Summary:

- Roku, Inc.’s trends have greatly deteriorated since Q2 of 2022.

- A weak ad market as well as a report on streaming ads running when TVs are turned off could be to blame.

- That said, it looks like Roku, Inc. low-balled Q1 guidance.

Justin Sullivan

Roku, Inc. (NASDAQ:ROKU) has a number of issues it is dealing with, but the company likely set a really low bar for 2023 with its guidance.

Company Profile

Roku, Inc. is a television streaming company whose operating system (OS) powers its own streaming devices as well as third-party TVs. It also began offering its own Roku-branded TVs in 2023. In addition, the company offers various smart home products including cameras, video doorbells, plugs, light bulbs, and light strips.

The company generates revenue through the sale of devices, as well as through advertising and content distribution services, which it refers to as platform revenue. Platform revenue consists of the sale of subscriptions, video advertising in ad-supported channels, transaction-based content, billing services, and brand sponsorship & promotions.

The firm owns its own free ad-supported streaming service called the Roku Channel. It is available in the U.S., Canada, Mexico, and the U.K. In the U.S., Roku Channel gives users access to more than 350 linear channels as well as on demand content.

In addition, ROKU has an ad buying platform for streaming TV called OneView. The service lets advertisers set up, measure, and make any changes to ad campaigns, while providing them engagement analytics.

Opportunities and Risks

To understand ROKU, you really need to understand its business model. While the company is known for its streaming devices, the company’s primary business is its platform business. Its streaming devices are generally sold around cost or even as a loss-leader to drive more users onto its platform.

In some ways, the ROKU model is similar to Apple Inc.’s (AAPL) App Store. For paid subscription services, ROKU generally takes a commission when a service is purchased through its platform. Through a revenue share program, ROKU generally takes a 20% cut.

Now, larger streaming service may be paying less than this percentage. Netflix, Inc. (NFLX), the largest streaming service, has never generated much revenue for ROKU, as its clout has helped it avoid this revenue share. How much newer, larger streaming services pay is not disclosed, and there have been contractual disputes in the past, so there are clearly negotiated prices for larger companies.

For ad-supported streaming services, meanwhile, ROKU generally gets 30% of the ad inventory. Now how this works with larger services likely differs as well, and recently several large streaming services have shifted to a mix of paid subscriptions with ads. It took four months for Disney + with ads to get onto the ROKU platform as the two sides hashed out an ad-share agreement. While the final deal will not be disclosed, the House of Mouse likely played hardball, as streaming services have turned their focus on profitability over subscriber growth.

Thus, in many ways, ROKU is a play on non-NFLX streaming growth, as it participates in subscriber growth and increased advertising on other streaming channels that are purchased on its platform.

Starting in Q2 of last year, ROKU warned of sudden weakness in the advertising scatter market, which appeared to hit streamers a little harder than traditional linear TV operators. The company blamed a softening economy and advertisers looking to pull back, but there could be another reason behind this.

In June, GroupM and advertising measurement company iSpot.tv came out with a study that said 17% of ad impressions from streaming devices (such as dongles, consoles, and sticks) actually play when the TV is turned off. While on its Q2 call ROKU management said it was at the forefront of helping prevent this on its devices, this is simply not true, and its devices are perhaps among the worst offenders.

The reason why – its devices cannot be powered down by turning off the TV and must be unplugged from the TV or power source to be turned off. Anecdotally, I have noticed that when I turn off my TV watching a streaming show via a Roku device that I often find it several episodes ahead of where I had left it off.

This might not sound like a big deal, but it’s estimated that this issue is costing advertisers $1 billion a year. That’s a problem.

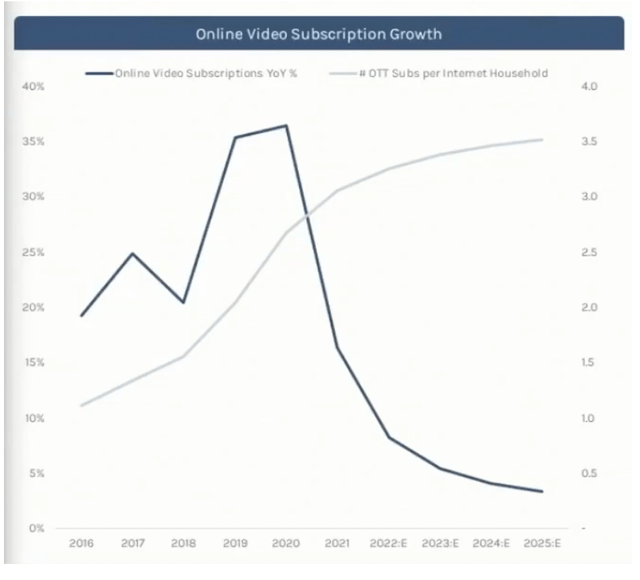

Another issue for ROKU is that OTT sub growth peaked in 2020, and is projected to grow at a much slower rate going forward. With over 3 OTT subs per Internet household, the market for new devices to connect to streaming services just isn’t there.

