Summary:

- Space stocks are getting exposure with recent ASTS contracts.

- Rocket Lab has a strong cash position of $540m, setting them apart from struggling competitors.

- Anticipation of revenue growth from Neutron, space systems, and Haste missions leading to potential stock price increase to $15 by end of 2025.

Maliflower73

Rocket Lab (NASDAQ:RKLB) and many other space related stock prices have begun to rise over the last few weeks as recognition of large contracts and potential contracts have come into focus. This comes on the back of a great second quarter of results for Rocket Lab where revenues are up 71% year over year, Electron delivered its 50th launch – faster than any other rocket in history, and a key delivery milestone for the company’s medium launch vehicle Neutron. Those notables out of the way, there is much to look forward to before the stock can sustain a break out above the $8 range, in my opinion, the next 12-18 months we are on the path to a new wave of growth for the company, and with a $3.4bn market cap valuation at the time of writing this, I find there is much upside to be had here.

Rocket Lab has a stellar $540m cash position at the end of 2Q, all the while many competitors in the industry are struggling. Notable rocket or part makers have already declared or are on the verge of bankruptcy, namely Astra, Velo3D, Mynaric. Thus setting Rocket Lab apart from many in the industry that are cash strapped, this allows the team the ability to acquire bolt-on assets for pennies on the dollar as was done with Virgin Orbit earlier last year.

While I anticipate sequential revenue growth to slow between now and mid-2025, there are many avenues which could generate the next tranche of revenue growth for the company as we proceed into the second half of 2025 and into 2026. Most evident is Neutron and the continued milestones that will be delivered in the second half of 2024 ahead of the mid-2025 launch, which still seems to be attainable. The second is continued growth in the space systems arena, with SDA and other government agency spending increasing and competitor list shrinking, more dollars will eventually lead to Rocket lab in the second half of the decade. And lastly, Haste – while there has only been one Haste launch from Wallops Virginia in June 2023, there are four Haste missions for separate clients happening in the next 6–9 months and I believe the Haste contracts are the least obvious but next leg-up for the Electron/Haste platform. The cadence of Haste could grow to be greater than Electron’s and will provide a consistent revenue stream with decent margins if fully built out.

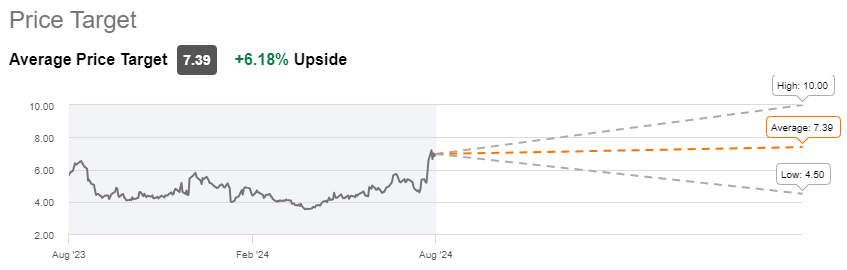

Rocket Lab will continue to demonstrate its experience and capability over the coming 18 months and finish 2025 with a $15 stock price, or just shy of a $7.5Bn market cap. Wall Street Analysts see the stock rising to $7.39, or 6% upside, in the next 12 months.

