Summary:

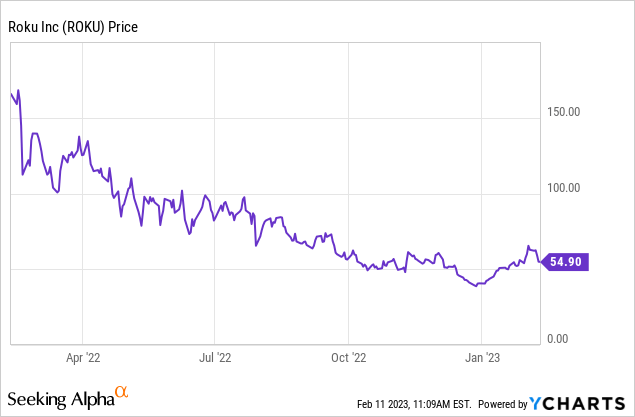

- Shares of Roku have rebounded more than 30% year to date, but the stock remains down more than 65% over the past year.

- The company grew platform revenue at a double-digit pace in a market that saw sharp declines in traditional ad spending.

- New Roku Smart Home products, including security cameras and smart lights, position Roku to eventually pivot to being a full-on smart home company.

- The company is cash-rich, with more than $2 billion in cash against very minimal debt.

Justin Sullivan

Even though the year to date has seen sharp recoveries in many tech stocks, many iconic brands still remain deeply underwater and far below their all-time highs. Investor sentiment has not been very forgiving to growth stocks, where even the smallest slips have translated into huge stock losses.

Roku (NASDAQ:ROKU) is a stock worth watching on this upswing. The streaming-device company has suffered over the past year as the downturn in advertising hurt its services platform, and declining hardware sales have investors worried that Roku’s install base expansion is slowing. Up more than 30% this year, Roku still remains down more than 65% over the past year – and I think there’s plenty of steam for a rebound left to go.

I am shifting my recommendation on Roku to very bullish, and on top of holding onto my position this year amid a rapid recovery, I have also added more to my holdings on the way up. I think expectations on Roku have reset to historic lows, and Roku’s ability to execute well against diminished expectations will be a major catalyst for the stock in 2023.

Here is my full long-term bull case for Roku:

- Roku has done an excellent job shifting its business to primarily a services/platform model. At one time, Roku’s revenue split between its low-margin hardware players and its platform revenue was closer to 50/50; now, hardware is less than 20% of Roku’s overall revenue. This has lifted Roku’s overall gross margins and paved the way for profitability.

- Beneficial flywheel of services. The Roku platform is broad, serving as an entertainment hub for all of a consumer’s services. Roku earns both advertising revenue from the free content it delivers on its platform plus distribution revenue from displaying content on its home pages. In other words, the monetization capacity of Roku’s platform is vast.

- Advertising spend is yet to follow the cord-cutting spend. Advertisers have been slower to move off of “linear” TV and onto streaming than consumers have. Roku notes that while 45% of U.S. adults’ entertainment is provided by streaming services, U.S. companies only spend 18% of their ad budgets on streaming. So it’s not just the consumers’ secular shift away from traditional TV and into streaming that will benefit Roku; but as advertising strategies evolve as well, Roku’s wallet share will increase.

- Active accounts and streaming hours continue to grow. Though growth rates have certainly slowed from the immediate boost that the pandemic delivered, Roku is still delivering constant growth in both active accounts and streaming hours, boosting its monetization capabilities.

- International push. Roku has recently set its sights on expanding aggressively overseas, with recent overtures in the UK, Canada, and Mexico – representing the next leg of growth for the company.

- Smart home. We’ll discuss this in more detail in this article, but Roku’s push into home cameras and lighting gives the company not only a new stream of hardware revenue, but also a new subscription offering.

Roku next reports earnings on Wednesday, February 15. It’s a prudent move, in my view, to add to Roku prior to earnings (while the stock is off YTD highs and the market is waiting with bated breath to see the results). Stay long here.

Positive read-through from other streamers

First things first: while earnings reports from other streaming companies don’t necessarily translate into Roku, I think there is still positive read-through we can infer from Netflix’s results.

