Summary:

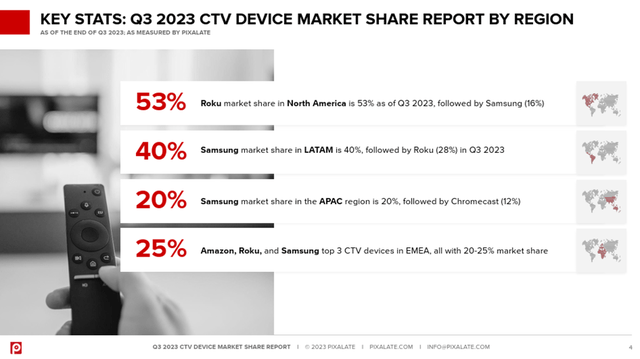

- Roku dominates the connected TV market with a 53% US market share of connected TV devices.

- Roku’s flywheel effect creates positive feedback loops among users, content providers, advertisers, and device manufacturers, giving it a competitive advantage.

- Roku’s streaming hours have reached a critical mass, leading to a positive revenue trend and potential for further growth.

Bloomberg/Bloomberg via Getty Images

Thesis

The traditional TV industry is dominated by few companies like Comcast, Disney and Paramount that own the entire value chain, from production to distribution to exhibition. These media giants control a large share of the traditional media market and their vertically integrated business models gives them a huge competitive advantage over their smaller rivals.

However, the digital media landscape is very different and these traditional media giants are facing serious challenges. They have to compete with hundreds of channels, streaming services, and device types that offer more choice and personalization to consumers. In this crowded and highly competitive environment, we think that Roku (NASDAQ:ROKU) has a clear advantage over the rest. The company has built a vertically integrated streaming platform that links devices, users, content, and advertisers with a great business model.

In this article, we will look at Roku’s compelling business model and explain why we think it’s a great investment opportunity.

Dominating the Connected TV Market

Roku has established its dominance in the connected TV market through a multi-layered approach. First, Roku offers a diverse range of connected TV products including streaming players, smart TVs, and Roku mobile apps. This wide product portfolio serves various consumer needs and preferences, thereby broadening its market reach.

Second, Roku has formed strategic partnerships with TV manufacturers such as TCL, Hisense, and Sharp. This allows Roku’s OS to be embedded directly into these manufacturers products, further expanding its presence in the smart TV market.

Third, Roku’s device strategy is to provide affordable and high-quality products that drive user engagement. Despite selling its devices at a loss, this strategy aims to reach as many users as possible and grow its installed base, thereby strengthening its market dominance.

Roku’s device segment revenue grew by 33% yoy in Q3, driven by strong demand for Roku TVs and streaming devices. According to Pixalate’s report, Roku has a 53% US market share of connected TV (CTV) devices as of 3rd quarter of 2023, ahead of Amazon, Samsung, and Apple which is really remarkable. The company is also increasing its presence in other parts of the world (see below).

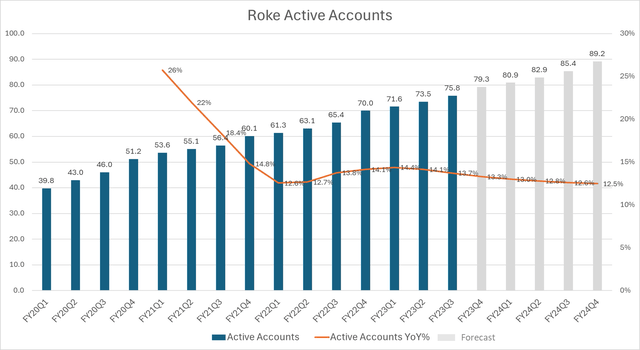

According to a report by Research and Markets, the streaming media devices market is expected to grow to $31.7 billion at a 17% CAGR until 2028 (this market includes Smart TVs, streaming devices and game consoles). When we look at Roku’s active accounts, they are growing at 14% CAGR and we expect this trend to continue in alignment with the overall market growth. Our projection is that the company’s active accounts will reach 89 million by Q4 2024 which is a key indicator of its scaling strategy (see below)

The Flywheel Effect

Roku’s business model is based on a flywheel effect that creates positive feedback loops among its users, content providers and advertisers. The flywheel gives it a competitive advantage over other streaming players, since it has the largest active user base, the most comprehensive content offering, and a very advanced ad platform. Also its customer base is very loyal, with a high retention and low churn rate. We think that Roku’s vertical capabilities makes it very difficult for its competitors to gain share in the connected TV market.

