Summary:

- Roku delivered on its FY2023 targets while offering an optimistic FQ1’24 guidance, implying that its turnaround may finally be here.

- Despite the recent profit-taking and WMT-VZIO headwinds, the stock remains well supported at the $60s, offering interested investors with an attractive entry point.

- ROKU stands to benefit from the increased introduction of ad-supported streaming tiers from multiple media giants, due to their improving ad monetization and sustained cord-cutting trend.

- We expect to see certain concessions from WMT on the VZIO deal, with ROKU’s operating platform likely to be integrated as it is on the former’s onn TVs.

- Assuming that ROKU is able to sustain the high growth cadence while generating FCF profitability and maintaining its market leadership, its long-term prospects appear to be bright ahead.

photoman/iStock via Getty Images

We previously covered Roku (NASDAQ:ROKU) stock in August 2023, discussing why we believed that its FY2024 positive adj EBITDA target appeared to be overly ambitious, thanks to its underwhelming performance and declining ARPUs in FQ2’23.

Combined with its peaking user engagement and stagnant streaming hours then, we had preferred to prudently maintain our Hold rating then.

In this article, we shall discuss why we are rerating the ROKU stock as a Buy, with the recent pullback offering interested investors with an improved margin of safety as the management continues to execute improved margins in FY2023 and reiterates positive profit margins in FY2024.

At the same time, we believe that the VIZIO (VZIO) sell-off has been overly done since ROKU continues to benefit from the secular transition from TV Media to streaming as more platforms offer ad-supported tiers and report improved monetization.

The ROKU Investment Thesis Is More Attractive After The Deep Pullback

For now, ROKU has reported a top-line beat in the FQ4’23 earnings call on February 15, 2024, with total net revenues of $984.4M (+7.9% QoQ/ +13.5% YoY) and adj EBITDA of $47.7M (+9.9% QoQ/ +150.1% YoY), and FY2023 numbers of $3.48B (+11.5% YoY) and $4.2M (+104.1% YoY), respectively.

Most importantly, the company has been able to generate positive Free Cash Flow of $175.99M (+214.1% YoY) over the last twelve months, implying that its reversal may finally be here.

Much of the top/ bottom line tailwinds are attributed to ROKU’s growing Active Accounts to 80M (+4.2M QoQ/ +10M YoY) and relatively stable TTM ARPU of $39.92 (-2.7% QoQ/ -4.2% YoY), resulting in the expansion in its Platform revenues of $828.9M (+5.3% QoQ/ +13.3% YoY) by the latest quarter.

While its TTM ARPU appears to be declining thus far, readers must also note that this is attributed to the management’s aggressive expansion in international markets beyond its main market in the US, since the US labor market and discretionary spending are still relatively robust.

At the same time, the Devices segment has recorded improving gross margins of -13.2% (-5.7 points QoQ/ +18.9 YoY), further aided by the optimized operating expenses of $542.1M (-24.5% QoQ/ -11.7% YoY).

Shift In TV Viewing

From these numbers, it is unsurprising that ROKU has benefitted immensely from the secular transition from TV Media to streaming.

This is observed in the growing Global Streaming Hours on its platform to 29.1B (+2.4B QoQ/ +5.2B YoY) and Streaming Hours per Active Account per day to 4.1 hours by FQ4’23 (compared to 3.8 hours in FQ4’22 and 3.6 hours in FQ4’21), contributing to the robust growth in the Platform revenues above.

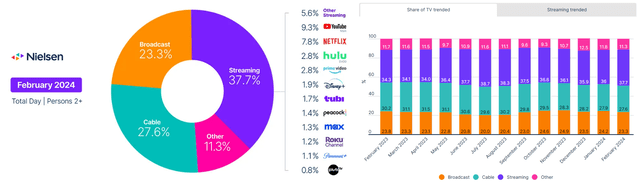

The same has been reported by Nielsen, with the entire streaming industry continuing to gain to 37.7% (+1.7 points MoM/ +3.4 YoY) and ROKU comprising 1.2% in viewing share by February 2024 (+0.1 points MoM).

As a result of the long-term tailwinds, we believe that ROKU is likely to benefit from the increased introduction of ad-supported streaming tiers from multiple media giants, particularly Netflix (NFLX) and Disney (DIS), due to their improving ad monetization in the streaming segments and the revenue share agreement.

We also believe that ROKU’s intermediate-term prospects are unlikely to be overly impacted by Walmart’s (WMT) planned acquisition of VIZIO, with the market being big enough for multiple players.

