Summary:

- ROKU’s growth is driven by its platform segment with a six-fold increase in revenue from 2018 to 2022.

- High US market penetration is due to lower prices and a user-friendly OS; however, long-term durability is uncertain due to competitors like Amazon and Google aggressively pricing their products.

- Content neutrality and advertising value are key strengths for ROKU, attracting a wide array of on-demand services and providing valuable behavioral information for advertisers.

- Technological advantages and R&D investment have resulted in an easy-to-navigate OS that runs smoothly even on low-powered processors.

- I value the shares at $52, a 17% downside from current levels, with international expansion, competition, and customer loyalty being primary concerns.

Justin Sullivan

While Roku, Inc. (NASDAQ:ROKU) boasts advantages such as high penetration in the US market and technological advantages, it faces fierce competition, and international expansion may prove to be a challenge. Taking these assumptions into consideration, I see the value of the shares at $52, a 17% downside from current levels. In this article, I will explore factors contributing to ROKU’s growth, including its platform segment, market penetration, content neutrality, and technological advantages. Additionally, I will discuss the challenges the company faces, such as competition, customer loyalty, and international expansion.

Growth Driven by Platform Segment

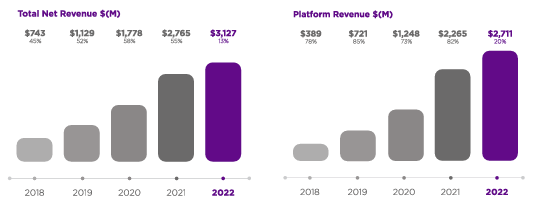

ROKU has experienced tremendous growth in recent years, primarily driven by its platform segment. The platform segment generates revenue from advertising, platform and distribution fees, and licensing. From 2018 to 2022, Platform revenue increased six times from $389 million to $2.7 billion representing the entire growth of revenues in that period for ROKU. The increasing importance of the platform segment highlights the shift from a hardware-based business model to a more service-oriented one.

Company presentation

High Penetration in US Market

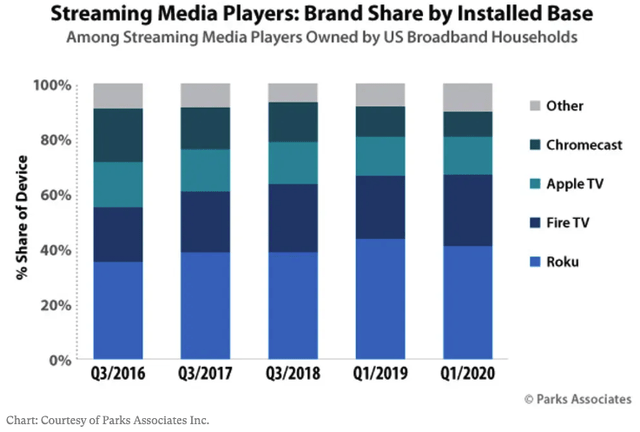

ROKU has successfully captured a substantial portion of the North American market. As of 2020, Roku TVs secured a market share of 38% in the US and 31% in Canada. Furthermore, Roku maintains its position as the leading CTV device provider in the US, with a penetration rate of approximately 52% among CTV users. This elevated adoption rate can be attributed to the lower price points of both its branded devices and smart TVs incorporating its OS.

While this advantage has contributed to ROKU’s market share growth, it remains unclear if this edge will persist over an extended period. Rivals such as Amazon and Google have also competitively priced their streaming devices, presenting features akin to Roku. For example, Amazon’s streaming stick can provide high-quality 4K resolution, Dolby Vision HDR, and immersive Dolby Atmos surround sound for a mere $50.

Content Neutrality and Advertising Value

A key strength of ROKU resides in its impartial stance regarding content, assisting the platform in attracting new services while retaining existing ones. The company presents an extensive variety of on-demand offerings, surpassing competitors like Apple TV, Chromecast, and Fire TV. Many of these services rely on ad support, and Roku claims a share of its advertising revenue. This vast audience bolsters the company’s competitive edge, as it supplies advertisers with valuable insights into user behavior.