Roku Flywheel (Roku)

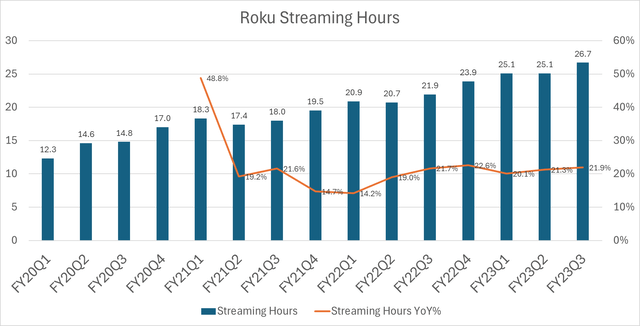

In terms of engagement, Roku is steadily growing its streaming hours per account which increased to 3.9 hours per day in the last quarter (up 5% YoY). The total hours of streaming increased by 22% YoY, indicating a healthy level of engagement growth (see below).

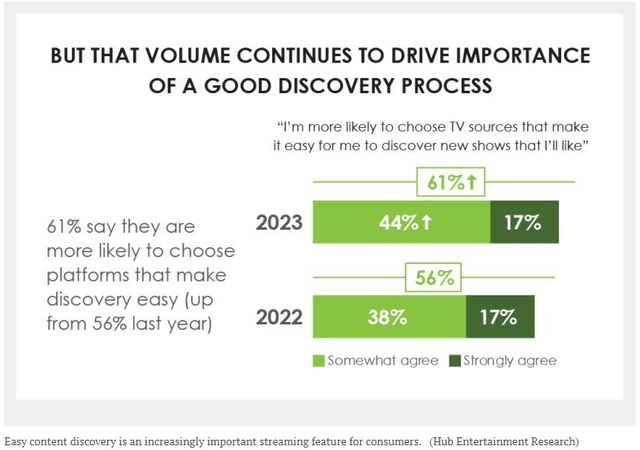

The company has key engagement capabilities, such as its Home screen, that makes content discovery easier since finding content is a real problem for streaming users. Customers prefer streaming platforms that have better content discovery process as per Hub Entertainment Research (see below)

Content discovery research (Hub Entertainment Research)

Roku continuously adds new discovery features to its platform, such as Universal search and Sports Zone, which enhance the discovery experience and also increase the engagement levels for its customers.

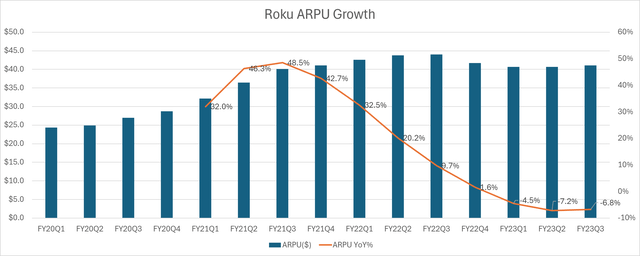

Roku’s ARPU (average revenue per user) was $41.03 (on a trailing 12-month) in Q3 2023, down 7% YoY. When we look at the ARPU trajectory, we see that it has been dropping for the past few quarters (see below). The management attributes the decline to the slowdown in the ad market, which we agree with. We believe ARPU will improve in FY 2024 as the ad market recovers.

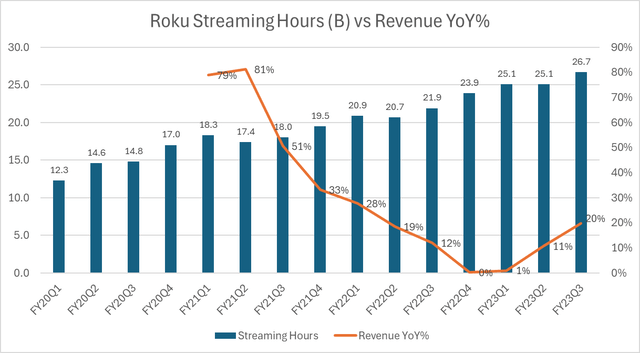

Roku Streaming Hours Reached a Critical Mass

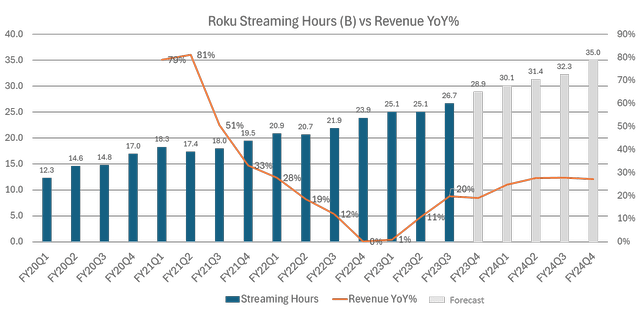

Roku’s device strategy has returned great results, as the company has seen impressive growth in its key metrics including its active accounts and streaming hours. This has enabled the company to attract more content providers and advertisers to its platform, generating some kind of a flywheel effect. Our observation is that Roku’s streaming hours have achieved a critical mass, where revenue has reached a turning point and started to re-accelerate as of Q2 2023(see below).

