Summary:

- The main investment thesis lies in Roku’s ability to achieve profitability quickly, and to re-accelerate its advertising revenue growth.

- Share Price fell by 8%, suggesting that Roku has fallen short of market’s expectations.

- Its premium valuation suggests that the market has priced in greater risk, and Roku has to demonstrate it can deliver strong execution.

- I rate Roku as a hold for now.

Steven Errico/DigitalVision via Getty Images

Investment Thesis

In its early days, Roku (NASDAQ:ROKU) was riding on the structural tailwind of the shift from traditional TV to online streaming, propelling it to becoming the market leading online streaming platform that boasts a large user base of over 120 million users in the U.S. today. Roku is an indispensable partner in helping streaming giants like Netflix, Prime and Disney+ to drive subscriptions, it is also a valuable asset in the advertising industry for ad-tech platforms like The Trade Desk (TTD) and advertisers that are increasingly shifting their ad budgets from traditional TVs to digital platforms including Roku.

Roku’s investment thesis revolves around two critical factors: (1) its path to profitability and the speed at which it can achieve it, and (2) the resurgence of its advertising revenue growth. As of 1Q24, while Roku has shown ongoing progress in improving its bottom line, and appears to be making progress on re-accelerating its advertising revenue, the recent 8% decline in its share price suggests that it fell short of Wall Street’s expectations.

This market reaction indicates that investors perceive greater risk associated with Roku’s current trajectory, leading to its premium valuation. Therefore, Roku must demonstrate robust execution to justify this valuation and alleviate investor concerns. At the moment, I would rate Roku as a hold.

Analysis of Roku’s Results

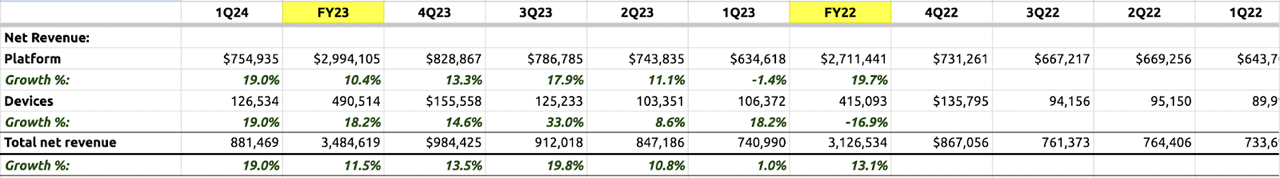

In 1Q24, Roku delivered revenue growth of 19% YoY, and this can be broken down into 2 parts:

1) The higher margin platform revenue grew 19% YoY, and this is driven by the advertising revenue and streaming services distribution revenue (which Roku earns a cut for aiding streaming services in acquiring customers).

The streaming service distribution segment was the main growth driver, as Roku benefitted from price increases implemented by subscription-based apps. This implies that its advertising revenue is still growing at a rate slower than the streaming service distribution segment. These results are likely to be perceived badly as the market is hoping that Roku can resolve its monetization issues for its advertising business, and ultimately grow at a rate faster than the streaming service distribution. This is likely a contributing factor to the 8% decline in the share price following the release of its results.

Additionally, I also believe the lack of transparency in the detailed breakdown of its platform revenue has further added to investor’s uncertainty, and here’s why. Subscription services have been aggressively raising prices as high as 33% and the impact is that the growth of Roku’s streaming service distribution segment will continue to mask the growth of the advertising revenue. The lack of detailed breakdown of its platform revenue makes it difficult for investors to accurately gauge advertising revenue progress. Consequently, until Roku can convincingly reinvigorate its advertising revenue growth to outpace streaming service distribution revenue, investors are likely to continue to price in uncertainties.

2) Moving on, the lower-margin device revenue grew 19% YoY. Roku acquires customers by selling its hardware, and subsequently tries to retain them by ensuring they continue to use Roku’s operating system. This segment is a drag on its margin, which leads me to the next point.

