conversation about RKLB has to begin with the size of the space economy opportunity.

Depending on who you ask, the space economy is supposed to grow to at least $1 trillion by 2033, and potentially $1.8 trillion by 2035 from a base of somewhere between $440 billion and $630 billion today. These estimates are a bit far apart due to differences in how you slice the different ‘segments’ of the space economy, and what you end up including.

That said, no matter which one is more accurate, the clear message here is that commercial investment into space is heating up.

Traditionally thought of as a domain exclusively occupied by Governments and Militaries, you might be surprised at how much commercial activity happens in space nowadays:

Why the growth?

Because space is the place to be when it comes to enhancing the utility of your product.

Whether you’re Starlink offering space-based internet to subscribers, Planet Labs trying to image the entire planet once per day, or Uber (UBER), simply trying to give your service a higher level of accuracy when it comes to pickups and routes, a LOT of commercial applications today rely on space to function.

Servicing these players are so called ‘backbone’ companies, that handle spacecraft manufacturing, launch, and systems. SpaceX, as we mentioned, is the top dog in this field, but RKLB is gaining ground.

Today, we’ll take a look at some company updates from over the last 8 months, and then we’ll explain why we’re bullish on RKLB’s long term vision.

First, some updates.

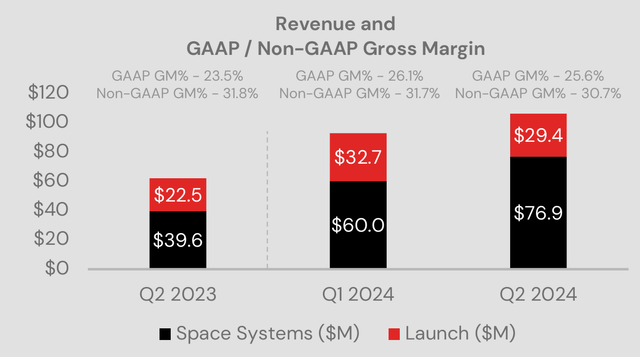

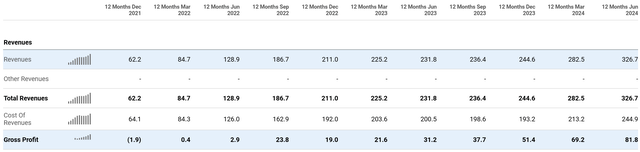

On the financial side, RKLB’s has strung together a few solid quarters from a top and bottom line POV.

Q2 Revenues grew 71% YoY, and sales have grown to more than $325 million over the last twelve months overall, which is an all time high.

Profitability has also improved somewhat, as gross margins topped 25% in Q2:

This is due to an improving mix on the launch side as promotional pricing has mostly flushed through the system. Systems has also grown considerably with a number of new contracts that we’ll talk more about in a minute.

While the company is still unprofitable on a net basis, TTM bleeding has slowed quite a bit and has begun to move in the right direction.

Powering this revenue growth has been strength in both the launch and space systems segments as we mentioned.

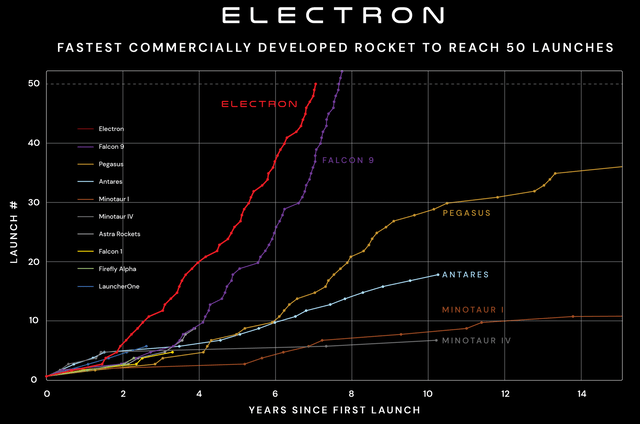

Electron has been doing well, completing 4 launches this quarter vs. the 3 it did in Q2 2023. From a milestone standpoint, the light launch rocket just broke the record for the fastest commercially developed rocket to reach 50 launches, which is ahead of Falcon 9:

This shows how quickly RKLB has been iterating and executing, which is no mean feat.

