Summary:

- Roku stock has gained 77% this year, aided by the improving market sentiment toward growth stocks.

- The changing streaming and ad market dynamics will create a level playing field for Roku to compete in the streaming sector.

- The anticipated recovery of the ad market paints a promising picture of what the future holds for Roku.

- Roku stock might shed some of its gains in the short run before moving higher in the long term.

Justin Sullivan

Roku, Inc. (NASDAQ:ROKU), a streaming distribution platform that produces streaming devices, audio products, and ad-supported streaming services has become one of the leading players in the streaming devices market, competing with Apple TV, Amazon Fire TV, and Google Chromecast. Roku devices allow users to access various online streaming services, such as Netflix, Disney+, Amazon Prime Video, and more. Roku also has its own streaming channel, which offers free and premium content from different providers. The company makes money from selling hardware, advertising, and subscriptions. Roku has been witnessing a surge in its stock price recently, driven most probably by the new developments in the streaming industry such as the introduction of ad-based tiers by major streaming platforms. With the growing prevalence of advertising-supported video on demand (AVOD), Roku stands to benefit significantly due to its reliance on advertising revenue. Going by recent earnings revision trends, I believe Roku stock will be highly volatile in the short run and I would not be surprised if ROKU sheds some recent gains in the coming months. However, there are long-term growth opportunities that remain to be explored.

Streaming And Ad Market Dynamics

The shift towards ad-based streaming has gained significant momentum in recent years, driven by various factors that indicate a change in consumer behavior and preferences. The connected TV ad market, in particular, has shown signs of a rebound in the second quarter, sparking optimism among investors. Furthermore, the success of Netflix, Inc.’s (NFLX) “paid sharing” rollout and its growing ad business has garnered positive attention.

The streaming market has reached new highs with the majority of households now utilizing at least one over-the-top streaming service (OTT). This segment, encompassing OTT, connected TV, and YouTube, continues to grow and presents ample opportunities for advertisers, even during an economic downturn. Among 18 to 43-year-olds, streaming TV accounts for at least two-thirds of TV time spent viewing. Research conducted by the Leichtman Research Group in 2023 indicates that 86% of U.S. households have subscribed to at least one streaming video service from the top fifteen Subscription Video On-Demand (SVOD) and direct-to-consumer (DTC) platforms.

The average consumer now subscribes to 2.8 streaming TV services, with 10% of consumers paying for more than five services simultaneously. This proliferation of streaming services has led to increased competition and rising costs. Consequently, consumers are re-evaluating their spending habits, particularly due to inflationary pressures. As a result, the adoption of AVOD platforms is poised to increase. Deloitte Global’s TMT Predictions 2023 forecasts that nearly two-thirds of consumers in developed countries will use at least one ad-supported service monthly by the end of the year, representing a 5% increase from the previous year.

Major SVOD services in developed markets are expected to introduce ad-supported tiers alongside their existing ad-free options to address this evolving landscape and consumer demands. By the end of 2024, half of these providers are projected to offer a free, ad-supported streaming TV service. This transition reflects the understanding that the fully ad-free experience has become costly for consumers, particularly because must-watch content is spread across multiple platforms.

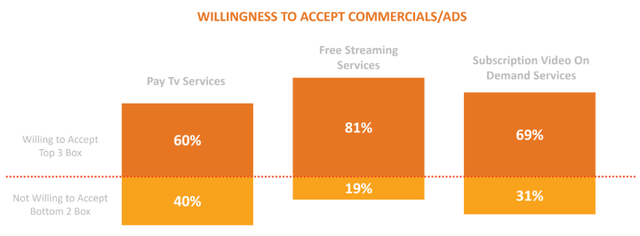

The growth of connected TV ad spend is a testament to the increasing popularity of ad-based streaming. In 2022, CTV ad spending rose by 33%, reaching $18.9 billion. This accounted for over two-thirds of U.S. upfront digital advertising spending. The trajectory indicates a growing acceptance among consumers for advertisements in exchange for access to streaming content. A survey conducted by Magid reveals that 81% of free streaming service subscribers and 69% of SVOD subscribers are willing to accept commercials in exchange for access to premium content.

