Summary:

- Roku holds a substantial amount of cash, nearly 25% of its market cap, with no debt and profitable operations.

- Its current valuation at 40x forward EBITDA raises questions about further upside potential.

- Now rated as neutral due to uncertainty in revenue growth stability and current valuation concerns.

JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

Here’s the punchline, Roku, Inc. (NASDAQ:ROKU) is fairly valued.

While the business has a lot going for it, for example, a tremendous amount of cash on its balance sheet, plus a business that is evidently already profitable.

And yet, the bearish overhang here is that there’s too much uncertainty over the stability of its revenue growth rates. And until there’s a clear sense of what Roku’s go-forward revenue growth rates will stabilize at, it doesn’t make sense to pay 40x forward EBITDA for Roku.

Therefore, following a hiatus from following this stock, I now rate it as neutral.

Rapid Recap

Back in December, I said,

The bull case is built on [Roku’s] ability to turn substantially and sustainably profitable in 2024. Here I discuss the pros and cons of this investment.

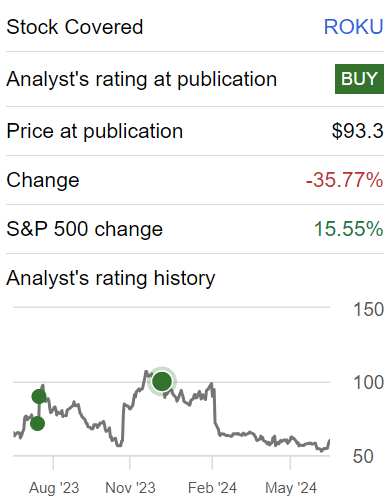

I recognize that I was bullish on Roku, before many investors were bullish, and show you the proof too.

Looking ahead, while I’m still bullish, I’m not as bullish as I once was, as I believe that the bulk of my bull case has already started to be reflected in the share price.

Simply put, at this juncture, the upside, while still attractive, is more muted than it used to be.

Author’s work on ROKU

In hindsight, when I said that its upside was more muted than it used to be, I should have been firmer and turned neutral then. Because today, I’m struggling to see its upside potential.

Roku’s Near-Term Prospects

Roku is a platform for streaming entertainment, enabling households to access various streaming services through Roku devices and smart TVs. Roku seeks to enhance user experience by simplifying the process of finding and watching content, and it monetizes this experience through advertising and subscription services.

In the near term, Roku is determined to improve user engagement. Moreover, they plan to capitalize on its large user base of 81.6 million streaming households and the extensive reach of its home screen, which is seen by 120 million people daily.

With initiatives such as enhancing the home screen with new video ad formats, growing Roku-billed subscriptions, and expanding programmatic ad capabilities, Roku aims to accelerate revenue growth and improve profitability starting in 2025.

However, Roku faces challenges too. They anticipate slower growth in streaming service distribution due to tough year-over-year comparisons and a higher mix of lower-priced, ad-supported offerings (more on its revenue growth rates soon). Additionally, device margins are expected to decline as Roku continues to invest in expanding its branded TV program.

Given this balanced background, let’s now discuss its fundamentals.

Revenue Growth Rates Will Decelerate Further

In my previous article, back in December, I neatly and presciently summarized the setup that investors are facing six months later.

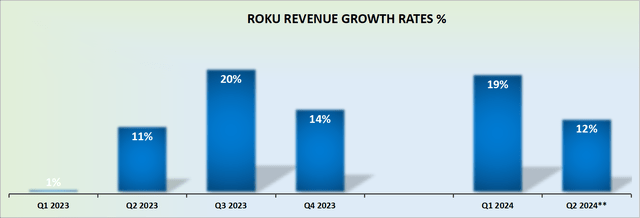

I don’t believe that many investors would expect to see Roku growing in the +20% CAGR again.

Therefore, following my reasoning, I suspect that in 2024 Roku could also be growing around the mid-teens.

On the one hand, that’s not particularly exciting growth. On the other hand, investors will be more than willing to pay for Roku if they believe that its growth prospects have finally stabilized.

As you know, what investors truly dislike, nearly as much as bad news, is uncertainty. If Roku can be counted on to deliver stable and mid-teens growth rates, then the business is worth a premium valuation.

The core issue that Roku faces is not only that its growth rates are no longer going to deliver more than mid-teens growth rates, but more importantly, investors are not confident in the stability of its growth rates.

As Roku’s comparables become more challenging for the remainder of 2024, this means that its revenue growth rates will decelerate. And, perhaps, end up delivering just high single digits for H2 2024.

And therein lies the problem with Roku. It’s poor growth rates and the uncertainty of what’s a reasonable revenue growth rate to be expected in the near term. And if investors can’t get comfortable with its revenue growth rates, this will impact its overall valuation.

ROKU Stock Valuation — 40x EBITDA

What complicates matters for investors is that there’s a lot to like about Roku. The arguments to be bearish are not clear-cut. For example, the business holds no debt. And crucially, nearly 25% of this business market cap is made up of cash. Let that sink in. That’s a lot of cash!

And then, to compound matters, it’s easy to estimate Roku making nearly $200 million of EBITDA over the coming twelve months. So, it’s not exactly that Roku is bleeding cash. On the contrary, the business is profitable, with a lot of cash on its balance sheet.

And yet, having to pay around 40x forward EBITDA for Roku, a business that has so many hairs on it, doesn’t appeal to me right now. Here’s the thing, I know that in my portfolio, what drives the bulk of the upside is a re-rating in investors’ expectations. I call this inflection investing.

But if you already start with a multiple of 40x EBITDA, how much more re-rating can there be? Does it make sense to pay 50x forward EBITDA for Roku? I don’t believe so.

In sum, I estimate that Roku is probably already fairly valued.

The Bottom Line

In conclusion, while I see significant potential in Roku’s business model and its large user base, the uncertainty surrounding its revenue growth rates makes it challenging to justify its current valuation.

Despite its strong cash position and profitability, paying 40x forward EBITDA seems excessive given the potential for decelerating growth.

Therefore, I now rate Roku as neutral, as I fail to see its multiple expanding substantially higher.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.