Company Overview

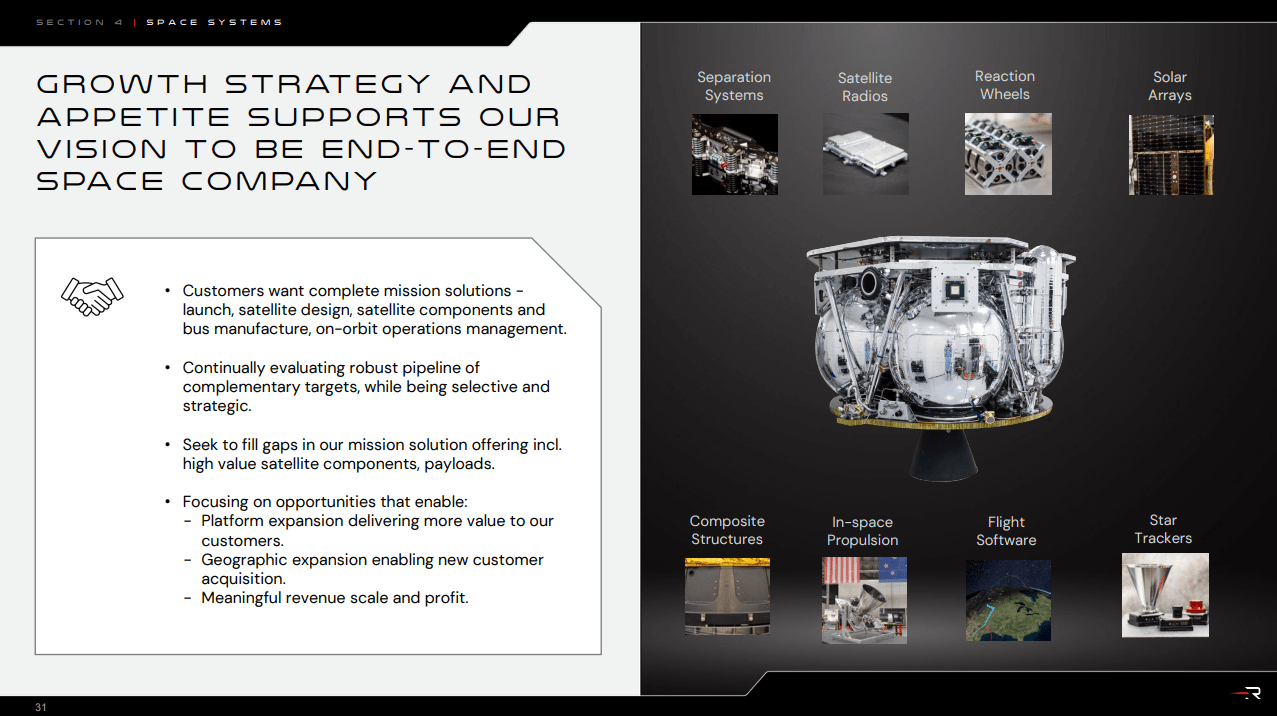

Established in 2006, Rocket Lab has grown over the years into an end to end space company. End to end meaning Rocket lab has the capability to create spacecraft and spacecraft solutions by providing whole satellites, satellite subsystems, launch capability, onboard software and flight management. Rocket Lab’s wholly owned subsidiary SolAero is one of the premier satellite solar companies in the world. The company’s small launch vehicle, Electron, has launched over 50 times since 2017 and the company will debut their medium launch vehicle, Neutron, in the next 12 months. The company went public via SPAC in August 2021 via Vector acquisition corp.

Follow-up from my previous Rocket Lab article

In January 2024 I first wrote about my bullish view of Rocket Lab, noting their end to end vision as a space company which differentiates them from many other launch only or space systems only organizations. While that article highlighted 2024 being the year of Electron delivery with an expected 22 launches in the manifest, as noted in my risks, the range they are now looking to achieve is 15-18, this is still an increase from 2023 and a step in the right direction. What continues to give me confidence is that the delay for launch has been satellite readiness, not launch readiness, which demonstrates that Rocket Lab continues to do as they say and are ever ready to launch satellites. The second item is the delay of Neutron launch by six months – originally after hearing this news, I anticipated that would drag on my $15 price target, however there are so many other items that have come to fruition in the space systems front and potential with Haste, that I remain steadfast on my $15 price target for year end 2025.

