Summary:

- Over the last decade or so, the bearish refrain has been that competition would dent Roku, Inc.’s market share.

- After ~10 years of competitive pressure from the largest and most well-capitalized businesses ever (e.g., Apple or Comcast or Amazon), Roku’s market share hit an all-time high in Q1’23.

- While a cursory glance at the business of Roku may leave one unimpressed, a deeper exploration into this vertically integrated platform reveals there’s a method to CEO Anthony Wood’s madness.

- Those that have owned Roku since its early days as a public company may be experiencing a madness of their own due to the volatility of the stock price; however, I believe a bright future awaits Roku.

- In short, Roku continues to capture market share in the U.S. via its vertically integrated offering. It has just started international expansion where it’s already finding success, and it has a giant cash hoard of ~$1.63B alongside no long-term debt whatsoever.

hapabapa/iStock Editorial via Getty Images

- As an important point of consideration, I believe Roku, Inc. (NASDAQ:ROKU) made a great hire in Charlie Collier, President of Roku media. We discussed this gentleman in this note, and Roku’s Q1 2023 earnings call did nothing but further galvanize our excitement for this hire. Additionally, I am doing my best to think about the hire more philosophically: “The CEO of Fox Entertainment jumped ship and is now, in a sense, jumping for joy for his work at Roku. Why? A legacy media and entertainment gentleman just jumped ship for what some believe to be a dubious new entrant. Why would he do that?”

- I think we’ve provided answers to these questions already; however, I still don’t know that I fully appreciate what this hire will mean over the long run. I do think it represents a pivotal moment in Roku’s multi-decade evolution. We will explore this and more together today.

Preamble Data Points

Before we delve into our review of Roku’s Q1 2023 and the business broadly, I wanted to emphasize the data points below:

