Summary:

- Roku has had a tough year in 2022 due to a softening digital ad market.

- If some of Roku’s biggest ad-sharing revenue opportunities, from companies like YouTube and Netflix, are practically paying Roku nothing, then its potential is limited.

- Even though many anticipated a decline in streaming in 2022 as the world began to recover from the pandemic, Roku still found a way to expand.

- The valuation is still not tempting enough.

- I give the stock a SELL rating.

Justin Sullivan

Investment Thesis

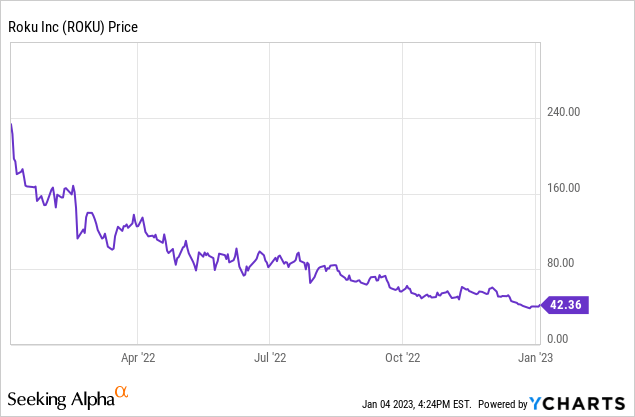

Over the past ten years, Internet-connected television (CTV) has expanded to become one of the most popular consumer categories. Many people all across the world are choosing CTV options over traditional TV viewing as a result of the loss of the cable package. However, Roku (NASDAQ:ROKU) has had a tough year in 2022. The company’s sales growth rate decreased to barely 12% in the most recent quarter from 56% revenue growth in 2021, and the stock has fallen 83% over the past year as a result of management’s expectation of a 7.5% year-over-year revenue decline in the fourth quarter due to a softening digital ad market. That decrease was much worse than the S&P 500’s (SPY) 20% dip or even Netflix’s (NFLX), an industry competitor, 50% decline.

Even though those data indicators might seem to point to a failing company, Roku also has some positive features. In light of this year’s savage sell-off, it may be worthwhile to consider whether the stock will recover well in 2023 or continue to decline.

Uncapable To Close Deals

Using Roku has benefits for both consumers and advertisers. Viewers can access what seems like an infinite number of streaming services in one location, and businesses can use a connected-TV platform to advertise to them.

Investors should take into account Roku’s negotiation power with its third stakeholder group, the content providers. In its platform business, Roku typically agrees to control 30% of the ad inventory provided by content providers in exchange for keeping 100% of the associated income. Roku should gain as more ad-supported services are made available and as more companies see the benefits of marketing in this ad environment.

With less lucrative streaming services, Roku may be able to dictate deal terms, but with the bigger ones, it’s a different story. For instance, Roku and Alphabet’s (GOOG) (GOOGL) YouTube were in difficult discussions about renewing their distribution agreement around a year ago in order to maintain the services on Roku’s platform.

In the end, a solution that benefited the audience was reached between the two parties. Roku, however, doesn’t share any ad inventory with YouTube, and therefore it doesn’t receive any money from Alphabet. Additionally, it’s probably safe to assume that Roku depends more on YouTube than vice versa.

The industry leader in streaming, Netflix, has introduced its own cheaper, ad-based membership alternative. Like YouTube, Netflix probably will not provide Roku with any ad inventory. This is particularly true because Netflix is so powerful in the market, and it has leverage over Roku as a result.

The firm boosting its platform-segment revenue by luring more advertising expenditure to its ecosystem is the main argument for buying Roku stock. But it’s also becoming clear that if some of Roku’s biggest ad-sharing revenue opportunities, from companies like YouTube and Netflix, are practically paying Roku nothing, then its potential is limited.

Growth Is Still Here

Even though many anticipated a decline in streaming in 2022 as the world began to recover from the pandemic, Roku still found a way to expand. In Q3, the firm added 2.3 million new active customers, and 21.9 billion hours—a 5% increase from the previous quarter—were streamed in those households.