Exhibit 1: Willingness to accept commercials

Looking ahead, the global subscription streaming services landscape is expected to incorporate ad-funded models to cater to diverse consumer preferences and economic considerations. By 2030, most online video service subscriptions are anticipated to be partially or entirely ad-funded, mirroring the long-standing trend in emerging markets where ad-funded video-on-demand has been the norm. This transition, in my opinion, will create a level playing field for Roku to compete with not just streaming device manufacturers but also premium streaming services.

Roku’s Advantages In The Ad Space

Roku, a prominent player in the streaming industry, holds a significant advantage in the ad space due to the widespread adoption of ad products by major streaming platforms. The company derives a substantial portion of its revenue from advertising and secures 30% of its ad inventory from its streaming partners. In the first quarter of 2023, Roku exceeded analyst expectations by gaining 1.6 million active streaming accounts, surpassing Wall Street’s projections.

While viewing hours on traditional TV in the U.S. experienced a 10% year-over-year decline, the Roku platform witnessed substantial growth, with global streaming hours increasing by 20% year-over-year. This was a notable development for Roku as platform users streamed a total of 25.1 billion hours in the first three months of 2023. This translated into a record-breaking 3.9 streaming hours per active account per day, demonstrating the platform’s strong engagement, user loyalty, and expanding monetization opportunities.

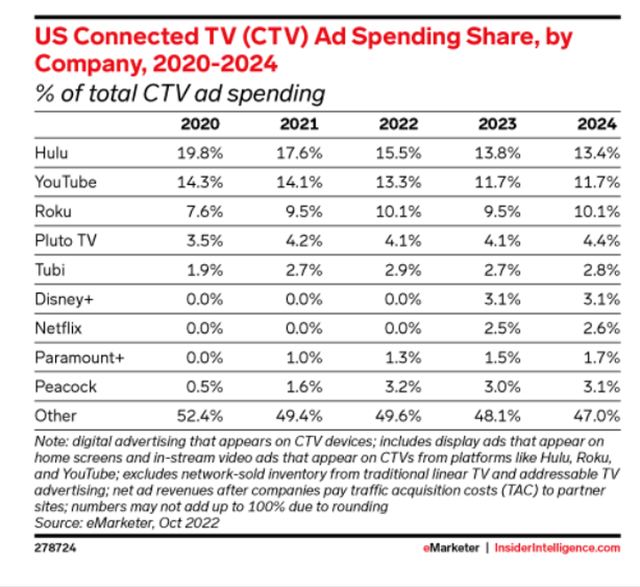

Additionally, Roku’s strong performance in the smart TV market reflects its ability to deliver value and a superior user experience to consumers. In Q1, the Roku operating system maintained its position as the leading smart TV OS in the U.S., capturing an impressive 43% of TV unit share. This achievement surpassed the combined market share of the next three largest TV operating systems. Notably, Roku experienced year-over-year share gains across various TV screen sizes, particularly in the larger-screen segment, indicating the widespread appeal of its platform.

Exhibit 2: U.S. smart TV installed base by streaming OS

S&P Global

The success of Roku’s OS extended beyond the U.S. market in the first quarter. In Mexico, the Roku OS was once again the top-selling smart TV OS for the second consecutive quarter, while in Germany, Roku expanded its TV program with the addition of Coocaa as its third TV OEM partner. With over 20 licensed Roku TV partners worldwide, the company’s TV program continues to deliver excellent results and further solidifies its market position.

Roku’s entry into manufacturing its own TVs with the Roku Select and Roku Plus Series has been met with positive reception. These Roku-branded TVs, available exclusively at Best Buy, offer a range of models with various sizes and advanced features such as QLED Technology, 4K Dolby Vision Picture, and the Roku Voice Remote Pro. The combination of Roku’s expertise in hardware, intuitive TV software, and connectivity has resonated with consumers seeking value, simplicity, and choice in their TV experience. The recognition received from industry experts, including Tom’s Guide, TechHive, and Yahoo, further highlights the quality and appeal of Roku-branded TVs.