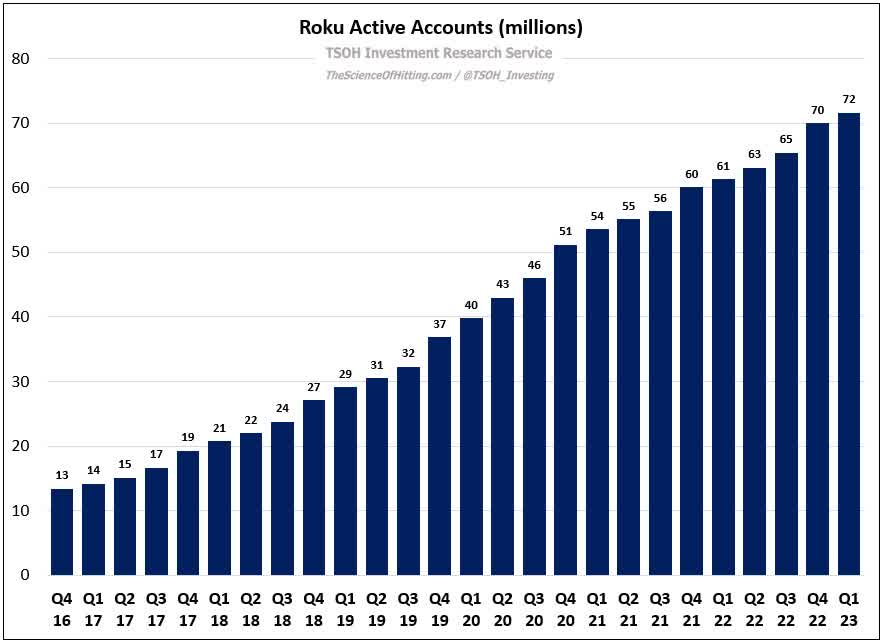

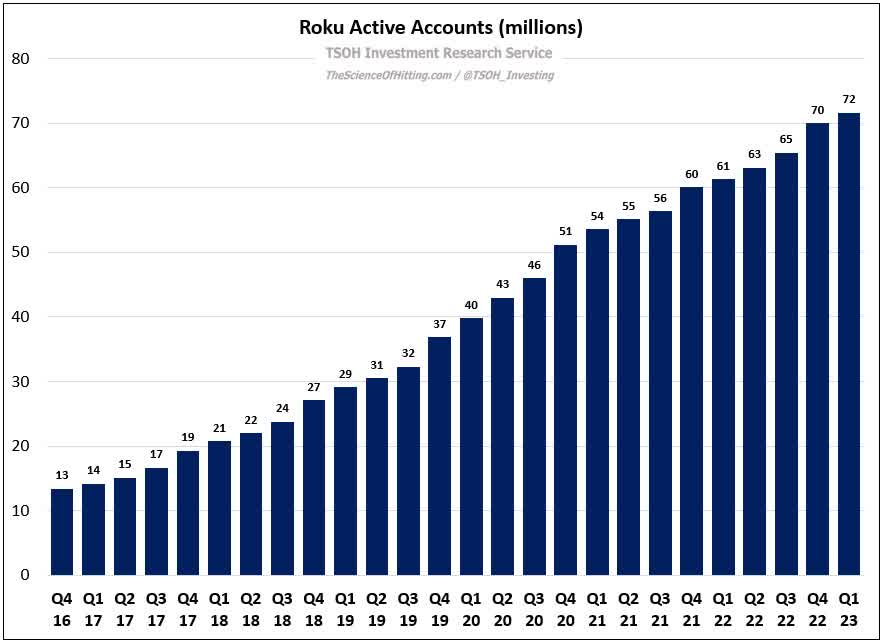

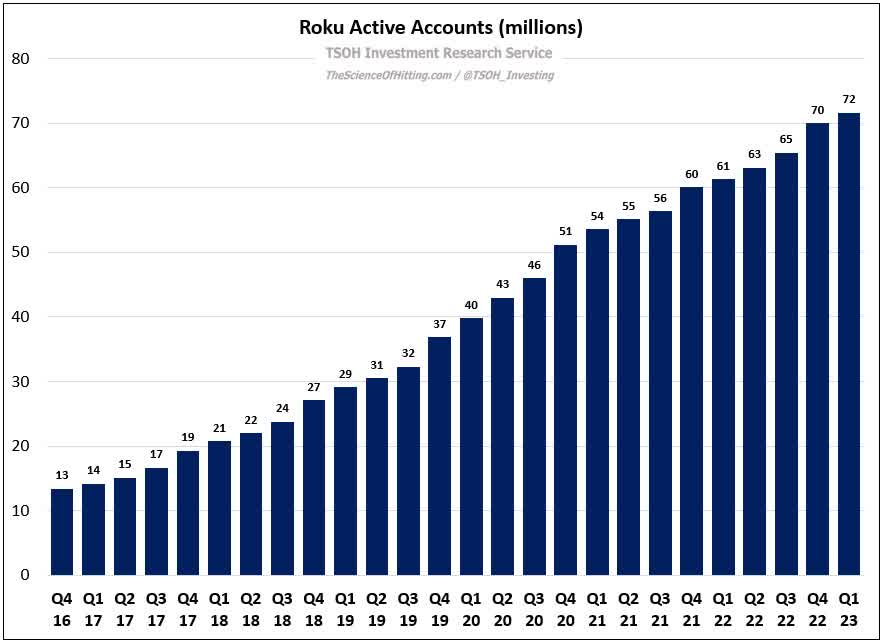

The Science of Hitting By Alex Morris

- Note: Roku’s Q1 2023 active account adds came in at 1.6M, which resulted in a total active account count of 71.6M. Consensus analyst expectations were for 1.14M active accounts to be added in the quarter, so this was pretty good.

We were very satisfied with these results, as we were for the Q4 holiday season add.

Roku delivered solid first quarter results in a challenging economic environment. We grew both our active accounts and streaming hours. Roku’s TV operating system was once again the number one selling TV OS in the U.S., achieving a record high TV unit share of 43%, which is more than the next three operating systems combined. We achieved share gains across the full range of TV screen sizes, particularly in the larger screen segment.

CEO Anthony Wood, Roku’s Q1 2023 Earnings Call (emphasis added).

Again, Roku has accomplished this while being assailed by some of the largest and most well-capitalized businesses in human history.

In Roku’s Q1 2023 shareholder letter, Mr. Wood shared (emphasis added):

“In Q1, the Roku operating system (OS) was once again the #1 selling smart TV OS in the U.S., achieving a record-high 43% of TV unit share, which was more than the next three largest TV operating systems combined (according to Circana). We achieved YoY share gains across the full range of TV screen sizes, particularly in the larger-screen segment.”

In Mexico,the Roku OS was the #1 selling smart TV OS for the second quarter in a row. And in Germany, we expanded our Roku TV program with our third TV OEM partner, Coocaa. With more than 20 licensed Roku TV partners globally, we continue to drive great results across the program.

A Handful Of Charts

In serving the investment community, I do my very best to: 1) work very hard; whereby 2) I create simplicity; 3) whereby I serve you to the absolute highest extent possible.