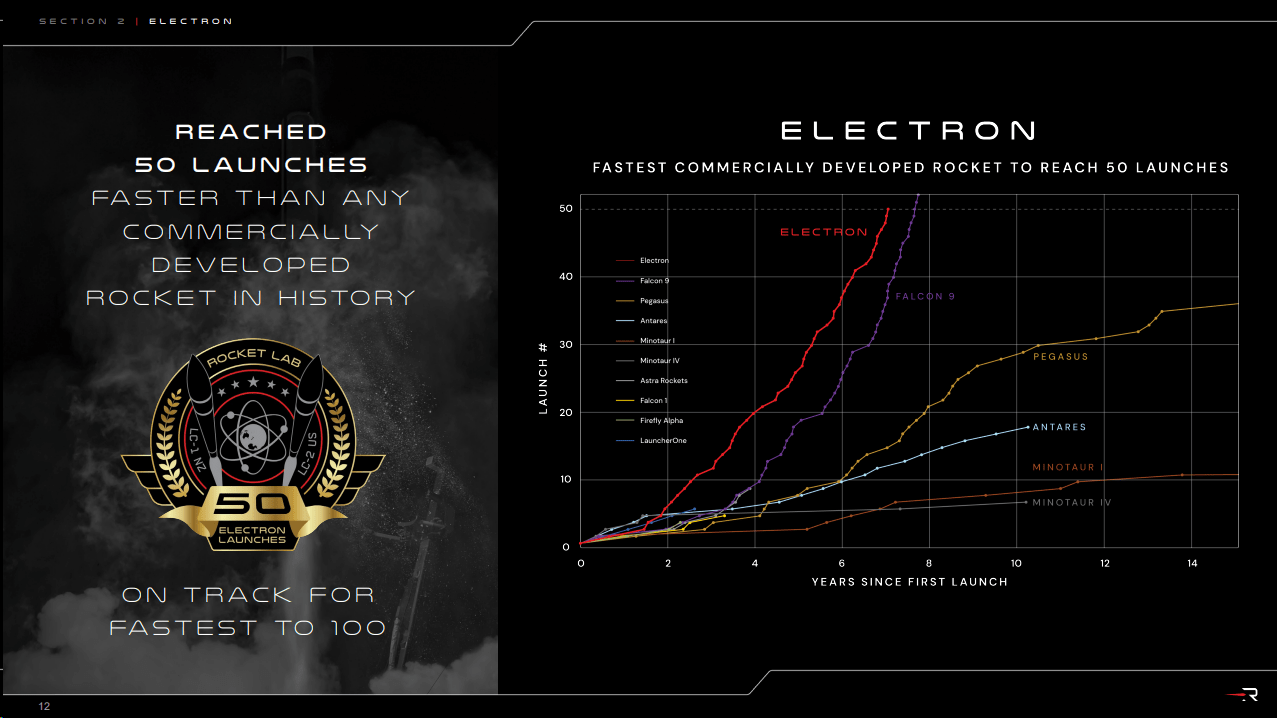

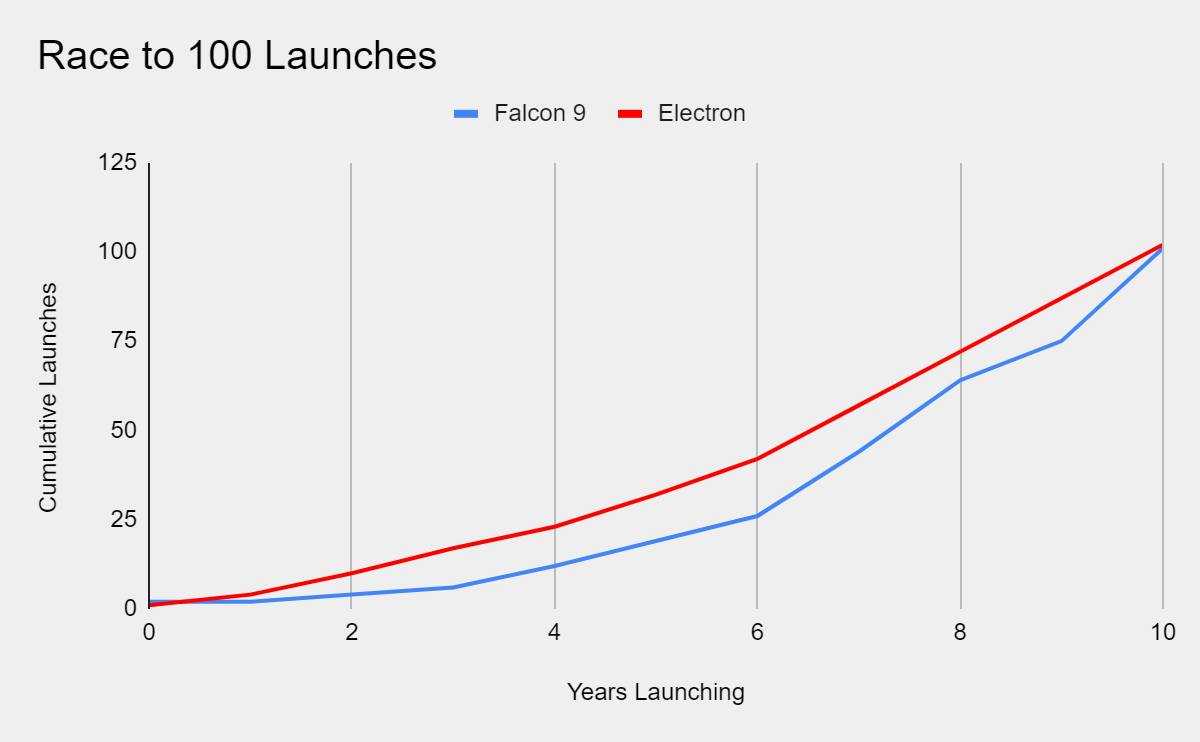

Electron – First to 100 Launches

In 2Q, Electron reached 50 launches faster than any other commercially developed rocket in history – including Falcon 9. Electron needs to maintain a cadence of 15 launches per annum from 2025-2027 to claim the title of first commercially developed rocket to 100 launches ahead of SpaceX’s Falcon 9.

Slide From 2Q2024 Investor Deck (Rocket Lab Investor Relations)

Falcon 9 vs. Hypothetical Electron Launches (Rocket Lab / Wikipedia / Graph created by Author)

