Summary:

- Shares of Roku dipped after reporting strong Q2 results, which showcased a successful new Pro series launch.

- The company is also expecting platform revenue to accelerate in both Q4 and FY25.

- Roku also continues to drive impressive adjusted EBITDA and free cash flow growth.

- ROKU stock trades at reasonable FCF multiples, creating a great buy point at the current post-earnings dip.

JHVEPhoto/iStock Editorial via Getty Images

Suddenly, it seems that investors can’t sell tech stocks fast enough. The dramatic underperformance of chip stocks this earnings season and fears that the coming Fed rate cuts will be too minor and ineffective have sparked a sharp sell-off in the stock markets, cutting especially into the massive gains that growth stocks have accumulated this year.

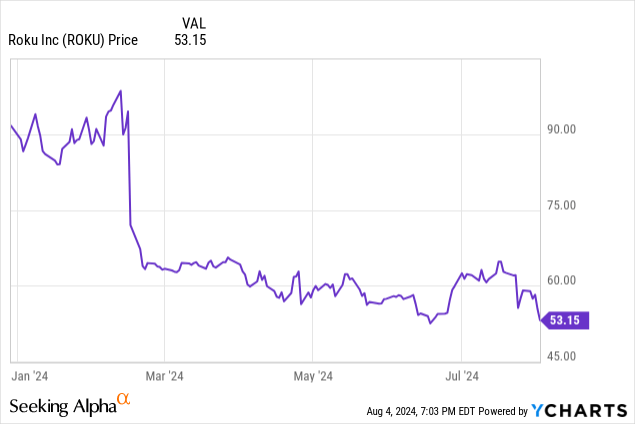

It’s also brought Roku (NASDAQ:ROKU) down even further after posting strong Q2 results. Now, the streaming stock is down more than 40% year to date:

Bull case remains robust, especially amid growing FCF and modest valuation

I last wrote a bullish note on Roku in May, when the stock was still trading in the high $50s. Now, at new post-earnings share prices and amid strong advertising results that we saw in the most recent quarter plus continued growth in device sales (ensuring the growth of Roku’s all-important install base), I remain at a buy rating for Roku, and I am receiving the company’s Q2 print with much more enthusiasm than the market is.

In my view, the lower valuation also gives us plenty of room to appreciate Roku’s growing cash flow story. Several years ago, when Roku was trading at pandemic-era peaks above $400, it would have been unthinkable that one day soon we’d be able to actually value Roku based on its earnings and cash flow. But now, we can.

At current share prices near $53, Roku trades at a market cap of $7.98 billion. After we net off the $2.06 billion of cash on the company’s latest balance sheet, Roku’s resulting enterprise value is just $5.92 billion.

Over the trailing twelve months, Roku has generated free cash flow of $317.9 million, which represents an FCF margin of 8.5%. Meanwhile, for the next fiscal year FY25, Wall Street analysts are expecting Roku to generate $4.38 billion in revenue, or 12% y/y revenue growth.

Even if we conservatively assume no further FCF margin expansion next year, FCF in FY25 on this revenue estimate would be $372.3 million, putting Roku’s valuation multiple at 15.9x EV/FY25 FCF. Considering the massive growth story underpinning Roku in advertising and services, as well as the large leaps that it’s currently making in operating margins and adjusted EBITDA, I’d say this is quite a reasonable entry point for the stock.

Beyond the burgeoning FCF story and strong recent results, here is a refresher on my full long-term bull case for this stock:

-

Platform business has become the company’s focus, driving high-margin growth. At one time, Roku’s revenue split between its low-margin hardware players and its platform revenue was closer to 50/50; now, hardware is less than 20% of Roku’s overall revenue. Not only has this improved profitability, but this also means Roku’s revenue is more stable from quarter to quarter and isn’t heavily reliant on the seasonality of device sales.

- Secular tailwinds towards streaming and away from traditional TV. According to Roku, streaming activity continues to grow double digits while traditional linear TV is down (for example, viewership of the recent presidential debates was down -30% y/y). Meanwhile, Roku’s own streaming growth is topping 20%+ each quarter.

-

The company continues to drive growth via the Roku Channel and is also a leader in original programming. The company’s platform is now one of the leading streaming offerings in the U.S. This channel is also now producing original content, including a new documentary in partnership with the NFL that became one of the most popular shows on Roku. Sports-oriented hubs, like the company’s NFL and NBA zones, continue to drive engagement and sign-ups to other companies’ streaming services.

-

Streaming distribution and Roku Pay. The company has also picked up the pace of facilitating sign-ups for streaming services from its platform, where it also generates revenue by processing via Roku Pay.