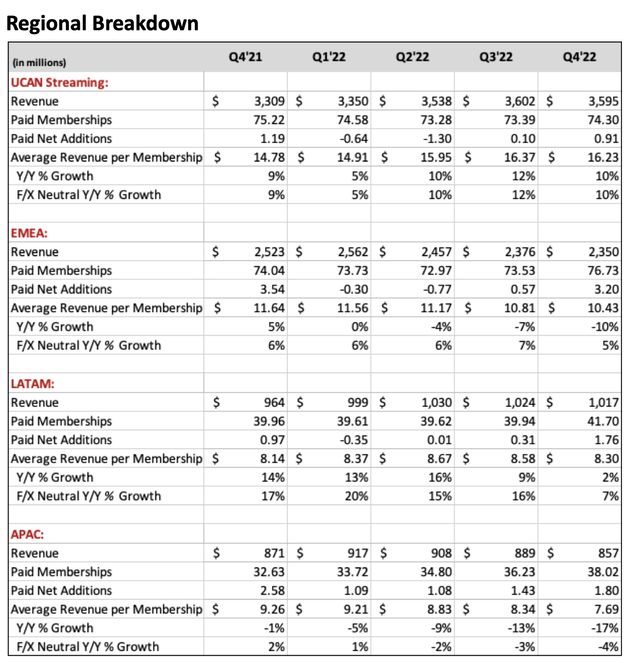

Netflix subscriber stats (Netflix Q4 shareholder letter)

The company added 7.66 million in net-new subscribers in the fourth quarter (see breakout by market above, with the important and high-ARPU United States and Canada market seeing impressive 10% y/y growth against a tough macro backdrop), far above the company’s internal expectations of 4.5 million adds and Wall Street’s less optimistic consensus of 4.1 million adds.

From these results, we can hope that Roku also saw the benefit of an uptick in streaming activity on its own platform.

Against macro headwinds, Roku is still executing well

Here’s the reality we have to face: Roku is up against a tough macro backdrop, especially in the advertising space. Companies are tightening their belts, and especially when the expectation is that consumer spending will decline, the propensity to go all out on advertising budgets is much lower.

This all being said, Roku still grew across several key metrics in its most recent reported quarter (Q3, the September quarter). Active accounts grew 16% y/y and streaming hours grew 21% y/y, indicating that user engagement is still high. Note that Netflix substantially accelerated net adds in the fourth quarter (from a net loss of 1 million subscribers in Q2, to an add of 2.4 million subscribers in Q3, to an add of 7.7 million in Q4) – so we can hope that Roku exhibits similar behavior when it reports its fourth-quarter results.

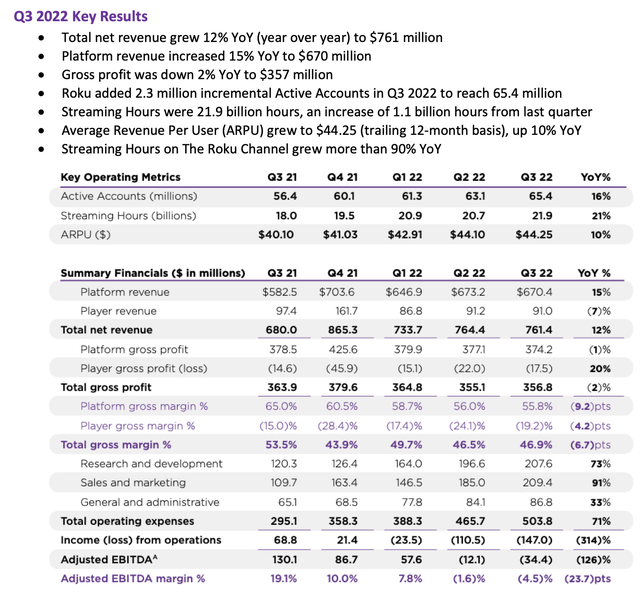

Roku Q3 highlights (Roku Q3 shareholder letter)