Beyond hardware, Roku’s software innovations and content partnerships have garnered acclaim. Fast Company recognized Roku as one of the Most Innovative Companies for 2023, acknowledging the company’s advancements in both hardware and software, such as the Roku Voice Remote Pro and content offerings on The Roku Channel. Leveraging its extensive platform scale and user engagement, The Roku Channel has witnessed remarkable growth in streaming hours, with a 65% year-over-year increase in Q1. Maintaining its position among the top-five channels on the platform, The Roku Channel continues to be a popular choice for viewers, solidifying Roku’s presence in the streaming market.

Roku continues to expand its partnerships and offerings, solidifying its position as a leading streaming platform. One of its notable collaborations is with Instacart, the online shopping service, aimed at helping consumer-packaged goods advertisers measure the impact of their ads on Roku by tracking consumer purchases on Instacart. This partnership demonstrates Roku’s commitment to providing advertisers with valuable insights into the effectiveness of their advertising campaigns and the ability to connect ad exposure to real-world consumer behavior.

In addition to the Instacart partnership, Roku also announced a significant partnership with TelevisaUnivision, the world’s leading Spanish-language media and content company. As part of this collaboration, ViX’s premium tier, offering a vast library of Spanish-language content across various genres, became available on Roku’s lineup of Premium Subscriptions. This move enhances Roku’s appeal to Spanish-speaking audiences and further expands its content offerings to cater to diverse viewer preferences.

Furthermore, Roku unveiled its groundbreaking Roku City Neighborhoods, with Paramount+ becoming the first entertainment brand to launch a custom neighborhood. These city-themed experiences within the Roku platform create an immersive and engaging environment for viewers, featuring brand-specific buildings, visuals, and destinations. By integrating brands into the streaming experience, Roku enhances brand visibility and provides advertisers with an opportunity to captivate viewers from the moment they start their streaming session.

These strategic partnerships and initiatives showcase Roku’s commitment to delivering innovative advertising solutions and enhancing the streaming experience for both viewers and advertisers. By focusing on measuring ad effectiveness, expanding content offerings, and creating immersive brand experiences, Roku is building on its position as a dominant force in the streaming industry.

Challenges

Roku faces several challenges in the evolving advertising landscape, despite experiencing increased engagement on its platform. In the first quarter, the company saw a 1% decline in Platform revenue, which encompasses various revenue streams such as ad sales, streaming service distribution, and Roku Pay. This decline can be attributed to the challenging macro environment, with the total U.S. advertising market experiencing a 7.4% year-over-year decline. Traditional TV ad spending was even more adversely affected, with a 12.7% year-over-year decline, and traditional TV ad scatter dropped by 20%.

Although some verticals, like travel and health and wellness, showed improvement in ad spending on the Roku platform, verticals such as financial services and media and entertainment remained under pressure. The company remains cautious about the future, expecting macro uncertainties to persist throughout 2023. Consumers are facing inflation and recessionary concerns, leading to limited discretionary spending. The company expects to return to profitability in 2024.

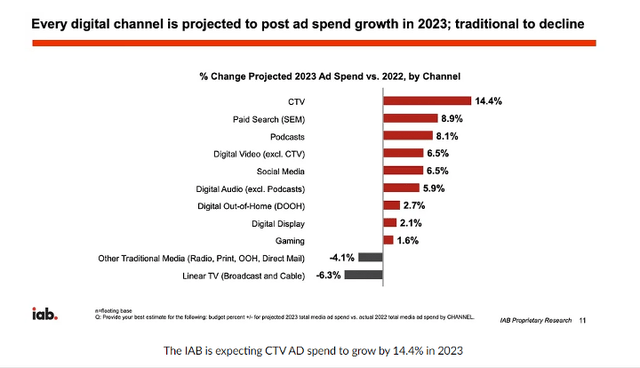

Despite Roku, Hulu, and YouTube accounting for almost half of the U.S. CTV ad market before the pandemic, their combined share is expected to decline to approximately one-third of the $26.92 billion CTV ad spend in 2023. This indicates a significant expansion of the CTV market and increased competition from other players.

