Summary:

- Roku’s underlying business has performed better than expected in 2023, leading to a +56% price gain since my last article, but operating losses remain a long-term worry.

- Wall Street estimates suggest Roku will continue to burn through cash for years, leading to a downgrade in my rating from Buy to Hold.

- The company’s valuation is rich without a major refocus on income generation, and technical trading indicators point to potential selling pressure and price declines in the future.

Marvin Samuel Tolentino Pineda

I wrote a contrarian, bullish-focused piece on Roku (NASDAQ:ROKU) last year in October here. In fact, it was one of my top turnaround picks for 2023, partly because of ill-mood toward the name by investors after years of price decline, alongside a completely oversold technical argument. The good news is Roku’s operating business has performed slightly better than Wall Street expected, leading to a solid +56% price gain since then (roughly +80% at the peak weeks ago), far above the equivalent S&P 500 rise of +22%. Unfortunately, the company has not taken up my idea to push advertising more aggressively on its set-top boxes, including the valuable Roku box home screen space for tens of millions of viewers daily.

Seeking Alpha – Paul Franke, Roku Article, October 19th, 2022

And, based on updated Wall Street analyst estimates, using a slightly more bullish slant than springtime, Roku is still going to burn through cash years into the future. As a consequence, I am downgrading my rating from Buy to Hold. If you wish to enter a position in the stock, a weakening economy, and overdue selloff in the hot Big Tech names this summer could mean a $10 to $15 Roku price decline is approaching into the autumn.

Operating Loss Picture

The whole point of my article in October was Roku holds a clear path to profitability if it refocused on this goal (through aggressive ad placements), instead of gaining eyeballs and revenues. There are no guarantees the Amazon (AMZN) “business model” of adding market share at all costs (literally) is the right path for Roku. New product rollouts from company-branded TVs to home security cameras all connected to the voice-enabled and all-powerful Roku remote control are interesting concepts. But, neither are going to produce instant operating income, priced at or below manufacturing/marketing costs.

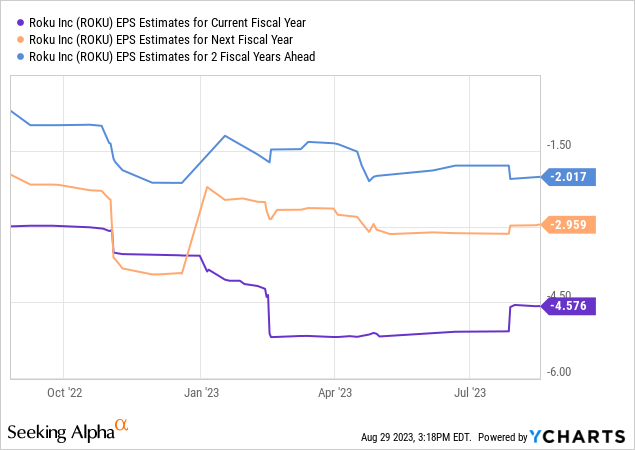

Despite an honestly very strong Q2 “beat” for sales and earnings last quarter, analyst consensus estimates for total annual losses in 2023-25 have not really changed much.

YCharts – Roku, Consensus Analyst EPS Estimates for 2023, 2024, 2025 – 12 Months of Change

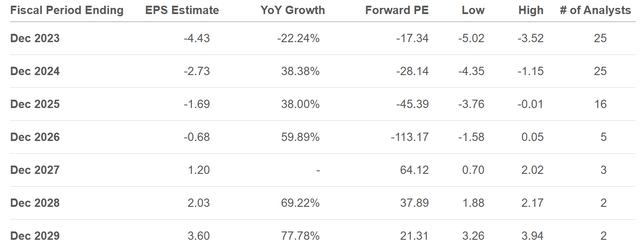

All told, using Wall Street projections, it may take until 2029 (six years down the road) for Roku to deliver an earnings yield in the 3% to 4% range. That is my baseline minimum business return to consider any equity investment as having a serious valuation component. I can capture a 6-year Treasury bond with a “risk-free” yield of 4.3%, each year, right now. Why not just grab this return for my capital?

Seeking Alpha Table – Roku, EPS Estimates for 2023-29, Made August 28th, 2023

Again, my primary bullish take on Roku 10 months ago was based on a quicker resumption of operating profitability. So, if losses remain, I cannot be as optimistic on the stock’s future.

