Summary:

- Roku, Inc. reported strong Q3 2024 results with revenues growing a crisp 16%.

- The stock is slumping due to weak guidance, though the company has a history of conservative guidance leading to big quarterly beats.

- Roku is cheap at 2x EV/S targets with the potential for upside growth due to new initiatives.

JHVEPhoto

Roku, Inc. (NASDAQ:ROKU) delivered another strong quarter, but the market wasn’t happy. The streaming platform continues to produce consistently strong growth, yet the stock doesn’t get any respect. My investment thesis is ultra-Bullish on the large opportunity to monetize a massive and growing user base while the stock trades down.

Lots To Love

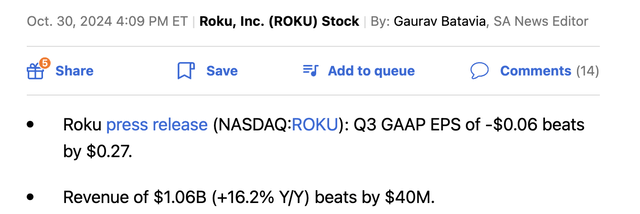

Roku reported another big quarterly beat with the following Q3 ’24 results:

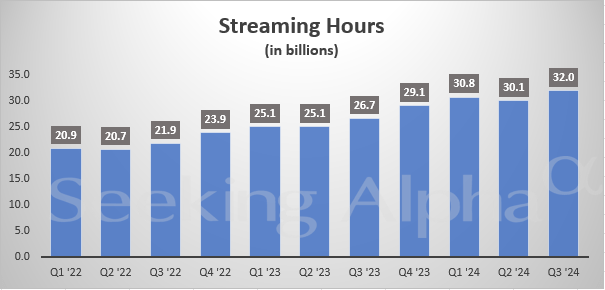

The company has a considerable history of smashing estimates, so the stock dipping in after-hours trading on disappointing guidance is slightly odd. Roku grew Streaming Hours by 20% to a record 32.0 billion hours and The Roku Channel grew 80% YoY.

Source: Seeking Alpha

The streaming platform has the usage to drive platform revenues at a higher clip than the 15% in Q3. The guidance for Q4 is just as positive at 14% growth, whether the market wants to view this guidance as deceleration or not.

When combined with a vastly improved bottom line, Roku is far more appealing here. The company boosted gross margins to 45.2% with platform margins at 54.2%, up 6.1 points YoY. The negative device margins are a controllable amount subsidized to feed future growth.

The supposedly weak guidance needs to be viewed in context of Roku’s history of lowballing quarterly guidance. The company beat Q3 revenue targets by $40 million and followed the last 2 quarters of $30 million beats.

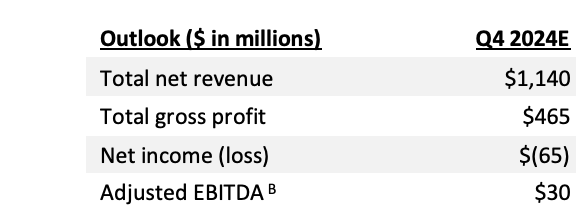

Roku guided to Q4 revenues of $1,140 million and the consensus estimates were down at $1,110 billion. The number is big considering management is normally very conservative and the sequential guide up for Q4 revenues is actually above the $72 million sales jump last year.

Source: Roku Q3’24 shareholder letter

While the revenue target is very strong, indicating 16% growth, Roku guided to some weak profit metrics. The total gross profit is only targeted at $465 million, actually down from the $480 million in the prior quarter, despite revenues growing $80 million sequentially.

The Trade Desk deal is supposed to grow revenues via monetizing ad inventory at a higher clip by using the UID2 for better user targeting. The DSP integration only started in mid-August, so Roku hasn’t even seen a full quarterly benefit from the advertising partnership as it optimizes over time.

Low Enterprise Value

The stock market seems to consistently forget that Roku had a massive cash balance still reaching $2.1 billion. With the stock price struggling, the company only has a market cap below $9 billion, pushing the enterprise value to only $7 billion.

Roku now generates over $1 billion in quarterly revenues, highlighting the cheap valuation. The company is cash flow positive with the generation of $157 million in free cash flow over the last 12 months.

The company has produced adjusted EBITDA profits the last 5 quarters. In the last quarter, adjusted EBITDA was $98.2 million, up over 100% YoY.

The guidance for Q4 of only $30 million in adjusted EBITDA definitely isn’t helping the price action today, but Roku only guided for $45 million in Q3 and more than doubled the guidance. The company even has massive interest income included in the other income line item, excluded from the EBITDA numbers.

The streaming platform is targeting $4.0 billion in revenues hit year, with the consensus estimates up at $4.5 billion next year. The stock only trades at 2x EV/S targets while being very free cash flow positive already.

Roku is a major bargain here with the opportunity to grow sales beyond the 11% analyst target for 2025 due to the integration with The Trade Desk and increased functionality in the user interface and the Home Screen. The market is focused on short-term profit forecasts and whether platform revenue will decelerate into 2025 despite the strong growth. What ultimately matters is Roku generating consistent double-digit growth over time.

Takeaway

The key investor takeaway is that Roku, Inc. stock is far too cheap here to sell on weakness. The stock had strong support at $65, but Roku has already fallen to $60 and could be headed to $50 to $55 where the stock hit prior lows. Either way, an investor can buy weakness on Roku due to the strong franchise and the planned solid growth ahead, regardless of whether the market likes the likely conservative guidance of management.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ROKU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to end October, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.