Summary:

- Roku stock surged 25% on Friday after releasing strong earnings.

- The company handily beat guidance as the ad recovery is underway.

- The company has a $1.8 billion net cash balance sheet position.

- The stock is still trading at a reasonable 8x gross profits even after the rally – I reiterate my buy rating.

Phillip Faraone/Getty Images Entertainment

Roku (NASDAQ:ROKU) stock surged on Friday after unveiling earnings results which blew away guidance. If Nvidia (NVDA) delivered “guidance for the ages” earlier this year, then ROKU delivered a “beat for the ages.” OK, I exaggerate a bit. Like other advertising giants that reported before it, ROKU showed that the advertising recovery was underway, with solid YOY revenue growth. But ROKU was also able to deliver a surprise profit beat. These strong results increase investor confidence in management’s ability to deliver against their commitment of positive adjusted EBITDA by 2024, which may be explaining in part the strong stock rally today. I reiterate my buy rating for the stock as the stars are beginning to align here.

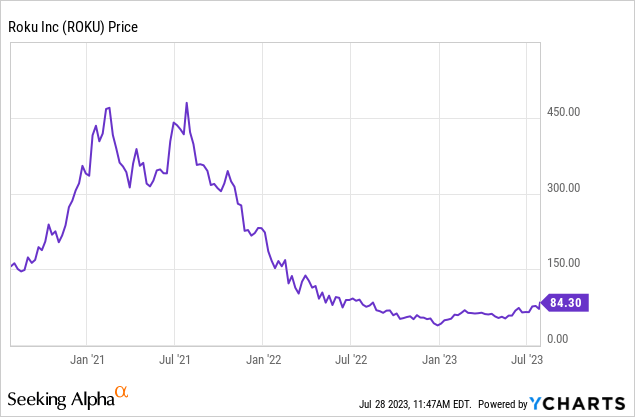

ROKU Stock Price

While ROKU remains far below all-time highs, the stock is now trading near 52-week highs. This rally is for real.

I last covered ROKU in April, where I rated the stock a buy but explained why investors (perhaps just yours truly) were growing impatient on the growth story. My impatience proved unwarranted, as ROKU has turned things around.

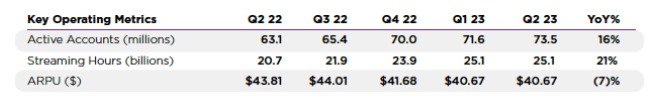

ROKU Stock Key Metrics

This past quarter saw ROKU continue to take market share in TV viewing, with active accounts growing 16% YOY and streaming hours growing 21% YOY. It pays to be the top selling TV operating system in the country. Average revenue per user (‘ARPU’) declined 7% YOY but that is not too surprising given the tough economy as well as the fact that new users inherently have lower monetization rates to begin with.

2023 Q2 Shareholder Letter

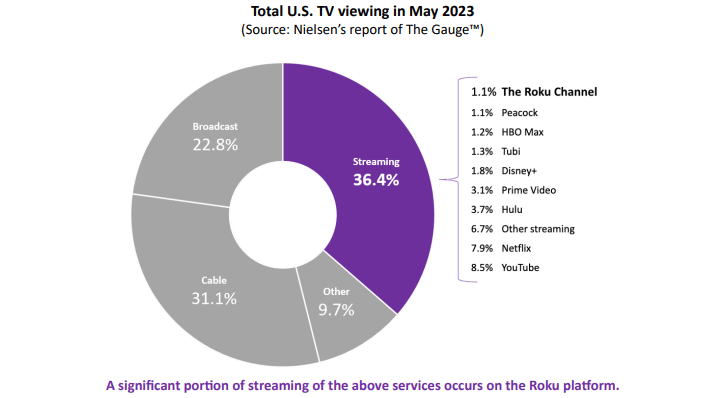

It is curious that The Roku Channel represented 1.1% of all TV viewing (ROKU notes that a large portion of the other streaming hours are done on their platform).