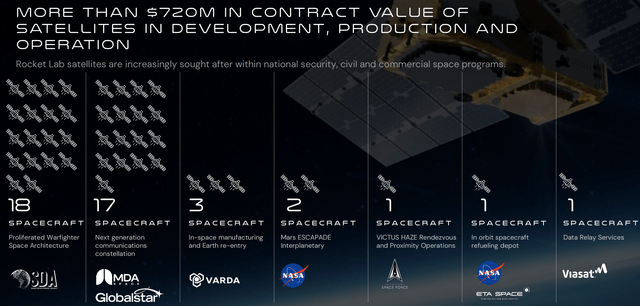

RKLB’s systems business has also been performing well, with a number of new contracts announced in Q2, which adds to the growing development pipeline:

Among these contracts are a $515 million constellation for Scorpius and the Space Development Agency, and a space-pharmaceutical-manufacturing system for Varda Space Industries.

The bottom line here is that the company seeing big demand for space systems, which validates RKLB’s mission of being an end-to-end space company.

Let’s now talk about RKLB’s updated strategic vision, which management has been doing a better job of articulating as of late.

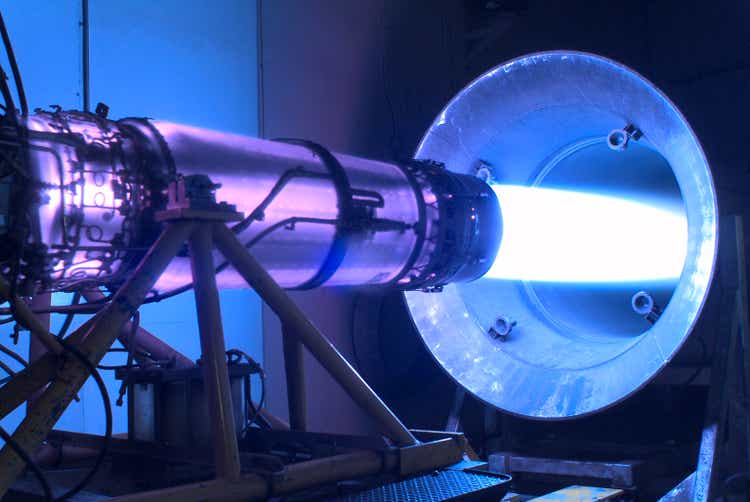

The first piece of this is the company’s Neutron rocket, which has continued to make progress. On the Q2 earnings call, CEO Peter Beck had the following to say:

I’m pleased to confirm we’ve largely progressed past the design phase and we’ve moved swiftly into production and qualification of flight hardware for 100% of the vehicle. With flight articles now coming together, we’re on track to first launch for mid-next year.

A lot of organizations will focus their attention on their first rocket but we knew that –that would be very important to build up all the infrastructure and to support production, test and launch in the long term so that’s what we’ve done in parallel.

[Finally, we] recently [had] a successful Archimedes hot fire. We started off with a series of low power hot fires with great results then cranked it up to put the engine through its paces. We’ve now reached main stage hot fire at 102% power. Now taking a new stage combustion liquid rocket engine from clean sheet design to hot fire in a flight configuration in just a couple of years is really industry leading stuff.

RKLB estimates that Neutron’s TAM is about $10 billion, which alone should prove to be a huge potential business driver if and when it comes online.

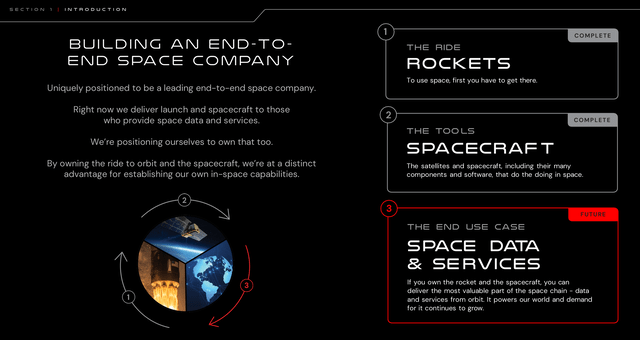

However, the key here is how RKLB now sees itself positioned in the space value chain.

The company has realized that only a handful of companies are actually able to get cargo to space and manufacture the components necessary to make space ‘work’.

As one of those companies, the market opportunity is much larger than just the ‘backbone’ launch and spacecraft market – RKLB can begin capturing some of the services utility as well. Here’s a slide explaining this leverage from the recent Q2 slides:

This is exactly the playbook SpaceX has run with as they launched Starlink, and we see RKLB capturing a similar opportunity here.

