Summary:

- Roku’s Q3 earnings were mixed, but the stock rose due to accelerating growth and improving cash flows.

- The company’s low valuation and improving fundamentals should help the stock move higher in coming quarters.

- Concerns about Roku’s competitive position, concerns about the ad market and questions on international expansion will probably limit any gains.

demaerre

Roku’s (NASDAQ:ROKU) third quarter results were mixed, although the stock moved sharply higher. This was probably due to Roku’s accelerating growth and improving cash flows. While digital advertising and device sales headwinds are abating, Roku’s operating expenses are still elevated, and account growth is only modest. This is concerning given Roku’s stated focus on international expansion and the launch of Roku-branded smart TVs, both of which should be supporting account growth. Until Roku can demonstrate greater traction internationally, there should be skepticism regarding the company’s ability to drive long-term growth.

Roku also has a questionable competitive position, which has likely behind initiatives like The Roku Channel, smart home devices and Roku-branded smart TVs. These factors must be weighed against Roku’s low valuation, which prices in little growth and modest margins going forward. An end to interest rate hikes, along with accelerating growth and improving margins, should help Roku’s stock to move higher in coming quarters.

Roku Q3 Earnings

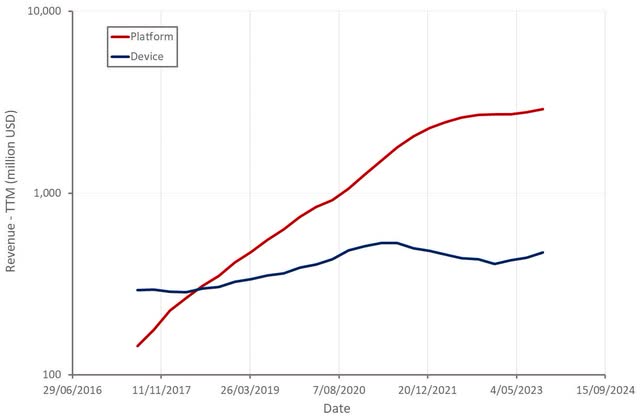

Roku’s revenue increased 20% YoY in the third quarter to $912 million USD. Platform revenue grew 18% on the back of both content distribution (subscriber growth and subscription price increases) and video advertising, offset by lower media and entertainment promotional spend. Platform revenue also benefited from a 606 adjustment due to changes in forecasts of Roku’s content distribution deals. Roku’s growth is clearly reaccelerating, which is a positive, but questions remain about efficiency and competitive positioning.

Figure 1: Roku Revenue (source: Created by author using data from Roku)

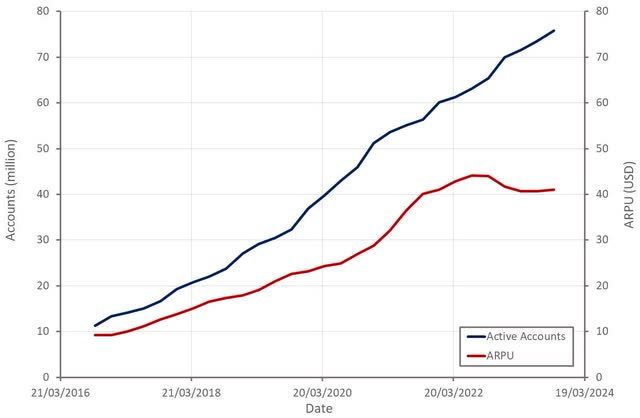

Active accounts increased 16% YoY, which is somewhat disappointing given the fact that device sale headwinds have eased. Active accounts in the US are approaching half of broadband households, indicating that Roku is probably nearing market saturation there. Roku generally has a small presence internationally though, and given the company’s focus on this segment, account growth should ideally be stronger.

With ad market conditions improving, Roku’s ARPU has stabilized and is expected to improve going forward. The combination of solid account growth and rising ARPU should support fairly robust growth in the near term, unless macro conditions deteriorate.

