Summary:

- Roku’s Q4 sales targets may be difficult to achieve due to writer and actor strikes reducing content for the video streaming market.

- Despite potential Q4 weakness, investors should focus on Roku’s active accounts and streaming hours growth for long-term value.

- ROKU stock is cheap at only 2x ’24 sales targets with a bonus cash balance of $1.8 billion.

Justin Sullivan

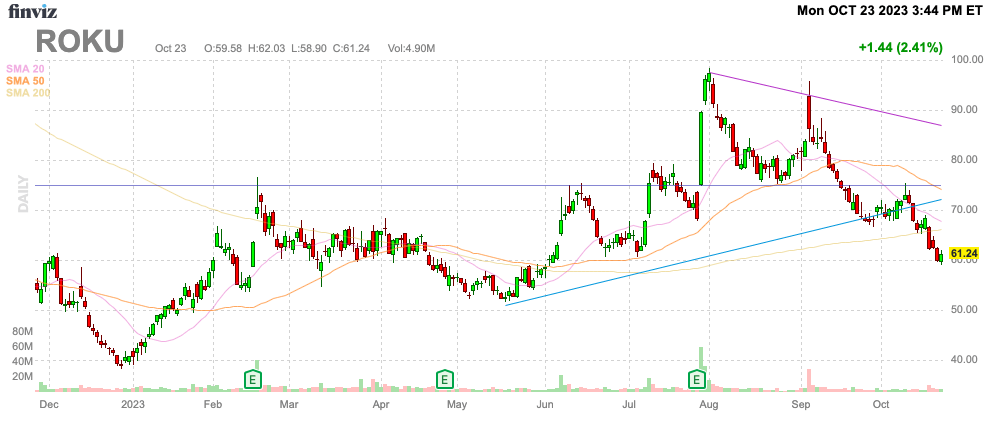

Only at the start of September, Roku (NASDAQ:ROKU) boosted Q3 sales targets in a sign business was far better than expected. Now, analysts forecast the video streaming service will struggle to hit targets due to writer and actor strikes. My investment thesis is ultra Bullish on the stock trading at the lows now despite a Q3 guide up mid-quarter.

Source: Finviz

Q3 Rebound Might Falter In Q4

The video streaming market faces a difficult period over the next few quarters due to potential weak content offerings after either the writers or actors have been on strike since back in May. A host of analysts have cut estimates for the streaming service with Wells Fargo forecasting only $929 million for Q4 revenues versus consensus estimates still up at $953 million.

Roku forecast back in early September for Q3’23 sales to hit between $835 and $875 million, up from a prior outlook of $815 million. The consensus analysts were expecting $828 million at the time and estimates now sit at $853 million for the September quarter the company will report on November 1.

The company announced another 10% workforce reduction when announcing the Q3 beat. The move could signal some expected weakness ahead due to the strikes, especially considering the actors guild is still striking about 6 months after the writers’ strike started.

Investors should be cautioned to not overact to any perceived guide down for the December quarter. The current analyst estimates forecast a nearly 10% growth rate in the quarter for Roku and the streaming market probably isn’t ideal with the strikes reducing content creation for a very lengthy period now.

Roku still forecasts a Q3’23 adjusted EBITDA loss topping $20 million even with the revenue guidance soaring past estimates. The company had guided to a $50 million EBITDA loss back in July along with the Q2 earnings report.

At the top end of guidance, Roku will see 50% of additional sales drop to the bottom line providing strong leverage. Remember though, Q3 is the second strongest quarter of the year due to the adverting market strength and the video streaming platform was still forecasting a hefty loss.

In Q2, Roku spent $504 million on operating expenses, including $90 million in stock-based compensation, with the Platform business producing a 53% gross margin. The company had already cut operating expenses from the excessive levels of $550 million Q1’23 leading to a still very large EBITDA loss of $69 million.

Roku didn’t provide any guidance on the workforce reductions impact on the financials. The March workforce reduction of 6% was part of what helped cut operating expenses by nearly 10% when reporting Q2’23 numbers even with revenues jumping over $106 million sequentially from Q1.