Technological Advantages and R&D Investment

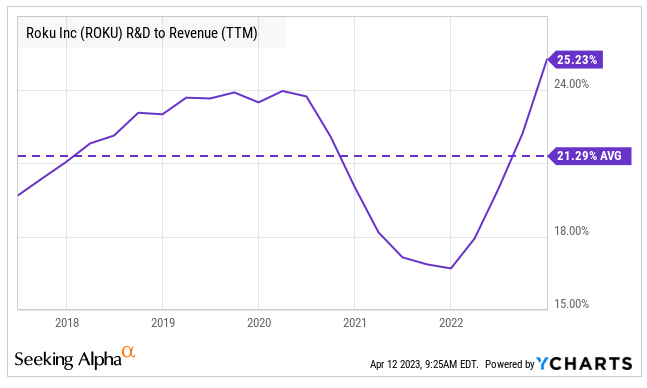

The Roku OS is designed to be relatively easy to navigate and requires only modest processing power. This aspect makes the user interface experience a sense of agility and smoothness even on low-powered processors in cheaper TVs. The company heavily invests in R&D spending on average 21% of revenues on R&D.

YCharts

Competition, customer loyalty, and international expansion

Despite its growth and market share, ROKU may not benefit from significant switching costs. Many households use multiple platforms, including Roku, to interact with OTT content. Since account information and passwords for OTT services are saved in multiple places, there is a minimal necessity to stick with Roku while buying a new device or TV. As a result, customer loyalty to the platform may not be as strong as it appears.

ROKU competes in a fiercely contested market against companies with significantly greater resources such as Amazon (AMZN), Google (GOOG), and Apple (AAPL). In case these companies devote additional resources to their streaming platforms, ROKU could be at a significant disadvantage.

Furthermore, ROKU’s long-term growth depends on international expansion, as the US market is mostly saturated and ROKU has a high market share. The company may face challenges in international markets, where it has little brand recognition compared to Amazon and Google, which have been willing to price their devices at similar levels to ROKU.

Valuation

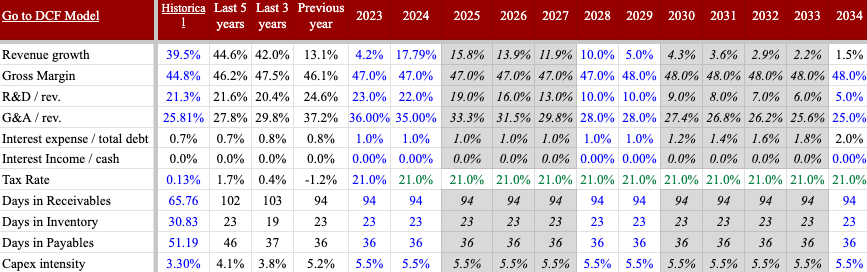

My analysis suggests that the shares are worth $52, based on a DCF valuation. I assumed a cost of capital of 9.7% based on an unlevered beta of 1.33 for the industry. The primary driver of revenue growth will be international expansion, given ROKU’s substantial market share in North America. In the medium term, revenues are expected to continue growing at a double-digit rate. Moreover, I anticipate margin improvement due to operational leverage, which will decrease SG&A and R&D as a percentage of revenues.

Below are my main assumptions:

Author estimates & company filings

Conclusion

ROKU has witnessed remarkable expansion owing to its platform segment. Nevertheless, the company encounters substantial obstacles, including intense rivalry from well-financed competitors like Amazon, Google, and Apple, which might impede its international growth efforts. In spite of its existing accomplishments, ROKU’s enduring success is not assured. Considering these elements, I value ROKU shares at $52, signifying a 17% decline from the present levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.