Exhibit 3: U.S. connected TV ad spending share

Roku investors will have to closely monitor the competitive landscape in this industry to identify inflection points.

Growth Opportunities Amid The Anticipated Recovery Of The Ad Market

Roku’s business model, which revolves around hardware sales and monetizing its platform through advertising, has faced challenges in recent times due to a slowdown in the digital ad market. Tightening marketing budgets and reduced ad spending has impacted the company’s advertising revenue. However, there are promising signs of recovery on the horizon, as the global economy is anticipated to improve in the second half of 2023. Roku, with its strong user acquisition track record and expanding international presence, is well-positioned to capitalize on the anticipated recovery in the ad market.

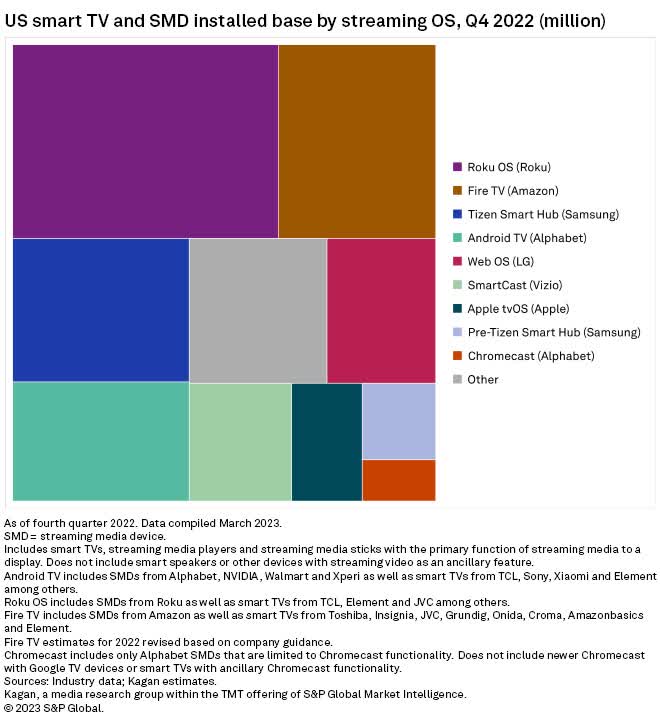

While 2023 may not be a year of significant growth for ad budgets, forecasts suggest that the digital advertising landscape will gradually rebound. Digital ad spending worldwide is projected to increase by around 5%-9% in 2023, still lower than projected growth rates in 2022. The CTV market, in particular, is expected to grow faster than the overall advertising market, with a forecasted growth rate of 14.4% in 2023. This presents an opportunity for Roku, given its position as the leading smart TV operating system which makes it possible to capture a substantial share of the CTV ad market.

Exhibit 4: Projected ad spending growth by category

Investing in Roku will give investors exposure to both the digital advertising market and the global streaming market, which makes ROKU an interesting pick for investors who are bullish on the recovery of these two business sectors.

Takeaway

Despite the challenges faced by the digital ad market in recent times, Roku is well-positioned to capitalize on the anticipated recovery of this market. With the company’s strong track record of user acquisition, and advertisers shifting focus toward streaming platforms, Roku’s platform segment holds significant potential for monetization. While competition in the streaming video industry remains fierce, Roku’s unique combination of streaming technology and advertising platform sets it apart from its competitors. Given that next fiscal year’s earnings estimates have trended lower in the last three months, I expect ROKU stock to give back some of its recent gains in the coming months, which might create an opportunity to invest in Roku at a better valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Unlock Alpha Returns With Our Comprehensive Investment Suite

Beat Billions offers a wide range of tools and resources to help you achieve superior investment returns. Our team of expert analysts uncovers undercovered and thinly followed stocks to supercharge your investment returns.

- Access our model portfolios and receive actionable ideas to build a successful portfolio.

- Join our community of like-minded investors and exchange ideas to maximize your investment potential.

- Keep track of the real-time activities of investing gurus.

Don’t miss out on our launch discount – act now to secure your subscription and start supercharging your portfolio!