Summary:

- Roku’s market share in TV usage is growing, with increased streaming hours and ad-supported content consumption.

- The company is making strides in opening up its ad platform to more advertisers, potentially driving higher ad demand.

- Despite trading at low forward sales multiples, Roku’s potential for sales growth and market share gains make it a buy in H2 of 2024.

Marvin Samuel Tolentino Pineda

Investment Thesis

Among the myriad of user preferences and consumer behaviors that have rapidly changed in the last few years, user consumption of TV content and online media has been at the forefront, with inflation being one of the primary factors forcing this rapid shift in media consumption behavior. Expeditious price hikes by many online streaming platforms have given way to the rise of free ad-supported streaming platforms like Roku’s Roku Channel (NASDAQ:ROKU) or TubiTV by Fox (NASDAQ:FOX).

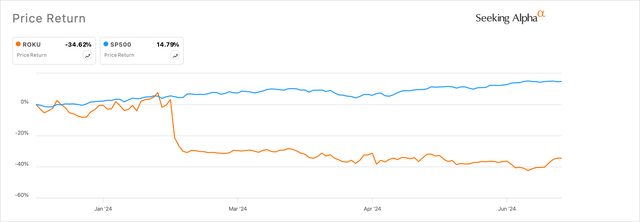

Roku has not had it easy so far in 2024, after its horrible Q4 FY23 earnings report that could not build on the success of the preceding Q3 FY23 earnings report. Since the start of the year, Roku is now down 35% for the year, as seen in Exhibit A below.

Exhibit A: Roku is down 35% for the year as compared to the S&P 500 index (SA)

I believe most of the fears have been priced in, and the company appears to have made some headway in gaining market share based on my analysis of NielsenIQ data, which puts Roku in a relatively favorable position in terms of risk/reward.

For now, I rate Roku as a Buy.

Roku gains market share in TV Usage

Since the torrid Q4 2023 report earlier this year, I see some positive signs emerging which swing in favor of Roku’s business.

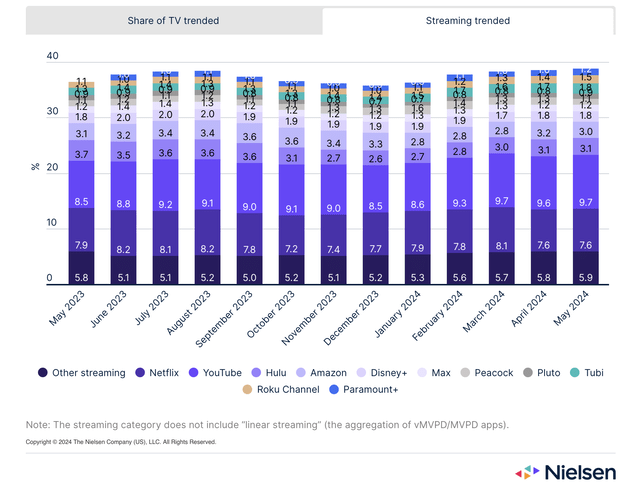

First, Roku’s namesake channel, the Roku Channel appears to have penetrated the market in terms of TV usage as seen in Exhibit B below. Per Nielsen’s audience viewing behavior data, the Roku Channel has gained its market share in all time at 1.5% of TV usage in terms of minutes across all TV platforms.

Exhibit B: Roku’s TV Channel gains all time high market share in TV usage in terms of minutes streamed (Nielsen Streaming Data)

In addition to that, other TV channels that offer free ad-supported content, such as Tubi, have also gained share, which points to users spending more minutes watching and browsing through Free Ad-Supported TV content or FAST content viewed on Roku’s own channel and Tubi.

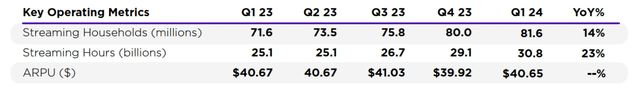

This also corresponds to the increase in Streaming Households on Roku’s TV platforms across devices that are spending more Streaming Hours watching content on Roku’s platform, as illustrated in Exhibit B below.

Exhibit C: Roku’s business operational metrics (Q1 FY24 Investor Shareholder)

As seen in Exhibit C above, Streaming Hours have been rising steadily over the past few quarters and recorded a 23% bump in the most recent Q1 quarter. While ARPU did surprise markets with a 4.2% drop to $39.9 per user, that looks to have normalized to some extent in Q1 FY24. The rise of Streaming Hours along with the initial normalization of ARPU, allows Roku to sell ad inventory to advertisers at prices favorable to the platform, in my opinion.

Opening Roku’s ad platform will benefit the company

Second, Roku has also made some strong advances in furthering their ad business, which could benefit the platform in addition to the usage tailwinds that Roku has already witnessed in the last few months.

Most recently, Roku launched their own ad exchange, allowing advertisers to buy and bid for ad inventory directly on Roku’s platform. The availability of audience-based ad decision-making and programmatic ad buying features should make it more appealing for advertisers to spend on Roku’s platform.

