Summary:

- Roku is building itself into the leading TV partner for manufacturers and streaming companies, with a strong ecosystem and improved viewer experience.

- The shift from linear TV to streaming services presents a significant opportunity for Roku, especially in terms of advertising spend.

- Despite positive financial results, Roku’s growth is slowing, competition is intensifying, and the company may lack a sustainable competitive advantage.

Rainer Puster

I have previously been bearish on Roku, Inc. (NASDAQ:ROKU), noting that the company is burning a lot of cash today and the path to positive earnings (after stock-based payments) is too far in the future, with the realm of possibilities too wide between now and then to comfortably recommend an investment. Since my first and only Roku article it has been a volatile ride, but the stock has now underperformed the S&P500 by over 8% (12.2% vs 20.4%). That volatile ride pretty much exemplifies the risk that concerned me. The market is valuing the company on their long-term future cash flows, so, in the same way as a long duration bond might, any slight shift in the expectation of cash flows in the future means a meaningful adjustment in the share price today to compensate.

Unfortunately, in a stock like ROKU, a company that is reshaping how we approach streaming (an industry that itself disrupted linear television within the last decade), that is the price of admission.

But is this a genuine buying opportunity, or are the risks still too great? Bulls and bears both make a strong case and while I upgrade my rating from a sell, I only move to a hold. In short, my reasoning is because Roku is likely to continue leading the way in the shift from linear/cable to connected TV (in terms of both eyeballs and advertisers) but the company is still far from being GAAP profitable and the threats are significant.

Let’s elaborate…

Investment Thesis

ROKU continues to execute and is building itself into the “go-to” TV partner for both manufacturers and streaming companies. The company’s 4th quarter 2023 result highlighted several areas where Roku is strengthening that will position it well for many years into the future. Roku is building an ecosystem of streaming that simultaneously enhances the experience of the viewer (through intuitive and intelligent content discovery), while delivering measurable results to both streaming platforms (subscription growth) and advertisers (measurable and effective advertising).

In this article, I’ll discuss the five trends that will drive the investment case for Roku, as well as three threats that could keep a lid on the share price in the coming years.

Cutting the cable

TV watchers continue to leave linear TV and cable in droves in favour of streaming services. Advertising spend is lagging this transition. CEO Andrew Wood noted that 60% of all TV viewing hours are on streaming, but only 30% of the advertising dollars are. The recent launches of ad-supported tiers should support the closing of this gap, and Roku should benefit.

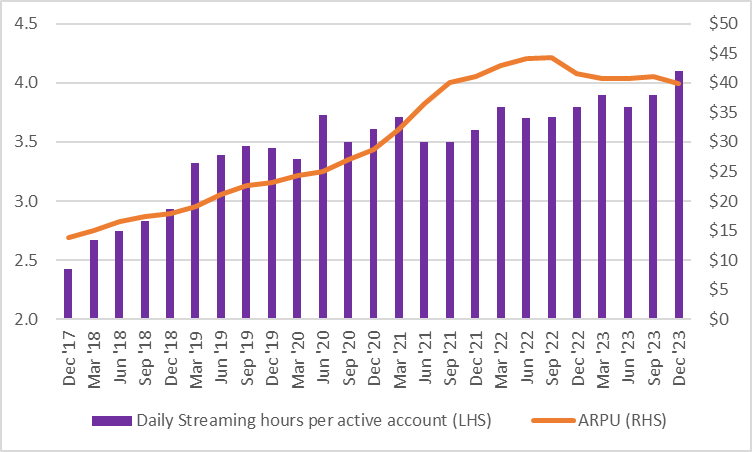

Engagement will continue growing

Engagement from users on Roku active accounts (4.1 hours per day per active account) is still lower than traditional TV (7.5 hours), as per the 4Q23 conference call. This may be because households still watch both. But that gap will also close in time. User engagement (as measured by streaming hours per active account) has grown meaningfully throughout the last 6 years, this is likely to continue. And as it does, the value to advertisers will increase, ARPU should increase, and this will come at minimal incremental cost to Roku.

Roku Shareholder letters

Roku’s product continues to improve

Roku continues to improve the viewer experience with new features, better menu options, and intelligent aggregation of programming. Roku simplifies the television experience by making it easier to sift through the enormous volume of content that is now available across all platforms. For example, the home screen now curates by genre such as food, sports, and lifestyle. Sports is a good example because the rise of streaming has actually made sport licensing more fragmented, meaning it can be difficult to know where the game you want to watch is available. Roku aggregates by sports, making discovery much easier, and can lead to subscriptions if the user does not have the requisite subscription for their desired match.

This is perhaps the weakest trend, as some of these are likely the easiest for competitors to copy, as I’ll discuss further below. Still, Roku leads the pack and that is a good thing.