With respect to Roku, we’ve, indeed, spent many hours working on the business; at the end of which, I believe the thesis could be summarized via just a handful of charts.

Indeed, I could stop writing this note to you after sharing just these handful of charts via which the entirety of the Roku thesis could be understood (at least in my opinion):

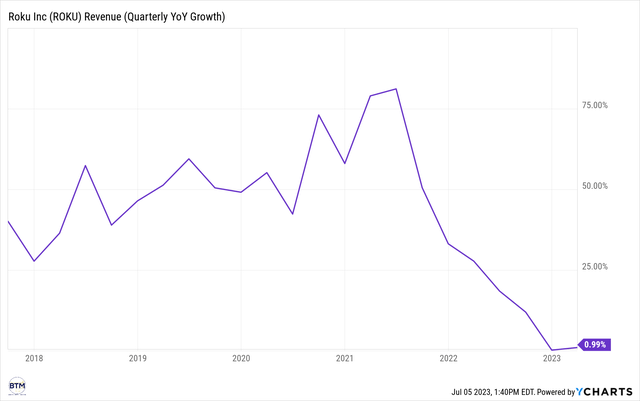

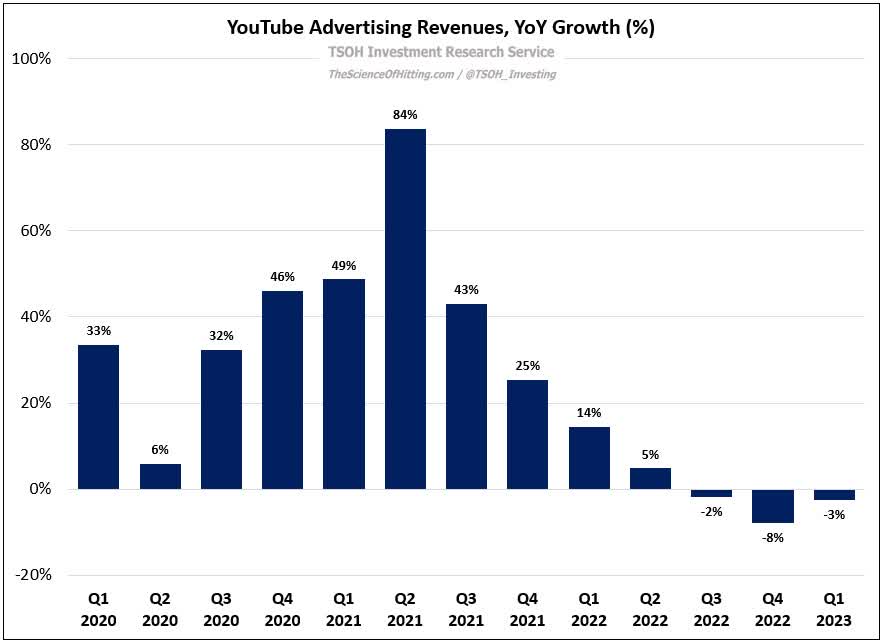

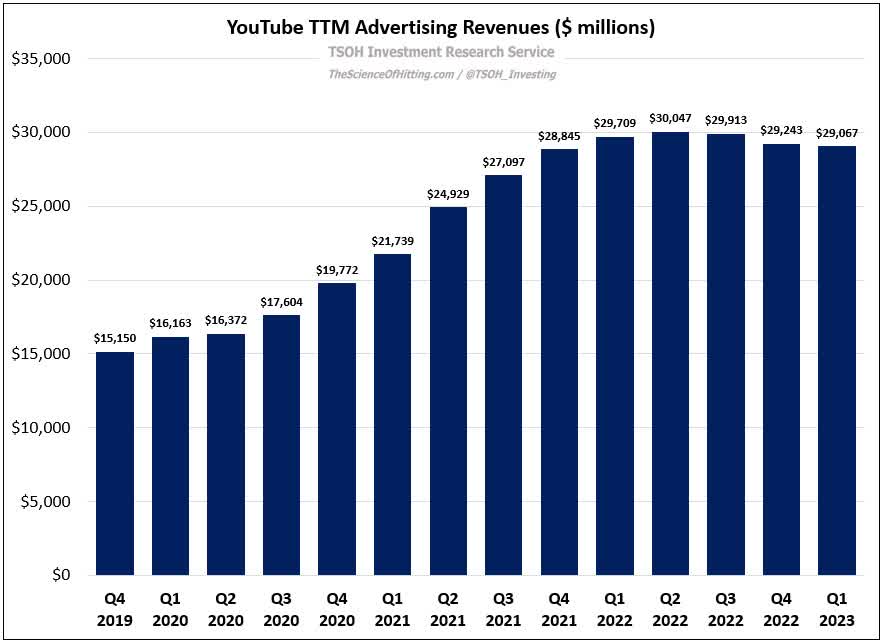

Chart 1A: Enlisting YouTube (GOOGL) For Context

The Science of Hitting By Alex Morris

As can be seen above, YouTube, which I believe to be the most popular video platform in human history, has experienced declining sales for the last three quarters.