As we see it, the company has done a good job improving gross margins, validating the product, and building the infrastructure needed to get to space consistently.

Now, we anticipate that the business will grow, launches and spacecraft demand will pick up, and RKLB can begin monetizing the space services opportunity with its reusable Neutron rocket.

This model wouldn’t work with Electron, but with a reusable launch vehicle, the incremental cost comes down drastically when it comes to building an internal IRR case for space services.

Rocket Lab’s Valuation

Right now, RKLB is valued at around $3.4 billion, which is expensive relative to the company’s financial performance so far.

As we said, on a net basis the company is still less than breakeven, and the company’s record quarterly and TTM revenues still only sit at $106 million and $326 million respectively:

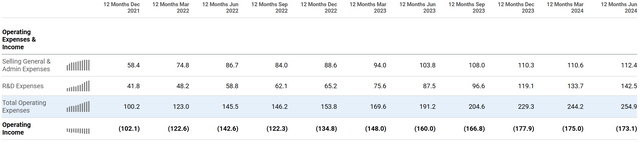

This is less than 1/10th of the market cap, which doesn’t even take into account the fact that ‘fixed’ costs in this operation are near 35% of revenue, and total operating costs are 78% of revenue:

With only 25% GAAP gross margins, the company’s revenues will need to grow substantially to make RKLB economically feasible in the long term.

However, that’s exactly what we anticipate will happen.

RKLB’s backlog alone is worth roughly $1 billion, and we see rising demand for RKLB’s offerings as competitors in the industry consolidate.

With $500 million in cash, limited current liabilities, and narrowing losses, we think that RKLB has considerably runway to achieve its dream. With every successful launch, investors are also likely to keep giving management rope with which they can further the vision.

We see the company breaking even at around $1.4 billion in revenue. This would mean (with some economies of scale), roughly $400 – $420 million in gross profit, which could cover operating expenses which would have grown from $250 million now to ~that point roughly when the company would be producing that much revenue.

With 70% YoY top-line growth, a big backlog, and growing demand, it’s not impossible to think that the company could reach this much in annual revenue sometime in the next 3–4 years.

At that point, we’d estimate that a financially stable space company going after the services market with a proven, re-usable rocket and limited competition would be worth at least $10 billion (a 8x sales multiple) as a hyper conservative estimate.

In 2024, SpaceX could do roughly $13 billion in revenue, and in December, the company was valued at $180 billion. This is a 14x multiple.

If RKLB can grow, become breakeven, and begin capturing the space economy opportunity more thoroughly, we think the company could be worth roughly 10x within 6-8 years, if not more.

Risks

The big question here is if.

There are a lot of steps that need to happen in order for RKLB to achieve this massive upside, chief among them being a successful launch of the Neutron rocket sometime on schedule in 2025. This would cement the company as a true player and offer the company a cheaper way to space to begin building a services offering, which is the thing that really has a lot of long-term value for shareholders.

Second, RKLB needs to keep winning new business on the Space Systems front. Right now, the company has done this, and in the words of the CEO, the team is highly capable:

What I will say is our team has earned a reputation for delivering high quality spacecraft on rapid timelines and these programs are tracking no differently. We had a huge milestone recently by completing production and test of two identical spacecraft for the NASA Mars mission. It’s not uncommon for an interplanetary mission to take a decade to go from design to flight ready so to design, build and test not one but two Mars spacecraft in around three years is pretty impressive.

RKLB does continue to win new contracts, but there are always execution risks when it comes to something as complex as running a launch and space systems company.

Finally, the valuation has an immense amount of future value baked into the price. This is from RKLB’s track record of delivering on targets, and the general level of integrity from management.

That said, if any of the company’s targets aren’t met, or there’s a sense among investors that deadlines are getting pushed and the wheels are falling off a bit, then we could see the multiple cratering quickly.

Between these risks, there’s every chance that the company could fail, or the stock could get crushed on any given day. As such, we see the general risk profile here as a LOT higher than what it would be for the average company.

Summary

Taken together, though, RKLB seems like a highly compelling opportunity.

There are a lot of risks to consider, but the opportunity of becoming a true end to end space company could result is tremendous profits for investors over time.

On balance, we fall into the camp of thinking it’s worth taking a shot on the firm.

Thus, we re-iterate our ‘Strong Buy’ rating.

Stay safe out there!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RKLB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.