The Roku Channel

The Roku Channel is in its infancy and could grow into its own profit centre. The Roku Channel is a bit of a misnomer. It is more than just a “channel” in the way that CBS is a “channel.” The Roku Channel is a full video on-demand app that integrates traditional live TV channels, ad-supported video on demand (AVOD), and premium subscription content via content partners. This may sound like it simply describes Roku itself, but the Roku Channel is available as an app on the Roku OS as well as on other streaming services such as Amazon Fire Stick, Google Chromecast, Apple TV, web browsers, and as a smartphone app.

The Roku Channel has grown to become a top 10 streaming app in its own right in the US, with similar user numbers as Paramount+, Peacock, and HBO’s Max (per the 4Q23 Shareholder letter).

Further, The Roku Channel also includes Roku Originals, which not only serve to attract and maintain viewership on the Roku Channel, they are supported by ads and also drive revenue through sponsorship partnerships of some shows. For example, Roku Original How to Fall in Love by the Holidays was sponsored by Walmart.

It is this sort of innovation that is driving engagement and driving the uplift in ARPU that Roku has reported consistently over its history.

Roku is underpenetrated in the global market

Roku is the market leading CTV Device (which includes TVs and streaming devices) by some distance in North America, with 53% device market share, as reported by Pixelate. However, in Latin America and EMEA, Roku is second with 28% and 23% respectively, but in APAC, Roku is 3rd with only 9%. Amazon and Samsung both feature highly in all markets. Roku has quietly been building a presence and although traction has been minimal, the offering of Roku to both manufacturers and consumers is compelling. It will likely be slow-going, but there remains immense opportunity if Roku can get their messaging and sales strategy right.

Reasons to be bearish

Roku may be the leader in Smart TV operating systems and up there with the most engaging streaming App in the Roku Channel, but it isn’t a layup and there are reasons to be cautious.

Growth is slowing

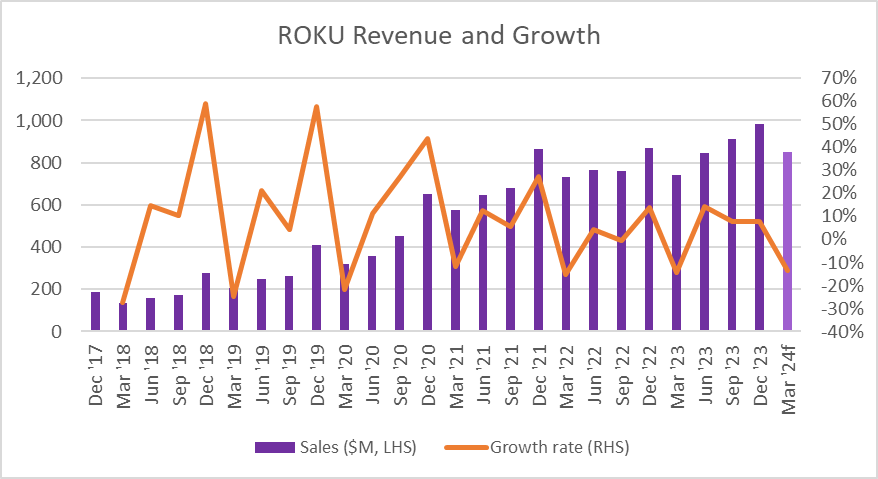

Despite recording revenue growth in the go-go years of 2019-2021 of more than 50%, revenue growth was only 13.1% in 2022 and 11.5% in 2023. Further, this trend doesn’t seem to be reversing either, with year over year revenue growth for the first quarter of 2024 forecasted to be 15%. Yes, 15% is still very respectable, but it isn’t the rapid growth story of years past. I have no doubt that Roku will continue to grow for many years, but it may not be the explosive growth previously expected. This will have implications on the price investors are willing to pay, and indeed, this may have already played out and be priced in.

Competition may be more intense than it seems

Roku has grown to become the dominant force in the North America and Mexico markets. But can this be replicated in other markets such as Asia and Europe? Roku has been a big beneficiary from having the early mover advantage in North and Central America, but its progress has been slow.

With all their spending on sales and marketing (over a billion dollars at 30% of sales), it is somewhat of a concern that, with what might be the most feature-rich CTV device in the world, the company has not been able to more meaningfully increase their international penetration. What is it going to take?

Roku’s features are copyable

In other words, Roku may actually have a little moat. Morningstar assigns a “no moat rating” if a company is unlikely to sustain excess returns derived from their competitive advantage for more than 10 years. Never mind that Roku doesn’t produce excess returns yet (defined as return on invested capital being greater than the cost of capital), but I would argue that Roku’s financial returns suggests that Roku does not have a moat. I will concede that, at the very least, if the company was to have a moat, they are still building it.

Yes, Roku spends big on research and development ($874m for 25% of sales), but a well-capitalised competitor that already sells advertising and has strong relationships with both consumers and brands could be incentivised to move in on Roku’s turf. This is the concern with the news that Walmart has recently announced its agreement to acquire Roku competitor Vizio for $2.3 billion. Walmart is a giant in ecommerce ($82bn in online sales in 2023) and sold $2.7bn in advertising in 2022. This is a sensible match because Walmart already has a thriving advertising business in Walmart Connect, and this can now plug into the Vizio operating system, expanding the ecosystem and broadening the reach for Walmart’s advertising customers.

