Summary:

- Roku has prioritized its investments to enhance its streaming platform infrastructure and expand its search and content discovery capabilities.

- Roku remains within a strong bearish trend, hinting at further consolidation and a potential drop before a firm market bottom is established.

- The appearance of a bear flag in the existing bearish market amplifies the possibility of an additional decline in Roku’s value.

demaerre

This article explores the financial and technical performance of Roku Inc. (NASDAQ:ROKU), shedding light on the broader economic factors at play, including the rise in interest rates, fluctuations in consumer demand, and shifts in advertising spend. It underscores Roku’s tactical responses to market dynamics, particularly their cost reduction efforts and prioritization of investments. The technical analysis for Roku shows a bearish trend and hints at the likelihood of further consolidation before a firm bottom is established. The piece concludes with crucial insights for investors, providing them with guiding principles for considering their positions in Roku.

Financial Performance and Recent Development

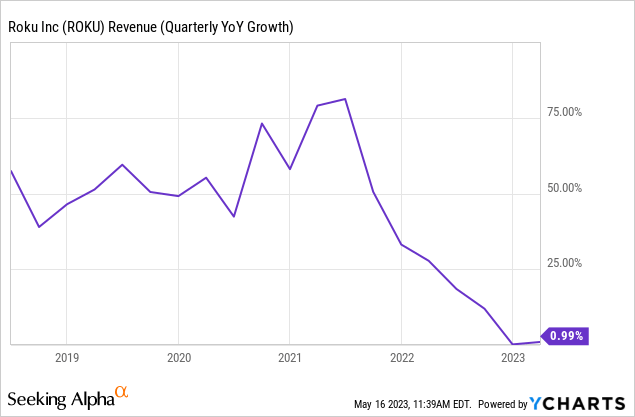

Primarily, Roku generates its revenue by levying service fees on content publishers and by providing advertising services to publishers and advertisers alike. This business model is particularly effective in a robust economy, but it becomes vulnerable during economic downturns. In 2022, Roku faced significant obstacles due to the Federal Reserve’s decision to raise interest rates to combat inflation. This led to a decline in consumer demand, and in anticipation of a potential recession, advertisers dramatically cut back their expenditures, particularly in the ad scatter market. Given Roku’s heavy reliance on this market for its advertising business, the company experienced a sharp decline in its revenue growth as shown in the chart below. A recovery in this sector is crucial for Roku’s revenue growth to bounce back.

Despite being in the market since 2002 and being publicly traded since 2017, Roku is still in a relatively early stage of its business lifecycle. The company only achieved meaningful profitability in 2021, largely boosted by the pandemic. In times of economic uncertainty, the market tends to look unfavorably upon early-stage companies that aren’t profitable. Therefore, Roku’s stock may face challenges in recovery as long as the threat of a recession looms in investors’ minds.

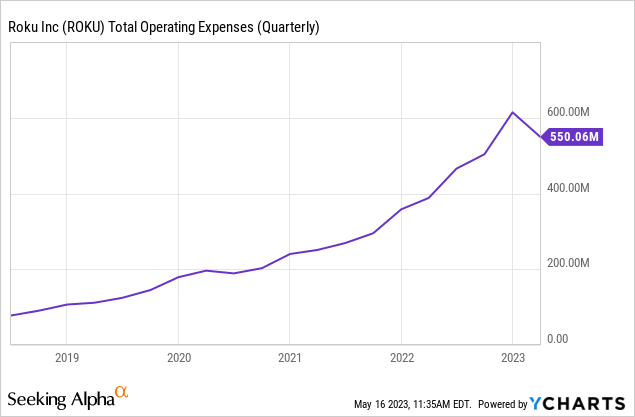

However, Roku’s management has responded to these market conditions by shifting its strategy. The company has moved away from an all-out growth focus, choosing instead to adopt a more cost-efficient approach. This strategy involves eliminating low-return projects and activities while prioritizing investment in critical streaming platform infrastructure for consumers, content publishers, and advertisers. This shift in strategy has halted the steady increase in operating expenses since 2020, with Roku’s quarterly operating expense falling from $614 million in the fourth quarter of 2022 to $550 million in the first quarter of 2023.

Roku’s future profitability seems promising, given its continued commitment to financial discipline and cost-cutting measures. If it can maintain its allure for advertisers, the company is poised for a significant comeback as soon as the economy and the advertising market bounce back. Roku’s primary function of content discovery, coupled with its unique ability to target audiences prior to program selection, makes it a highly desirable platform for advertisers. This is further emphasized by Roku’s recent focus on expanding its search and content discovery engines.

Furthermore, Roku has also leveraged the potential of live sports viewership through a content discovery engine known as the “Sports Experience.” The company has expanded its Live TV Guide from 100 free access channels in 2020 to over 350 live channels today. This positions Roku at the forefront of monetizing the rapidly growing sector of free ad-supported streaming TV (FAST).

