Summary:

- Roku delivered a significant earnings beat for Q3, with adjusted EPS surpassing estimates by a wide margin.

- The streaming platform saw growth in active accounts and streaming hours, indicating favorable core streaming trends.

- The company’s Q4 revenue forecast is strong, but the average revenue per user trend is still weak, posing a potential risk.

- Due to improving top line growth and positive adjusted EBITDA, I am upgrading to hold.

Justin Sullivan

Shares of Roku (NASDAQ:ROKU) exploded higher by 31% after the streaming company delivered a solid earnings beat for the third-quarter last week and management said that the platform is benefiting from a strong rise in video ads. Roku’s streaming platform also saw double-digit growth in active accounts as well as streaming hours, indicating that core streaming trends are favorable. The average revenue per user trend is still questionable, however, and raises concerns about Roku’s monetization. All metrics considered, I believe that a hold rating on Roku after a 40% share price revaluation after Q3 earnings is justified.

Previous rating

I sold Roku in August as the streaming company also showed monetization weakness: Here’s Why I Have Sold (Rating Downgrade). I believe strong account and accelerating revenue growth as well as positive EBITDA have improved the risk profile for Roku, but I do see continual issues with Roku’s ARPU trajectory.

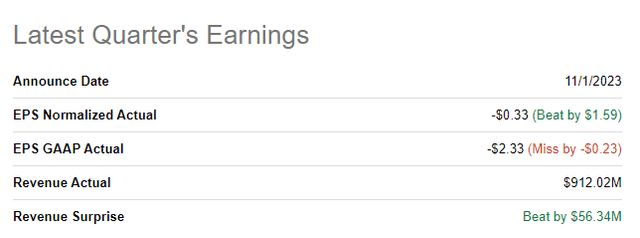

Sizable earnings EPS beat for the third-quarter

Roku delivered a significant earnings beat for the third-quarter: the streaming company reported an adjusted loss of $0.33 per-share on revenues of $912M. Adjusted EPS flew past estimates while the top line beat was more moderate.

Strong platform trends, with the exception of ARPU

Roku’s platform managed to attract a decent number of new customers last quarter. Roku grew its active accounts, one of the most important metrics for streaming companies, to 75.8M, showing an increase of 16% year over year (the same rate customer accounts grew at in the second-quarter). Engagement metrics slightly improved with streaming hours growing 22% (21% in Q2’23) to 26.7B.

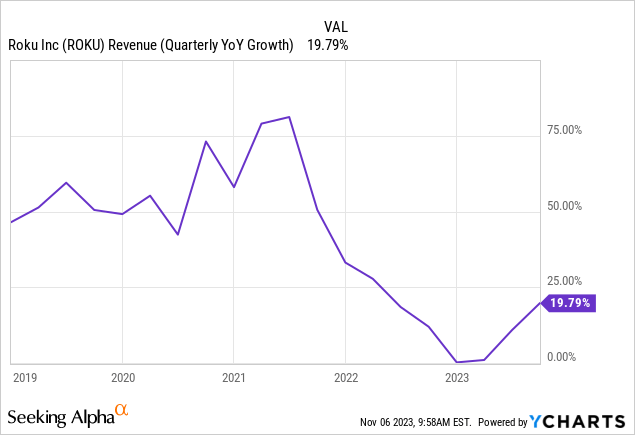

Roku’s total revenues, a function chiefly of customer net account additions and customer monetization, hit $912M in Q3’23, showing a year over year growth rate of 20%. In the third-quarter, Roku’s top line growth accelerated 9 PP quarter over quarter faster than in the second-quarter, chiefly due to a strong rebound in the video ad business.

Unfortunately, this growth in the Roku customer base has still not translated to more robust growth in the streaming platform’s average revenue per user metric. Roku’s average revenue per user in Q3’23 totaled $41.03, indicating a 7% year over year decline. On a sequential basis, ARPU was up 1%, however, it is too early to conclude that this uptick in average revenue per user marks the beginning of a trend.

|

Actual Results |

Q3’23 |

Q2’23 |

Q1’23 |

Q4’22 |

Q3’22 |

Growth Y/Y |

|

Active Accounts (millions) |

75.8 |

73.5 |

71.6 |

70.0 |

65.4 |

16% |

|

Streaming Hours (billions) |

26.7 |

25.1 |

25.1 |

23.9 |

21.9 |

22% |

|

Average Revenue Per User/ARPU ($) |

$41.03 |

$40.67 |

$40.67 |

$41.68 |

$44.01 |

-7% |

(Source: Author)

Strong forecast for Q4’23

With moderating account growth after the pandemic also came weakening revenue growth. The pandemic helped boost Roku’s business initially, but revenue-boosting pandemic effects quickly faded, resulting on growing pressure on Roku’s top line.