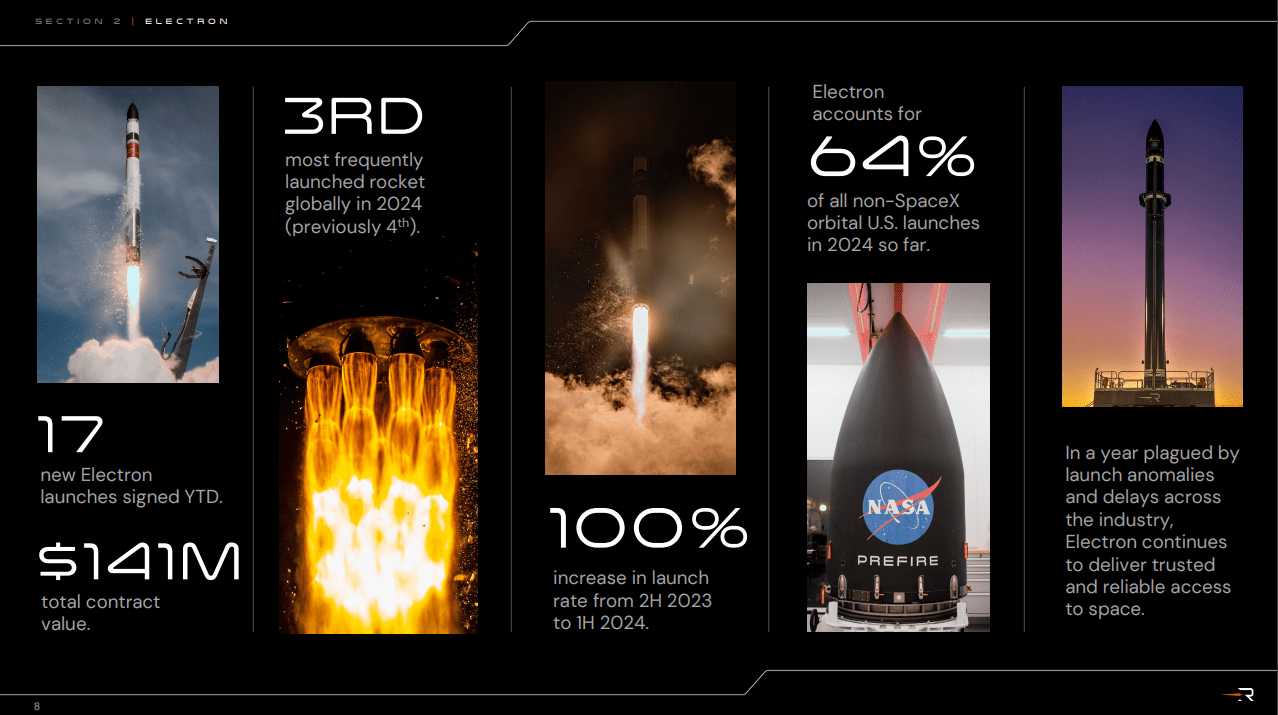

With the increased cadence, Rocket Lab has become the third most frequently launched rocket worldwide and maintains its dominance for #2 in the United States behind SpaceX’s Falcon 9. Without the Falcon 9, Rocket Lab dominated 64% of US launches in 2024, demonstrating its dominance as #2 in the launch space within the US. The Electron doubled cadence from 2H of 2023 to 1H of 2024 and signed over $140m of additional Electron contracts in the quarter.

Electron Stats as of 2Q 2024 Earnings Call (Rocket Lab Investor Relations)

Of the $140m of additional contracts, this includes 10 additional contracts from Syspective and several from the US Department of Defense, including a Haste contract, further integrating Rocket Lab’s future with the Electron launch system.

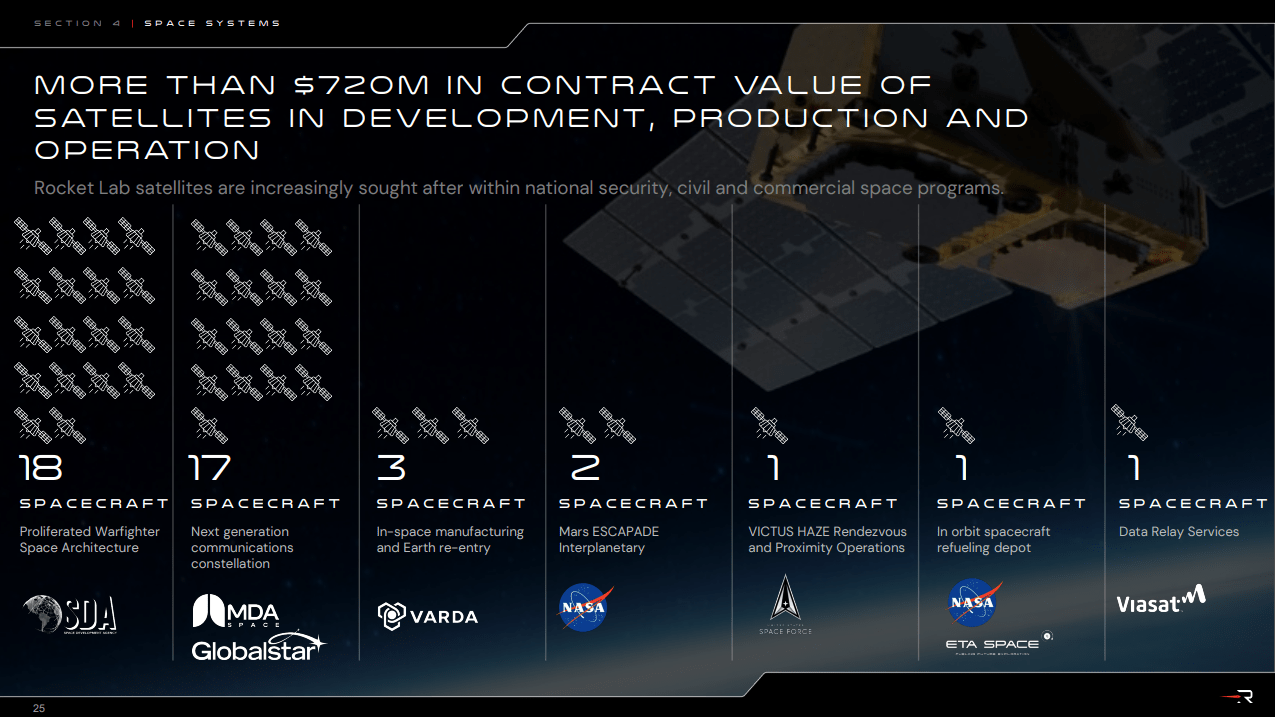

Space Systems The Industry Envies

Rocket lab has a long list of upcoming satellites they are prime or subcontractors to, and will be delivered to orbit, namely Victus Haze, Apple’s Globalstar satellites, Escapade (Mars) and the LoxSat for ETA. This builds on top of successfully delivered satellite programs to date, namely Varda zero-g satellite landing, Nasa’s Capstone and Psyche missions – there’s too many to count.

The backlog of space system contracts remains north of $720m and is anticipated to grow to over $1bn in the coming quarters as test missions are deemed successful and follow-on contracts from SDA and others are awarded.

The largest contract to date was awarded in January 2024 by the SDA for 18 spacecraft for the SDA’s Tranche 2 beta layer. With delivery starting in 2027 the satellites will be monitored by Rocket Lab’s SOCC (Satellite Operations Control Center) until 2030. This $515m contract demonstrates Rocket Lab’s capability as a prime contractor – a step in the right direction for future contracts and confidence by the government that Rocket Lab will be here to stay.