The Bearish Perspective and Potential for Further Consolidation

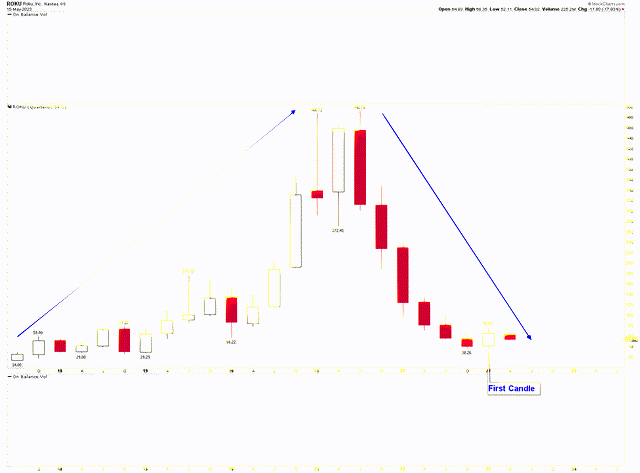

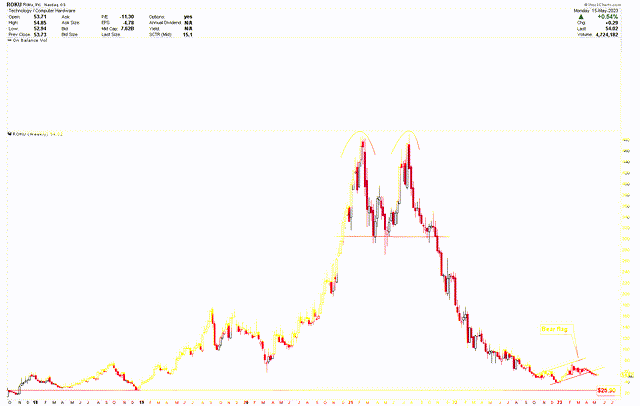

The technical analysis for Roku also indicates a bearish outlook, with the potential for further consolidation at lower levels. As shown in the quarterly chart below, Roku’s price has witnessed a significant rise from roughly $29 in 2018 to the $490 range in 2021. However, a substantial drop from the 2021 peak of $490.76 to $38.26 in 2022 reversed the trend, representing a strong bearish movement. This downswing was marked by consistently negative quarterly candles.

Roku Quarterly Chart (stockcharts.com)

Despite this, the first quarter of 2022 saw a modest recovery from the 2022 low of $38.26. Nevertheless, this uptick appeared weak and was overshadowed by a prominent bearish trend in the stock price. Given the stock’s prolonged weakness, it may take time to stabilize at the current level, with a likelihood of further consolidation or a continued decline.

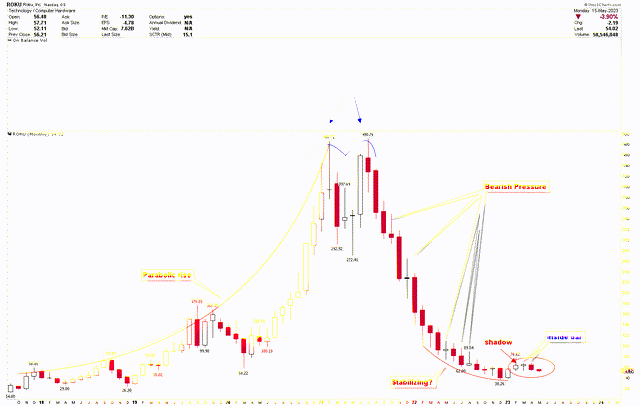

A closer examination of Roku’s price trends using the monthly chart reveals a parabolic rally from 2018, which is typically associated with high volatility and uncertainty. This meteoric rise culminated in a double top at $486.72 and $490.76, followed by a continued descent. The monthly candles following this double top were predominantly bearish, further emphasizing the market’s bearish potential.

Roku Monthly Chart (stockcharts.com )

Roku’s decline from the 2021 highs began to stabilize in early 2022, possibly due to the stock being oversold after dropping more than 90%. However, the bearish shadow in February 2023’s monthly candle, along with the inside bars of March and April 2023, suggest a price compression. This compression could be viewed as an opportunity for Roku to bottom out and rally, but given the persistent bearish momentum, there’s a greater likelihood of further consolidation or a continued drop to confirm a bottom. As Roku’s price is already breaching the lows of April 2023, the odds of a continued decline increase.

Key Takeaways for Investors

Roku’s low price levels may capture investors’ attention. However, the potential for further price declines could present even better investment opportunities. The emergence of a bear flag, as indicated in the weekly chart below, enhances the probability of market decline. The red support line in the same chart signifies December 2018 low, from where the price began its upward trajectory.

Roku Weekly Chart (stockcharts.com)

If Roku’s price continues to decline and breaches $38.26, it could plummet to $25.90. At this point, investors can anticipate a substantial rebound due to this level’s historical significance as a strong support point. Conversely, if the price surpasses $76.62, it could potentially continue to rise, warranting caution from investors. Until $76.62 is not broken, investors may consider selling the rallies in Roku.

Bottom Line

In Conclusion, it is evident that Roku’s resilience and astute strategic agility underscore its ability to weather economic storms and turbulent market conditions. Roku’s pivot from an emphasis on growth towards a focus on cost-efficiency is a testament to its adaptive strategic measures. By enhancing its platform infrastructure and extending its search and content discovery capabilities, Roku has expertly positioned itself to capitalize on any risks in the economy and the advertising market.

Roku’s current trajectory indicates a robust bearish market, suggesting potential further consolidation or a drop before market stabilization. The appearance of a bear flag further underscores this outlook. Yet, any decline in Roku’s price should be seen as a lucrative buying opportunity for long-term considerations. If the price drops below $38.26, the bearish perspective will intensify. However, should the price rise above $76.62, it could counteract the short-term bearish trend. Investors may consider selling during price rallies, as long as the price remains under $76.62.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.