Figure 2: Roku Active Accounts and ARPU (source: Created by author using data from Roku)

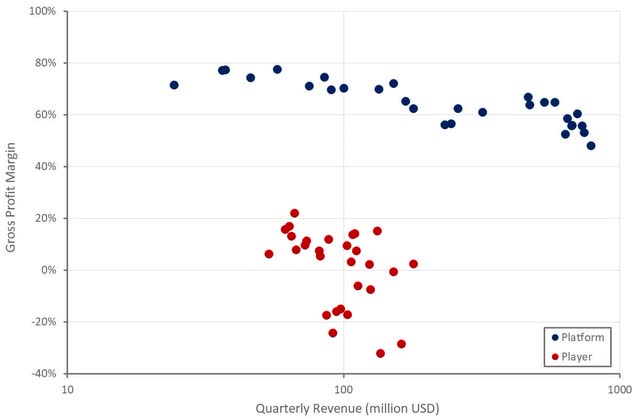

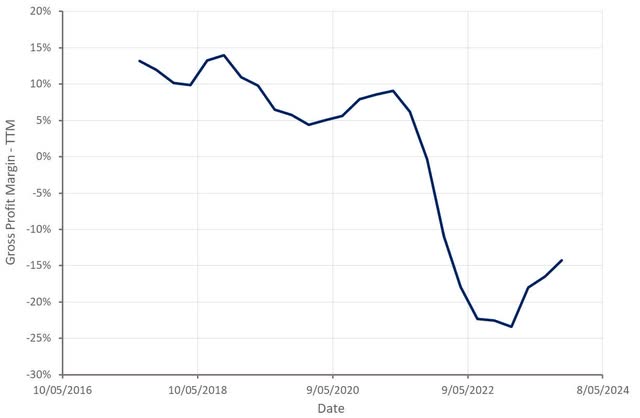

Roku’s gross profit margin was only roughly 40% in the third quarter, although it was significantly impacted by restructuring and impairment charges. Roku’s Platform gross margin was 48%, or 56% excluding impairment charges. There was a 606 adjustment in Q3 that added 2% to Platform gross profit margins though. Devices gross margin was negative 8% and continues to improve on the back of easing supply chain pressures and improved pricing.

Figure 3: Roku Gross Profit Margins (source: Created by author using data from Roku)

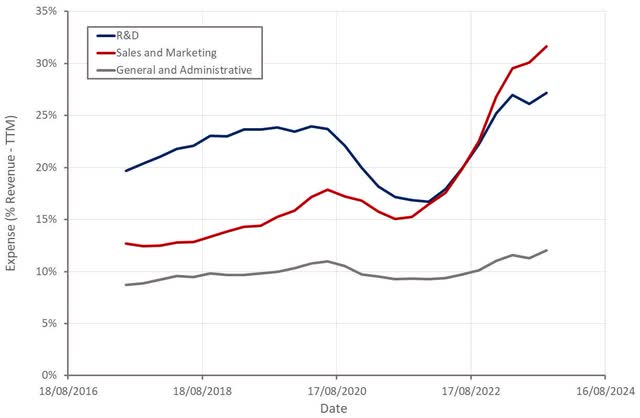

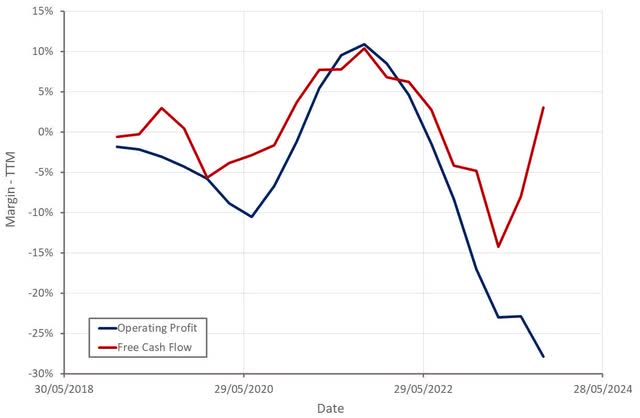

Roku’s operating expenses were elevated in the third quarter due in large part to restructuring and impairment costs. Excluding these costs, the combination of solid revenue growth and Roku’s cost cutting efforts is beginning to reduce the burden of operating expenses. This can be more clearly seen from Roku’s cash flows, which are now returning to more healthy levels.

