Summary:

- Roku, Inc. openly discusses its ambitions to be EBITDA profitable next year.

- Roku’s main troubles are due to the cyclical elements of advertising. If we assume that digital advertising will at some point improve, Roku is well-positioned to bounce back.

- Roku is priced at 47x next year’s EBITDA. What’s the best way to think about this valuation?

deimagine/E+ via Getty Images

Investment Thesis

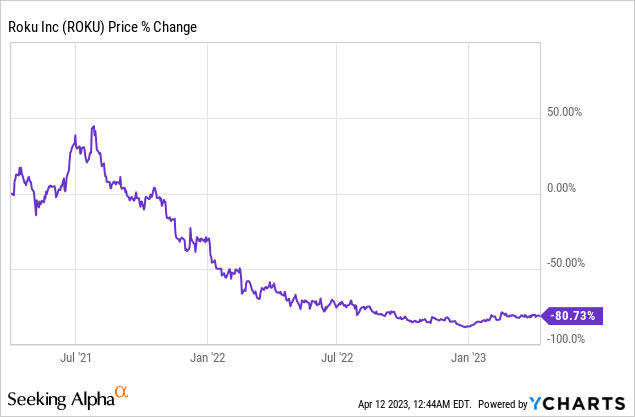

Roku, Inc. (NASDAQ:ROKU) has fallen from grace. But as we look ahead to 2024, there’s a path for Roku’s bottom-line profitability to dramatically improve.

Further, my key contention is that investors will reward the stock for making progress on its bottom line. The inflection in profitability and regaining the trust that Roku’s worst days are now in the rearview mirror, that’s how investors should think about this bull case.

Focused Reality

Momentum cuts both ways.

When things are going well, the stock is going up, nobody is asking difficult questions about their investment. Meanwhile, when the stock is falling incessantly day after day for a couple of years, investors can only think the worst about a company.

In the past two years, all kinds of negative considerations have surfaced about Roku. Everyone knows these. And those are now in the price.

What investors must now think about is where will the company be over the next 18 months? There’s no point in price anchoring to where the stock was.

Let me put it this way, will Roku’s prospects be worse than in the prior 18 months? I doubt it. And inside, if you are honest with yourself, you’ll doubt it too.

Yes, we can all acquiesce that in hindsight it was obvious that Roku was over-earning. But as we look ahead to the next 18 months, the overall direction of the company will be much more stable.

After all, Roku’s core prospect is participation in the digital transition of advertising dollars from linear TV to connected TV. That’s not going way.

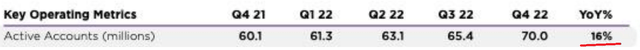

What’s more, you can see that even in the infamous Q4 2022 period, active accounts were still up firmly, at 16% y/y.

Accordingly, the problems with Roku have mostly to do with a weak advertising market. But that consideration is industry-wide. Everyone knows that the advertising market was weak throughout 2022.

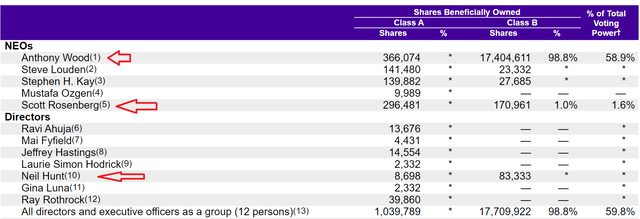

That being said, it’s not like Roku’s management team, with their substantial skin in the game, just stood still in 2022 and did nothing to improve Roku and their prospects.

Under founder and CEO Anthony Wood, the Roku team continues to press ahead to carve out market share in advertising dollars going through Connected TVs. It’s not like a management team isn’t aware that their stock is down 80% from the highs.

When things are this bad, management teams adapt and become creative.

Case in point, at a recent fireside chat, Roku’s Wood discusses the company’s plan to enter the hardware business. On the surface level, I believe this is a bad move.

First-party TVs are a natural extension of that program. The lots of companies that are in the platform business that also sell hardware, you see that with Google, for example, with the Pixel phones for Android or Microsoft with the Surface line for Windows laptops.

And so by — and the reason a company does this is it allows — it provides more choice for customers. It also kind of provides a direct contact with the customers that allows us to make the innovation cycle even faster.

However, my point here is that management has to do something. Anything. It may not work. But having the energy to muster up new ideas is the fallout of not being content with the status quo.

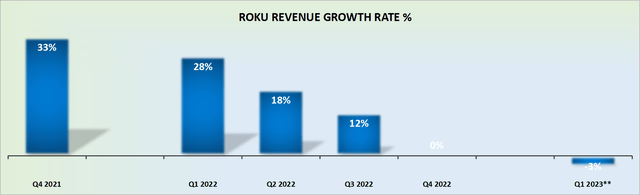

Revenue Growth Rates Fizzled Out, What’s Next?

As noted throughout, we can all now come to terms that Roku’s growth rates will be a shadow of its former self. In the best-case scenario, Roku’s growth rates in 2023 will be around 10% y/y.

Although, keep in mind that Q1 2023 will be up against the most challenging comparable period. What’s more, Q1 is already in the bag. And investors will now be looking towards the end of 2023, what’s the growth rate for Roku towards the back end of 2023? What’s a realistic exit rate from 2023?

That’s where the investment opportunity lies. Having a view of Roku’s outlook for the exit rates from 2023. Could Roku continue to steadily grow next year at a 10% CAGR? If that’s the case, that would be a dramatic setup for Roku.

That would be a magnitude better than investors eyeing up negative revenue growth rates as they do now for Q1 2023.

ROKU Stock Valuation — Path to Profitability in 2024

Roku has made its ambitions clear, that Roku will be EBITDA profitable in 2024. I don’t know how profitable Roku will end up, but I believe that 5% EBITDA profitable is a good place to start our assumptions.

Consequently, according to my estimates, Roku could end up reporting around $190 million of EBITDA. Note, back in 2021, when Roku was over-earning, Roku’s EBITDA margin reached 17%. Therefore, my 5% is a relatively easy hurdle.

That would put the stock priced at 47x forward EBITDA. That may sound like a punchy multiple, but I don’t believe it is. After all, 2024 is a stepping stone for Roku as it seeks to consistently deliver 10% EBITDA. At this point, Roku’s multiple will compress even further.

The Bottom Line

Roku, Inc.’s valuation premium has fully washed out now and the risk reward is much better than it’s been for a while.

There’s still plenty of heavy work needed to get Roku to its highly anticipated positive EBITDA profile in 2024. But keep in mind, what investors want to see above all else is progress in Roku’s profitability.

Investors want the company to move away from being EBITDA negative, to EBITDA positive. That inflection in profitability is where investors’ upside potential is to be found.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.