Summary:

- Roku, Inc.’s Q3 earnings led to a significant surge in its stock, recovering all October losses and more.

- As a result, the market moved from over-pessimism to over-optimism in less than two months.

- However, the expensive valuation and recent tepid market response suggest that further upside may be challenging.

- In other words, Roku could struggle to replicate its recent outperformance unless management could outperform significantly over the next three years.

- I argue why it’s timely for investors who bought into its November lows to consider cutting exposure. Take the money and run.

PeopleImages

Roku, Inc.’s (NASDAQ:ROKU) third quarter, or Q3, earnings release in early November 2023 led to a buying frenzy that saw ROKU recover all its October 2023 losses and more. I assessed a combination of short-covering and dip-buying likely led to ROKU’s significant surge, as its upward momentum continued through this week.

I have been waiting for an opportunity to take a more decisive rating on ROKU since I urged investors to consider buying other stocks in my previous update. I argued that the steep pullback in ROKU was constructive for the stock as it headed into its Q3 release. I highlighted the pre-earnings steep collapse likely baked in “much less optimism than the previous quarter, foreboding well for a potential beat-and-raise.” Therefore, I must clarify that I was not bearish on ROKU at its bottom in October.

Observant investors should recall that Roku registered a solid Q3 earnings scorecard, recording a double beat on revenue and adjusted EBITDA. Roku posted adjusted EBITDA of about $43M in Q3, well above Wall Street’s estimates of -$30M. As a result, it led to a sharp improvement in its adjusted EPS of -$0.33. Therefore, it suggested that bearish investors could have been too pessimistic, likely expecting Roku to suffer a steeper profitability decline into 2024.

Roku doesn’t guide for GAAP EPS, which are affected by expense items such as stock-based compensation, depreciation and amortization, and restructuring charges. For example, the company took a $283M restructuring charge in Q3 that impacted its GAAP EPS, leading to a miss in its GAAP EPS metric (-$2.33 Vs. -$2.1). Despite that, the market is expected to focus on what the company guides in its outlook to represent the underlying strength in its core business based on adjusted EBITDA.

As a result, the recent surge in ROKU toward its June 2022 highs reflected the market’s optimism about an improved 2024, coupled with less intense macroeconomic headwinds. Accordingly, Roku remains well positioned to continue its growth drivers globally and improve its monetization in the U.S. With a streaming platform penetration exceeding 50% of U.S. broadband households, Roku is expected to benefit as streaming platforms move toward ad-supported monetization, improving engagement for leaders like Roku.

With that in mind, Roku offers exposure for investors keen on leveraging a streaming platform leader that allows investors keen on participating in the cord-cutting secular shift. In addition, Roku’s users have exposure to several content streaming services such as Netflix (NFLX) and Disney+ (DIS), and even Alphabet’s YouTube (GOOGL, GOOG). Furthermore, its ability to monetize its streaming platform with multiple revenue streams help to diversify its business model. These sources include advertising, distribution fees, and subscription sales. Its hardware sales aren’t expected to be a core profit driver, as seen in its negative gross margin for device sales. As a result, the monetization engine is predicated on the success of its platform sales, driving growth for the company.

Given Roku’s platform sales are main driven through advertising, Netflix’s shift toward ad-supported streaming is an acknowledgment of the criticality of this segment. As a result, the streaming leaders understand that an ad-supported model is pivotal to overcome the limitations of subscriptions-based growth as the number of streaming services increase. Therefore, Roku’s ability to drive platform revenue growth by 18% YoY in Q3, supported by “content distribution and video advertising” corroborates the shift toward ad-supported streaming. In addition, the increased engagement saw Roku tapping into “new advertising demand sources, integrating with more than 30 programmatic partners.”

As a result of its scale and agnostic platform, Roku seems to have recovered its mojo as we head into 2024 with much less pessimism. Furthermore, management corroborated its commitment to balance growth and profitability as it anticipates reaching adjusted EBITDA profitability for FY24. Moreover, Roku suggested that the gains in operating leverage are expected to continue, suggesting “ongoing improvements in adjusted EBITDA beyond 2024.” Therefore, it likely led to the market reassessing ROKU’s execution risks as it fell to its October lows, suggesting the worst could be well over.

However, for recent investors who didn’t buy into its lows in October 2023, could the urge to chase its recent rally be too little too late? ROKU last traded at a forward EBITDA multiple of 185.3x, indicating that significant optimism into its multi-year recovery could have been reflected. In other words, for the market to consider re-rating ROKU even higher, I believe the market needs to have high conviction that Roku could post a much higher profitability growth profile over the next three years.

Moreover, the relatively tepid response from the market yesterday (December 13) on ROKU as Fed Chair Jerome Powell unveiled his “dovish pause” could suggest that the risk/reward could be much less attractive at the current levels.

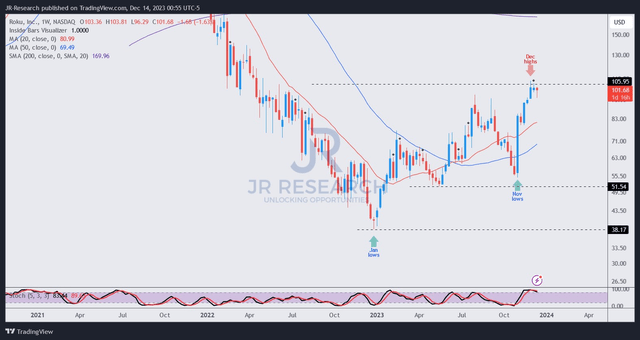

ROKU price chart (weekly) (TradingView)

My assessment suggests that ROKU has struggled at the $100 level over the past three weeks. The sharp surge from its November low at the $55 level appears to have captured most of its near-term upside, reflected in its expensive valuation.

The relatively less enthusiastic response from the market in response to the Fed’s dovish pause suggests that further upside from ROKU could be more challenging, in line with my earlier explanation.

While I have yet to glean a clear sell signal on Roku, Inc. stock, the weight of the evidence suggests it’s time for dip buyers who bought at the ROKU November low to consider cutting exposure and taking profits.

Rating: Downgraded to Sell.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!