According to Roku’s fourth-quarter forecast the streaming company expects $955M in revenues next quarter which implies a year over year top line growth rate of 10%. Wall Street expected Q4’23 revenues of $952M.

The 20% revenue growth rate in Q3’23 was a reflection of strong advertising trends on the Roku platform. Management said that the firm’s advertising trends resisted the broader trend in the advertising market (Source) as growth in video adds fueled Roku’s top line results. Additionally, new partnerships as well as tapping into the market for small and medium enterprises helped the streaming company boost its advertising business in Q3’23.

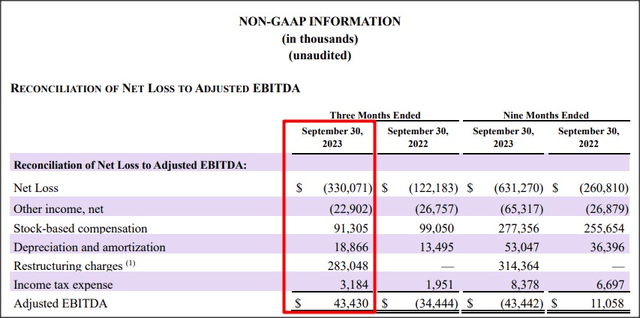

Adjusted EBITDA profitability

Roku achieved adjusted EBITDA profitability of $43.4M in the third-quarter, but otherwise remained unprofitable. The streaming platform, in fact, generated a massive net loss (on a GAAP basis) of $330.1M and total year-to-date losses of $631.3M. Roku did guide for positive adjusted EBITDA in FY 2024 earlier this year which I believe is a realistic target considering the improved revenue picture. Previously, I cited weak ARPU growth as a potential reason for a delayed profitability timeline.

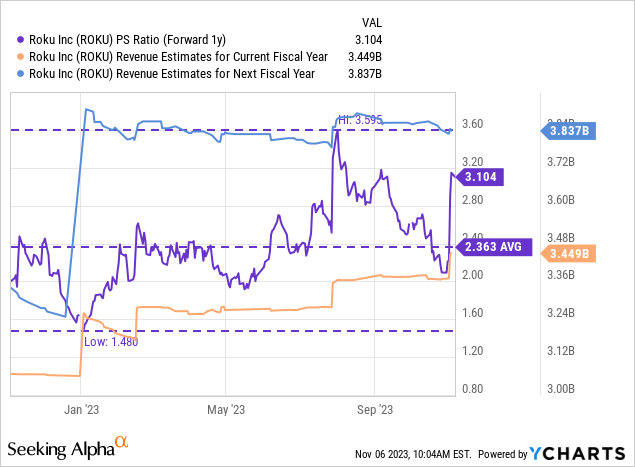

Roku’s valuation, potential for upside revenue revisions

Roku is expected to generate revenues of $3.45B in FY 2023 and $3.84B in FY 2024 which implies a year over year top line growth rate of 11%. The robust outlook for Q4’23 will likely result in revenue estimate upgrades which itself might be a catalyst for a revaluation.

However, I just don’t like buying Roku, despite improved fundamentals, after the share price has soared 40%. Based off of FY 2024 revenues, Roku is currently valued at a price-to-revenue ratio of 3.1X which is 24% above the 1-year average P/S ratio of 2.4X. Netflix (NFLX) is valued at 5.0X forward revenues and I consider the streaming company to be overvalued as well. Netflix recently reported strong quarterly earnings for Q3’23, driven by subscriber gains, but I don’t believe the risk profile is very attractive here for investors either.

The best thing I can do, considering that ARPU headwinds still existed in Q3’23, is to upgrade my rating to hold.

Risks with Roku

Roku’s main risks relate to the company not being able to achieve adjusted EBITDA profitability next year and a delay in the profitability timeline, although I believe those risks have decreased after Q3’23 results. What I continue to see as a risk is that the ARPU trend is not convincing. Roku needs to improve its customer monetization and translate its revenue/account growth to ARPU growth. If the platforms fails to do this, I believe Roku’s high valuation multiplier factor won’t last.

Final thoughts

Although there were some encouraging signs in Roku’s Q3’23 earnings report, including a 9 PP Q/Q acceleration of revenue growth, strong video ad performance, a robust top line forecast for Q4’23 and positive adjusted EBITDA, the lack of real ARPU expansion, in my opinion, is sooner or later going to be weight on Roku’s valuation. I also don’t like recommending or buying into a company whose valuation has just risen 40% because it exposes investors to material correction risks once the initial excitement about Roku’s solid Q3’23 earnings card wears off. I believe Roku could achieve adjusted EBITDA profitability next year, but the valuation seems a bit high again, based off of revenues, and my rating remains hold for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.