In addition, Roku also recently partnered with a leading DSP, Trade Desk (TTD), which opens up Roku’s ad inventory to Trade Desk’s large network of advertisers on the demand side. Most of these product announcements were made after Roku’s Q1 earnings call, where management revealed their strategic efforts to open up Roku’s platform to more advertisers rather than remaining a walled garden:

This strategic pivot has been paying real dividends. In the first quarter, we continued to see increase in programmatic ad spend as a percentage of total video investment on our platform, and that underscores for me the strength and appeal of our offering. Our strategy isn’t just about expanding the platforms we operate on, it’s also about deepening these relationships. So we’re making it easier for advertisers to execute campaigns programmatically with us and easier for them to use Roku inventory.

These comments and subsequent initiatives by Roku tie into the high-level strategy that Roku’s CEO articulated on the same call itself, where the company will be focusing on driving higher platform growth by driving higher ad demand as one of the priorities.

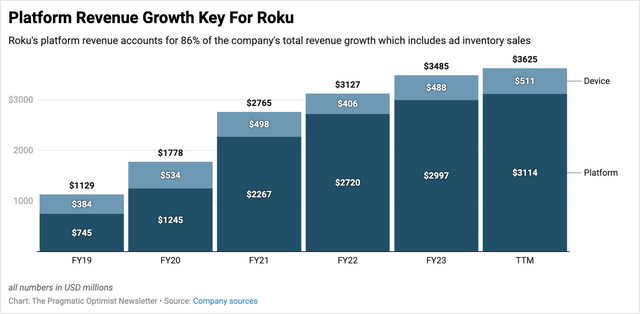

As can be seen in Exhibit D below, platform revenue growth has been key for Roku, which grew 74% CAGR between FY19 and FY21 but increased in the mid-teens on a CAGR basis between FY21 and now.

Exhibit D: Roku’s platform revenue growth accounts for 86% of Roku’s total revenue and has slowed significantly since during the pandemic. (Company sources)

I believe Roku would be on the right track to open up their ad system to more advertisers and DSPs, and the added benefit of increasing usage on Roku’s platform by users would incentivize advertisers to spend more on the platform moving forward.

Valuation appears to have priced in the worst

The company appears to be profitable on an adjusted basis, but I will value the company using sales forecasts via traditional metrics such as price/sales or EV/sales.

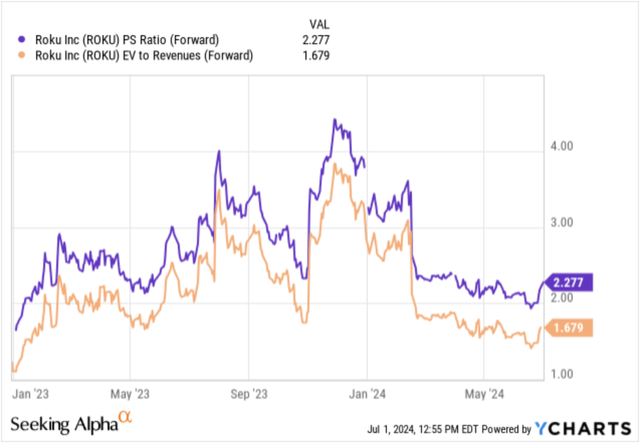

I believe the company could achieve sales growth of ~10% over the next two years through FY25, as the expansion of Roku’s ad platform products could increase ad spend on the platform, supported by sustained market share of the company’s channel and platform. Unfortunately, investors appear to be extremely pessimistic about Roku when I observe the company trading at 2.3x forward sales on a price/sales basis or 1.7x forward sales on an EV/sales basis.

Exhibit E: Roku’s forward sales estimates indicated depressed investor sentiment (yCharts)

Compared to Roku, the S&P500’s long-term expected growth rate is usually ~4.8% and trades at a forward sales multiple of 2.2x. On a relative basis, this points to significant upside in Roku as the company enters H2 of 2024.

I believe there is room for Roku’s valuation multiples to expand to at least 4-5x based on the sales growth I am forecasting for Roku this year.

Risks & other factors to consider

Competition will be key to watch as we move into H2 not only in the devices space, where different streaming devices and TV OEMs, especially low-cost OEMs, compete directly with Roku’s streaming device products, but also in the ad space, where Roku may not be able to get a share of the ad budgets that it vies for via its recent slate of ad products. For now, most of the competition on the device side is priced in, but I will be closely watching the performance and commentary on the reception Roku’s ad products are receiving from advertisers.

It is also important for Roku to demonstrate higher ARPU moving forward. On the Q4 FY23 earnings call, management mentioned that ARPU had taken a hit due to a surge in streaming users from international geographies, especially in regions like Mexico and Brazil. While the company does not break out ARPU by region, management revealed that ARPU of North American users was flat, but the company will need to do more to provide just anecdotes of ARPU moving forward, especially because the company has thin adjusted EBITDA margins of under 5%.

Takeaway

While risks do persist in Roku’s path to transitioning into an H2 winner, I am encouraged by the progress the company has demonstrated in penetrating TV usage minutes as well as deploying more ad products that should make it more appealing for advertisers to increase spending on the platform.

This positions Roku as a winner in the second half of FY24 and I recommend buying Roku.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.