Summary:

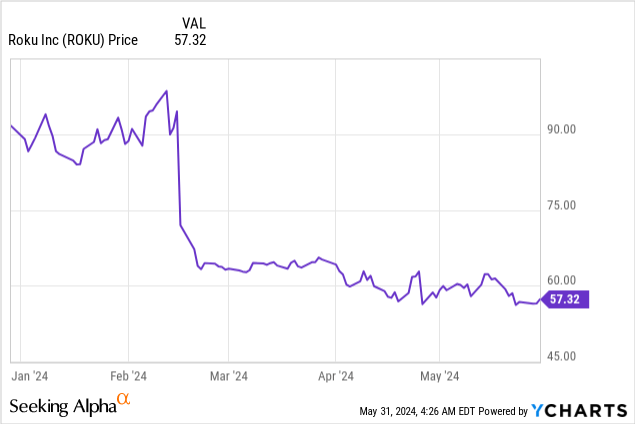

- Roku’s stock price has dropped nearly 40% this year despite positive Q1 earnings results that featured an acceleration in revenue.

- The company reported strong sales of its latest Roku Pro models.

- At the same time, it’s also expanding its streaming distribution, having signed up many customers for Peacock during the Super Bowl.

- Streaming sign-ups also create a strong revenue opportunity for Roku Pay.

- Roku is trading at a cheap ~14.5x TTM FCF multiple.

hapabapa

In the volatile stock market of 2024, the winners have won big while the losers have shifted deeper and deeper into the penalty box. Oftentimes, however, stock price performance has been completely uncorrelated with underlying fundamental performance, which I believe to be the case with Roku (NASDAQ:ROKU).

Roku, a leading streaming company for both hardware and platforms, is now down nearly 40% year to date. The company’s Q1 earnings release, unveiled in April, did little to placate investors despite an acceleration in revenue growth and sharp gains in profitability. It’s a great time, in my view, for investors to reassess the bull case for Roku.

After the price drop, the bull case for Roku has never looked more favorable

I last wrote a bullish article on Roku in March, when the stock was still trading in the mid-$60s and prior to the company’s Q1 earnings release. With the drop in share prices since then, plus the positive updates coming out of Q1 (which we’ll discuss in the next section), I remain bullish on Roku for the remainder of the year.

A couple of product updates worth mentioning: first, the company noted successful sales of the new Roku Pro TV product. This is Roku’s high-end smart TV that starts at $699 (for a 55″ model; there are additional options for 65″ and 75″ screen sizes), incorporating AI-assisted brightness and color adjustment features and a new side-speaker system. We remind investors that while hardware is not profitable for Roku (and in fact, that strong hardware sales here is a driver behind the company’s y/y decline in gross margin), but it’s the gateway toward streaming and platform revenue.

Speaking of which: the company notes that its streaming services distribution activities are accelerating. During the Super Bowl, the company generated revenue from directing viewers toward Paramount+. Roku also handles payment processing for sign-ups through the Roku platform, which creates a captive growth market for its Roku Pay segment. The company also continues to innovate in its viewer experience to try to drive engagement and more subscription sign-ups, with sports in particular. The company’s new NBA Zone, complementing the existing NFL zone, creates a one-stop shop for sports fans to access their content through the Roku platform.

Here’s a refresher on my full long-term bull case for Roku:

-

Roku’s shift toward a platform-first model has dramatically improved its margins and revenue stability. At one time, Roku’s revenue split between its low-margin hardware players and its platform revenue was closer to 50/50; now, hardware is less than 20% of Roku’s overall revenue. Not only has this improved profitability, but this also means Roku’s revenue is more stable from quarter to quarter and isn’t heavily reliant on the seasonality of device sales.

- Secular tailwinds towards streaming and away from traditional TV- The company notes that in the U.S. in Q1, streaming hours grew 23% y/y in the U.S. while traditional TV viewing time declined 13% y/y in the same time period.

-

The company continues to drive growth via the Roku Channel and is also a leader in original programming. The company’s platform is now one of the leading streaming offerings in the U.S. This channel is also now producing original content, including a new documentary in partnership with the NFL that became one of the most popular shows on Roku. Sports-oriented hubs, like the company’s NFL and NBA zones, continue to drive engagement and sign-ups to other companies’ streaming services.

-

Streaming distribution and Roku Pay- The company has also picked up the pace of facilitating sign-ups for streaming services from its platform, where it also generates revenue by processing via Roku Pay.

-

International expansion opportunity- Roku has recently set its sights on expanding aggressively overseas, with recent overtures in the UK, Canada, and Mexico – representing the next leg of growth for the company. Though this has dented the company’s ARPU (international markets generate less ad dollars than in the U.S.), we should focus on drawing in eyeballs first and worrying about revenue contribution later.

