Summary:

- Roku is one of those stocks which soared during the pandemic but now trade lower than pre-pandemic levels.

- Growth was supposed to accelerate after the company finished lapping tough pandemic comps.

- That has not materialized as the company is now facing a tough macro backdrop.

- The stock remains undervalued and improving profitability may be a key near-term catalyst.

Slaven Vlasic/Getty Images Entertainment

Roku (NASDAQ:ROKU) was a pandemic darling which after seeing its growth disappear has seen its stock price get crushed in the aftermath. As the company exits 2022 and begins the 2023 year, growth has not re-accelerated as expected from lapping tough comps. The tough macro environment is now to blame but management has guided for positive adjusted EBITDA within 2 years. While there is not much to be optimistic about in the near term, the vicious valuation reset gives shareholders enough reason to continue holding over the long term.

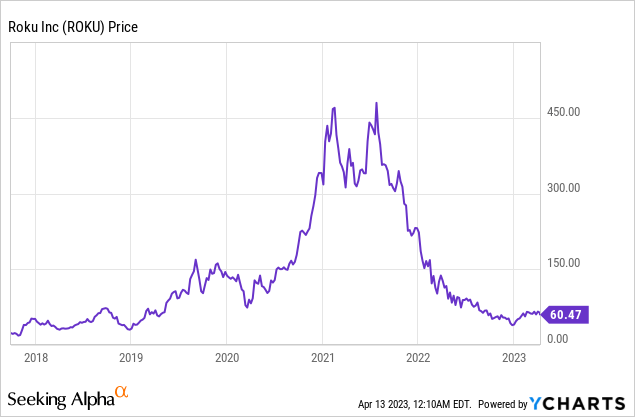

ROKU Stock Price

Just a few years ago, ROKU stock was trading at well above $450 per share. ROKU was one of the first tech stocks to undergo a vicious crash as its growth rates plummeted following strong pandemic growth.

I last covered ROKU in October where I rated the stock a buy with 26% of its market cap held in net cash. The stock has since returned 10% but valuation has not been the problem for quite some time now.

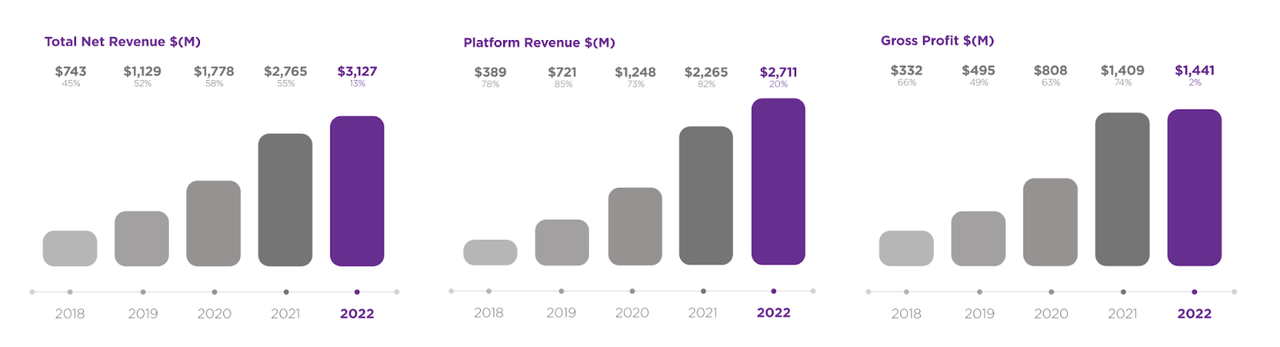

ROKU Stock Key Metrics

In its most recent quarter, ROKU delivered just 5% YOY growth in platform revenue (primarily online advertising) but platform gross profit actually declined 4% due to weakness in the ad scatter market. Devices revenue declined 18% leading overall gross profits to decline by 4% to $364.4 million.

