Summary:

- Roku has been up 30% in the last week mainly as a result of optimism on this stock post its earnings release.

- When I reviewed the release I could not understand the market’s optimism.

- Outside of the metrics the company wanted the investors to see, there was nothing delightful about the release.

BenAkiba/E+ via Getty Images

There was plenty of cheer after Roku (NASDAQ:ROKU) released its earnings. Expectations were low and the company did not really have a high bar to set for its earnings. At its lowest point, the stock had been down more than 90%, so this year it was at a stage where any news was good news. Its earnings served just that. It highlighted the addition of net new accounts giving it more than a 15% increase from last year (YE subscribers at 70M). Streaming hours increased by almost 20% from last year (YE streaming hours at 14.3B hours). But when I started digging deeper there were multiple signs that not everything is what it seemed and in my write up I will attempt to deconstruct their earnings narrative.

Peeling back the narrative

While growth in streaming hours and an increase in subscriber numbers seem good, in the context of Roku it still hasn’t helped the company in terms of numbers that really matter. Total net revenue from Q4 2022 only increased by 0.2% from the comparable quarter! Its total net revenue for Q1 2023 is guided down to $700M and for the same quarter last year, it made $733M. So this begs the question – How are all the increases in subscribers and the increases in streaming hours helping?

You can make the argument that the platform’s revenue has shown some growth but it’s just not enough to arrest the decline in revenues from devices which are down 18% from the comparable quarter.

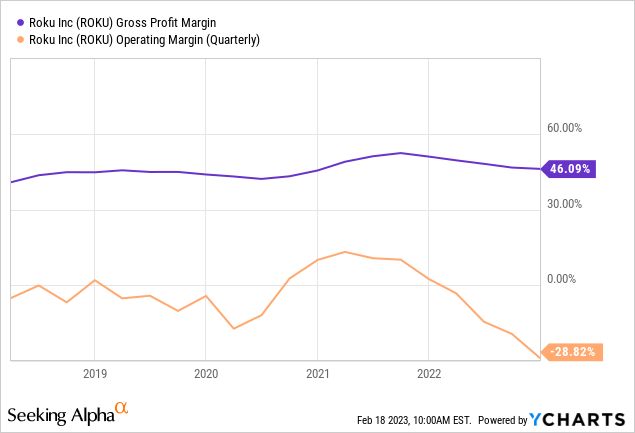

Margins

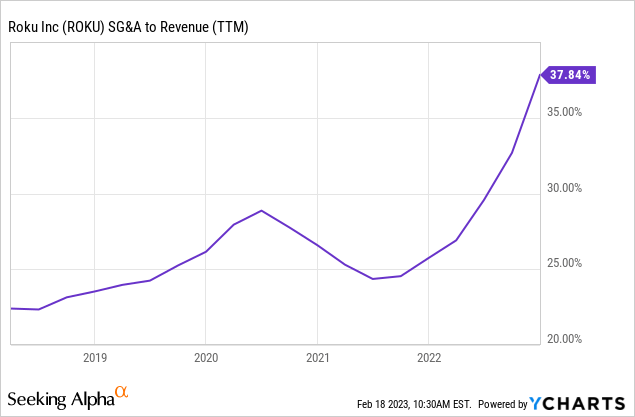

Although their gross margins started improving in 2021, it has declined for the last several quarters. Their operating margins are at the lowest they have ever been! When you look deeper, you realize their Sales and Marketing spend is up 82% and makes up more than 30% of their revenues! This means they are spending more and more dollars on marketing but not having much to show for it.

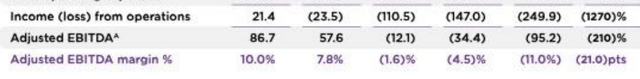

Adjusted EBITDA

When net losses are widening, companies resort to this made-up metric to show things in a positive light. First of all, you take your earnings and remove/exclude everything that matters (i.e. taxes, depreciation, etc.). On top of that, you strip more things till you arrive at a number that looks decent and that is called Adjusted EBITDA.

Not only did their net losses widen, but their adjusted EBITDA is also negative and increasing! I am not sure what the point of adjusted EBITDA is anymore.

Income and Adjusted EBITDA (Company website)

Diworsifying and Buzz words

From their earnings release –

In Q4, we launched new smart home products to build new service revenue streams. This product offering includes cameras and video doorbells that offer subscription plans enabling users to view cloud recordings of the videos, along with AI-based alerts (e.g., person, package, vehicle, pet). Similar to our TV streaming model, we plan to build scale with our devices, then monetize through smart home services, which we expect to become a very large market.

Diworsification is a term popularized by Peter Lynch to express regret over the fact that certain companies venture into domains that are significantly distinct from their primary operations, leading to their eventual downfall. I fail to see how smart home products are related to their core business. Also, this is a domain already crowded by the big players (Ex: Google (GOOG) (GOOGL)) and I don’t know how Roku plans to compete here.

“AI” is the new buzzword that has caught up with the market. Just a year earlier, it was blockchain and from the advent of ChatGPT, the term “AI” has got a new lease of life. When companies resort to using buzzwords for absolutely little reason I start to distrust them more. I still remember the time when detecting persons, package, etc. was called sensor-based alerts.

They talk about building scale with their new devices similar to the streaming model and the last time I checked, this is what scale meant. From Investopedia –

But we already saw their financials and I could see little evidence of their “scale”. So I again fail to see the intentions behind these statements.

Shareholders funding their growth

| Date | Stock Based Compensation to Revenue |

| 2022-12-31 | 12% |

| 2021-12-31 | 7% |

| 2020-12-31 | 8% |

| 2019-12-31 | 8% |

| 2018-12-31 | 5% |

| 2017-12-31 | 2% |

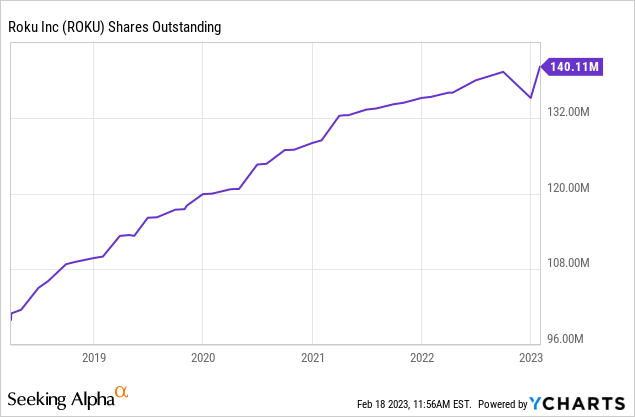

The stock has been diluted massively since its IPO and if we have to connect the dots here on how their business is still operational without profitability and widening losses, the answer seems easy. The evidence above indicates that their growth has been increasingly coming at the expense of shareholders.

Final Call

Wrapping up, I rate this stock as a strong sell:

- As an investor I feel I have better uses for my money regardless of the story that is painted by the company. At the end of the day, the financials speak for themselves

- Trading at 3 times Price to Sales the stock is not cheap either.

- I am not confident of their vision and skeptical about the direction they are taking their business.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.