- Rich cash balances- The company has over $2 billion of net cash on its books and no debt, which represents about a quarter of its current ~$8 billion market cap.

Stay long here and buy Roku on the dip.

Q1 download

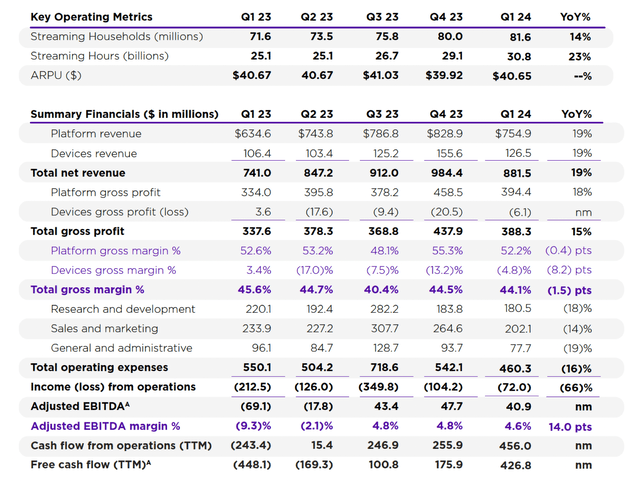

Let’s now go through Roku’s latest quarterly results in greater detail. The Q1 earnings highlights are shown in the snapshot below:

Roku Q1 results (Roku Q1 shareholder letter)

Roku’s revenue grew 19% y/y to $881.5 million, with growth of 19% in both its platform (software and advertising) and device sales. It beat Wall Street’s much more modest expectations of $850.4 million (+15% y/y) by a four-point margin, while also accelerating versus Q4’s 14% y/y growth rate – making the stock’s post-earnings drop even more puzzling.

This is the start to a year in which Roku expects accelerating growth overall. Per CEO Anthony Wood’s remarks on the Q1 earnings call:

We will accelerate platform revenue, adjusted EBITDA, and free cash flow growth in 2025 by focusing on three key opportunities, maximizing the Roku home screen as the lead-in for TV, growing Roku bill subscriptions, and growing ad demand for Roku.

Every day, the Roku home screen reaches US households with nearly 120 million people. This significant reach creates a lot of opportunity. I see many ways to improve the user experience while also growing monetization for Roku […]

We also see a big opportunity to grow Roku-billed subscriptions. Roku Pay, our payment and billing service, simplifies the sign-up process for users so they can quickly transact and start streaming and ensures content partners don’t lose subscribers due to unnecessary friction at the point of purchase. Additionally, we are making it easier for advertisers to execute campaigns programmatically on the Roku platform by expanding and deepening our relationships with third-party platforms.”

We note that Roku’s guidance for Q2 implies a slowdown to 10% y/y revenue growth, alongside a devices gross margin that is expected to be in the negative teens. While certainly preventing Roku from having a perfect story, investors should keep in mind that Roku’s strategy is to produce price-competitive devices and generate long-term revenue through ads and subscriptions.

Having loss-leader products in hardware also hasn’t at all prevented Roku from improving its profitability, wherein Q1 adjusted EBITDA soared to a $40.9 million profit at a 4.6% margin, which represented a 14 point y/y improvement versus a -9.3% adjusted EBITDA margin in the year-ago Q1.

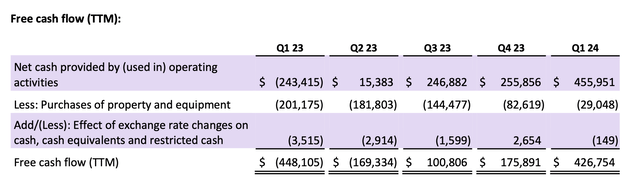

We note as well that Roku has generated a sizable $427 million in trailing twelve-month FCF, versus an FCF burn of a similar magnitude at the same period last year.

Roku TTM FCF (Roku Q1 shareholder letter)

Valuation and key takeaways

At current share prices near $57, Roku trades at a market cap of $8.26 billion. After we net off the $2.06 billion of cash on the company’s latest balance sheet, its enterprise value is $6.20 billion – which represents just a 14.5x TTM FCF multiple. Considering multiple levers for continued double-digit growth (and the fact that over the long run, higher-margin platform revenue will continue to represent a higher mix of revenue versus hardware, which will boost adjusted EBITDA and FCF margins), I’d say Roku stock is on sale right now.

Don’t miss the chance to build a position in Roku while it’s still cheap.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.