Of course, these declining sales are a confluence of a couple factors:

- Simply tough comps. It is hard to grow at 40%+ for more than a few years.

- The fastest repricing of credit in the history of the United States, which has caused the 2nd, 3rd, and 4th largest bank failures in U.S. history. It appears the Fed plans to hike rates further, and this could serve to create 1) more bank failures and 2) more economic uncertainty, which directly impacts ad spend.

Below, I added another perspective apropos of YouTube’s sales.

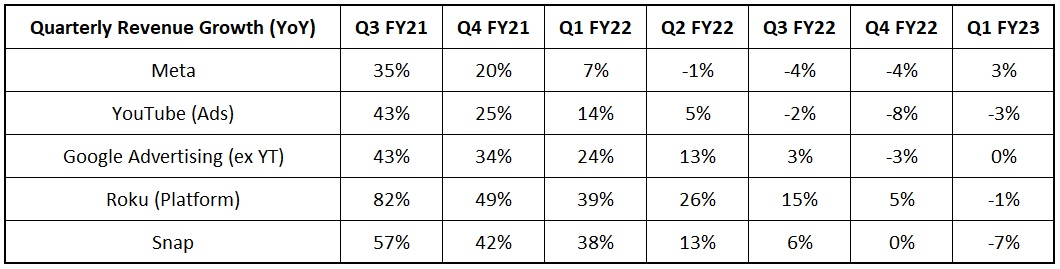

Chart 1B: More Context For Roku’s Business Performance

The Science of Hitting by Alex Morris

In short, when considering little, but mighty, Roku, I think it’s worthwhile to contextualize the business’ performance via its very popular peers’ performance. As we can see below, Roku’s sales have likewise flattened as of late, though they are not declining, as has been the case for YouTube.

Roku’s Quarterly Revenue Growth Since Going Public

To this end, below, Mr. Morris of TSOH created yet another fantastic chart for us whereby we may better understand the Roku’s growth rate presently:

Chart 1C: More Context For Roku’s Business Performance

The Science of Hitting by Alex Morris

As can be seen above, while the market has curiously rather violently traded Meta Platforms, Inc. (META) and Roku down, they appear to be the best performing out of the lot.

I believe the above data provides great context for the near term, i.e., growth has stalled, but this will likely not always be the case.

To that end, let’s now think about the long term:

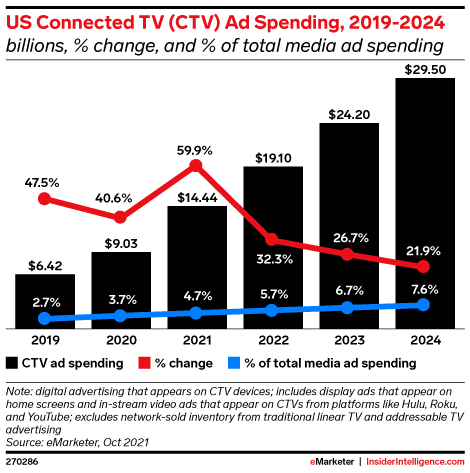

Chart 2A: Roku’s Long Run TAM

eMarketer

The above chart depicts the Connected TV ad market, which is set to experience fairly breathtaking growth beyond that which it has already experienced.

With this data in mind, it is no surprise that the largest, most-well capitalized companies on earth would attempt to field products that compete with Roku (we genuinely think very highly of our competitors!).

Notwithstanding these truly exceptional competitors attempts to take market share from Roku…

Roku delivered solid first quarter results in a challenging economic environment. We grew both our active accounts and streaming hours. Roku’s TV operating system was once again the number one selling TV OS in the U.S., achieving a record high TV unit share of 43%, which is more than the next three operating systems combined. We achieved share gains across the full range of TV screen sizes, particularly in the larger screen segment.

CEO Anthony Wood, Roku’s Q1 2023 Earnings Call (emphasis added).

