Summary:

- Rocket Labs reported record revenue of $106 million, up 71% year-over-year, with an order backlog of $1.07 billion.

- Launch Services segment revenue slightly exceeded guidance, while space system segment revenue met expectations.

- The company has a strong balance sheet to manage its operating timeline and has a project scheduled for 2025 that can compete with the market leader.

Pixelimage

Rocket Lab (NASDAQ:RKLB) reported a record revenue this week and the stock could be ready for its growth to take off. I’ll outline why the stock is currently my best growth idea.

Rocket Labs records best-ever quarter

Record Lab reported second-quarter earnings this week, with the highlight being the company’s first quarter of revenue of more than $100 million. The company reported a 15% quarterly increase to $106 million, up 71% year-over-year. The company also noted an order backlog of $1.07 billion.

The company’s Launch Services segment produced revenue of $29.4M, slightly above management’s guidance, while the space system segment produced $77M in the quarter, which met guidance.

“Our current backlog continues to support our current year target average revenue per launch of $7.5M,” management said.

Management expects Q3 revenue to be similar within a range of $100-$105 million.

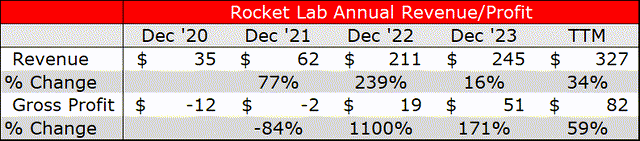

Rocket Labs Profit (Seeking Alpha)

Annual revenue is also growing steadily as the company builds its capabilities.

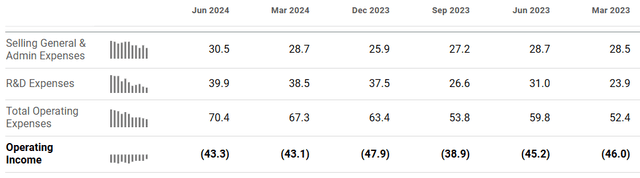

Rocket Labs Expenses (Seeking Alpha)

Operating losses are remaining steady on a quarterly basis in a range of -$38.9 million to -$47.9 million.

Innovation is key to the company’s growth story

With a strengthening financial picture, Rocket Labs is creating space to innovate for future growth.

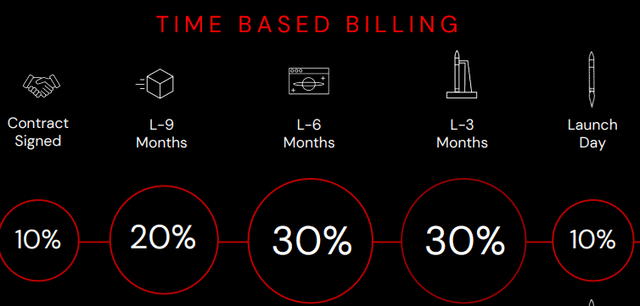

In the latest earnings presentation, the company announced 17 new contracts with a total value of $141 million. The company’s backlog, new contract wins, and time-based revenue will mean the company can continue to grow toward profitability.

Rocket Labs Billing (Rocket Labs)

Alongside the latest earnings, the company also announced a key technical milestone for its Archimedes engine, which will fire its Neutron rockets.

Rocket Lab founder and CEO, Sir Peter Beck, said: “Hot firing Archimedes is a major development milestone for Neutron and our team has done it on an accelerated timeline. Taking a new staged combustion liquid rocket engine from cleansheet design to hot fire in just a couple of years is industry-leading stuff.”

The press release also noted that many of the critical components for the new engine are 3D printed, reducing the cost footprint.

The Neutron rocket is critical to the company’s stated goal to become and end-to-end space company.

“If you look to where we ultimately want to go, in a lot of ways we want to emulate what SpaceX has successfully done, which is work their way towards the applications market,” Rocket Lab CFO Adam Spice said.

The earnings presentation also said that the Neutron rocket is “well-positioned to capitalize” on a $10 billion launch Total Addressable Market.