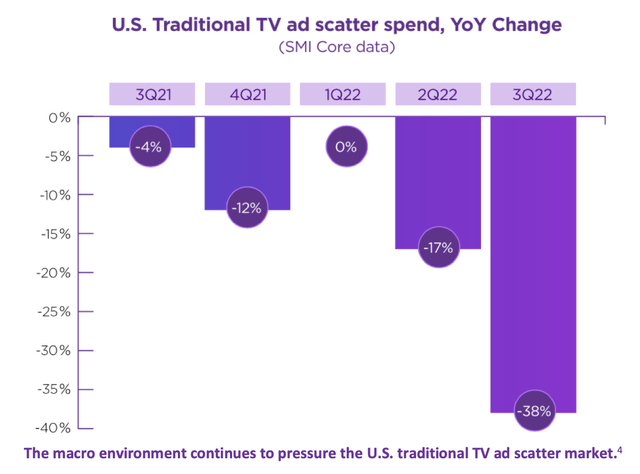

Moreover, platform revenue is still also up 15% y/y, despite a bulk of that revenue coming from advertising which is sharply down. The chart below from Roku’s most recent shareholder letter shows that traditional “ad scatter” spend on TV has declined -38% y/y in the U.S.:

Ad spend (Roku Q3 shareholder letter)

The company notes that player sales still remain well above pre-COVID levels. It does expect continued headwinds on advertising in the current environment, but Roku is taking this opportunity, like many other tech companies, to rationalize its headcount and focus on profitability. Per CFO Steve Louden’s remarks on the Q3 earnings call:

Meanwhile, Roku player unit sales remained above pre-COVID levels and the average selling price decreased 6% year-over-year, as we continue to insulate consumers from higher cost to prioritize account acquisition. Roku users streamed 21.9 billion hours in the quarter, an increase of 21% year-over-year as we continue to outperform viewing hour growth of traditional TV […]

For our Player business, we anticipate lower sales year-over-year and margins that will be significantly lower sequentially, primarily due to traditional holiday promotional pricing. For our Platform business we anticipate that these macro pressures will offset what would ordinarily be seasonal tailwinds, and as a result our platform revenue will be slightly down on sequential basis. In addition, our Player and Platform revenue in Q4 is typically back-end loaded, which further reduces our visibility.

As we indicated last quarter, we will continue to slow headcount and operating expense growth in response to the macro environment, while continuing to make disciplined investments in our most strategic project that will increase both the market penetration of our platform and long-term customer value.”

Smart Home opportunity

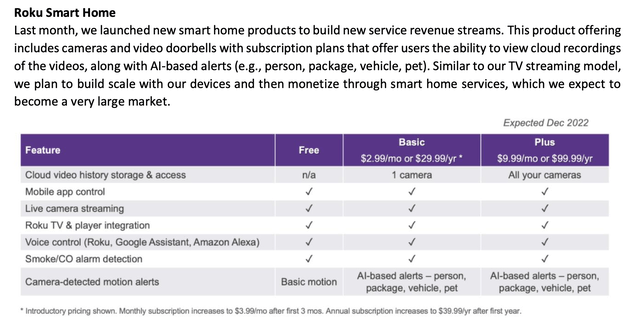

Looking beyond the near term, I’m also drawn to Roku’s ambitions to become a more fully-fledged smart home offering. Roku recently launched a new slate of product offerings in this category, centering around a Roku indoor camera ($27), a video doorbell ($80), and smart lights (2-packs starting at $18).

It’s less about the immediate hardware revenue, in my view, but more about the potential to draw in more subscribers, especially with the security products.

Roku Smart Home (Roku Q3 shareholder letter)

As shown in the table above, the company is offering subscription plans starting at $3/month that offer cloud video storage for these security recordings, taking from Arlo’s (ARLO) playbook. Though it’s still too early to tell how much traction Roku will gain from these new products, I think it’s a promising initiative that will boost to Roku’s higher-margin services revenue.

Key takeaways

On top of this, we’ll also remind investors that Roku is quite well cushioned from a balance sheet perspective, with $2.02 billion of cash (and only a minor $82 million debt load). With sufficient capitalization, new services revenue streams, and consistent growth in platform revenue amid a tough advertising market, I think Roku is well-positioned to weather the current downturn.

Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.