Summary:

- Roku’s Q2 earnings impress investors and the stock jumps higher.

- Steady customer adoption curve and strong Q2 2023 results indicate growth potential.

- Despite challenges and risks, I remain positive about Roku’s prospects, expecting potential valuation expansion.

simpson33

Rapid Recall

As we headed into Roku’s (NASDAQ:ROKU) I said in a bullish analysis,

I believe that its earnings call will be dominated by its strategy to better monetize its user base.

How can Roku take its approximately 72 million active users and provide end users the capabilities to make its ads more shippable?

[…] Paying $70 for Roku is an interesting entry point, if Roku’s prospects are able to restart and gather momentum.

[…] I believe there’s a positive risk-reward in the stock right now.

I stand by those comments today, even though I recognize that an investment in Roku is not blemish free.

Why Roku? Why Now?

As we headed into Roku’s earnings call I previously observed that advertising is improving, but that advertising strength is not being seen across the board. And along these lines, Roku was quick to note in its shareholder letter that ”TV advertising remains muted industry-wide’‘.

There were several noteworthy highlights from this set of results that I’ll turn to in the first instance. Then, I’m going to touch upon some pesky aspects that I believe investors should be mindful of.

I’ve you’ve read my work before you’ll know that I put tremendous attention to the customer adoption curve. I’ve stated in the past, and I’ll repeat now, that the customer adoption curve is an even better indication of the company’s prospects than revenue growth rates.

For Q2 2023, Roku didn’t disappoint with active accounts increasing by 16% y/y. For context, consider the following:

- Q2 2022: 14% y/y.

- Q3 2022: 16% y/y.

- Q4 2022: 16% y/y.

- Q1 2023: 17% y/y.

- Q2 2023: 16% y/y.

What you see above is a very steady progression in customer adoption. Incidentally, I should remark, that in my previous analysis, I estimated that Roku would report 72 million accounts, but in actuality, the number came in closer to 74 million.

Altogether this reinforces that even though the share price may lead one to believe that Roku’s prospects have dimmed, the fundamentals are proving quite a different story.

Consequently, I believe that in the next few months, if not sooner, the share price will start to progress higher to better reflect Roku as a business that’s still in growth mode.

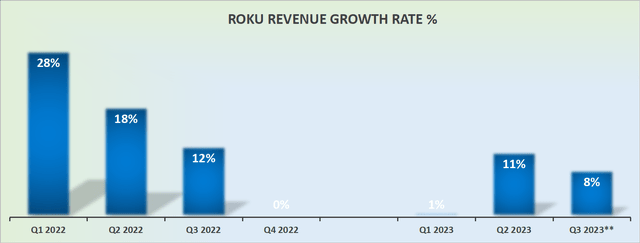

Revenue Growth Rates Impress

As you know, Roku beat Q2 2023 revenue consensus figures by quite some stretch. Accordingly, given this newly found momentum, I wouldn’t be surprised to see Roku’s Q3 2023 delivering a 10% CAGR on the top line.

What’s more looking slightly further out to Q4 2023, Roku’s comparables with the prior year becoming significantly easier.

Therefore, I believe, as I did as we headed into this earnings print that Roku’s H2 2023 will be dramatically better than H1 2023.

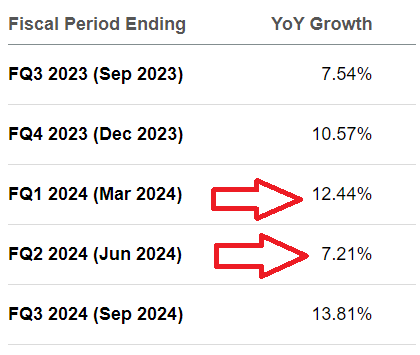

What’s more, with a further quarterly earnings report to support my original bullish investment thesis, I believe that Roku’s CAGR in 2024 could reach at least a mid-10s% CAGR. If not closer to the high-10s% CAGR.

Note, that this estimate of mine is quite high, at least compared with analysts presently have Roku’s revenue consensus figures at, see below:

SA Premium

The key contention I’m making is that investors should start to form a view of what Roku’s growth rates in 2024 could end up reporting. And if I’m right, and Roku ends up growing at approximately mid-10s%, we should see Roku’s valuation multiple expand. And this opening takes me to discuss Roku’s valuation.

ROKU Valuation — Not The Cheapest Stock

In the introduction to this analysis, I made clear that there were both good and bad aspects to be mindful of an investment in Roku. We’ve already discussed the positives. Now, let’s discuss the negative.

In the best-case scenario, according to my estimates, Roku is capable of reporting around $200 million of EBITDA next year. Note, for this estimate I assume that in 2024 Roku could reach 5% EBITDA margins.

Even if Roku doesn’t get to 5% EBITDA margins by H1 2024, Roku must convincingly and confidently put out informal guidance that would lead investors to believe that it could in actuality exit 2024 with 5% EBITDA margins, and that it’s poised for even higher EBITDA margins in 2025.

This would leave the stock today priced at about 50x forward EBITDA.

The Bottom Line

In my bullish analysis of Roku’s earnings call, I zeroed in on the company’s strategy to better monetize its user base, which currently stands at approximately 74 million active users.

Despite the challenges in the TV advertising industry, Roku’s advertising prospects were showing improvement.

The company’s steady customer adoption curve was a positive sign, with active accounts increasing consistently.

Roku’s Q2 2023 results exceeded revenue consensus figures, indicating strong growth momentum. Looking ahead, I believe that Roku’s revenue growth rates in H2 2023 and beyond could reach at least a mid-10s% CAGR, potentially leading to a valuation multiple expansion.

However, it’s essential to be mindful of the negative aspect of Roku’s investment, particularly regarding the company’s EBITDA margins.

Despite the risks, I maintain a positive outlook on Roku’s prospects, expecting the share price to progress higher to reflect the company’s continued growth potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.