Summary:

- Roku, Inc. is the clear market leader in smart TV operating systems and continues to grow its user base.

- As an industry, streaming is taking share of TV from cable and free to air, benefiting Roku.

- Roku isn’t forecast to produce any meaningful cash flow for shareholders for years, making the valuation very challenging.

Rainer Puster

Thesis

Roku, Inc. (NASDAQ:ROKU) is a highly innovative company that saw TV streaming coming before anyone else and has continued to pave the way for the shift from traditional broadcasting and cable TV towards streaming ever since. The industry trends are in Roku’s favor, and the company continues to make strides in expanding their member base through sales of TVs with the Roku operating system.

However, the Roku, Inc. financials are a disaster. There was a brief period when we were all locked up inside watching reruns and Roku made a very tidy profit for 6 quarters in a row. But operating losses have prevailed since 1Q22 and have been widening.

In this article, I will present why I think Roku has the potential to be a very good company, but why it is uninvestable until there is a clear line of sight to consistent profitability.

Company Profile

Roku, Inc. is a television streaming platform that connects consumers, content publishers, and advertisers via the Roku TV operating system (OS). Roku has agreements with a selection of television manufacturers who use Roku’s operating system on their TVs via a license agreement instead of developing their own. Roku has also recently started manufacturing their own Roku branded TVs — in addition to other streaming devices — to generally very positive reviews.

Roku’s business model is to increase the number of users streaming on the Roku OS, increase the number of hours streamed, then monetize these users through ads, subscriptions sales for other services (such as Netflix), and brand sponsorships.

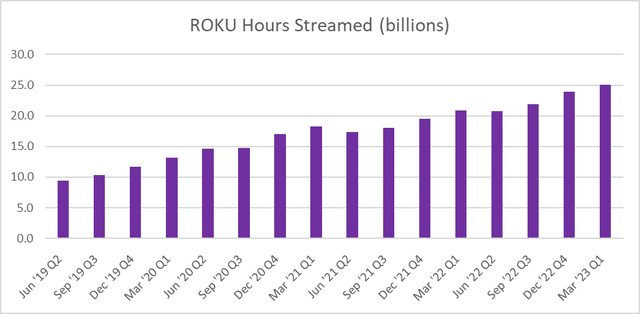

Roku has over 71 million active accounts that, in aggregate, watched 25 billion hours of streamed TV in 1Q23. These metrics have both been growing quite impressively. These users access their subscribed streaming platforms through the Roku TV software or they can sign up via their Roku account. Content publishers can utilize data insights and billing tools, which advertisers can use to serve targeted and measurable advertisements to TV viewers.

Roku is an Innovative Industry Leader Riding Industry Tailwinds

There is a lot to like about the Roku business model, and it has come a long way from selling cheap dongles that enable you to watch Netflix, Inc. (NFLX) on your TV. Through the Roku OS, Roku aggregates the content from many streaming services such as Netflix and Disney+ (DIS), making it easier to find the content you want to watch or have already started.

Roku has also launched the Roku Channel, which is taking share in terms of hours streamed and is a top 5 channel on the Roku OS. Roku also offers a LiveTV option, where viewers can watch over 350 live TV channels featuring local news, sports, food, reality TV, kids TV, drama, and more. Most recently, Roku has given live sports a dedicated page to improve access and aggregation across streaming services. To demonstrate its potential, Roku was the most popular streaming platform for watching Super Bowl LVII.

None of this is game changer on its own, but in aggregate, it demonstrates that Roku is building a streaming super-app that increases engagement with the consumer through a seamless experience and by continually increasing the amount and variety of content available. By providing a good user experience, the user base can grow from reputation and repeat purchases, which increases the ability for advertising revenue. Roku’s growth in user base and their ability to remain at the top of the charts (43% of TV unit share by OS in 1Q23) in television sales by OS demonstrates this fact.

Further, Roku is in the right part of the industry. Roku is currently riding a long term structural shift from legacy, linear television to streaming television, of which the smart TV operating systems such as Roku will be the gatekeepers. It is not unlikely that products such as the Roku Channel will become the new way for consumers to access linear TV.

For those unfamiliar, The Roku Channel aggregates (at the moment some, but in the future probably all) traditional channels for streaming on the platform. Further, Roku expects more TV manufacturers to begin outsourcing their operating systems, as this is a non-core function and can be outsourced to a specialized with best-in-class software.

