Summary:

- Roku, Inc. reported Q4 2022 numbers that beat analyst estimates while guiding better than expected for Q1’23.

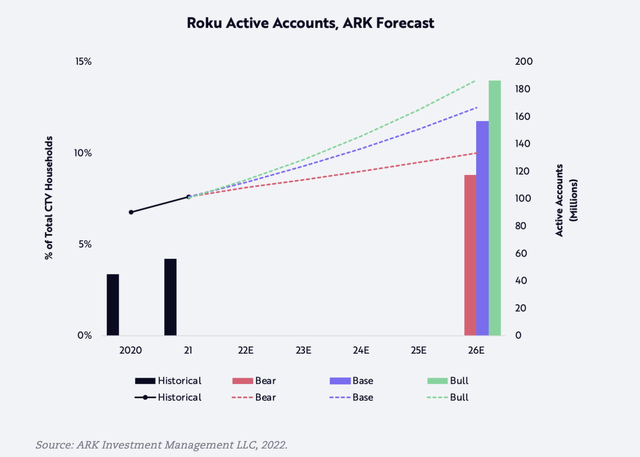

- The video streaming platform reported solid active accounts and streaming hours growth, supporting the ARK Invest base case.

- Roku stock is cheap at $70 at 2x forward sales, but Roku has to hit the new targets of returning to adjusted EBITDA positive in 2024.

Justin Sullivan

As previously pointed out, the market got far too negative on the story being developed by Roku, Inc. (NASDAQ:ROKU). The macro environment in the digital advertising market was clouding the long-term growth story presented by ARK Investment Management LLC (ARKK) and Cathie Wood. My investment thesis remains ultra-Bullish on the long-term story, with the streaming video platform growing both active accounts and the engagement of those viewers.

Growing Platform Is The Key

Roku sits in an interesting position in the streaming video market. The company offers a generally independent platform with a home screen to assist viewers in finding relevant content in an increasing crowed and difficult space to navigate. The company offers the ultimate opportunity to funnel viewers to numerous streaming services without being conflicted by a preference of sending viewers to their own app.

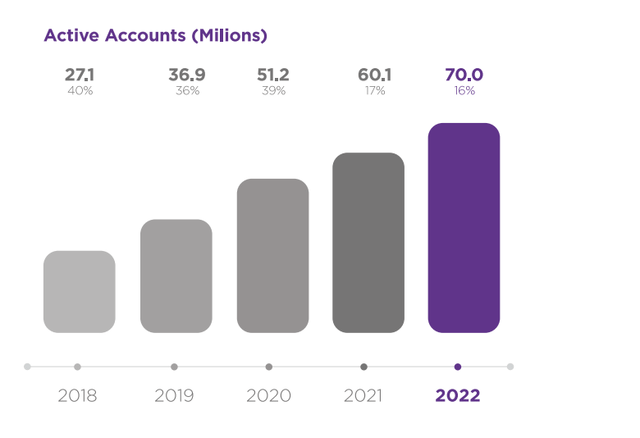

For Q4 2022, Roku added 4.6 million active accounts, growing accounts by 16% during 2022 to 70.0 million now. Even in a tough year for Roku stock, the streaming platform grew users during 2022 by an amount exceeding the growth levels in both 2019 and 2021.

Source: Roku Q4’22 presentation

The key to success is growing this active accounts total and turning on the monetization machine once a viewer becomes an active account. During Q4’22, revenues were generally flat at $867.1 million, as device revenue dipped 18% to only $135.8 million in the typical strong holiday period.

The company saw important streaming hours up 23% during the quarter to 23.9 billion hours, and the Roku Channel continues to expand as a top FAST (Free Ad Supported TV) offering due to Roku Originals. In addition, NBCUniversal (CMCSA), AMC (AMCX) and Warner Bros. Discovery (WBD) all added FAST channels to expand on the Roku Channel, offering since these channels need the exposure of the Roku platform in order to succeed.

The growth of these FAST channels further adds the need for an independent platform as compared to other offerings like Apple TV (AAPL) or Amazon Fire (AMZN) linked to a couple of the top streaming platforms.

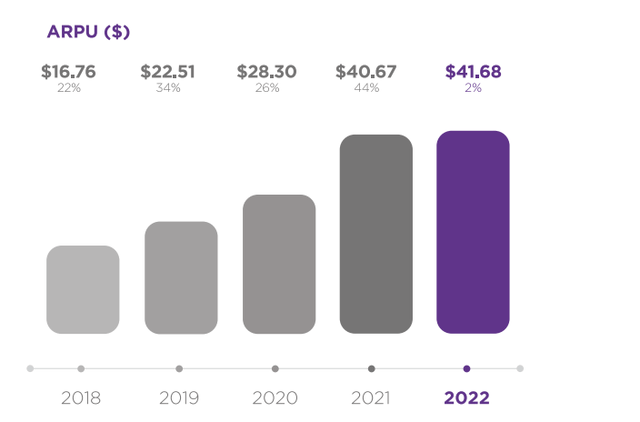

Roku suggests the U.S. ad market was down 12% during December hiding the vast majority of the market shift from legacy TV to TV streaming. Despite the additional streaming hours from more active accounts, the company wasn’t able to monetize these accounts at higher levels. After massive monetization gains in the prior years, ARPU was only up 2% on the year to $41.68.

Source: Roku Q4’22 presentation

The key is that Roku grew active accounts and streaming hours at a strong clip during 2022. The monetization will follow when the digital ad market improves as the economy rebounds.

Path Back To Profits

The big reason the stock plunged last year was the bottom line issues. Roku quickly went from a company with adjusted EBITDA profits and strong growth prospects to one losing a ton of money.

Roku isn’t necessarily the top-line growth story anymore, with the focus on becoming profitable and solving a lot of the problems facing the video streaming sector. The streaming platform now needs 70 million active accounts to be profitable, while previously planning for a much larger company before turning on the leverage machine.

The company doesn’t need to stray too far from the targets of ARK Invest. The Cathie Wood research firm forecast a base case where active accounts more than double by 2026 to reach 157 million.

Roku guided to Q1 ’23 revenues of $700 million, above analyst estimates of $688 million. The problem is that the company has been squeezed by wild opex growth while revenues have stalled.

The video streaming platform forecast a $110 million adjusted EBITDA loss in the March quarter alone, but the Q4’22 EBITDA loss of $95 million beat analyst estimates. The company now forecasts a dramatic reduction in opex growth throughout the year, leading to adjusted EBITDA profits in 2024.

As the advertising market rebounds, Roku already has $1 billion in up-front ad commitments to help build out the profitable ad business. The streaming platform was far too reliant on the ad scatter market heading into 2022, but the success of the Roku Channel and Roku Originals has altered the financial picture and increased the potential for the company to monetize users at a higher level by funneling engagement into a more high-value monetization path.

Takeaway

The key investor takeaway is that Roku, Inc. appears on track to reach some of the base case targets of ARK Invest. The video streaming sector hit some speed bumps in 2022, but the long-term story remains generally intact.

Roku stock has now run from $40 to $70 in months, and Roku probably needs a pause here. Regardless, the long-term story appears intact, and Roku, Inc. stock is a buy after a consolidation period.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.