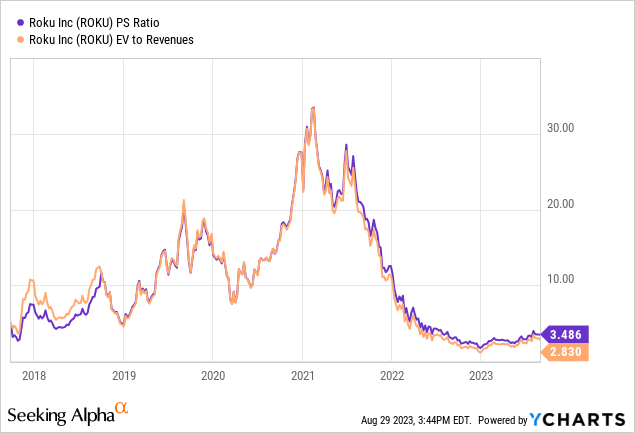

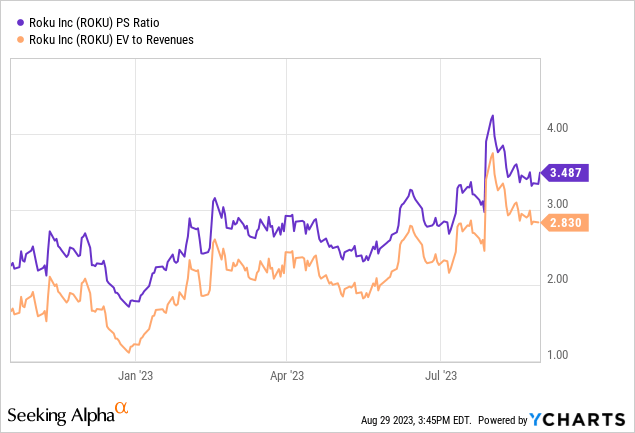

Rich Valuation without Major Changes

If losses are the new norm for years, how do we value the business? That’s a question I and others struggle with. Price to sales and EV to revenue ratios are no longer amazingly high for Roku (measured since its IPO), but these valuation stats are dramatically greater than my bullish call in October.

YCharts – Roku, Price to Trailing Sales & Enterprise Value to Revenues, Since 2017 YCharts – Roku, Price to Trailing Sales & Enterprise Value to Revenues, Since October 20th, 2022

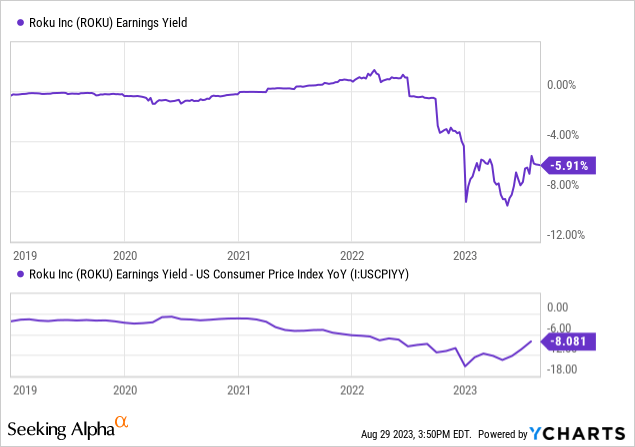

After the company went public in late 2017, minor earnings and losses had been the norm into late 2022. Below is a graph of the earnings yield on investment back to early 2019. I also plotted this relative business return idea vs. trailing CPI inflation rates. While Roku’s basic earnings return on investment has always lagged inflation, the late 2022 and first-half 2023 numbers have been especially rotten.

YCharts – Roku, Trailing Earnings Yield vs. CPI Inflation, Since 2019

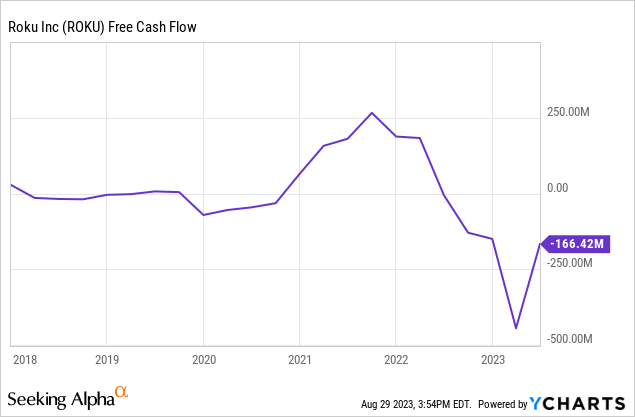

In addition, free cash flow has reversed from positive territory for years into a huge cash burning hole since 2022. Why do I want to invest in a company that may not be able to generate significant business income or free cash flow for many years?

