Summary:

- Roku’s business appears to have stabilized somewhat, although performance is currently quite poor and remains susceptible to a recession.

- The success of Roku’s branded TV and smart home products should become apparent in coming quarters. These are more important to competitive positioning than financial performance.

- Roku’s current valuation does not reflect the company’s long-term potential, but there may not be any near-term catalysts to drive a repricing.

imaginima/E+ via Getty Images

Roku’s (NASDAQ:ROKU) first quarter results were broadly in line with expectations. Underlying metrics continue to improve, but Roku is facing soft demand and has ongoing cost issues. Roku will likely do well when the advertising market rebounds, but they must also demonstrate further evidence of international growth. ROKU stock’s current valuation is pricing in little future success, but there is still potential downside if macro conditions deteriorate, pressuring consumer spending and further undermining ad spend.

Roku

The proliferation of streaming content means that users are spending more time looking for things to watch. This undermines the user experience and increases the value of discovery, particularly cross-service discovery. Roku is actively working on improving its content discovery offerings to try and capitalize on this situation. Success in this area would solidify Roku’s competitive position and create monetization opportunities for brand advertising, M&E promotion, and Roku content.

The potential of CTV advertising relative to traditional TV advertising still seems to be largely underappreciated. In addition to being able to monetize discovery, companies like Roku can provide improved targeting and performance visibility. For example, Roku recently partnered with Instacart to allow CPG advertisers to track purchases after a consumer sees an ad on Roku.

Roku launched its first branded TVs in March, but it is likely too early still to assess performance. The lineup is fairly broad in terms of TV size and price range, placing Roku into competition with OEM partners. Roku’s stated reasons for this move are that it provides more choice for customers, gives Roku a direct relationship with consumers, allows faster innovation and enables Roku to move upmarket faster.

The move appears to be an attempt to fix a perceived weakness in regard to competition with companies like Google (GOOG), Amazon (AMZN), LG and Samsung. Management have stated that their greatest opportunity it to take share from LG, Samsung, and Vizio. An increased presence at the high-end of the market would be a positive for Roku, but overall the benefits of the strategy are not clear. The launch is also not coming at the best time, as end-market demand is relatively soft. Smart TV unit sales in the US did increase in Q1 though, driven in part by lower TV panel prices and freight costs.

Financial Analysis

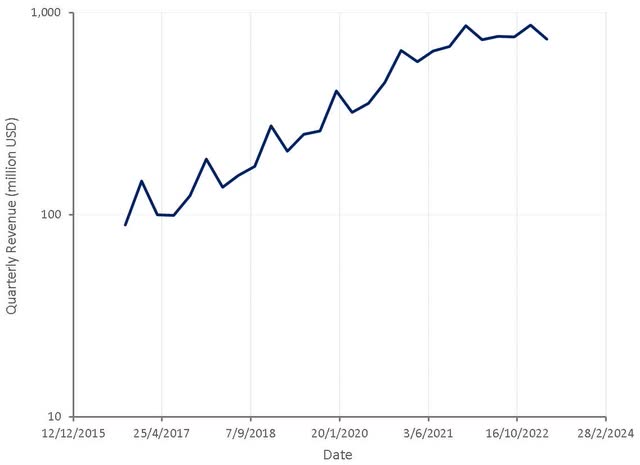

Roku’s revenue was flat YoY in the first quarter of 2023, as gains in streaming hours were offset by weak ad spend. Ad spend in verticals like financial services and media and entertainment remain pressured, while travel and health and wellness were areas of strength.

Device sales recovered somewhat, and helped to offset platform weakness, although are still at the same level as Q1 2020. Devices revenue was boosted by the launch of Roku branded TVs, smart home products and a one-time payment of 10 million USD, which was related to a licensing arrangement. Without these benefits, underlying player sales were likely quite weak.

Roku has guided to 770 million USD revenue in the second quarter, which again would be fairly flat YoY. Management expect consumers to remain pressured and ad spend to be soft throughout 2023 due to macro conditions. Comparable periods will be easier in the back half though, so it is possible that Roku returns to modest growth later in the year.