If anything, with Amazon (AMZN) already forgoing the iRobot deal as regulators tamped down on market consolidation, we believe that WMT may face a similar headwind ahead.

At the same time, we may see WMT offer certain concessions to push the deal through, with ROKU’s operating platform potentially integrated into VIZIO TVs as it is on WMT’s onn TVs, effectively eliminating any regulatory concerns on market monopoly.

In addition, we believe that the ROKU management remains shareholder-friendly with minimal share dilution thus far, attributed to the relatively reasonable share count of 143.01M by the latest quarter (+1.13M QoQ/ +3.35M YoY/ +27.82M from FY2019 levels of 115.22M).

If anything, readers must note that the company reports zero debts with growing cash on balance sheet at $2.02B (+1% QoQ/ +3% YoY/ +296% from FY2019 levels of $0.51B) by the latest quarter.

The management has also prudently made use of the elevated interest rate environment and healthy balance sheet to generate a net interest income of $92.94M (+140.7% YoY) in FY2023.

The Consensus Forward Estimates

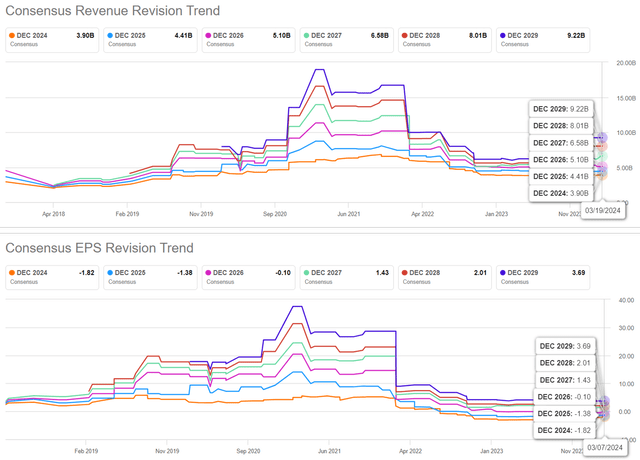

Perhaps this is why the consensus has moderately raised their forward estimates, with ROKU expected to generate a top-line growth at a CAGR of +13.5% compared to the previous estimates of +12.1%, with a GAAP break even expected by 2027.

However, we expect ROKU to consistently record adj profitability from FY2024 onwards, based on the optimistic FQ1’24 net revenue guidance of $850M (-13.6% QoQ/ +14.7% YoY) and adj EBITDA guidance of $0 (compared to $47.7M in FQ4’23 and -$69.1M in FQ1’23).

Combined with the management’s commitment to “achieving positive Adjusted EBITDA for the full year 2024,” we believe that the company may outperform expectations moving forward, with it finally achieving an improved operating scale as shareholder equity further grows.

So, Is ROKU Stock A Buy, Sell, or Hold?

ROKU 2Y Stock Price

For now, the double whammy of profit taking after the excellent FQ4’23 earnings call and the WMT-VIZIO deal have directly contributed to ROKU’s -31.7% price decline and -$4.14B loss in Enterprise Value.

With it trading rather attractively below the 50/100/200-day moving averages, it is also apparent that the stock is currently well supported at its previous floor of $60s.

ROKU Valuations

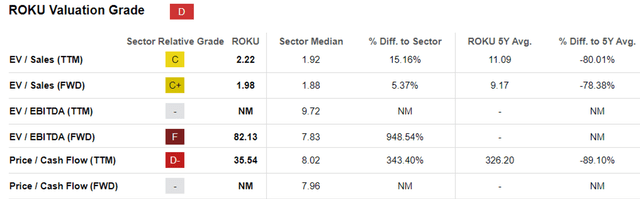

The same is also observed in ROKU’s FWD EV/ Sales valuation of 1.98x and TTM Price/ Cash Flow of 35.54x, moderate compared to its 1Y mean of 2.63x/ NA and pre-pandemic means of 7.64x/ NA, though still elevated compared to the sector median of 1.88x/ 8.02x, respectively.

While the stock is by no means cheap at these levels, we believe that the recent pullback has triggered an improved margin of safety for those looking to execute swing trades, as the company also grows into its premium valuations over the next few years.

Assuming that ROKU is able to sustain the high growth cadence while generating free cash flow profitability and maintaining its market leadership, we believe that its long-term prospects appear to be bright ahead.

As a result of the relatively attractive risk/ reward ratio at current levels, we are rerating the stock as a Buy here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.