Summary:

- Roku’s stock has risen over 60% this year due to efficiency measures and positive fundamentals.

- The company’s shift to a services/platform model and the success of the Roku Channel are driving its growth.

- Viewership on The Roku Channel is now roughly equivalent to Peacock and HBO Max, positioning the company for further platform revenue growth.

- Roku’s potential for increased advertising revenue and international expansion are additional factors that could lead to further gains.

Justin Sullivan

Amid interest rate hikes and macro fears, the driving theme across most of the corporate landscape this year is efficiency. Necessitated by slowing growth rates and weaker consumer demand, companies have pulled back drastically on hiring and opex, in an effort to pad the bottom line.

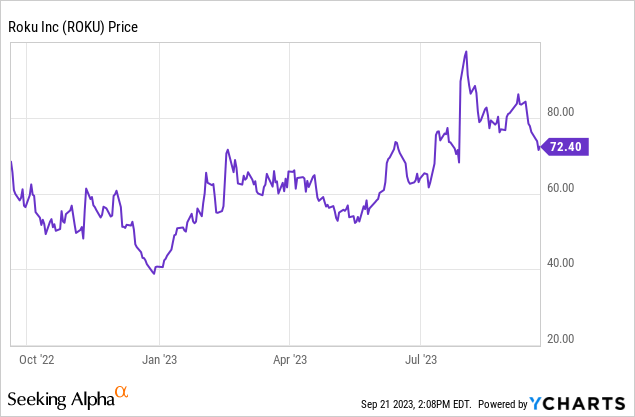

Such moves is what has driven Roku (NASDAQ:ROKU) upward recently, and newfound optimism for the stock has taken the company up more than 60% year to date. In spite of this sharp recent upside, I continue to view a path for further gains ahead.

I last wrote on Roku earlier this year and was very bullish on the stock in the ~$50s. Given the stock’s recent advance, I’m downgrading the name by one notch to simply bullish, but am quite comfortable holding onto my position.

Since the start of the year, a number of fundamentals have moved in Roku’s favor that more than justify the stock’s advance:

- As mentioned up top, Roku is planning to slice down its headcount by 10%; and on top of that, it boosted its initial Q3 outlook (from its Q2 earnings release) on both the top and bottom line.

- The company has released its first-ever Roku TV, sold exclusively through Best Buy (BBY), which has received positive reviews and helped the company return to hardware revenue growth

- The Roku Channel continues to gain in market share and improve its edge over current leaders like HBO.

And as a reminder to investors of my full bull thesis on Roku, here are the core drivers that can push this stock higher:

-

Roku has done an excellent job shifting its business to primarily a services/platform model. At one time, Roku’s revenue split between its low-margin hardware players and its platform revenue was closer to 50/50; now, hardware is less than 20% of Roku’s overall revenue. This has lifted Roku’s overall gross margins and paved the way for profitability.

-

The Roku Channel continues to draw more eyeballs. The company’s platform is now one of the leading streaming offerings in the U.S.

-

Beneficial flywheel of services. The Roku platform is broad, serving as an entertainment hub for all of a consumer’s services. Roku earns both advertising revenue from the free content it delivers on its platform plus distribution revenue from displaying content on its home pages. In other words, the monetization capacity of Roku’s platform is vast.

-

Advertising spend is yet to follow the cord-cutting spend. Advertisers have been slower to move off of “linear” TV and onto streaming than consumers have. Roku notes that while 45% of U.S. adults’ entertainment is provided by streaming services, U.S. companies only spend 18% of their ad budgets on streaming. So it’s not just the consumers’ secular shift away from traditional TV and into streaming that will benefit Roku; but as advertising strategies evolve as well, Roku’s wallet share will increase.

-

Active accounts and streaming hours continue to grow. Though growth rates have certainly slowed from the immediate boost that the pandemic delivered, Roku is still delivering constant growth in both active accounts and streaming hours, boosting its monetization capabilities.

-

International push. Roku has recently set its sights on expanding aggressively overseas, with recent overtures in the UK, Canada, and Mexico – representing the next leg of growth for the company.

Stay long here and continue to ride the recent upside.