Focus on Engagement

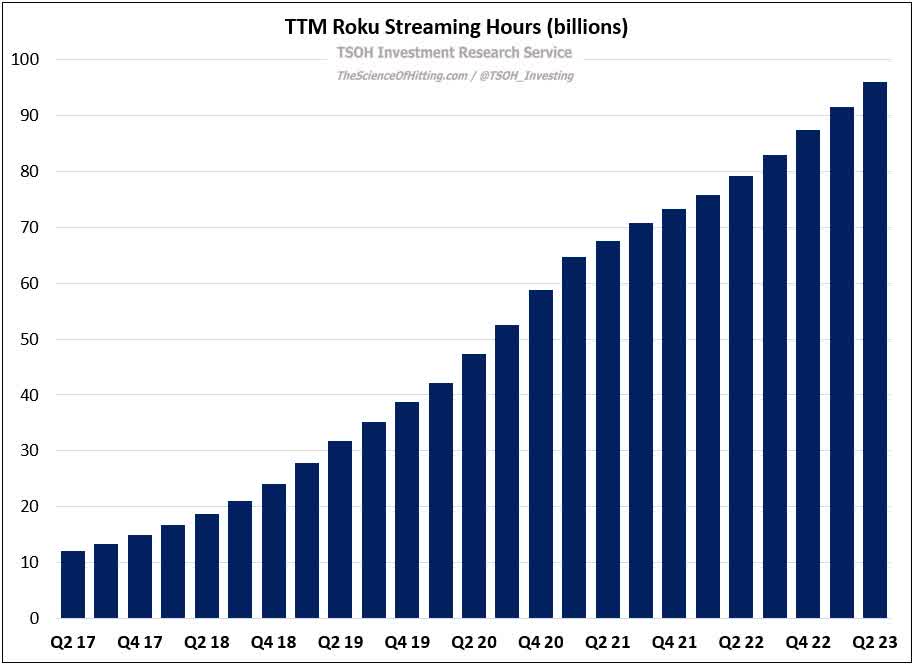

While some lack of new content could impact viewing in the next few quarters, the value of Roku should be based on Active Accounts and Streaming Hours growth. The video streaming platform saw ~20% growth in these areas during Q2’23.

The Streaming Hours hit 25.1 billion hours for impressive 21% growth in Q2’23. The number has shown consistent and strong growth over the last 6 years captured in this chart.

Source: TSOH Investment Research on Twitter/X

While ARPU has fallen in the last year due to weak advertising rates in the scatter market where Roku was stuck prior cycles, these amounts will eventually rebound. Not to mention, the company has already made a bigger push into the Up Front market to garner higher ad rates and lock in more committed ad deals.

Wells Fargo still predicts revenue per streaming hour to dip 8% during Q4’23 in a further sign of ad market weakness. Analyst Steven Cahall predicts ad market weakness due to the Hollywood strikes, which is something Roku can’t control.

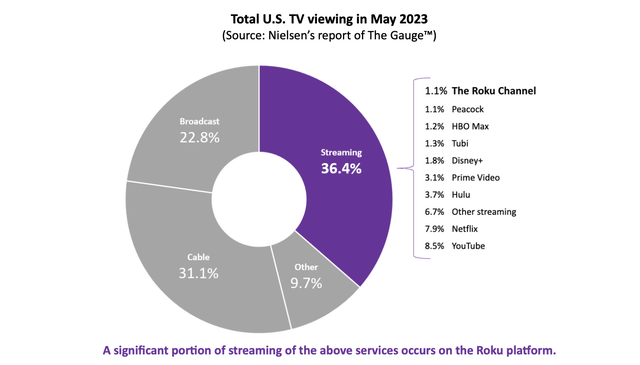

Our view is for investors to focus more on Active Accounts and the above Streaming Hours growth to garner the ultimate value of the stock. Roku should only get better at monetizing traffic on their Roku Originals channel that is strangely as popular as Peacock and HBO Max in the U.S.

Source: Roku Q2’23 shareholder letter

Down at $60, the stock only trades at 2x 2024 sales targets of $3.8 billion. The company still has a massive cash balance of $1.8 billion leaving the enterprise value at only $6.7 billion.

The key part of lowering operating expenses and pushing Roku towards breakeven is the ability to turn this large cash balance into an asset from a current piggy bank to spend. The company could easily flip to share buybacks and other favorable shareholder moves by improving the financials enough that the war chest isn’t needed to subsidize losses.

Takeaway

The key investor takeaway is that Roku has been beaten down far too much based on investor fears on Q4 weakness. Investors should focus on account and streaming hours growth, as this will ultimately lead to sales growth when the ad market normalizes.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ROKU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.