Summary:

- Rocket Lab’s $1.05 billion backlog (+80% YoY) includes $326M in launch services and $721M in space systems.

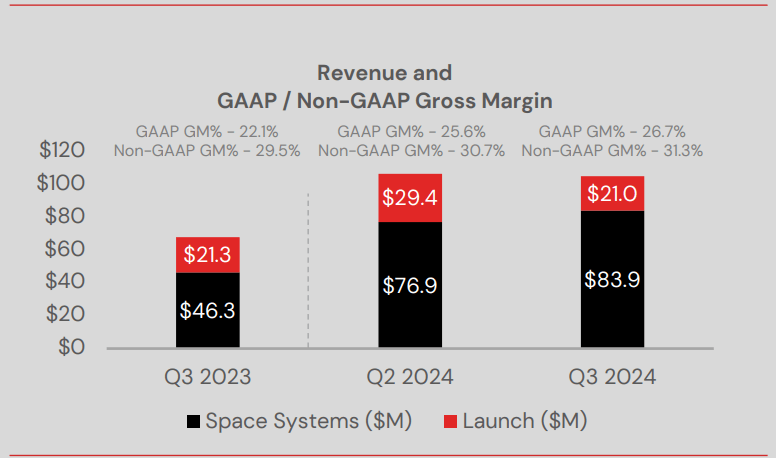

- Q3 2024 revenue hit $105M (+55% YoY), driven by $83.9M from space systems and $21M from launches.

- $44M invested in Q3 for reusable Neutron, targeting mid-2025 test flight and scalable launch operations.

- Defense agreements, including the $1B OSP-4 eligibility, align Rocket Lab with US government priorities and growth.

Alones Creative

Investment Thesis

Rocket Lab (NASDAQ:RKLB) is strategically positioned to capitalize on the growing space economy through its dual focus on scalable rocket development and innovative engine production. The company’s flagship Neutron rocket and Archimedes engine programs are advancing rapidly, targeting larger payloads and reusable components to meet industry demands for cost-efficient launch services. With a robust $1.05 billion backlog (+80% YoY) and plans to monetize 50% within 12 months, Rocket Lab has solid revenue visibility.

Lead in Rocket and Engine Development

Rocket Lab’s continued focus on developing Neutron reflects forward moves to capture larger payload missions ($55m in new launch contracts in Q3). The engineering progress on Neutron includes reusable fairings and second-stage components through advancements in design. Whereas the Archimedes engine program is scaling up with multiple engines entering the testing phase. With that, Rocket Lab 2Xed its sequential test cadence. Fundamentally, the company is prioritizing designs over iterative prototyping for production scalability. Now, this capability to move engines from testing to integration targets the industry’s demands for low-cost launch operations.

Q3 Presentation

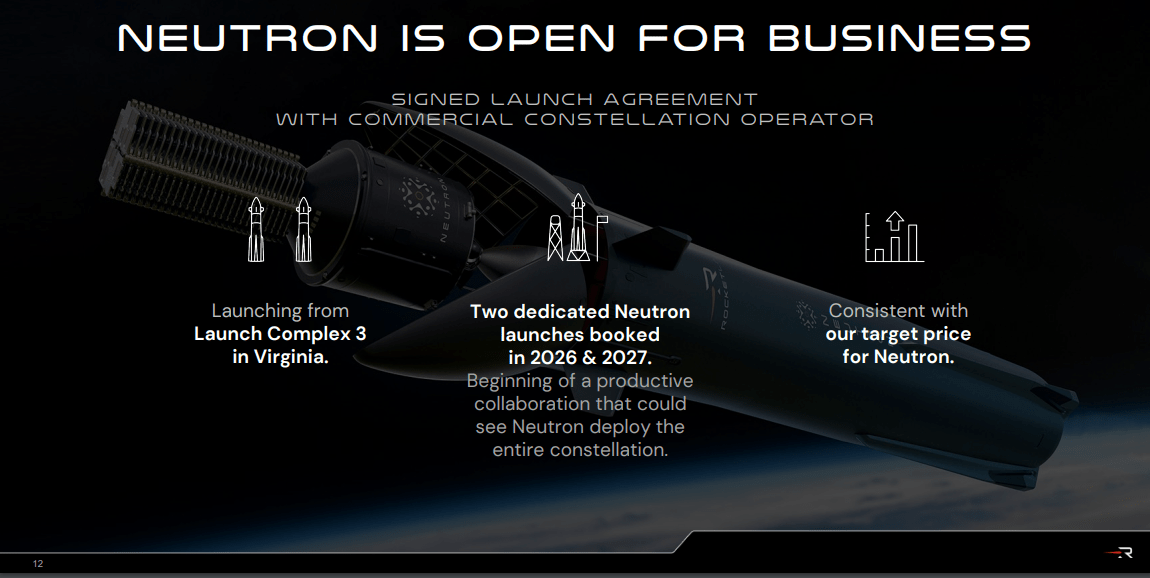

Moreover, Rocket Lab’s defense contracts point to a strong alignment with US government strategies. The company secured an $8 million study contract with the US Air Force Research Lab. Additionally, the USTRANSCOM extended a 2022 research agreement for point-to-point cargo delivery and the US Space Force confirmed Neutron’s eligibility for the $1 billion OSP-4 (launch program). The integration of Rocket Lab’s digital engineering frame into NSSL Phase 3 marks a formation with government strategies. This modernization potency for launch systems may yield a continuous revenue flow and a stable backlog.