To add to this perspective, I found this quote insightful:

But I’d like to point out, [if] you’ll forgive a baseball analogy. The teams with the biggest payroll do not win every year, not by a long shot.

…

So with the data, platform that we have and then using all the benefits of Roku passes to third parties and advertisers. I believe, again, fueled by this great team that Roku continue to deliver differentiated product at a price that doesn’t put us anywhere near the streaming wars, which probably is the heart of your question. I’ve said it before, and I’d say it with pride, Roku is not in the streaming wars. The streaming wars are being played out on our platform.

Charlie Collier, Roku’s Q1 2023 Earnings Call (emphasis added).

It’s a story as old as city-states themselves!

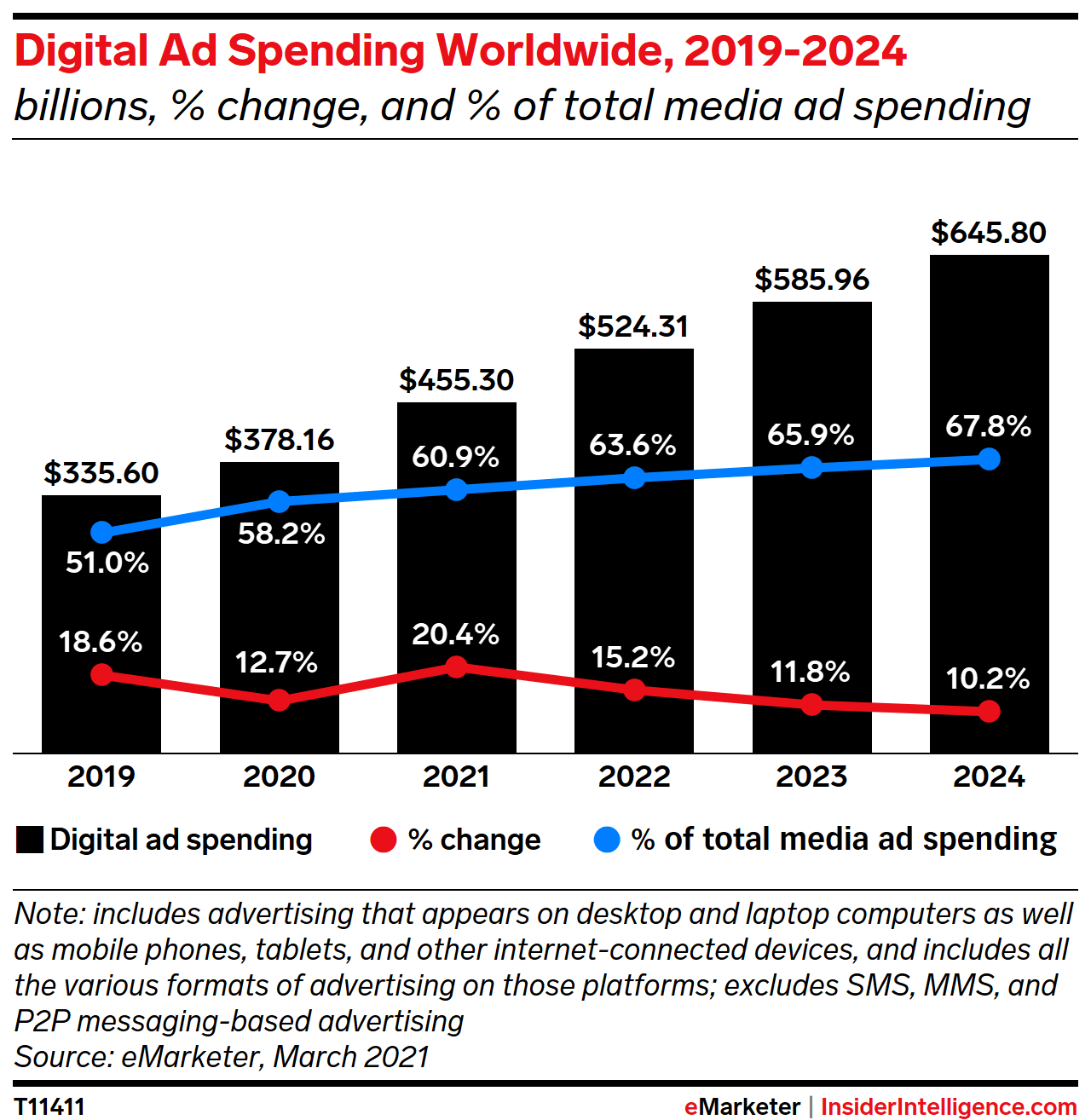

Chart 2B: Arguably, The Greatest Secular Growth Trend

eMarketer

I have shared over the years that we believe digital ads to be one of the most attractive areas for investment, by virtue of the massive size of the total addressable market (“TAM”) and the clear impact artificial intelligence (“AI”) has had on the industry over the last decade or so.