Like many beneficiaries of the pandemic, ROKU overestimated post-pandemic growth rates as it over-invested in growth. Adjusted EBITDA swung from positive $86.7 million to negative $95.2 million.

2022 Q4 Shareholder Letter

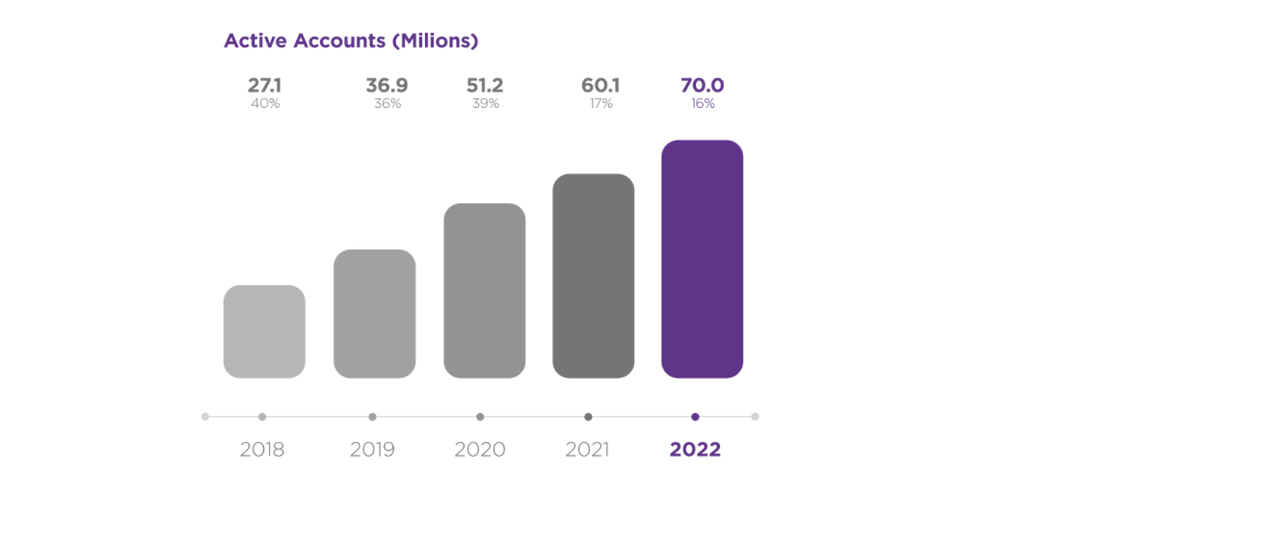

The lone bright spot is that ROKU was able to grow its active accounts by 16% to 70 million. The long term thesis for ROKU has centered around its ability to monetize its active accounts, thus investors may have been willing to overlook near term profitability issues (though the headwinds have admittedly persisted for longer than expected).