Further, Rocket Lab’s manufacturing processes and infra strategy scaled up with its Archimedes engine production lines in California. The company’s production and integration facilities are located ~3 miles from its launch pad, which can save the logistical cost for large rockets over long distances. The development of launch infra includes the 165-ton launch mount and propellant tank installations at Launch Complex 3 (LC3). This readiness for Neutron’s first flight ensures that Rocket Lab can hit a high launch sheet amid demand for commercial and defense missions.

Q3 Presentation

Financially, Rocket Lab’s Q3 holds solid growth across its launch services and space systems segments. Total revenue hit $105 million, with a YoY growth of 55%. Here, space systems led the quarter with $83.9 million in revenue (based on demand in the satellite and solar space markets) and launch services had $21 million. The company maintains an average revenue per launch target of $7.5 million, led by a consolidated backlog of $1.05 billion (+80% YoY). This backlog has $326 million in launch services and $721 million in space systems, holding a $515 million award for 18 spacecraft under the Space Development Agency (SDA) contract.

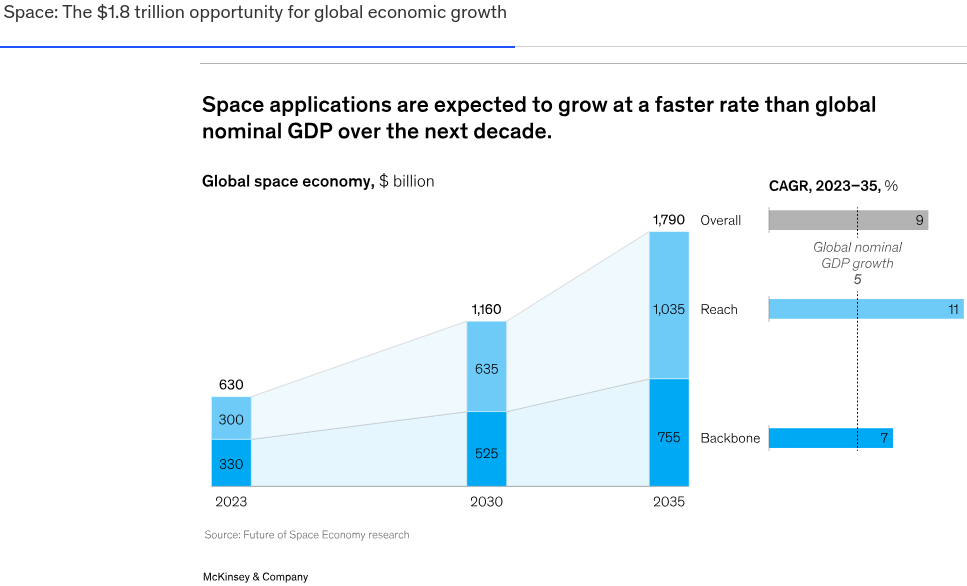

With 50% of this backlog expected to convert to revenue within the next 12 months, Rocket Lab stands with a strong cash flow. Finally, Rocket Lab has expanded satellite manufacturing at its headquarters and repurposed the facilities to scale up. This vertical integration reduces dependence on suppliers and accelerates production timelines. Projects like the Mars Sample Return Program and the ESCAPADE Science Mission point to Rocket Lab’s growth in addressing complex (high-profile) missions. With experience in Mars-related tech such as orbiters, rovers, and guidance systems, the company solidified interplanetary exploration-related top-line in the specialized space industry that may hit $1.8 trillion in global revenue by 2035.