Figure 1: Roku Quarterly Revenue (source: Created by author using data from Roku)

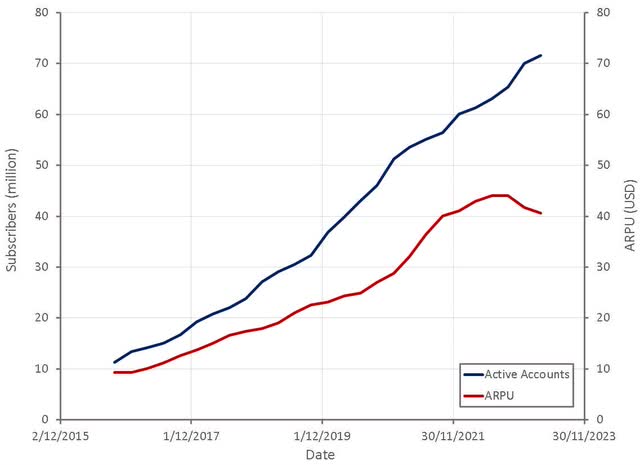

Roku continues to increase its active accounts, but this is being offset by declining average revenue per user.

Figure 2: Roku Active Accounts (source: Created by author using data from Roku)

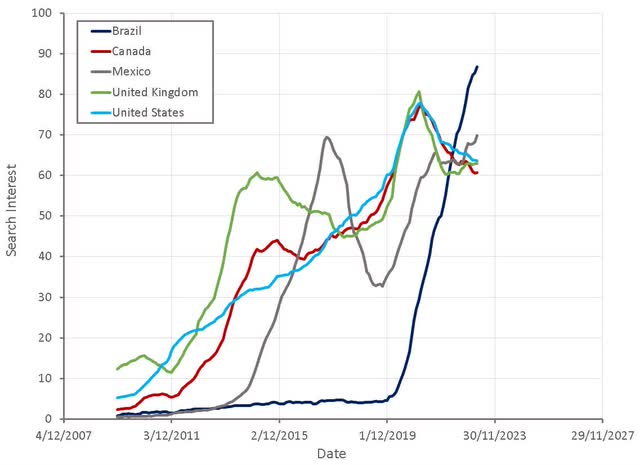

Roku is likely approaching market saturation in the US and will increasingly need international markets to drive growth. Management has indicated that they are growing market share in all of the countries in which they are active. In particular management pointed to Android’s strong market share internationally and suggested they were taking share in the new markets they enter.

Figure 3: “Roku” Search Interest (source: Created by author using data from Google Trends)

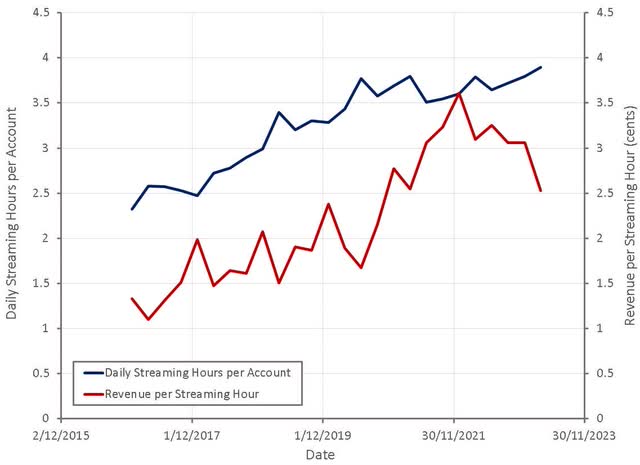

Streaming hours have remained robust coming out of the pandemic, but weak ad spend means that monetization is currently soft. Roku is working with more third-party DSPs to tap into incremental demand, which may help with this problem somewhat going forward.

Figure 4: Roku Streaming Hours (source: Created by author using data from Roku)

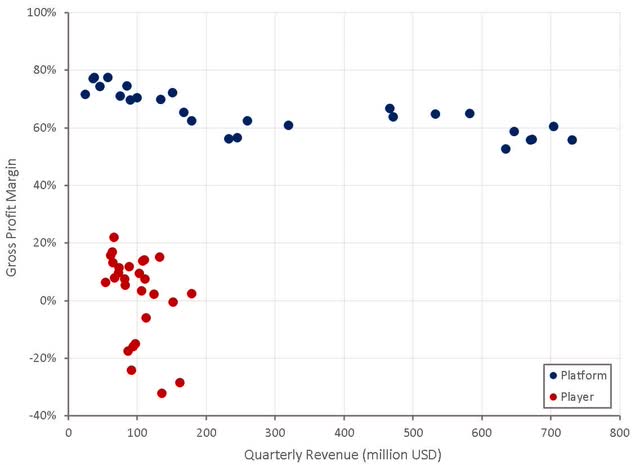

Platform margins remain soft, which should be expected due to weak advertiser demand, a mix shift away from M&E and growth in under monetized international markets. Excluding the one-time licensing benefit, device gross margin would have been -6%, which is an improvement on the back of normalizing supply chains.