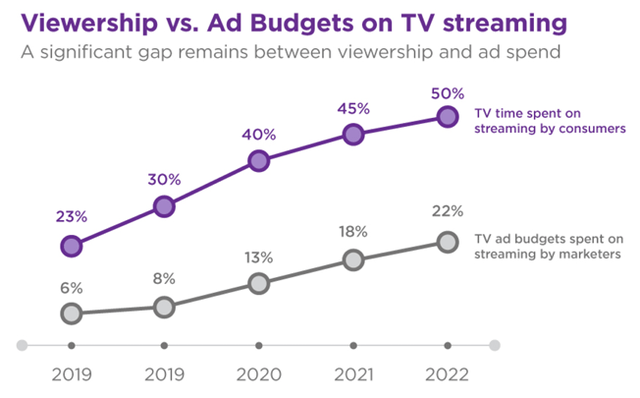

It is expected that both time spent streaming and streaming ad budgets will both continue to rise, having already doubled since 2019. This is a major tailwind for the company, as the streaming industry continues to take share away from traditional cable and free to air TV. However, there remains a significant gap between the growth in streaming and the ad spend, but this will close, as marketers will follow the consumer.

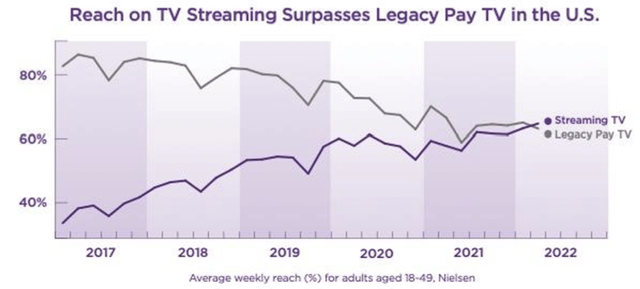

In the 1Q22 Shareholder Letter, CEO Anthony Wood shared that, according to Nielsen, streaming devices surpassed traditional television devices in terms of teach for the first time.

Further, in the most recent 1Q23 shareholder letter, Wood noted that this trend continued with hours spent watching traditional TV was down 10% year on year, while streaming hours were up 20% year on year. This is a trend I don’t have trouble believing will continue.

Recent results shows lack of fiscal discipline

In 1Q23, ROKU reported revenue growth of 1% to $741m (beat of $33m) and a decline in gross profit of 7% to $338m (beat of $17m). This was a result of growth in Devices segment sales on steady COGS, and the lethal combination of a fall in Platform segment sales and an increase in Platform segment COGS. As a result, gross margin fell from 58.7% to 52.6% The return of the Device segment gross profit to positive was pleasing though, as this had been flagged as a “loss leader” for the last 5-6 periods.

R&D increased 34% and sales and marketing increased 60%, while General and Administration costs increased 23%. In sum, operating expenses increased 42% to $550m while revenue increased a paltry 1%. This resulted in an operating loss of $212m (a slight beat of $3m), up from a loss of $23m in 1Q22. This lack of fiscal discipline concerns me because management has failed to foresee (or has ignored in real time) the stalling revenue and has aggressively increased operating expenses to the point that the company is wildly loss making.

Thanks to a clever equity raise at around $380 in 2021, Roku maintains a fortress balance sheet with $1.6 billion of cash and no debt. Liquidity is good with cash covering current liabilities twofold and current liabilities by over $100m. The current ratio is also strong at 3x. But the company burnt through $213m in cash this year, which is 13% of their period-ending cash balance.

Cash from Operating Activities for 1Q23 was an outflow of $153m, compared to an inflow of $102m in 1Q22, and capex was $54m compared to $14m respectively. This can only go on for so long before they run out of cash. Now, I don’t think management is even close to negligent enough to let it get to this stage, and they have indeed started reducing expenses to a small degree, but a lot more is needed without some aggressive revenue growth.

Roku’s Job Cuts

The good news is that Roku has seen the slowing in revenue in recent results and has responded, but this is taking time to flow through. In November 2022, Roku announced plans to sack approximately 200 people, which was ~5% of their workforce. The filing estimated severance costs of $28-$31m to be incurred in 4Q22 and the layoffs would be complete by the end of 1Q23.

The company then went further at the end of March, announcing they would sack another 200 workers, incurring another $30-$35m in severance costs and lease cancellation fees. These costs were incurred in 1Q23 and the restructure would be complete by the end of 2Q23.

The savings this headcount reduction would produce was not provided by the company so our best estimate is that it will reduce expenses by 10% (as 10% of the workforce were made redundant). There is still a long way to go before the income statement is right sized and I would not be surprised to see more job cuts.

Advertising environment remains weak

What is often overlooked is that as much as Roku’s business model is built on the changing way we consume media, it is essentially an advertising company. Providing a streaming aggregation platform is merely the avenue it has created to sell advertising. There is nothing wrong with that, but investors should analyze revenue trends in terms of advertising spend as much as (or more than) other metrics provided such as active accounts and streaming hours. I would expect these to remain rather steady but are not in and of themselves the big drivers of revenue.