McKinsey & Company

Inconsistent Launch Cadence and Forecast Misses

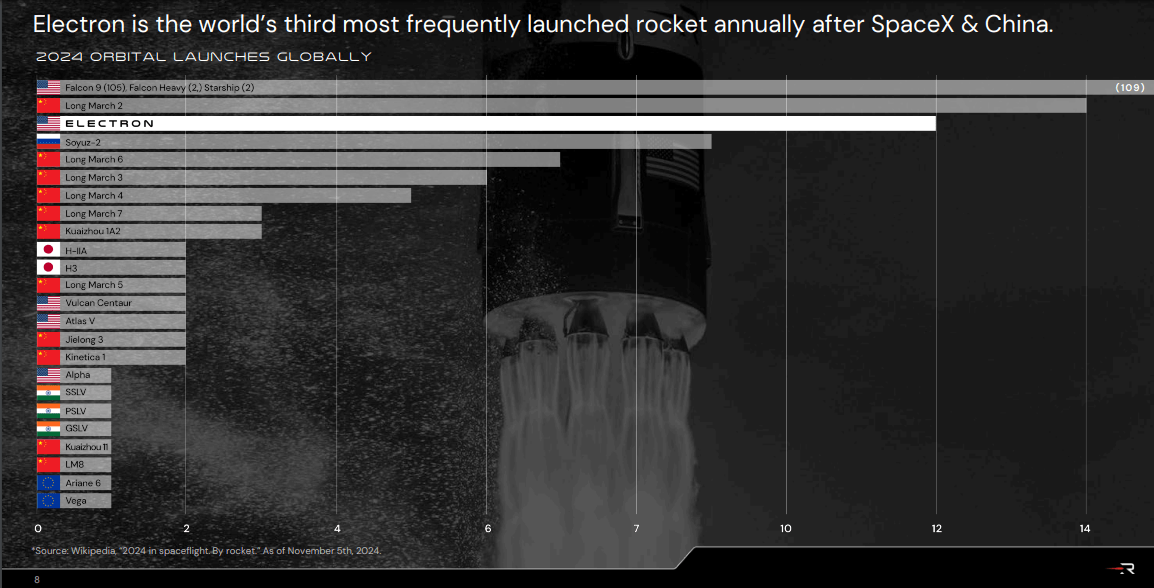

As a downside for the revenue flow, Rocket Lab’s launch frequency is variable. It initially projected 22 launches (in 2023) but adjusted this expectation to 15–18 launches. Now, as of Q3, 12 launches were completed, which necessitated at least four in Q4 to hit the lower target. This discrepancy is an operational bottleneck based on the lumpiness of launch contracts. This inconsistency directly affects revenue predictability and valuations. The Electron ASPs (average selling prices) also point to an irregular revenue pattern. The backlog for Electron shows an ASP of $8.2 million, but the projected ASP for 2024 is lower at $7.5 million. This reduction is based on bulk contracts offering signals of potential margin compression if launch frequencies fail to stabilize at higher levels. Variability in launches and ASPs restricts the scaling of Rocket Lab’s core business. This undermines the company’s capability to match competitors (like SpaceX) offering consistent pricing and launch frequency.

Further, revenue from bulk launch agreements introduces dependencies and timing risks. In Q3, Electron’s gross margin improvement coincided with a backlog increase. However, this was partly based on the integration of high ASP contracts. The dependence on large contracts to shore up margins leaves the business vulnerable during periods of sparse contracts. Additionally, Rocket Lab has longer timelines for larger contracts (including Neutron) that face delays. Contracts signed post-Q3 for Neutron do not contribute to the $326 million backlog, and the company postponed the revenue impact to Q4 or beyond. Delayed launches for Neutron also defer client revenues, as the first Neutron test flight is slated for mid-2025 and limited launches are expected until 2027. Such delays prolong the payback period for the high upfront costs of Neutron’s development.

Q3 Presentation

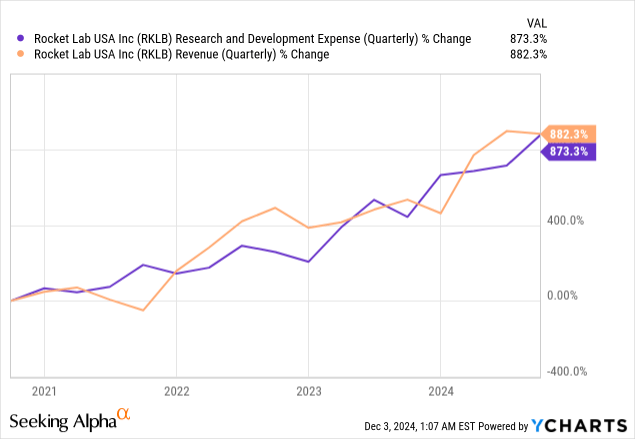

Finally, Rocket Lab’s research spending for Neutron is a necessary investment but creates a short-term bottom-line strain. In Q3 2023, Neutron’s development cost nearly $44 million, which exceeded the $40 million quarterly average projected earlier. The annual target of $160 million for Neutron R&D appears likely to be surpassed, with no immediate returns expected until post-2025. The delay in Neutron’s commercialization exacerbates the bottom-line issue and the stock’s value. Until mid-2025, R&D costs will primarily impact the P&L without cost recovery. The timeline for returns from Rocket Lab’s $250–$300 million total investment in Neutron stretches financial resources thin if launch milestones have further delays.

Takeaway

Rocket Lab is positioned for long-term growth, leveraging innovative rocket and engine development, a strong $1.05 billion backlog, and expanding satellite capabilities. While near-term challenges like launch variability and R&D costs for Neutron persist, its vertical integration, defense contracts, and focus on scalability support its potential to capitalize on the growing space economy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.