I’d also question how ROKU calculates its active users. The company states that it primarily generates most of its platform and player revenue from the U.S. and that international is a small percentage of revenue. So, presumably, the vast majority of its users are U.S. households (it defines an active user as a single account that may be used by more than one individual, such as a family, while noting that one account may be used on multiple streaming devices). Last quarter, ROKU reported that it had 70 million active accounts. This compares to Netflix reporting that it has 74.3 million paid members in the U.S. and Canada. There are about 131 million total households in the U.S.

To me, either ROKU’s active account numbers are being misrepresented or it’s reaching pretty extreme saturation in the U.S.

Meanwhile, while I think the shift towards ad-supported tiers for the big streaming companies is a positive for them, I don’t think it will be for ROKU. The take-rate ROKU gets from many of its customers already seems high versus the value it provides. It’s not providing the pipes into a home like a cable company, nor is it a duopoly developing sophisticated smartphone operating systems and marketplaces. There are plenty of ways to stream, and a ROKU device or a ROKU-powered smart TV doesn’t need to be used.

NFLX has never paid ROKU anything meaningful given its heft, and I don’t see other large streamers giving the company very favorable terms in an ad-supported tier. As is typical of ROKU management, when asked about the impact of subscription services creating ad-supported tiers, they talked about how more streaming hours is good for them. This, of course, isn’t necessarily true as someone watching more hours on NFLX does not help them in the least.

In the fall, the company announced that it was getting into the home automation market. The company plans to offer floodlight cameras, indoor/outdoor cameras, 360° indoor cameras, video doorbells, smart light bulbs, light strips and both indoor and outdoor plugs. The devices were developed in partnership with low-cost connected device maker Wyze.

To me, this move looks desperate. First, ROKU is delving deeper into hardware, when the company is primarily an advertising company. None of these devices will help it sell advertising. In addition, it’s going into a space with a number of well-established players such as Nest, which owned by Alphabet (GOOGL), Ring, which is owned by Amazon (AMZN), and Arlo (ARLO). Meanwhile, at the higher-end of home automation are generally security-related companies such as Alarm.com (ALRM) and Vivint.

Wyze, the company Roku has partnered with to develop the products, has also been at the center of controversy. The company failed to disclose a security vulnerability in its security cameras, and it took three years for it to finally roll out firmware to fix the issues. The company also had a major 23-day data breach in 2019.

Conclusion

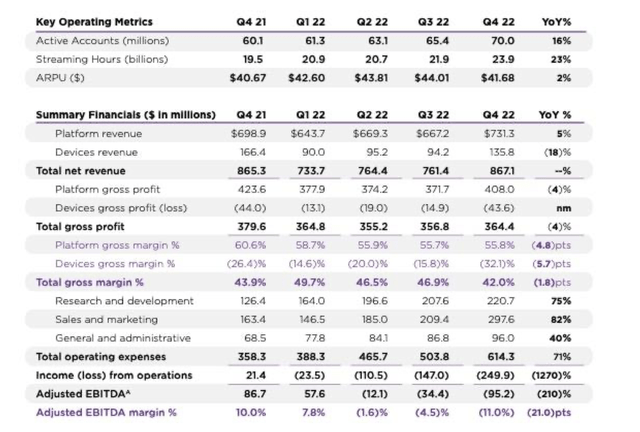

Roku, Inc.’s underlying numbers are faltering. Platform gross margins have gone from 65.0% in Q3 2021 to 55.8% last quarter. At the same time, sales and marketing expenses have skyrocketed, while active account growth has cooled. Sales and marketing was up a whopping 82% in Q4, while account growth only rose 16%. ARPU was up only 2% year-over-year and actually fell -5% sequentially.

ROKU’s EBITDA turned negative in Q2 and got worse in Q3 and Q4. The company is projecting -$110 million in EBITDA for Q1 2023. The current consensus for the full-year 2023 is for ROKU to generate negative EBITDA of -$299.5 million. The company also recorded nearly $360 million in stock-based compensation in 2022, which is a real expense that gets excluded in the EBITDA calculation.

Now, one thing likely working in ROKU’s favor is that it likely just kitchen-sinked its guidance. And that type of setup is often a good thing, as stocks often get rewarded for beating easy guidance. A larger company could also look to buy ROKU for its user base, which right now is valued at about $110 per sub. On that basis, it’s not that expensive for a large company wanting to come in and acquire a bunch of subscribers.

Thus, while the numbers and trends look really poor, I’m going to be neutral on Roku, Inc. at this time and rate it a “Hold.” I could move to “Sell” on a big move if Roku, Inc. stock rallies after beating easy Q1 guidance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.