2022 Q4 Shareholder Letter

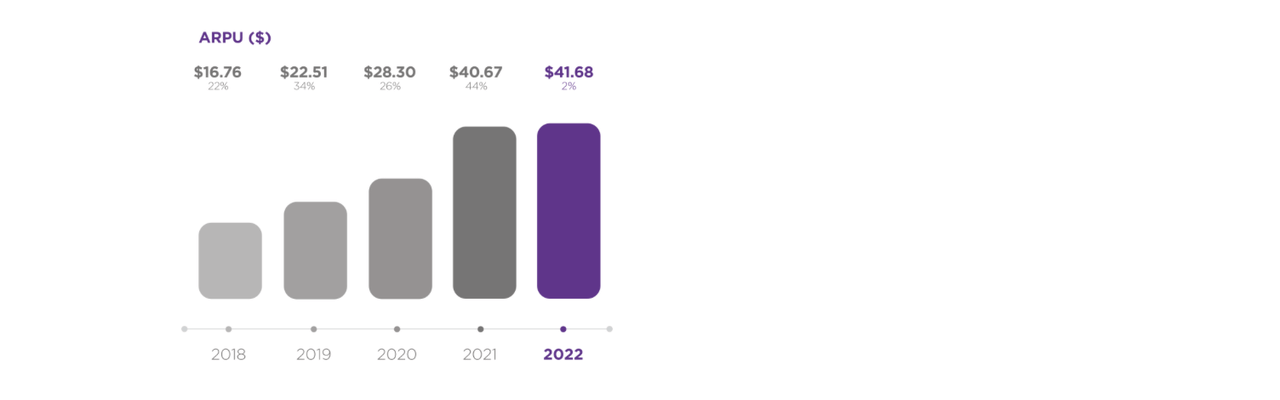

Average revenue per user (‘ARPU’) grew by only 2% in 2022, largely due to the greater growth in international customers.

2022 Q4 Shareholder Letter

ROKU ended the quarter with $2 billion cash versus $80 million in debt, representing a 25% net cash position.

Looking ahead, ROKU expects to generate $700 million in net revenues (8.7% YOY growth) and $310 million in gross profit (15% YOY decline) in the first quarter with the adjusted EBITDA loss expected to expand sequentially to $110 million.

On the conference call, management noted that OpEx YOY growth rates will modify throughout the year. Despite the deterioration in EBITDA margins, management remains committed to positive adjusted EBITDA for the 2024 year – but noted that this depends on an ad market recovery and associated acceleration in revenue growth.

ROKU launched a new line of smart home products ranging from cameras to video doorbells – management noted that this is part of their goals to increase subscription revenues.

2022 Q4 Shareholder Letter

Management noted that in regards to their M&A appetite, they remain “very cautious” with a “high bar” as they are already investing heavily on content.

Is ROKU Stock A Buy, Sell, or Hold?

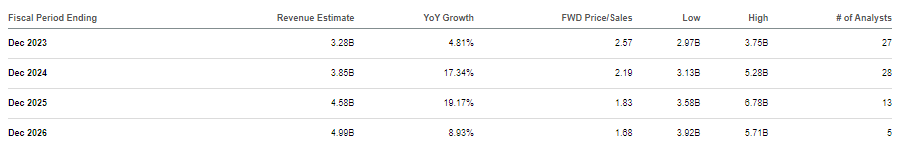

At recent prices, ROKU was trading at just around 2.5x sales. Consensus estimates call for an acceleration to mid-teens revenue growth by 2024.

Seeking Alpha

With ROKU not quite close to profitability on a GAAP basis, it may be difficult to judge the fundamental fair value of the stock. ROKU’s business model is prioritized around growing its user base, even if it has to sell its platforms at a loss. Over time as it monetizes these users, it may be able to generate high-margin revenues.

Assuming 40% net margins based on gross profits (equating to roughly 20% net margins based on platform revenues), a return to 15% growth, and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see ROKU trading at 9x gross profits, equating to a stock price of $90 per share. But if growth never accelerates to the 15% range and instead stays limited to around 8%, then that fair value estimate drops to 4.8x gross profits, equating to a stock price of $48 per share. Clearly, forward returns will be heavily dependent on the company’s ability to re-accelerate growth rates, as there are no GAAP profits to otherwise help support the valuation.

What are the key risks? It is possible that growth rates will not accelerate. While tough pandemic comps and now a tough macro backdrop have been easy excuses, it is possible that growth will not return even in a more “normal” environment. This may occur due to a multitude of reasons, including but not limited to rising competition. This might not just be due to competition in the smart TV space where ROKU is a clear market leader, but perhaps something more disruptive – will the broader public turn to personal viewing devices instead over the long term? I continue to view a basket of undervalued growth stocks as being a top strategy to position ahead of a recovery in the tech sector. ROKU can fit in such a basket though the stock may be more appealing as the company delivers on commitments for improved profit margins.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!