Figure 4: Roku Operating Expenses (source: Created by author using data from Roku)

Figure 5: Roku Operating Profit Margin and Free Cash Flow Margin (source: Created by author using data from Roku)

Cost Cutting

Following cost cutting efforts in November 2022 and March 2023, Roku announced another round of cuts in September 2023, including:

- Consolidation of office space

- Content portfolio rationalization

- Reduced outside services expenses

- Workforce reduction

- Limited new hiring

There were significant costs associated with these initiatives in the third quarter, depressing Roku’s margins.

Table 1: Restructuring Charges Q3 2023 (‘000 USD) (source: Created by author using data from Roku)

Roku Q4 Outlook/Guidance

Roku’s fourth quarter revenue is expected to be $955 million USD, a 10% YoY increase, although this guidance is conservative, with revenue likely to come in closer to 1 billion USD. Video ads began to recover in the third quarter and this strength is expected to carry over into the fourth quarter. The macro environment is still causing Roku to be cautious. Ad verticals like CPG and health and wellness continue to improve, while verticals like financial services and M&E remain challenged. The fourth quarter also faces a difficult comparable period due to strong content distribution and M&E revenue in 2022.

Roku’s gross profit margin is expected to be 42% in the fourth quarter and the company expects a positive adjusted EBITDA. Devices margins are expected to improve YoY but are still expected to be something like -20%, as the fourth quarter is a promotion heavy period.

Roku Devices

Smart TV unit sales in the US increased YoY in the third quarter and Roku grew significantly faster than the overall industry. Roku attributed some of this strength to consumer preferences switching toward lower priced TVs, a segment where Roku has a relatively strong position. The Roku operating system continues to be the number one selling TV OS in the US, with Roku gaining share across the full range of TV screen sizes.

Devices revenue increased 33% YoY in the third quarter, driven by the launch of Roku-branded TVs and smart home products. Margins also continue to improve as supply chain pressures ease and pricing improves. Manufacturing costs increased by 12.6 million USD YoY in the third quarter, which was largely attributed to costs associated with Roku-branded TVs and smart home products.

The launch of Roku-branded TVs and smart home products appears to have been in response to competitive pressures. Roku’s devices segment has marginal economics and really should be viewed as a customer acquisition cost for the Platform segment. Roku needs to maintain the presence of its OS on smart TVs, which makes it reliant on OEM partners. While Roku generally has good relationships with TV partners and can offer them advantages, like lower manufacturing costs and an improved user experience, this is a vulnerability.

Figure 6: Roku Device Gross Profit Margin (source: Created by author using data from Roku)

The Roku Channel

The Roku Channel is another part of Roku’s business that supports the company’s competitive position but has questionable economics. The Roku Channel increases the potential supply of ad inventory, but at this stage its ability to attract users to Roku is probably more important. The Roku Channel streaming hours increased 50% YoY in Q3 and represented nearly 3% of all TV streaming in September. It’s a top 10 streaming app with engagement comparable to Paramount Plus, Peacock, and Max.

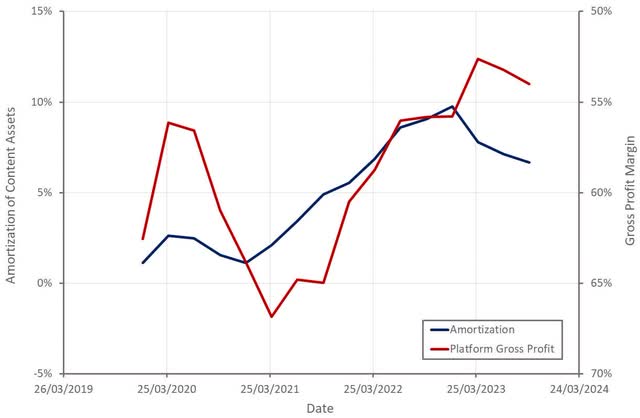

While The Roku Channel is growing rapidly and has long-term potential, it appears to be sub-scale and weighing on Roku’s Platform margins. Continued growth and the monetization of more international users should help to change this situation.