Space Systems Back Log (Rocket Lab Investor Relations)

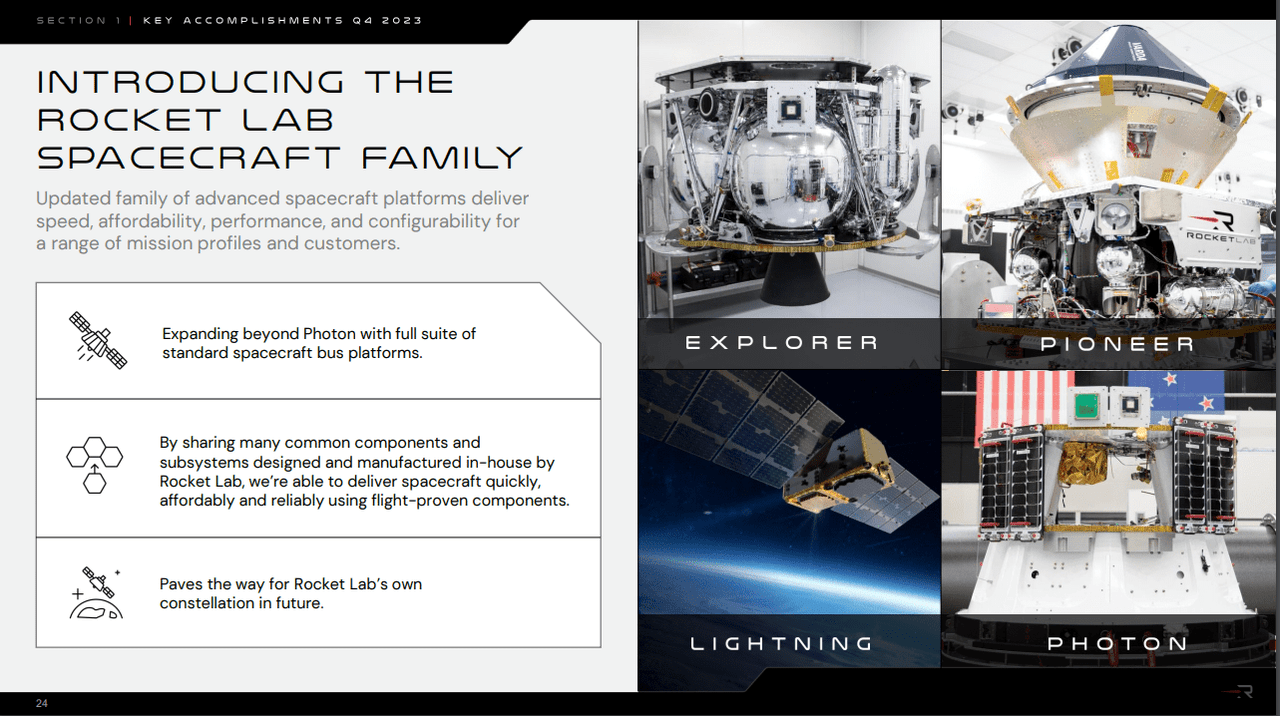

Rocket Lab management is thinking years down the road and have been consistently focused on providing customers the opportunity for an end to end space experience. With the projects they have accomplished to date, they have updated their ready-made satellite options to four, up from the original photon design.

They have based these designs off the success of past missions.

Explorer focused on deep space avionics with large propellant tanks. Explorer was first developed during the Capstone mission around the moon for NASA and will be the foundation of the Escapade mission later this year with Blue Origin (no earlier than October 2024).

Lightning focuses on extended lifespan in low earth orbit, having a highpower and high radiation tolerance with redundant systems to keep the satellite alive for longer. The Lightning vehicle was based on the Globalstar design and is the basis for the 18 satellite SDA contract.

Pioneer is designed to support up to 120 kg payloads and re-entry back to Earth. This satellite was first designed in collaboration with Varda Space for their re-entry mission that successfully returned to earth in February 2024. Three additional Pioneer satellites are being made specifically for Varda with a 5th Pioneer being created for an additional customer.

Photon is the original Rocket Lab satellite that is an integrated launch and spacecraft solution. Photon has a 200-300kg mass and will be used for missions like the ETA mission, which will assist with fueling in orbit. Other than that, Photon delivers propulsion and communications to low earth orbit and can meet a variety of customer needs.

Expanding off the shelf satellites at Rocket Lab (4Q 2023 Earnings Call)

Demonstrating Satellite Capability at Rocket Lab (2Q 2024 Earnings Call)

These off the shelf satellite models will lay the foundation for Rocket Lab’s future meta constellation in the future to be launched with Neutron.