Recent trends show continued platform growth and market share gains

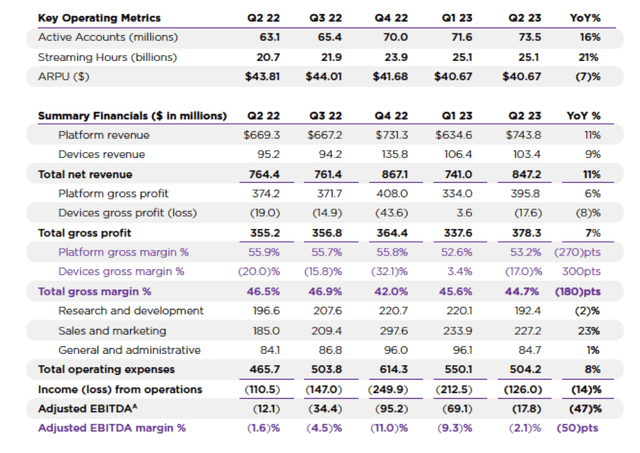

Unlike most companies over the now-passed Q2 earnings season, Roku delivered an incredibly positive update (that was later followed up by a guidance boost and opex reduction). Take a look at some of the key metrics in the chart below:

Roku key metrics (Roku Q2 shareholder letter)

Roku’s Q2 revenue grew 11% y/y in the quarter to $847.2 million, beating expectations at the time of just $774.5 million (+1% y/y) by a huge ten-point spread. Note as well that this is an outlier among companies that primarily generate revenue from advertising sources, as marketing budgets have severely compressed this year (as can be seen in the company’s -7% y/y decline in ARPU to $40.67).

Nevertheless, there is good news across the P&L. Note as well that Roku achieved 9% y/y growth in devices to $103.4 million, in part driven by the company’s March launch of its first Roku-branded Smart TV. Note as well that device gross margins have also boosted by 300bps y/y, which helped to partially offset a -270bps reduction in platform gross margins (driven by lower advertising dollars and ARPU).

The company notes that it saw improvement in the ad market throughout Q2 (which is what is driving the recent guidance boost to Q3). In the company’s Q2 shareholder letter, management wrote as follows:

We have begun to see some ad verticals improve, which resulted in modest YoY Platform revenue growth in Q2, and we are well positioned to re-accelerate growth as the ad market recovers. We continue to moderate the YoY growth rate of operating expenses and remain committed to our plan to deliver positive Adjusted EBITDA for the full year 2024.”

Note that the company’s initial outlook for Q3 called for $815 million in revenue, or 7% y/y growth. Now, the company is calling for between $835-$875 million in revenue, or a substantially improved range of 9-15% y/y growth.

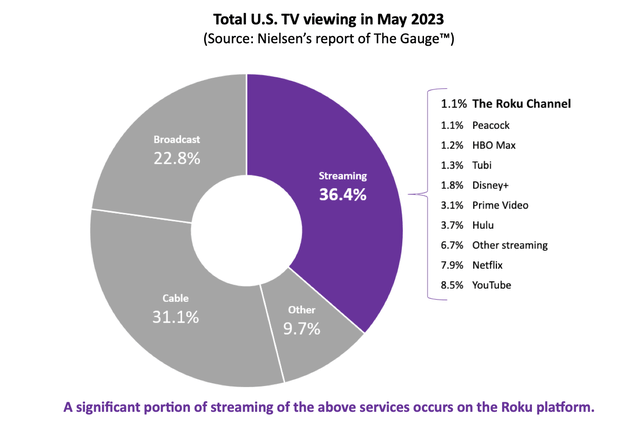

We also like the fact that Roku has made tremendous market share gains. The company is now 1.1% of total U.S. TV viewing (of which streaming is roughly one-third of the total), in line with Peacock and slightly behind Max at 1.2%. For a relative latecomer and lower-profile streaming offering, this is quite a significant win.

Roku Channel market share (Roku Q2 shareholder letter)

Valuation and key takeaways

At current share prices near $72, Roku trades at a market cap of $10.26 billion. After we net off the $1.76 billion of cash on the company’s most recent balance sheet, its resulting enterprise value is $8.50 billion. Versus Wall Street’s expectations of $3.86 billion in revenue for FY24 (+14% y/y; data from Yahoo Finance), the company trades at 2.2x EV/FY24 revenue. Considering Roku is likely to see adjusted EBITDA leverage over the next year as it banks on an ad market recovery and benefits from tighter headcount levels, I’d say there’s room for the stock to flex higher.

Stay bullish here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.