Figure 7: Roku Content Amortization Expense (source: Created by author using data from Roku)

Roku Advertising Revenues

Weak demand has been an issue across digital ad markets over the past few years. Supply growth also has been strong as many large companies have turned to advertising to maximize the value of their user base. This has resulted in an oversupply of inventory and downward pressure on pricing.

Demand has been an issue for Roku as well, even though the company has its own DSP. It’s not clear that Roku has sufficient scale to support a walled garden approach, and it has turned to third-party partners to supplement demand. Roku is now integrated with over 30 programmatic partners but has stated that this initiative is still ramping.

Video advertising revenues continue to rebound, and Roku’s sees this strength carrying through the remainder of the year. Unsurprisingly, video advertising on Roku is outperforming the overall ad market and the linear ad market in the US. Demand continues to vary significantly across ad verticals though. For example, CPG and health and wellness are areas of strength, while financial services and insurance remain weak. Importantly for Roku, M&E spend is expected to be further pressured in fourth quarter by limited fall release schedules.

International Expansion

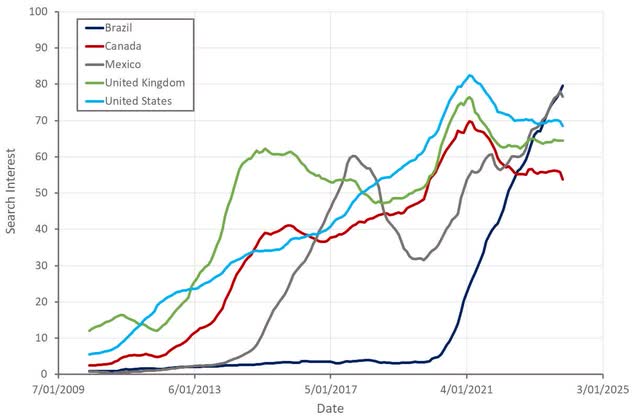

While international expansion has been a focus area for some time, only something like 15% of Roku’s active accounts are outside of the US, and international markets are still responsible for less than 10% of total revenue.

Roku could be set to gain market share over time, but it appears that some markets already have been lost. For example, Roku entered the UK streaming market back in 2012, but it only had an 8% share of screen viewing time in Europe in Q1 2021. International markets are generally far more fragmented, and Roku is mostly not one of the big players.

Roku is reportedly doing well in Latin America though. It has the No. 1 selling TV OS in Mexico and has also launched The Roku Channel there. Brazil is another growth market and Roku’s strength in lower priced TVs should help the company to expand in lower income countries.

Figure 8: Roku Search Interest (source: Created by author using data from Google Trends)

Roku Stock Outlook

While there are a number of doubts surrounding Roku’s business that are likely to prevent the stock returning to the type of multiple it traded on prior to 2022, improving fundamentals should lead the stock price higher. Improving ad market conditions should support continued growth and cost cutting efforts are now beginning to yield results.

Based on a discounted cash flow analysis, I estimate that Roku’s stock should be worth more like $150 per share. Roku’s business is capable of generating decent free cash flow margins and the company still has a long growth runway, even if international success is only modest, which isn’t currently reflected in Roku’s share price.

This is all dependent on the macro environment remaining stable though. Labor markets are weakening and there is growing evidence of mounting consumer stress, particularly amongst lower income individuals. If job losses accelerate, Roku is likely to be hit by lower device sales and weaker advertising demand, which would probably cause the stock to move back toward recent lows.

Figure 9: Roku EV/S Multiple (source: Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.