- This Is One Of The Greatest Secular Growth Trends (Digital Ads, which are basically just regular ads + AI/ML).

Roku stands to benefit substantially from the growth and maturation of this TAM.

Chart 3A

Of course, this above data is great: All Roku has to do is dutifully, loyally, and consistently serve its target market via its differentiated, custom-built TV Operating System, and it will, over the long run, capture this TAM.

And, despite what Mr. Market may want us to believe during this period of economic pain and uncertainty, Roku has been dutifully, loyally, and consistently serving its markets and then some!

In Q1, Roku grew Active Accounts to 71.6 million globally. Sequential net adds of 1.6 million were above net adds in Q1 2022. In the U.S., our Active Accounts are approaching half of all broadband households. This unmatched scale is the foundation of our business model, leading to significant engagement and growing monetization opportunities.

Roku Q1 2023 Shareholder Letter.

[As I already noted, this substantially beat consensus estimates for account adds in the quarter.]

Competition has been a bear thesis since Roku went public circa 2017. Roku’s U.S. market share just reached an all-time high, despite the company working to serve its customers against the gigantic likes of Apple, Amazon, and Comcast.

The Science of Hitting by Alex Morris

In short, I continue to believe that Roku offers a compelling, differentiated product that resonates with consumers. No more; no less.