The rise in Roku’s numbers indicates that the company is successfully luring more people to its platform and extending the amount of time they spend using its products. Despite the current challenges in the ad business, this should promote long-term growth.

The majority of Roku’s revenue comes from advertising, and since businesses can easily scale their spending up or down in response to demand or their budget, digital advertising is a highly cyclical industry. Therefore, given the current macroeconomic environment, it would not be surprising if revenue from this segment decreased noticeably in 2023, as also anticipated by management.

However, marketers are desperate to reach viewers who have switched from linear TV to streaming. Due to the fact that connected TV is the only channel that enables customized video adverts, it is a very effective kind of advertising. Over the coming ten years, connected TV is anticipated to increase dramatically, and if Roku manages to cooperate with companies like YouTube and Netflix and monetize their deals, it should profit from this development.

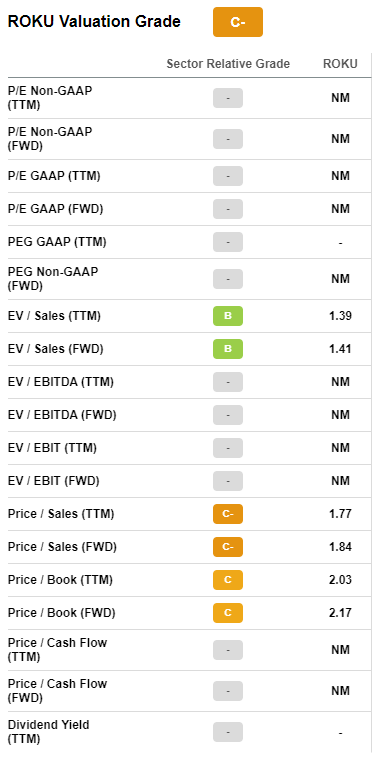

The Valuation Is Not Tempting Enough

Seeking Alpha

In 2022, it is safe to argue that Roku’s fundamentals have suffered. Not only have the company’s profits from the previous year been wiped out by losses in the first three quarters of 2022, but profits from the previous year have also been wiped out, and analysts do not anticipate profitability to return until 2026.

However, the revenue-based valuation has never been this low. For the first time in 47 months, the stock closed below $43 today, bringing its enterprise value to just 1.4 times its trailing revenue. And if the analysts’ estimates are accurate, with EPS reaching $5.85 in 2030 and assuming a P/E ratio of 17, we get a future price of over $100. Buying the stock at its present price of $43 would result in an annualized return on investment of 11.4% over the next eight years. Nonetheless, I do not believe that this scenario is plausible enough to justify the risk of a return of 11.4%, given that certain conditions must be met for the plan to succeed.

What Should Happen

There are a few steps that need to be taken before the business can succeed in the long run and be considered a good investment.

First, the organization must generate positive earnings as soon as possible. We are not living in the near-zero-interest-rate, capital-flush environment of late 2020 and early 2021. Investors care about profitability, not just top-line growth, so Roku’s stock price will likely continue to plummet until this issue is resolved.

Additionally, and in relation to generating positive earnings, the business must correct its spending structure. A paradigm in which operating expenses increase by 70% annually but income increases by just 12% is not sustainable. However, Roku did lay off 7% of its workers last month, and additional layoffs may be forthcoming if the company is serious about returning to profitability.

Conclusion

The macro environment will have a significant influence on how Roku performs in 2023. The ad market may see additional difficulty, and the streaming stock may decline even further, if the Federal Reserve keeps raising interest rates and the economy enters a recession. Nothing in this article implies that Roku is doomed. It is important to note, however, that things most likely won’t get any simpler from this point on. Roku’s future isn’t as promising as its past, and that history only featured sporadic financial success. In conclusion, I still don’t think Roku is a value play, and at $43, I don’t think it’s worth the risk to buy it. I therefore give the stock a SELL rating.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.