Don’t Get Too Haste-y

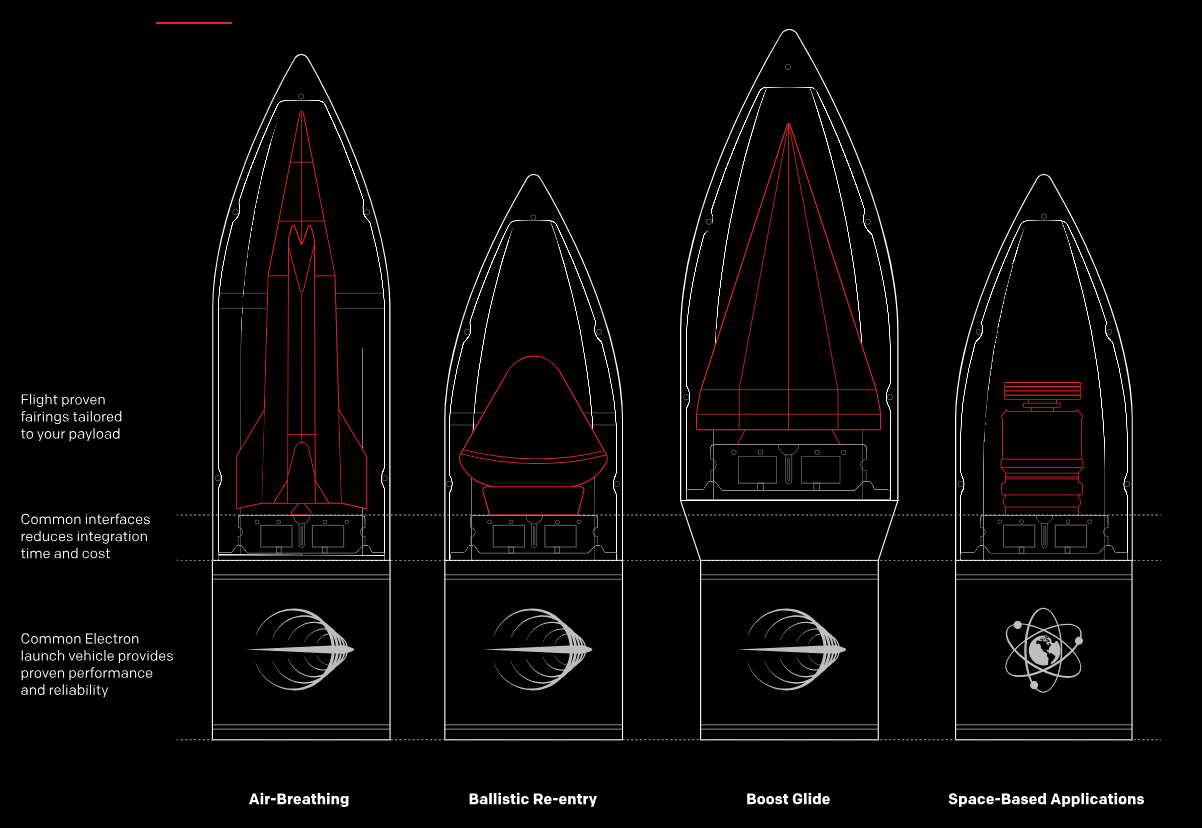

In the 2024 manifest there were two Haste (Hypersonic Accelerator Suborbital Test Electron) missions scheduled in the 2H of 2024, however since that manifest was laid out almost a year ago, there have been several other customer sign-ups for Haste.

Haste Use Cases (Rocket Lab Haste page)

To date we can count 3-4 customers and some of which more recently have signed up for up to 7 launches – demonstrating that the Electron launch system is a perfect test vehicle for suborbital launch. First launches we should expect to see in 2024 are with Leidos out of Wallops Island, Virginia. For context, Leidos was the first Haste customer in June 2023. That flight and the remaining three tests are for the Mach-TB project for Naval purposes and being carried out on behalf of the DoD test resource management center.

There is a confidential customer supposed to fly out of Launch Complex 2 in Wallops before the end of 2024. This particular group of flights will be operated under Rocket Lab National Security which is a subsidiary set up by Rocket Lab to handle unique needs for US (and our allies) defense.

The last named missions are for the Department of Defense innovation unit that will deploy an Australian company made Hypersonix called DART AE, which will be a scramjet-powered hypersonic capable of up to 5300 miles per hour. This mission will also launch from Wallops, Virginia.

To compliment the above DoD contracts, Rocket Lab has a new joiner to the board of directors, Ken Possenriede. Ken enjoyed a 35 year career in Finance at Lockheed Martin including the title of Chief Financial Officer. It is needless to say that Ken’s experience in Aerospace and defense can come in handy as Rocket Lab continues to expand into the end to end space company they envision. Sir Peter Beck, CEO of Rocket Lab noted that “the potential of space [is] the next industrial revolution in Human history.” To which Ken can play a key role there.

When I personally had the chance to interview Peter after 2Q earnings, Haste potential was my biggest area of focus, as I have noted there has only been a single launch for Leidos in 2023 but nothing else to date. That said, once we get several more flights off the ground, with the ease of rapid usability and short cycle times, I anticipate there will be many more applications and locations that could use the Haste platform for ballistics, boost gliding or other sub-orbital space-based applications. Peter agreed – cadence can be extremely frequent, and no capacity limits for launch at the moment.

I anticipate more details to come on this as we find out more about this potential revenue stream.

Let’s Get To The Numbers

Rocket Lab market capitalization currently trades at a price to sales of approximately 8x its 2024 revenue estimate of $420m. With the continued performance and capability demonstration by the company, I would expect the company to trade north of 10x P/S. The ongoing risks associated with Neutron and the lack of profitability continue to drag on the stock price. I was hoping as revenues increased this year, that market cap would follow into the $4bn range, however there are two more quarters to prove $400m in revenue is attainable for 2024.

Going into 2025, revenues should increase towards $550m per recent analyst estimates and once a major contract gets landed for Neutron, I expect a stock rally. Each launch is aiming to be approximately $55-$60m, meaning a single commercial launch per annum should raise the market cap by $400-600m minimum on top of the $550m revenue the market cap should easily be heading close to $6bn. Then, increasing the backlog to over $2bn as noted by Adam Spice, Rocket Lab CEO in previous earnings calls, would put a tailwind on the stock and remove some of the concerns about the longevity of the company’s prospects going forward. My anticipation is eventually analysts will start looking at forward valuations and growth prospects for the stock rather than pricing the company to fail.