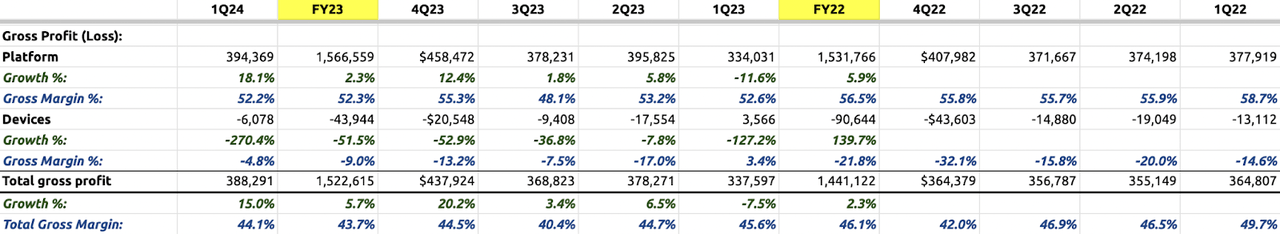

Overall gross margin fell from 45.6% in 1Q23 to 44.1% in 1Q24, mainly due to the negative device gross margin of ~5%. In Roku’s defense though, device gross margin has improved substantially from -9% in FY23 and -21.8% in 1Q23 as management focuses on improving the cost structure. On the other hand, Platform’s gross margin remained relatively stable at 52%.

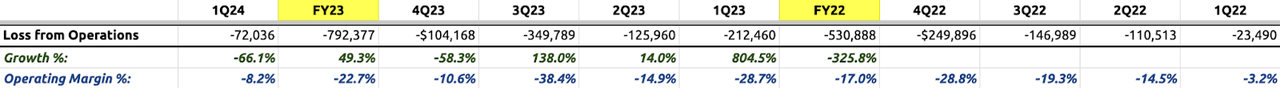

There were also clear signs of an improved bottom-line as negative operating margin improved from 22.7% in FY23 and 28.7% in 1Q23 to 8.2% in 1Q24.

Despite this continued improvement in profitability, its share price fell by 8%, implying that the firm has likely missed analysts’ estimates as the market anticipated greater improvement in its bottom-line. As a result, the market has priced in great risk that the company will take a longer time to attain profitability, and the uncertainty over Roku’s ability to re-accelerate its advertising revenue.

Thoughts on Valuation and My Rating of Roku

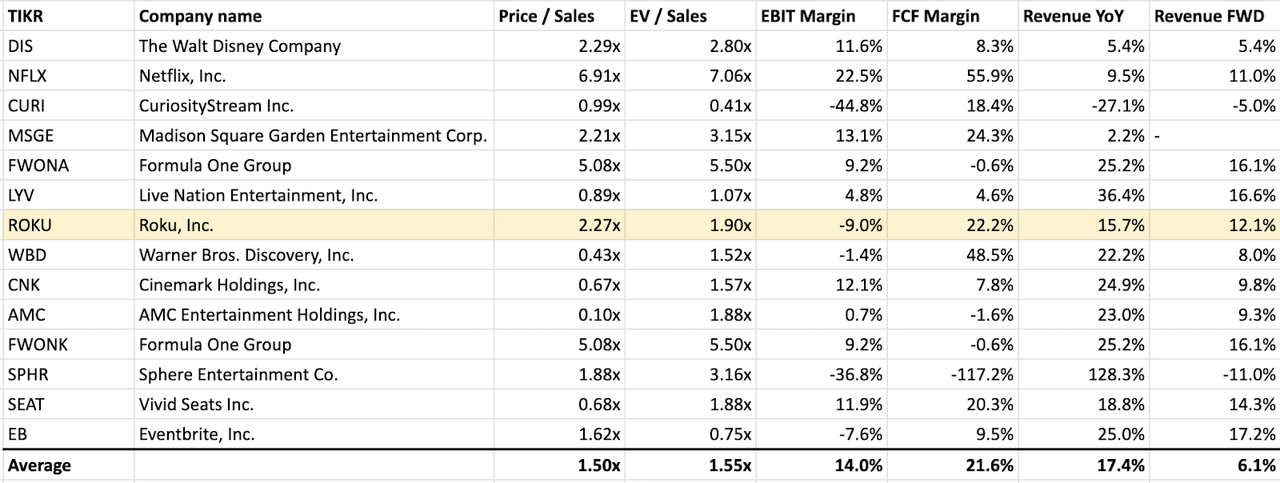

Trading at current EV/sales of 1.90x, it shows that Roku is priced at a premium above its peers. This indicates that the market has priced in greater risk, including the expectations that it will take longer to achieve profitability and the uncertainty over whether Roku can re-accelerate its advertising revenue, which is warranted in my opinion. Moving forward, the market would only expect strong execution from Roku as sentiments are weaker than before. Considering the risk-to-reward ratio, I would currently rate Roku as a hold and I would remain on the sideline for now.

What are your thoughts? Do you agree with my analysis? Let me know in the comment section below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.