Space Systems segment also growing

Rocket Labs’ Space Systems segment is also growing fast with $720 million in satellites in development or production.

Analysts at McKinsey have estimated that the global space economy will be worth $1.8 trillion by 2035, up from $630 billion in 2023. That figure will be driven by demand for “backbone” applications such as satellites, televsion and GPS. Alongside “reach” applications,” where analysts used the example of Uber combining satellite signals and smartphone chips for city navigation.

The Space Foundation said that 2023 was a record year for commercial launches, up 50% on the previous year.

Rocket Lab has an agreement on preliminary terms for $49.4m infederal and state local incentives. The company already makes solar cells and panels in a New Mexico and will use the funds for expansion.

The company is also nearing completion of its initial work with Varda Space Industries. The company builds products such as fiber optic cables in zero gravity situations, which are of higher performance. Other sectors could turn to space manufacturing tests, such as pharmaceuticals.

“Traditionally, almost all in-space manufacturing research has been carried out on the International Space Station. This research has demonstrated that innovative materials and products can be created in the consistent microgravity environment of low-Earth orbit, an environment that can’t be replicated on Earth,” a statement said.

Other considerations

The company said that Research & Development expenses had “ramped up” due to the Neutron and Archimedes testing. That will ease ahead of the proposed mid-2025 launch and free up working capital.

Rocket Lab had $546.8 million in cash and cash equivalents at the end of the most recent quarter. That allows for around 13 quarters at the current operating loss level of around -$40 million.

The company’s CEO highlighted the future potential of a Neutron-driven constellation this week, saying:

“We can build and launch our own spacecraft at cost, and we don’t have to wait in line for limited launch capacity. We completely avoid the pain point that most constellation operators face: being at the mercy of suppliers on cost and schedule, often causing deeply disruptive delays and bringing capability online at scale.”

Beck was also hopeful that his company can break the “monopoly” of the SpaceX Falcon which is the dominant rocket due to its high payload. Rocket Lab is also showing an ability to manufacture and fly at a similar speed to SpaceX.

The company’s Electron beat the Falcon as the fastest-commercial rocket to 50 launches. Neutron’s proposed 4.3 year announcement to launch schedule would also beat the 4.8 years of SpaceX.

In June of this year, Bloomberg reported that insider share sales of the privately-owned SpaceX were set to create a valuation of around $210 billion. By mid-2025, Rocket Lab could have a viable alternative to take market share from the company. That followed tender offers valued at $137 billion and $180 billion.

The current market capitalization of Rocket Lab is $2.35 billion and it therefore has the funding to comfortably get to its mid-2025 Neutron launch and begin tapping into new contract opportunities.

As the company gets closer to that date, positive contract wins and development news on its key project could fire up the stock price beyond the current price/sales ratio of around 8x.

Downside risks to the thesis

The key risk to the thesis is a problem with development of the Neutron rocket. The company is on a steady path to tap into a growing market for satellites, but Neutron can be a gamechanger for the company to rival SpaceX with its own constellation and a stronger reputation for large projects.

Another downside is obviously in safety, if the company suffered any negative effects in its manufacturing, and/or launches.

Conclusion

Rocket Lab has logged its best ever quarter with revenue of over $100 million. The company is making a loss each month, but the current operating loss is around the cost of R&D and other expenses are remaining steady. The company has more than $500 million in cash, which can see it continue operations for 13 months comfortable, but there is also an operating backlog of more than $1 billion, while the company is starting to see growth in its Space Systems segment with its largest contract win earlier this year for satellites. That could see the company move closer to profitability by year-end. The real moonshot for Rocket Lab is the development of its Neutron rocket. The Archimedes engine for this engine just reached a major milestone and is scheduled to launch by mid-2025. The rocket will have a payload to compete with the dominant SpaceX and can tap into a Total Addressable Market of $10 billion.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Growth Idea investment competition, which runs through August 9. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RKLB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.