The advertising market has been weak for some time, with Roku first warning that economic pressures were hitting both discretionary spending and advertising budgets in 2Q22. This theme remained through the following three quarters and Roku still forecasts the advertising market to be muted and mixed (depending on sector), without much growth expected. I don’t expect this to return to growth until recession fears recede, as marketing budgets are some of the most elastic and flexible budgets for businesses.

Outlook and Forecasts

With the above trends in mind, Roku guided to $770m revenue in 2Q23, which would be flat on the 2Q22 period. The gross margin guide was $335m, which is 43.5% gross margin, lower than the 46.5% gross margin reported in 2Q22 and below the TTM gross margin of 45.3%. Further, the company expects adjusted EBITDA of -$75 million and is working towards Adjusted EBITDA breakeven for the full 2024 year.

However, investors need to understand that this Adjusted EBITDA breakeven figure excludes stock-based compensation (SBC), which was $96 million in 1Q23 and $360 million for FY22. SBC is difficult to forecast at the best of times, but if it is in that ballpark again, regulation EBITDA will still be very negative. For this reason, achieving Adjusted EBITDA breakeven next year is hardly noteworthy in my view.

FactSet consensus currently forecasts a modest 5% sales growth in 2023 and net income of -$737m, which is a widening of $239 million on 2022. After a maiden net profit in 2021, consensus doesn’t forecast income at the operating or net line to become breakeven again until 2027.

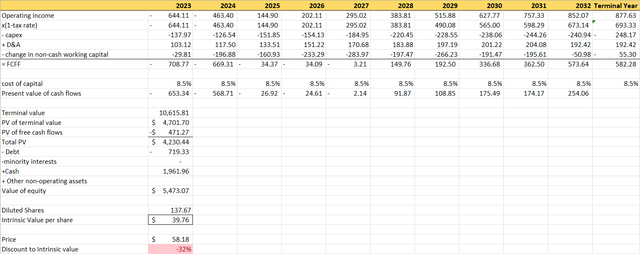

I have modelled a 10 year discounted cash flow to value Roku and in it I forecast operating income positive in 2025 and free cash flow to the firm (i.e. NOPAT less capex and investment in working capital, plus D&A) breakeven in 2028. My assumptions are that in the next few years Roku will be successful in rightsizing the business: advertising revenues will recover and by 2025, Gross margins have reached 2021 levels again, and operating expenses as a percentage of sales will also return to 2021 levels. Note that this is more aggressive than consensus estimates.

The thing is, I feel like my model is fairly aggressive and yet net margins only reach 6% at their best, and return on invested capital only reaches 8% in steady state.

This doesn’t paint a picture of a company that has a terribly strong business model or economic moat. It could be that my forecasts (and consensus forecasts) and actually way too low and in 10 years time margins and ROIC will both be substantially higher. In which, so will the valuation.

Author Analysis using data from FactSet

I estimate a weighted average cost of capital (WACC) of 8.5% derived from a levered beta of 0.96, risk free rate of 4%, and equity risk premium of 5.5%. I’ve also used a terminal growth rate of 3% and a cost of debt (9% weighting in WACC) of 0.7%. The model forecasts a revenue CAGR to 2032 of 13.5%, operating income to grow to $852m, and an FCFF terminal value of $582m. This produces a discounted cash flow, or DCF, valuation of $39.76, 32% below the current share price.

The problem with this model, however, is that the bulk of the valuation is derived from the terminal value because the present value of the cash flows is negative. When the terminal value contributes more than 100% of the valuation in a 10 year DCF, there likely isn’t a problem with your valuation, there is likely a problem with the company. Long term forecasts are modestly indicative at best and wildly wrong at worst, and if this is the best case scenario I can come up with it’s not a company I want to invest in.

Conclusion

To be sure, 10 years is a long time and anything can happen in that time. I could see upside to my forecasts if Roku, Inc. can realize profits bigger and earlier than expected by running a leaner ship without sacrificing revenue growth. This is well within the realm of possibility, but it is not something I am going to expect as a base case.

Like I said above, there is a lot to like about the company. It is innovative and is becoming the de facto gatekeeper of the streaming industry, an industry which is taking share away from traditional TV at a rapid pace. This gives Roku a lot of optionality in their business model. So, for these reasons, I will continue to monitor Roku, Inc., and if the financials and outlook improve quicker than my model anticipates, then I look forward to changing my mind. Roku, Inc. is a company I want to like, but their numbers don’t stack up, so ROKU stock is a pass from me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.