Roku’s Inverse Bubble

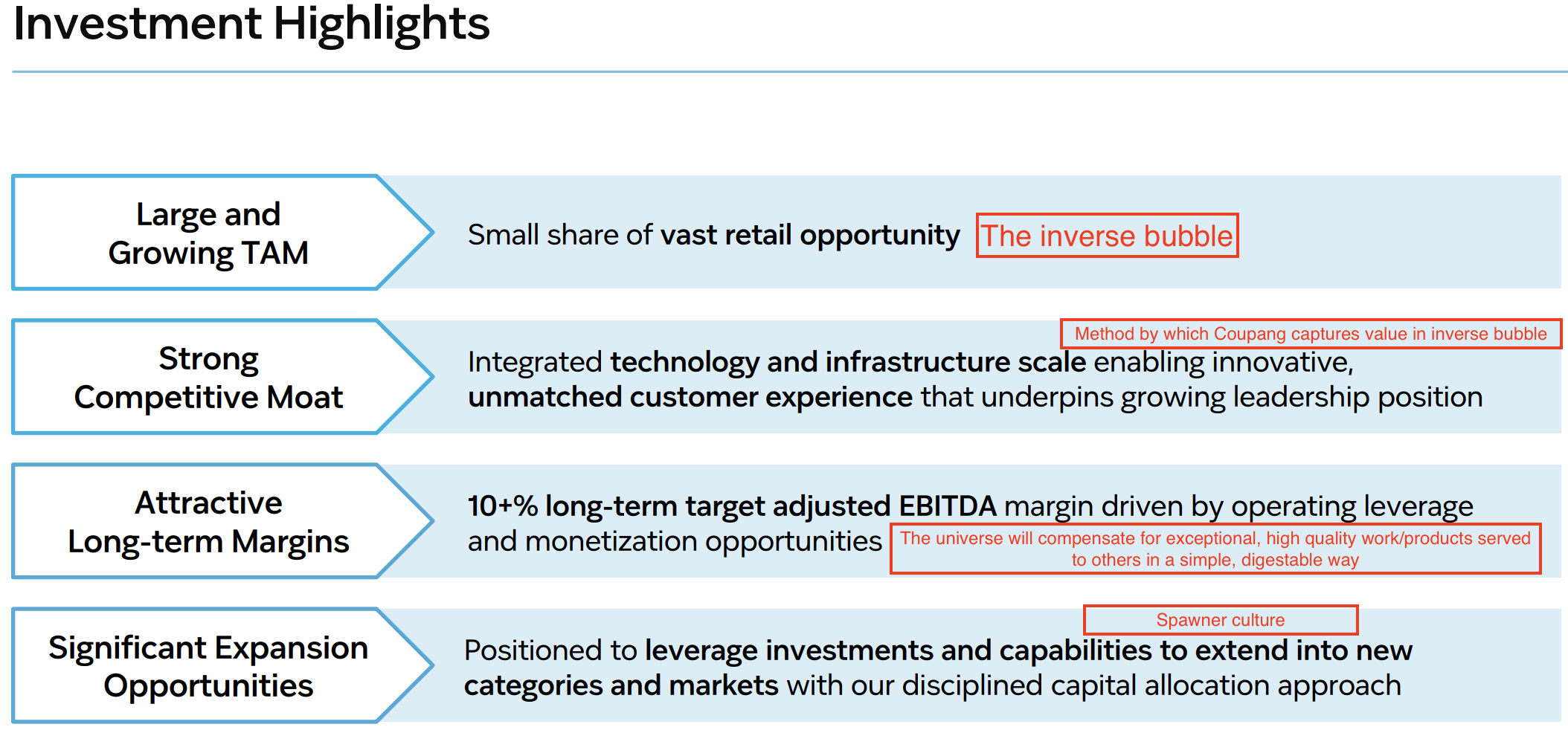

I and my community employ a few investment templates; using which, we select the companies we ultimately purchase.

Our “Inverse Bubble” template is certainly one of our most used.

For instance, it buttresses our investment in Coupang (CPNG) and Roku.

We delineated this idea in as pithy a manner as I think is possible below:

Beating The Market Investing Materials

For Roku, its Inverse Bubble is populated by legacy advertisement channels, which we’ve called “dumb channels,” which is not a description I take lightly. I generally do not believe in calling things dumb, as I know they are often just misunderstood.

That said, legacy advertisement channels could be aptly and professionally described as “dumb,” in that there is not a whole lot of “Artificial Intelligence” governing their placements, timing, etc.

There’s scantly any real time intelligence governing the system, which is an issue that I believe will vex humans in areas in which we do not apply AI with confidence and a faithful mindset.

In the above tweet, Alex shared a fantastic example of a component of Roku’s Inverse Bubble.

I think there may still be instances in which “dumb channels” are used. There’s likely situations where the “dumb channels” offer such fat pitch ROI that it makes sense, but, generally speaking, all advertising will be “AI-centric, smart advertising.”

Notably, all of the ad money is there in this industry already. It is merely a case of transitioning it into digital ads, or smart ads if you will.

This is a defining characteristic of the Inverse Bubble investing template.

In this vein, Mr. Charlie Collier, former CEO of Fox Entertainment remarked,

Charlie Collier: Well, Ben, first, thanks for noting how old I am and how many upfront I’ve been through. I appreciate that. [Multiple Speakers] Thank you. I appreciate that.

[Louis interjecting here. Mr. Collier is a character. Highly recommend listening to the Roku call. We’re very grateful and excited to have him on our team!]

So look, our approach to new fronts is really exciting for two reasons. One is, the trend that you talk about. Again, when you know traditional TV fell 10% and our streaming hours are growing 20% year-on-year.

That’s obviously a really interesting time to come and reintroduce ourselves to the market. And you think about some of what I said before and what we’ll be introducing in terms of the data partnerships and add focus offerings.

But, actually, I want to talk a little bit about why I am particularly bullish for Roku, which is that, we’re still quite new to this. These are not 50 year relationships. You have a lot of new advertisers coming to streaming for the first time, and we still have opportunity to both grow businesses that have seen how effective Roku is and also add new accounts. So Roku is in an interesting position because, again, the secular trends are coming our way, and I also feel really excited to present Roku in the context of really being the base of the advertising market.

[Go Mr. Collier! Head Salesman In Charge! Inspiring.]

Here’s what I mean by that. I think in the — really in the near term, more and more television is going to be planned platform first because of our scale and are really unmatched reach on this platform. So we actually chose to come to the new front instead of the upfront because we wanted to reach people early, and we wanted to show them how much we help all the people they’ll be hearing from. Again, those networks and apps and partners are M&E advertisers, and they value Roku and more and more you’re going to see the general marketplace do the same. So I’m excited to present with the team. They’re doing a great job and we’re hearing really positive feedback.

Charlie Collier, Roku’s Q1 2023 Earnings Call (emphasis added).

Alright, so those charts succinctly illustrate the Roku thesis from a higher level.

We could, and we will to some extent, run Roku through “The Greatest Irony Framework,” which we’ve done in the past (please read my last few notes on Seeking Alpha better understand this framework).