-

International expansion opportunity. Roku has recently set its sights on expanding aggressively overseas, with recent overtures in the UK, Canada, and Mexico – representing the next leg of growth for the company. Though this has dented the company’s ARPU (international markets generate less ad dollars than in the U.S.), we should focus on drawing in eyeballs first and worrying about revenue contribution later.

- Rich cash balances. The company has over $2 billion of net cash on its books and no debt, which represents about a quarter of its current ~$8 billion market cap.

Stay long here and use the earnings dip as a well-timed buying opportunity.

Q2 download

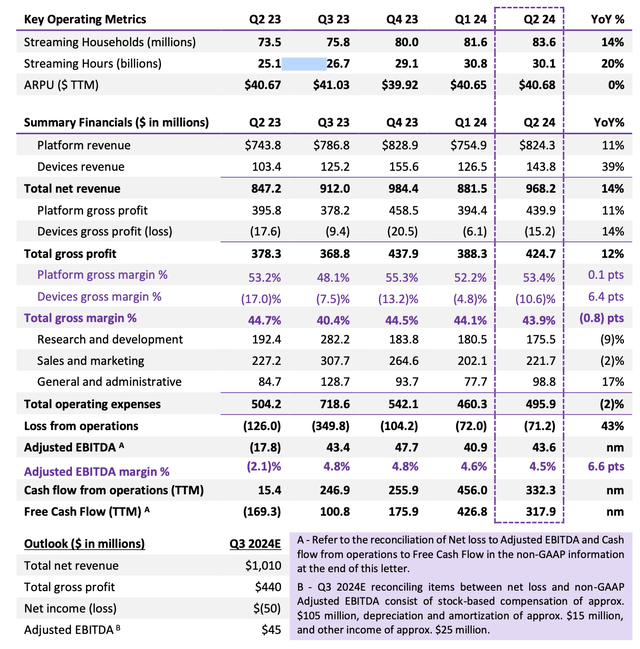

Let’s now go through Roku’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Roku trended results (Roku Q2 shareholder letter)

Roku’s revenue grew 14% y/y to $968.2 million, well ahead of Wall Street’s expectations of $937.9 million (+11% y/y) by a three-point margin. Also of note: devices revenue soared 39% y/y to $143.8 million.

While device sales and their near-zero (or below zero) margins are no longer the focus for Roku, device growth represents the most important channel for new account acquisition and platform expansion. Within the quarter, the company launched the new Roku Pro series, the company’s highest-end offering starting at $699 for a 55″ model (the series comes in three sizes: 55″, 65″, and 75″).

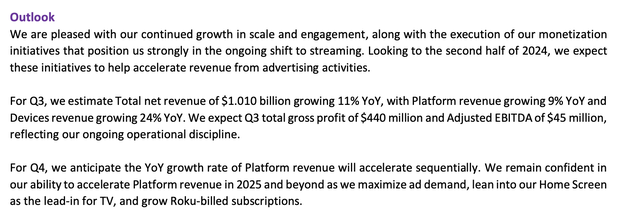

Another strong point to note: while Roku is expecting platform revenue growth to slow slightly to 9% y/y growth in Q3, the company’s outlook calls for platform growth to re-accelerate in Q4. We expect as well that election-related buzz and media coverage will drive elevated viewership, and advertising activity will also respond accordingly. Furthermore, the company also expects platform revenue to accelerate yet again in FY25: further solidifying that now is a great time to buy into this stock ahead of a long, planned growth stretch.

Roku outlook commentary (Roku Q2 shareholder letter)

It’s not just growth in streaming content and viewership that’s driving Roku’s results, however. The company has improved its advertising distribution and execution, in particular in Q2, by inking a new partnership with The Trade Desk (TTD), another company I’m bullish on that helps improve execution and pricing for ad inventory publishers like Roku. In addition, Roku has also been experimenting with its UI: on its home page, the company updated its marquee ad spot to include video ads (versus completely static banners).

And from a profitability standpoint, we note that Roku’s adjusted EBITDA soared to $43.6 million, representing a 4.5% adjusted EBITDA margin – up from a loss of -$17.8 million, or a -2.1% margin, in the year-ago quarter. That’s quite a considerable leap in margins considering the huge growth rate in devices revenue, which is a headwind to overall profitability (at least, in the near term before new users contribute to platform revenue growth).

Risks and key takeaways

Of course, Roku is not without its risks. Competition is the core item to watch for: Roku may be the leader in streaming boxes, but the company is squeezed on both the high end [Apple (AAPL)] and low end [from the likes of Amazon (AMZN) and Google (GOOG)], whose home screens also advertise marquee content.

But in spite of this, I consider Roku’s successful Pro series launch, its rampant growth in device sales, and expanding profitability and FCF story as powerful upward catalysts, especially at the stock’s current modest valuation. Stay long here and buy the dip.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.