Summary:

- Roku’s stock now trades almost eight times lower than its all-time highs, and the company’s fundamentals suggest that the stock sell-off was fair.

- Having profitability metrics deteriorating despite impressive revenue growth suggests the management prioritizes growth at all costs.

- My valuation analysis suggests that the stock is overvalued.

JHVEPhoto/iStock Editorial via Getty Images

Investment thesis

Roku (NASDAQ:ROKU) has been one of the hottest stocks during the pandemic stock market frenzy. The stock bottomed late last year and more than doubled by August 2023. Since then, ROKU once again plunged and my analysis suggests fundamental weaknesses that make the stock likely to continue to decline in the foreseeable future. Moreover, my valuation analysis suggests that the stock is slightly overvalued. All in all, I assign ROKU a “Strong Sell” rating.

Company information

According to the company’s latest 10-K report, Roku is the leading TV streaming platform in the United States, Mexico, and Canada by hours streamed.

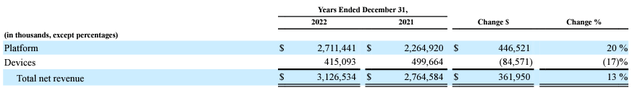

The company’s fiscal year ends on December 31. Roku’s two reportable segments are the platform segment and the devices segment. In FY 2022, the platform segment contributed 87% to total sales.

Financials

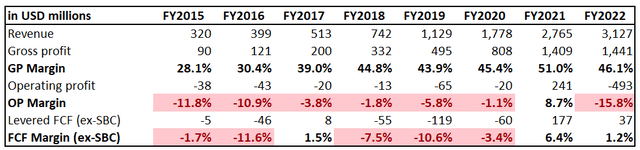

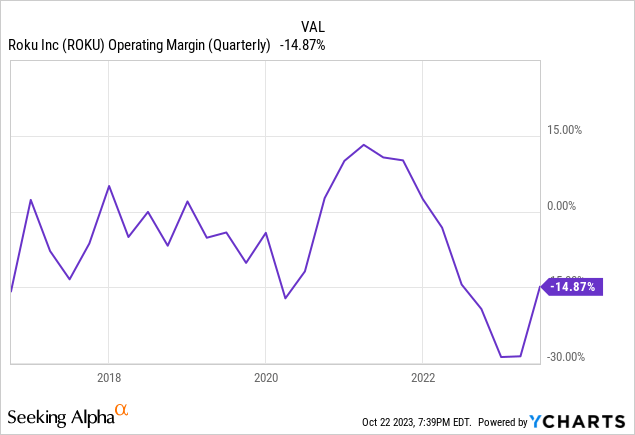

When I look at Roku’s financial performance over the long term, I see the classic example of a company that bets on aggressive growth at all costs. The company’s revenue compounded at a staggering 39% CAGR over eight years, but its operating margin was positive only once since then. The free cash flow [FCF] margin ex-stock-based compensation [ex-SBC] looks more successful but still has been very volatile.

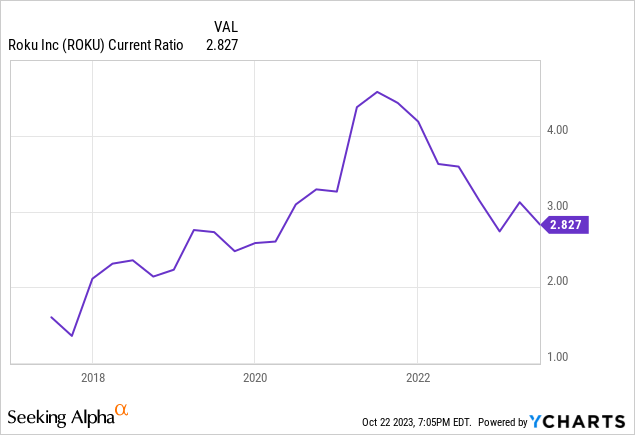

Despite having a volatile and mostly negative operating margin, the balance sheet looks strong with low leverage and over a billion dollars in net cash. Liquidity metrics are also in excellent shape.

Seeking Alpha

However, I would like to underline that the strong balance sheet was mainly built with substantial common stock issuance in FYs 2019-2021, totaling about $2 billion. As of the latest reporting date, the net cash position might look massive, but it is also important to know that it has declined substantially from its about $1.7 billion peak in March 2022. The same goes for short-term liquidity, which might look strong in isolation but has deteriorated significantly over the last two years.

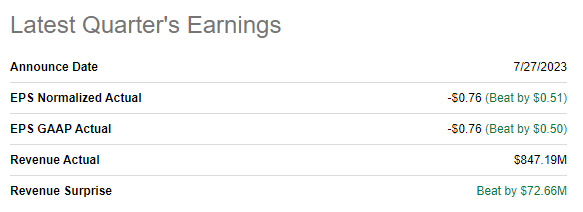

I am underlining the weakening balance sheet because the company’s profitability metrics are still negative, which means the financial position is poised to keep weakening in the next multiple quarters. The latest quarterly earnings, which were released on July 27, were weak despite topping consensus estimates and demonstrating almost 11% YoY revenue growth.

Seeking Alpha

I think that the last quarter’s financial performance was weak because of profitability metrics. The gross margin shrank YoY by almost two percentage points despite revenue growth, which is a red flag, meaning the company strives to demonstrate growth at all costs. The operating margin also deteriorated on a YoY basis. It might look like a slight decrease of just 40 basis points, but I want to emphasize that it was achieved by the decreased R&D to revenue ratio by almost three percentage points. That said, the operating margin was somewhat sustained at the cost of innovation while the SG&A’s portion of revenue even increased.