Roku Streaming Hours vs Revenue (Author)

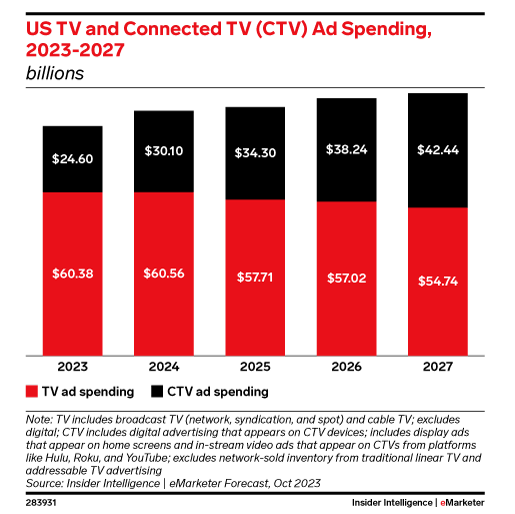

We don’t see any reason for the positive revenue growth trend not to continue in 2024. The shift from linear TV to streaming is accelerating and digital ad spending is also projected to grow in 2024. As per the report from Insider Intelligence, CTV ad spending will increase by 22% in 2024 which is the main source of revenue for Roku.

CTV Ad Spending (Insider Intelligence)

Valuation

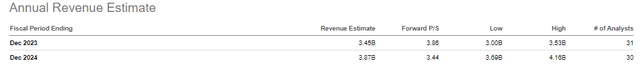

We think that the sales multiple of Roku, is the most relevant valuation metric we want to look at. Based on its projected revenue of $3.84 billion in 2024, Roku’s forward sales multiple is 3.44.

However, this multiple significantly underestimates Roku’s revenue growth potential, considering the momentum and other positive market factors we have discussed. Our analysis suggests that Roku will achieve a minimum of 20% growth in FY2024, driven by streaming hours and CTV ad spending rise.

Roku Streaming Hours vs Revenue (Author)

We want to apply a modest forward sales multiple of 5 to estimate Roku’s fair value (which is a conservative multiple for 20%+ revenue growth) Using this multiple, we arrive at a fair value of $148 per share for Roku, which indicates a 50% upside potential from the current price levels.

Risks

Competition from the Mega-caps: The biggest risk for Roku is the competition from the mega-cap companies. Google, Amazon, and Apple are all investing significantly in their streaming businesses and broadening their platform, which could make it harder for Roku to grow its market share.

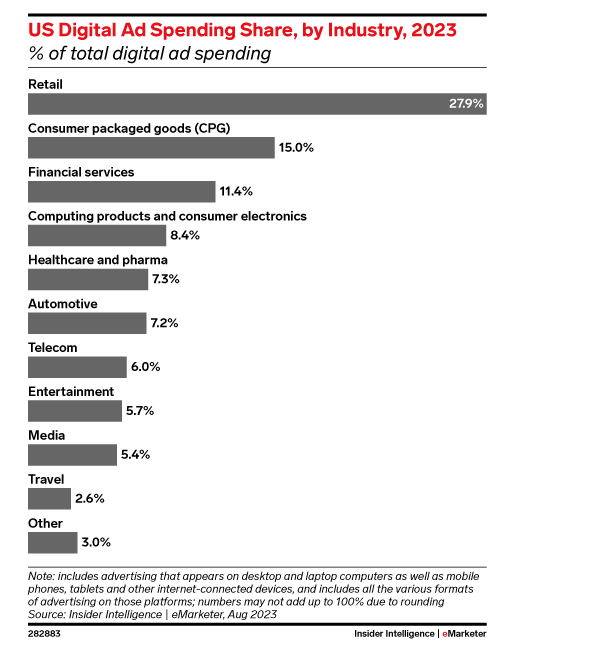

Ad Market Uncertainties: Roku’s biggest revenue source is the advertisement market which is very dependent on macroeconomic factors. Any slowdown in consumer-facing industries, like retail, consumer goods, or automotive, can directly impact Roku’s advertisement income (see below the Ad spending share by industry)

US Digital Ad spending by Industry (eMarketer)

Upcoming Q4 Earnings

Roku is scheduled to announce Q4 earnings on February 15th, 2024. The company guided for $955 million revenue which we find quite conservative. The analysts expect Roku to report revenue of $966 million and an EPS of -$0.55.

We believe that the company will beat the earnings estimates, as we expect the strong revenue growth to continue. Our analysis suggest that Q4 revenue will be around $1.02 billion (a 17% YoY increase)

Conclusion

As a vertically integrated streaming company, Roku is in a great position to benefit from the cord-cutting trend, where growing number of people are switching from cable TV to streaming.

Our analysis suggests that Roku is undervalued and that the market underestimates Roku’s revenue growth potential. We are projecting that Roku will achieve 20%+ growth in FY2024, driven by increased streaming hours and ad spending.

In conclusion, we are bullish on Roku’s long-term prospects and think that it is a compelling investment opportunity. We see 50% upside potential from current price levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.