But why do I continue to refer to a 10x P/S being reasonable? SpaceX’s market cap is now in the $200bn+ range for $8-9bn of revenue – a 20x+ price to sales valuation. So if SpaceX is a leader in the industry with a 20-30x price to sales multiple, then Rocket Lab who is several years behind SpaceX should be valued at least half as much – it is the #2 most launched space vehicle in the US.

We know that Rocket Lab does have much to execute on before being listed in the same league as SpaceX, thus a 10x multiple seems reasonable for now and may expand as it executes. There may be upside to the current P/S as Rocket Lab reaches closer to cash flow break-even, which is currently targeted for 2 quarters post Neutron launch, per Adam Spice, CFO of Rocket Lab.

How does Wall Street and Seeking Alpha view the stock?

I continue to align with Street and Seeking Alpha analysts on my buy rating for Rocket Lab. While I have an 18-month price target on the stock, I stand with the $10 upper end price target the Street has on the stock, representing a 40% increase or more in the stock price over the next 12 months as we will have or will be on the verge of a Neutron launch.

Since my last writing, Peer Analysts on Seeking Alpha have become more bullish on the stock with a rating of 4.66 out of 5 on Rocket Lab, which signals a strong buy. SA analysts have 2 strong buy recommendations, 1 buy recommendation on the stock in the last 90 days. There are no sellers at this time.

Wall Street analysts remain at a 4.3 out of 5 rating on Rocket Lab stock, with 7 strong buys, 1 buy, and 4 holds in the last 90 days. There are no sellers at this time.

The Street has updated the 52-wk price target from $8.03 to $7.39, an 8% decrease in target price. The Street also updated the downside range from $5.25 to $4.50 signaling potential for further downside. The upside target of $10 remains the same.

12 Month Price Target for Rocket Lab (Seeking Alpha)

Risk Thesis

Since my first article, several of my key risks have been realized, such as the Electron launch cadence and delay of Neutron launch by 6 months. I maintain these risks going into the second half of 2024 as they remain. For now, these realized risks do not put pressure on the $15 price target, however, continued delays in Neutron may push my $15 PT out of the 18-month window I have currently.

In 2024, Rocket Lab observed several launch delays, mostly due to customer preparedness. The 3Q 2023 earnings call outlined a manifest of 22 launches and at the moment, Electron cadence for 2024 is falling into the range of 15 to 18 per Adam Spice during the 2Q earnings call where he noted that fifteen launches seems very attainable but there seems to be a hard line in the sand at 18 launches in 2024. I do not blame the company on this – they were transparent that 22 launches was the max launch cadence they expected in 2024 and there should not be estimates north of 22 launches. That said, as we prepare for the 2025 manifest to be laid out in the 3Q 2024 earnings call, I anticipate these delays to persist into 2025 and the consequence of that will lead to plenty of questions in the Q3 earnings call around appropriately scheduling and/or how to eliminate unused time windows in the manifest. I do not see a way to mitigate this in the short term, I am sure we will discuss this in the coming articles.

Archimedes Hot Fire!! (2Q 2024 Earnings Call)