Figure 5: Roku Gross Profit Margins (source: Created by author using data from Roku)

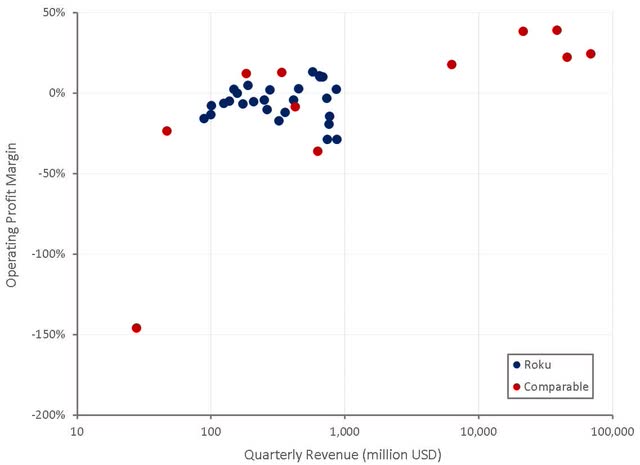

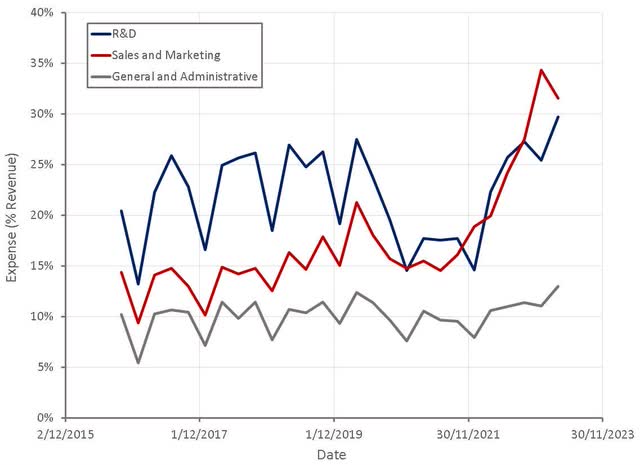

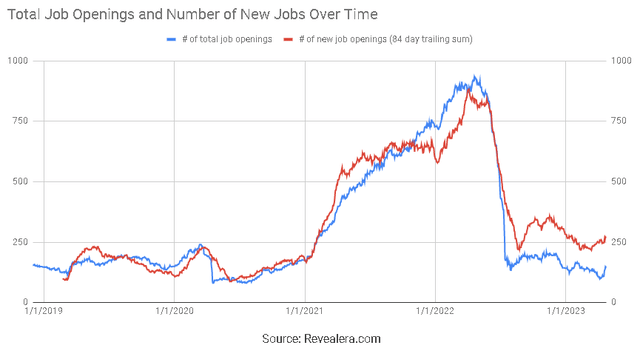

Roku’s operating profit margins are one of the most concerning aspects of the company at the moment. Rapid hiring in recent years and large investments are currently weighing on margins, and it is not clear when this situation will be resolved. In particular, sales and marketing expenses have continued to increase, even as growth has evaporated. While increased device sales and a more supportive macro environment may help to resolve this situation somewhat, Roku appears to have a problem.

Figure 6: Roku operating Profit Margins (source: Created by author using data from company reports)

Figure 7: Roku Operating Expenses (source: Created by author using data from Roku)

Figure 8: Roku Job Openings (source: Revealera.com)

Valuation

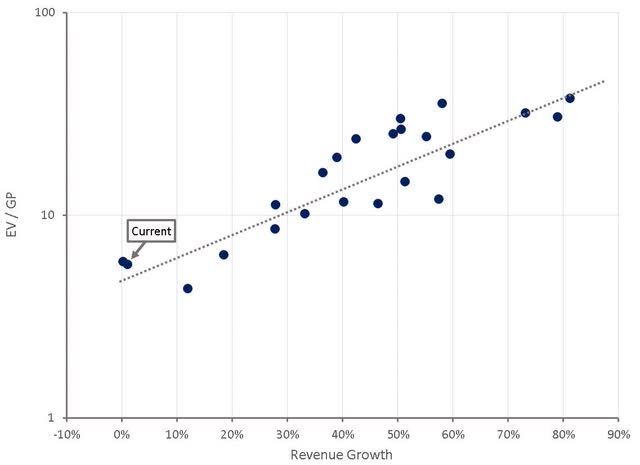

Roku’s current valuation is quite low, which is a reflection of its stagnating growth and large losses. The long-term shift to streaming is supportive of Roku’s valuation, although the company’s competitive position is not clear. A recovery in the ad market should lead to a substantially higher share price, particularly if hardware initiatives prove fruitful, although this could take time.

Figure 9: Roku Historical Relative Valuation (source: Created by author using data from Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.