YCharts – Roku, Trailing 12-Month Free Cash Flow Generation, Since 2018

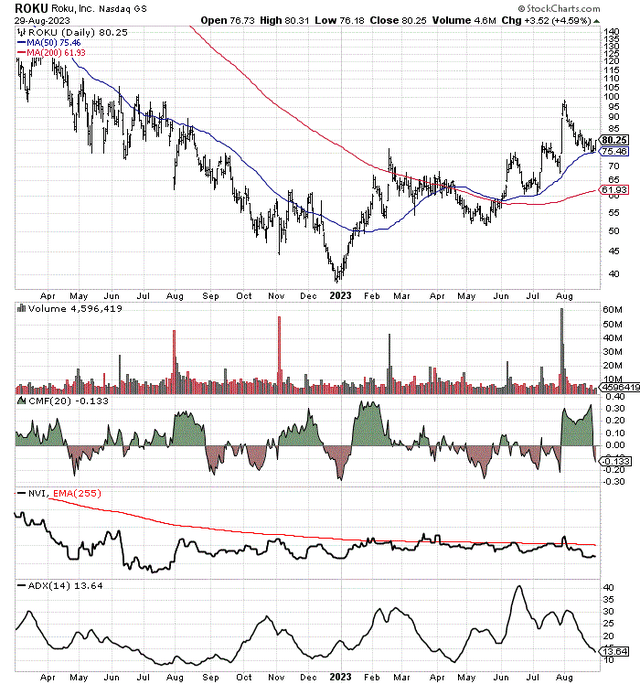

Technical Trading Chart

At first glance, the Roku daily trading chart looks somewhat constructive. Price is above year-ago levels and above the important 50-day and 200-day moving averages.

However, if underlying momentum indicators follow patterns outlined over the last couple of years, renewed selling pressure could be on deck. When the 20-day Chaikin Money Flow indicator has fallen sharply from positive to negative territory, price has declined over the next month or two.

The Negative Volume Index has not shown any strength to confirm the price upmove of 2023. NVI seems to be indicating plenty of sellers are willing to liquidate on lower-volume trading sessions.

In an unusual circumstance from what I like to see, low-volatility Average Directional Index scores approaching 10 have actually preceded larger price declines. Typically, about 60% of the time historically in my research, stocks with low ADX readings have reached a share supply/demand balance, just before a price breakout to the upside. Yet, for Roku, low volatility and volume conditions have often translated into a vacuum of buyers days or weeks later.

StockCharts.com – Roku, 18 Months of Daily Price & Volume Changes

Final Thoughts

There is some potential for one last leg higher toward $100 a share, if the Big Tech names are not finished running hot. Considering all the pros and cons, I would sell into such strength, as the odds of an extended flat to weaker period for price appears likely.

What’s the downside for Roku? Well, if losses actually move in the wrong direction, a retest of last year’s low around $38 is a real possibility. Investors would rethink their bullish views of this summer and rerate shares with an eye toward going-concern issues. Roku does have ample cash on hand for the next year or two, even if losses mount.

So, best-case reward to $100 vs. worst-case investment risk under $40 a share suggests the average investor should pass on owning Roku in their retail brokerage account. The risk-reward setup from $80, from my vantage point, seems to project more downside than upside.

My long-term view for a business turnaround remains – a shift in focus in favor of cutting losses as management’s main priority is an important (if not mandatory) ingredient to get the stock quote sustainably over $100.

Until then, I would avoid the stock for new purchases and look to sell out any existing position. I prefer to stick to companies with stronger underlying valuations, especially those based on repeatable earnings and free cash flow. Reasonable buy propositions can be found today, and I try to outline many of them in my Seeking Alpha research and analysis efforts.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.