Summary:

- Roku reported strong growth due to a 20% increase in streaming hours and 14% growth in accounts.

- The streaming video platform is set to top the $1 billion quarterly sales milestone and is targeting accelerating growth heading into 2025.

- ROKU stock only trades at ~1x forward EV/S targets due in part to a massive cash balance.

JHVEPhoto

A lot of stocks have been irrationally hit in the recent market selloff, with Roku, Inc. (NASDAQ:ROKU) down to new lows. The streaming video platform continues to report strong viewership growth, setting up a stronger future. My investment thesis is ultra-Bullish on the stock at the lows, trading at a very discounted valuation multiple.

Crossing $1 Billion Threshold

Roku reported another quarter of growth topping estimates, in part to the company providing consistently weak guidance. The streaming video company reported Q2’24 revenues of $968 million, $30 million above consensus estimates.

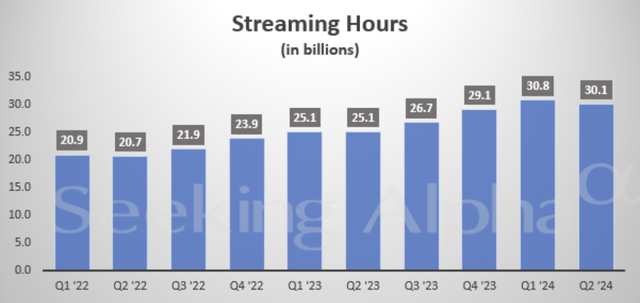

The sales growth rate dipped down to 14% with the key platform revenue only growing 11%. Roku reported key Streaming Hours grew 20% in the quarter to 30.1 billion hours, up 20% YoY.

Roku grew streaming accounts to 83.6 million, up 14% YoY. The main negative is that ARPU was flat despite the higher hours streamed. The company should start monetizing customers at much higher rates with each additional hours on the platform, though some international customers will pull down the ARPU.

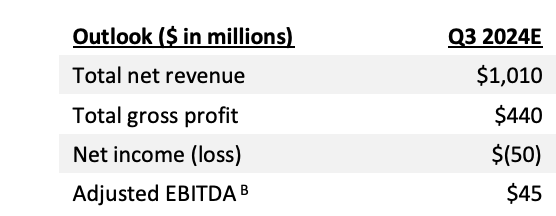

The company guided to this goal, with Q3 sales forecast to top the $1 billion mark. Roku will produce the first quarter above $1 billion in sales heading into the strong holiday ad market.

Source: Roku Q2’24 shareholder letter

The forecast is for sales to grow at an 11% clip, similar to the prior guidance for Q2. Roku has now beaten consensus estimates by at least $30 million in 7 of the last 8 quarters in the last 2 years.

While Roku is likely to keep smashing conservative targets, the company is also guiding to additional growth starting by Q3 and especially into Q4. On the Q2’24 earnings call, CFO Dan Jedda made the following statement:

We are confident the year-over-year growth rate of Platform revenue will begin to accelerate sequentially in Q4 of this year, as a result of executing on our monetization initiatives to maximize ad demand and leverage our Home Screen as the lead-in for TV.

A big key to the accelerating growth in 2025 is adoption of the Unified ID 2.0, or UID2, as an identity solution. The advertising product was developed by the Trade Desk (TTD) and will allow Roku advertisers to achieve more precise targeting and enhanced data collaboration for the open internet.

Another growth opportunity is The Roku Channel. The company grew this channel by 75% YoY and is the #3 app on the platform.

Depressed Valuation

The market selloff has pushed the market cap down below $8 billion. Roku is now producing solid free cash flow this year at $318 million on a trailing 12-month basis.

The media company ended the quarter with $2.1 billion of cash and cash equivalents balance. Roku only has an enterprise value of ~$4.5 billion, while revenues are quickly growing above the $4.0 billion level.

The consensus analyst targets only have Roku growing at a 12% clip in 2025 to reach $4.44 billion in sales. Management has consistently guided to accelerating growth in 2025 due to advancements in ad revenues on the streaming platform via new products like UID2 and growth in the Roku Channel. In essence, the current revenue targets appear very conservative.

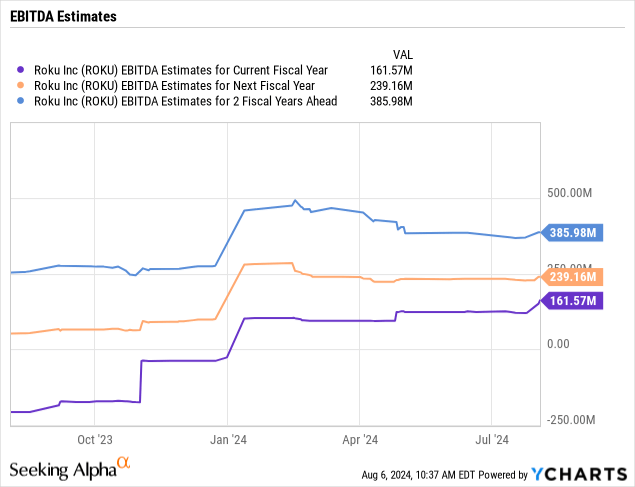

The stock shouldn’t trade at a forward EV/S of 1x. Roku is even becoming increasingly profitable, with adjusted EBITDA set to hit $162 million this year and more than double by 2026 to $386 million.

The stock only trades at ~12x 2026 EV/EBITDA targets. Roku will grow EBITDA at a far faster clip during this period, which makes a 12x multiple as extremely cheap. The discount is unlikely to last long.

Takeaway

The key investor takeaway is that Roku now trades at the yearly lows, despite the company continuing to report solid results. As the streaming platform starts reporting accelerating growth headed into 2025, the stock will be back to trading closer to the yearly highs around $100.

Investors should use the market weakness to buy Roku at the lows, knowing the company has a massive balance sheet to protect any downside risk going forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ROKU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market to start August, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to start finding the best stocks with potential to double and triple in the next few years.