Whether or not this impacts the Roku models sold in Walmart remains to be seen, but you can bet Walmart will be pushing Vizio models in their stores heavily. And with Walmart’s financial firepower, they have plenty of capital to throw at Vizio to bring its features into line with Roku’s and to meaningfully increase the content offering.

4Q23 Result Reaction

Roku released some solid numbers for the fourth quarter of 2023. To very briefly recap:

-

Active accounts grew by 10 million (14%) to 80 million,

-

Streaming hours grew 21% to 29.1 billion,

-

Revenue grew 14% to $984 million, with a gross margin that was 250 bps higher than the 4th quarter in 2022, and

-

Adjusted EBITDA and free cash flow were both positive for both the 3rd and 4th quarters.

Despite this, I think the market reacted savagely to the result because of the soft commentary on the 2024 fiscal year in the Shareholder letter and the conference call.

The comment in the Outlook section of the shareholder letter read:

We remain mindful of near-term challenges in the macro environment and an uneven ad market recovery.”

This might be a little vague, but Roku CFO Dan Jedda said in his remarks on the conference call:

We will face difficult year-over-year growth rate comparison in streaming services distribution and a challenging M&E [media and entertainment] environment for the rest of this year… We expect a continued mix shift away from M&E activities, which will compress platform margins in the near term.

The first quarter is always a seasonally weaker period, sequentially speaking (see chart below), so this comment should come as no surprise. And the 13% y/y gross profit growth at 43.5% margin is also in line with recent periods. I don’t think the market is taking issue with that. It’s what happens after Q1 that the market is concerned with. And while platforms gross margin is expected to be solid in the first quarter, the device gross margin (of “negative mid-single digits”) is expected to be lower than that of 1Q23 (of +3.6%), despite improving significantly from Q1 of 2023 to Q1 of 2024.

FactSet

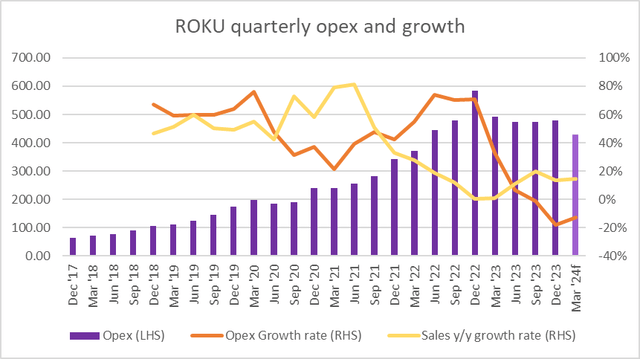

Positively, operating expenses are forecast to decline “by low- to mid-teens,” which is a pleasing continuation of the trend seen since operating expenses and opex growth both peaked in 4Q22.

The chart below shows opex (purple bars) as well as y/y sales and opex growth. Since 3Q21 opex had been growing faster than sales (meaning margins were worsening) but this year things have been reversing. Jedda also noted that they expect to improve EBITDA from the breakeven level of 2023 but said little more on the topic.

The M&E comment shouldn’t overly concern long-term holders, as this simply reflects the fact that there will be fewer major television and movie releases through the year as a result of the writers’ and actors’ strikes last year. Fewer programs released means fewer programs to promote on platforms such as Roku. This should rebound in time as the actors and writers get back to work, the recovery in releases and the subsequent promotion should be reasonably predictable.

Price/Sales remains undemanding

I have compiled a short list of listed companies in the online platform and advertising space that have new economy business models and are still in the growth phase of their business (albeit at different stages of growth). Roku trades with the equal lowest Price/Sales value of this peer group and significantly lower than its own historic average P/S (which is admittedly less meaningful given the vastly different interest rate environment).

No doubt this table lacks some nuance, but I think it is indicative of what investors are currently prepared to pay for digital platform businesses, and with Roku significantly below its peers, it may represent an opportunity to buy Roku while it is out of favour.

|

Name |

Fwd P/S |

|

Roku (current) |

2.4 |

|

Roku (historic average) |

8.9 |

|

Shopify (SHOP) |

11.4 |

|

Netflix (NFLX) |

6.5 |

|

The Trade Desk (TTD) |

16.7 |

|

Alphabet (GOOG) |

5.2 |

|

Meta Platforms (META) |

7.8 |

|

PubMatic (PUBM) |

3.2 |

|

Magnite (MGNI) |

2.4 |

|

AppLovin (APP) |

4.8 |

Conclusion

The market has reacted negatively to Roku’s earnings and outlook, and there are reasons to be sceptical. For Roku bulls, it may feel like a classic dip-buying opportunity, given the business momentum and the improving financials. But despite all that Roku has going for it, I remain on the sidelines because of the tough year ahead, the (comparatively) subdued future growth rates, and the competition risk that I think the market is underestimating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.