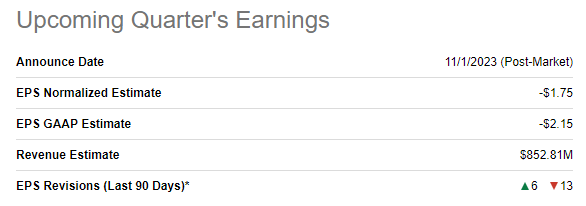

And the upcoming quarter’s earnings consensus estimates suggest that more pain for profitability is expected ahead. While consensus expects revenue to maintain a solid YoY growth momentum of 12%, the adjusted EPS is forecasted to plunge from -$0.88 to -$1.75. The Q3 earnings release is scheduled for November 1, and there were 13 downgrade EPS revisions over the last 90 days.

Seeking Alpha

I understand that a big reason for the expected EPS decrease in Q3 is due to impairment charges and severance costs due to the announced in September new round of layoffs. However, I do not like the trend demonstrated by the operating margin. Despite demonstrating solid quarterly revenue dynamics in 2022, the operating margin nosedived.

The company’s financial performance suggests that the business model is likely to be inefficient. Delivering a tenfold revenue growth over the past eight years and solid current topline growth momentum with shrinking profitability metrics is a huge red flag. Businesses, especially those offering discretionary entertainment products and services, face a challenging environment. I expect the management to realize the depth of the crisis and be much more determined to protect shareholders’ value. Roku’s management’s cost-saving initiatives do not demonstrate much determination to fight for shareholder’s wealth, in my opinion.

Valuation

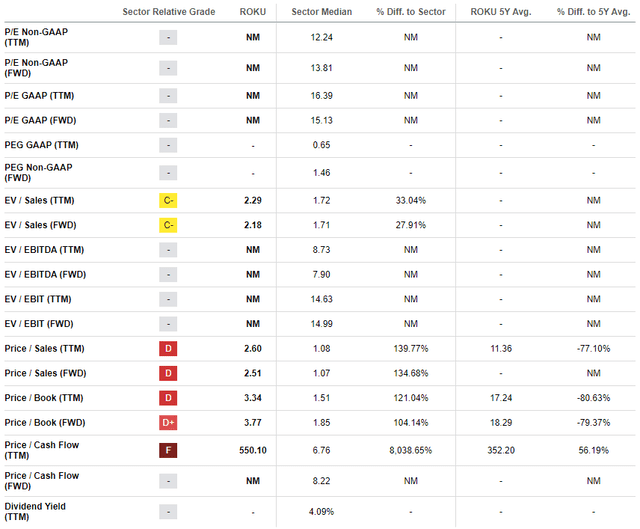

The stock rallied 47% year-to-date, significantly outperforming the broader U.S. market. Seeking Alpha Quant assigns the stock the lowest possible “F” valuation grade because ratios are substantially higher than the sector median across the board. It is also important to underline that several ratios are unavailable because the company still does not generate profits.

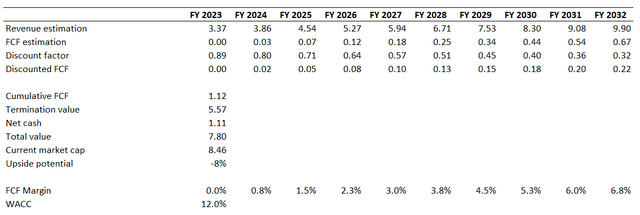

ROKU is an aggressive growth stock, so I want to proceed with the discounted cash flow [DCF] simulation. I use an elevated 12% WACC due to the very high level of uncertainty regarding future growth and profitability expansion. I have revenue consensus estimates available for the next decade, forecasting a 13% CAGR. The growth rate looks moderate compared to the historical performance and the increased scale of the business since then. I expect a zero FCF margin for my base year with a further 75 basis points yearly expansion.

According to my DCF simulation, the stock is slightly overvalued even if I add the net cash position to my fair value calculation. That said, the stock’s fair value is around $55.

Risks to my bearish thesis

Valuations of many growth companies had shrunk significantly from their recent year’s peaks. For example, Roku’s stock now trades about eight times cheaper than its all-time high of 2021. Still, the company demonstrates solid ability to deliver solid revenue growth even in the current environment. The business just needs the business approach to be realigned to achieve greater efficiency, and here I see two potential ways out which can suddenly boost the stock price.

First, the U.S. stock market’s technology hyper scalers have massive outstanding cash balances and these companies are constantly seeking new ways to boost revenue growth and create more value to shareholders. These companies’ vast resources and stellar management teams can make a real impact to improve Roku’s profitability. Therefore, Roku can become an attractive acquisition target for one of the American technology giants to expand their massive ecosystems. That said, in case of just rumors regarding the potential acquisition, the company’s stock price might skyrocket.

Second, the board might decide to change the management and this could also inspire investors. This might be the case if the new CEO with a strong track record of profitability improvement takes over the leadership in the company. The potential positive market overreaction is also possible if such a scenario unfolds.

Bottom line

To conclude, Roku is a “Strong Sell”. The company’s balance sheet is deteriorating at a relatively rapid pace and my analysis suggests that more pain is likely to be ahead for the company’s profitability. Roku struggles to improve monetization of its business model comparable to impressive revenue growth which means the management prioritizes revenue growth at all costs. The valuation does not look attractive either.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.