2023 Q2 Shareholder Letter

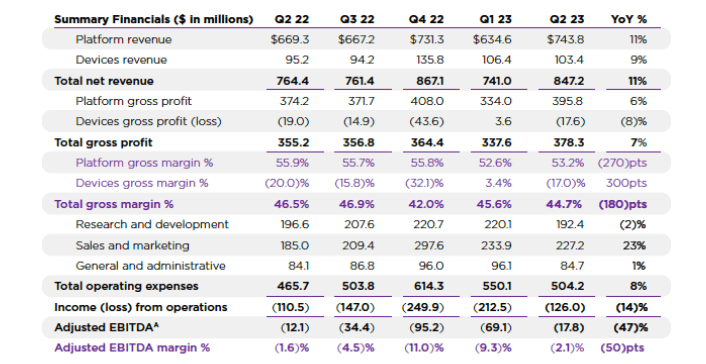

ROKU delivered 11% YOY revenue growth to $847.2 million, blowing past guidance for $770 million. Gross profits came in at $378.3 million (ahead of $335 million guidance) and the adjusted EBITDA loss came in at $17.8 million (ahead of $75 million guidance). I can say that this beat came as a surprise as I am doubtful that investors were expecting the recovery to happen so swiftly as it has here.

2023 Q2 Shareholder Letter

ROKU ended the quarter with $1.8 billion of cash versus no debt. Looking forward, ROKU has guided for $815 million in net revenue in the third quarter, representing 7% YOY growth but a sequential decline. That reflects some impact from the ongoing writers’ strike. Gross profits are expected to come in at $355 million, roughly flat YOY and the adjusted EBITDA loss is expected to widen to $50 million. It appears that investors are looking past the expected reversal of fortunes.

On the conference call, management reiterated expectations for positive adjusted EBITDA for the full year 2024 and guided for device gross margin to improve to the “negative low teens.” I note that despite the stock price reaction today, management cannot be blamed for being promotional. An analyst asked why management described their 11% revenue growth as being modest, asking “what’s normal,” but management clarified that they are “very happy with” their results. The tough macro environment has not completely subsided, but ROKU appears to have turned the corner here.

Is ROKU Stock A Buy, Sell, or Hold?

ROKU finds itself in an enviable position of benefitting from both the shift towards smart TVs as well as the growth of video streaming.

2023 Q2 Shareholder Letter

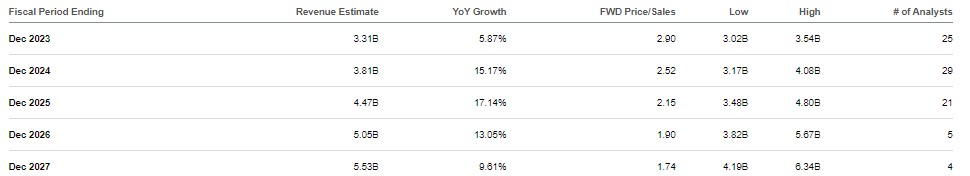

Growth in these segments has been difficult following the pandemic due to tough comparables and a tough economy, but the long term outlook remains bright as I find it difficult to imagine these tailwinds reversing. After today’s rally, the stock traded at around 8x gross profits, which is a reasonable valuation given consensus estimates for double-digit top-line growth in the years to come.

Seeking Alpha

Based on 13% projected growth, a 50% net margin (based on gross profits), and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see ROKU trading at around 10x gross profits, representing ample upside from both multiple expansion and projected growth.

What are the key risks? As management stated, “advertising is cyclical” and it has been curious to witness ROKU undergo such dramatic shifts in profitability over the past several years. It is possible that growth slows down moving forward, perhaps due to unforeseen competition. I am of the view that ROKU may be better off focusing on its smart TV business instead of its own streaming ambitions as I question the long term economic benefit there. It is possible that management invests even heavier in streaming, or that their heavy investment is indicative of their view that competitive threats may impede their smart TV growth thesis.

I reiterate my buy rating due to the strong net cash balance sheet, reasonable valuation, and evidence of a fundamental turnaround.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!