Indeed, in my eyes, Roku operates positively from its greatest position of strength ever…

From the Charlie hire to the growth of the Roku Channel to Roku’s success with original content to Charlie’s expertise in original content to the company’s expanding DSP partnerships, which we think could lead to industry consolidation over the long run, to Roku’s gargantuan cash hoard of about $1.6B+ and no long term debt…

I believe Roku operates from positively its greatest position of strength ever.

With these ideas in mind, let’s close out this review by considering a few of Roku’s products whereby we highlight the evolving and expanding nature of the Roku conglomerate.

Exciting Roku Products: Roku TV and The Roku Channel

I, as a consumer of quality products, am very excited for two Roku products which I will buy/use myself:

- Roku’s Premium, Vertically Integrated TVs

- The Roku Channel.

Roku’s new TV will be its first in-house built TV. Historically, Roku has exclusively sold its TV operating system to third party TV manufacturers.

It will now both integrate that TV OS into its own hardware products and continue to license it to third party TV/hardware manufacturers.

I believe this is exciting because it could poise Roku to further innovate in building the best AI-centric TV platform ever, and this will serve to further drive Roku’s network effects moat, which is something we’ve postulated in the past.

What we’ve been doing at Roku over the last couple of years is really investing in the tools to enable that symbiotic relationship. And that’s what enables us to achieve the fantastic engagement results. I mean, 3.9 hours per consumer count per day is huge engagement and that’s been driven by the investments we started making a few years ago. We started to invest in live, initially launched it within Roku channel in 2020…

CEO Gideon Katz, Roku’s Q1 2023 Earnings Call.

Interestingly, Mr. Katz work is almost exclusively AI work in a sense.

From Roku’s programmatic, smart ads to Roku’s AI-orchestrated TV platform (The Roku Channel), Roku is principally a leading AI business in my humble opinion.

AI Creates Consumer Surplus

To close out this section, I found two pieces of “field research” to be important in substantiating the value of Mr. Katz’ AI work.

First, TidalCap illustrated how TV Operating Systems can differentiate themselves by creating “the best AI that morphs to the consumers’ preferences in real time.”

I included a quote from Roku’s Q1 2023 earnings call, but, in response to recent feedback, I will refrain from sharing it here, as I believe it was too long based on the aforementioned feedback (which asked not to share extremely long conference call quotes).

For those interested, it is the portion of the call in which Mr. Wood analogized Roku’s TV products to Microsoft’s strategy in licensing Windows while also offering a fully-vertically integrated product.

Many buyer personas on this rock with 8B people!

Concluding Thoughts: Convequity (A Brilliant Seeking Alpha Contributor/Analyst) Research’s Wisdom

We’re leaning into our unique role as the number one TV streaming platform in the U.S., Canada and Mexico to simultaneously benefit consumers, content partners, and advertisers, while growing monetization opportunities. You can see this with features like our sports experience, live TV guide, and continue watching.

CEO Anthony Wood, Roku’s Q1 2023 Earnings Call.

In past work on Roku, we’ve detailed our perception as to how Mr. Wood, Mr. Collier, and the dynamic Roku team might consolidate the TV operating system industry over time.

We detailed the idea that our universe, and discrete systems within it, appears to exist in a state of “transitioning back and forth between consolidation and fragmentation of large energy systems.”

This happens in social systems. It happens in government systems. It happens in business systems (and they are all just energy management through a certain lens).

Convequity’s thinking was integral in our ability to divine this reality for Roku, and we shared as much with you in the past.

And, by the grace of this beautiful and incredibly abundant universe, it appears that our thinking, inspired by the brilliant folks at Convequity Research, continues to come to fruition.

In fact, while working through Roku this time around, for the first time, I felt a visceral sense of “gravity shifting towards the Roku” platform.

The Science of Hitting by Alex Morris

These are important data points, but also the transition to ad-supported streaming appears to be an instance in which Mr. Wood was far ahead of the pack, as he has been for decades as a serial entrepreneur.

In closing, we’re looking forward to the unique ways in which Roku will serve the world (advertisers, consumers, and content producers) in the years and decades ahead.

Thank you for reading, and have a great day.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU, TTD, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Beating the Market: The Time Is Now

There has never been a more important time in stock market history to buy individual stocks at the heart of secular growth trends. Mature market performers/underperformers and index funds simply will not cut it, as we face a decade during which there is absolutely no guarantee the overall markets will rise.

This is why the time is now to discover high-quality businesses with aggressive, visionary management, operating at the heart of secular growth trends.

And these are the stocks that my team and I hunt, discuss, and share with our subscribers!