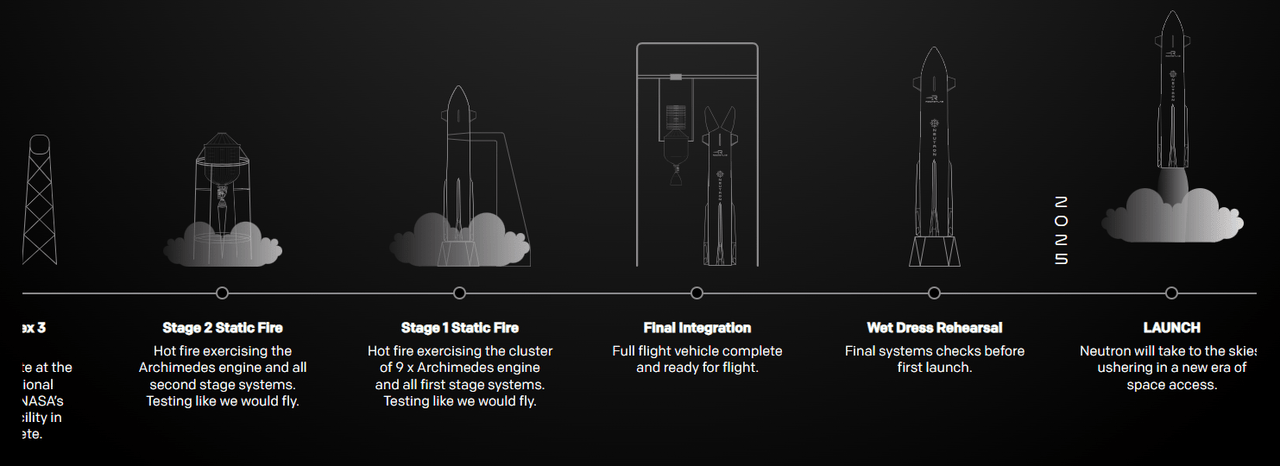

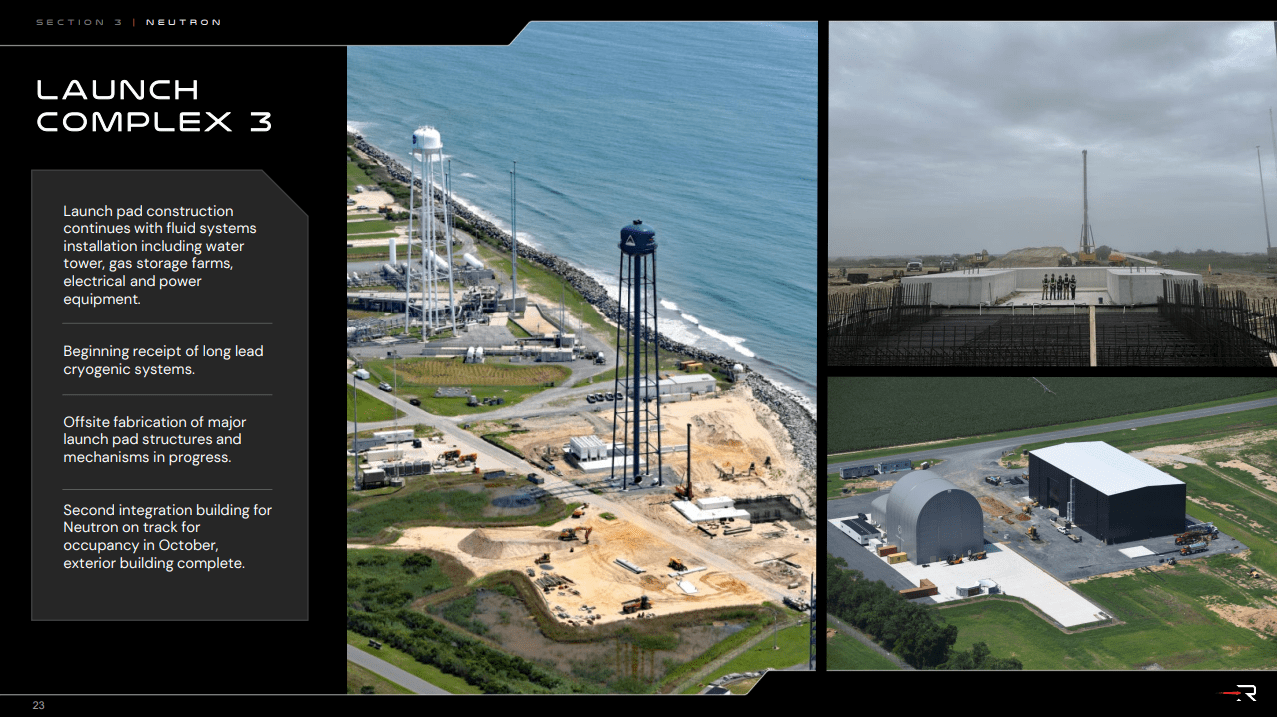

The Neutron delay until mid-2025 has had a drag on the share price over the past 6 months with many investors speculating further delays into 2026. The Archimedes hot fire test and progress at Launch Complex 3 in Wallops Island, Virginia demonstrates there is progress in the Neutron program, however that does not mean subsequent static fire tests for Stage 2 and wet dress rehearsal cannot cause further delays to the first Neutron launch – all of these on the website are noted to be completed prior to 2025. Delays for Neutron launch into 2026 would push revenue and contract awards outside my current 18-month window and push down the 2025 exit price below $15.

Neutron Future 2024 Milestones (Rocket Lab Neutron page)

Launch Complex 3 progress at Wallops Island Virginia (2Q 2024 Earnings Call)

Lastly, gross profit margins for the past few quarters have continued to land in the low 30% range non-GAAP and mid 20% range for GAAP. This value seems to be in a stalemate over the past few quarters – Electron cadence has increased to improve margins on the launch side, but legacy contracts are putting a drag on the space systems business. This has suppressed where margins can top out in the short term. With more focus than ever on space systems with competition heating up from less competitors, I anticipate margins in the space systems side of the business will continue to improve – this has also been affirmed with Adam Spice in the Q&A’s post earnings calls. He has stated, and I paraphrase here, “I have not seen a sub-30% margin contract in a while” talking with respect to recent contracts in space systems – more specifically SolAero.

Conclusion

Rocket Lab’s stock price has received a lot of love from retail and street investors due to the renewed focus on space stocks in recent weeks, coupled with the 71% year over year revenue growth observed in 2Q 2024. Rocket Lab celebrated its 50th Electron launch in the quarter demonstrating the company’s true capability and outlining a path to reach 100 launches the fastest. The Neutron Archimedes engine hot fire test was also a huge milestone over the past few weeks that definitely lofts up the stock price. Despite the good news, the stock drags at $7 a share pending risks to executing the initial Neutron lift and increasing Electron cadence.

The next 12-18 months could signal a new growth phase for Rocket Lab as a successful Neutron test will open the floodgates to a new revenue stream for the company at $55m-60m/each. Coupling with the four upcoming Haste tests in the next 6-9 months, we can build a backlog of revenue with less partner preparedness risk than a typical Electron launch. With $540m in cash, Rocket Lab has sufficient cash run-way to wait for profitability and grow other income sources and choose to pick up assets of bankrupt companies for pennies on the dollar. All the while, the company is setting themselves up for success, expanding off the shelf satellite options for customers while pushing the edge. Analysts rate the stock a buy to strong buy, with price targets over the coming 12 months between $7.50 and $10. My price target for the stock at the end of 2025 is $15.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RKLB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.