Summary:

- ROKU has exceeded our expectations, due to the impressive expansion of its active accounts and streaming hours in FQ1’23, despite the uncertain macroeconomic outlook.

- The moderation in its operating expenses has also yielded visible results, potentially moderating its cash burn rate before achieving adj. EBITDA by FY2024.

- However, given the peak recessionary fears, we believe there may be more attractive entry points ahead, preferably at the December 2022 bottom for an improved margin of safety.

- The opportune time to add ROKU is not here yet.

Anastasiia Yanishevska/iStock via Getty Images

We had previously covered Roku (NASDAQ:ROKU) here in our previous article. The management had offered a bearish FQ4’22 guidance, triggering Mr. Market’s pessimism then. However, it was no secret that the company would likely remain unprofitable through 2025, therefore, investors should also disregard its growing SBC expenses and share dilution, while it continued to grow its subscription base.

The ROKU Investment Thesis Is Robust – But The Time Is Not Here Yet

In this article, we shall be discussing ROKU’s double beat in its FQ1’23 results, exceeding the consensus expectations despite the uncertain macroeconomic outlook. It reported revenues of $740.99M (-14.5% QoQ/ +0.9% YoY) and GAAP EPS of -$1.38 (+18.2% QoQ/ -626.3% YoY).

The streaming company has also made great efforts in optimizing its operating expenses to $550.1M (-10.4% QoQ/ +41.6% YoY) in the latest quarter. This is on top of the improvement in its device gross profit margin to 3.3% (+35.5 points QoQ/ +18 YoY), despite the slight moderation in the platform gross profit margin to 52.6% (-3.1 points QoQ/ -6.1 YoY) attributed to the lower ARPUs.

However, any investors concerned about ROKU’s reduced FQ1’23 ARPU of $40.67 (-2.4% QoQ/ -4.5% YoY) must be aware that it is partly attributed to the YoY deceleration in advertising spend. The US market is expected to only report a YoY growth of 2.8% in 2023, compared to the 9.8% reported in 2022 and 25.8% in 2021.

The same cadence has been reported by the two advertising giants in their recent earning calls, Alphabet (NASDAQ:GOOG) and Meta Platforms (NASDAQ:META), with the pronounced deceleration in advertising spend in the financial services, technology, and Media/ Entertainment segments.

However, the market trend still appears relatively optimistic, in our opinion, with GOOG reporting a modest revenue expansion of -5.3% QoQ/ +1.8% YoY and META an expansion of -10% QoQ/ +4.1% YoY in FQ1’23.

The streaming market remains healthy as well, with Netflix (NASDAQ:NFLX) recording revenue growth of +3.9% QoQ/ +3.7% YoY at the same time, while increasing its subscribers by +0.7% QoQ/ +4.8% YoY.

In light of the recent advertising and streaming trends above, it is unsurprising that we remain bullish about ROKU’s execution, especially given the impressive expansion of its active accounts to 71.6M (+2.2% QoQ/ +16.8% YoY) and streaming hours to 106.4B (+5% QoQ/ +20% YoY) in the latest quarter.

This feat alone is highly admirable, given that the streaming company has to navigate one of the toughest advertising environments post-pandemic boom, greatly exceeding our expectations. Assuming a similar cadence in its engagement ahead, we may see it achieve excellent profitability once the macroeconomics normalizes and advertising dollars return, speculatively by 2025.

The launch of Roku-branded TVs in March 2023 also demonstrates ROKU’s brilliant device strategy, which offers beneficial exposure to both the conventional TV market and TV streaming platforms. This further optimizes its monetization prospects, since its operating system records 43% of the TV unit share in the US, with its active accounts “approaching half of all broadband households” by FQ1’23.

Combined with the variety of streaming services on its centralized platform, ROKU remains well-positioned during the peak recessionary fears over the next few quarters. However, we must also warn investors to calibrate their expectations accordingly, since the rising inflationary pressure may delay its path toward GAAP profitability over the next two years.

For now, the streaming company has guided FQ2’23 revenues of $770M (+3.9% QoQ/ inline YoY), gross profits of $335M (inline QoQ/ -5.6% YoY), and adj. EBITDA of -$75M (-8.5% QoQ/ -519.8% YoY). As a result, the stock is only suitable for investors with long-term investing trajectories, since it may continue trading sideways in the intermediate term.

Meanwhile, investors may want to continue monitoring the health of ROKU’s balance sheet, given the sustained increase in its inventory to $109.23M ( +2.3% QoQ/ +49.9% YoY) by FQ1’23. Its cash/ equivalents have also declined moderately to $1.63B (-16.8% QoQ/ -26.9% YoY) at the same time.

Given its inherent lack of profitability and rate of cash burn at approximately $600M annually, the streaming company may need to raise more capital by the end of 2024 or early 2025. Then again, with practically zero debts, we believe its prospects still appear decent, given the management’s guidance of positive adj. EBITDA by FY2024.

So, Is ROKU Stock A Buy, Sell, or Hold?

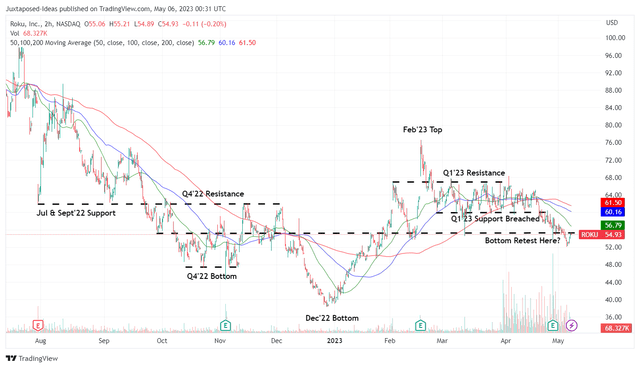

ROKU 6M Stock Price

ROKU has been trading sideways for the past few weeks, before declining post-NFLX’s mixed FQ1’23 results by mid-April 2023. As a result of the pessimism, we may see the stock retest the February 2023 support levels in the near term, suggesting more volatility ahead.

With the recessionary fears likely peaking in H2’23, significantly worsened by the recent banking crisis and the Fed’s potential 25 basis point hike in May 2023, we are uncertain that those support levels may hold in the near term.

While this dip may appear attractive to speculative investors, those who choose to buy the stock here must also size their portfolios accordingly, in the event of capital losses.

In the meantime, we prefer to prudently rate the ROKU stock as a Hold (Neutral) here, given the potential volatility. There may be more attractive entry points ahead, preferably at the December 2022 bottom for an improved margin of safety.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, NFLX, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.