Summary:

- Roku’s FY2024 positive adj EBITDA target appears to be ambitious, thanks to its underwhelming FQ3’23 guidance and declining ARPUs.

- Its user engagement appears to have peaked as well, with stagnant streaming hours despite the growth in Active Users.

- For now, the CTV ad-spending appears to be a promising tailwind, though ROKU may have to contend with YouTube, NFLX, and DIS, amongst others.

- Combined with ROKU’s apparent premium forward EV/EBITDA valuation of 27.6x against the sector median of 8.33x, patience may be a more prudent choice for now.

izusek/iStock via Getty Images

The ROKU Investment Thesis Is Still Overly Optimistic, With Premium Valuations

We previously covered Roku (NASDAQ:ROKU) stock in May 2023, rating the stock as a Hold (Neutral) since we believed that there might be more attractive entry points ahead, attributed to the uncertain macroeconomic outlook and slower ad-spend environment.

The company appeared to momentarily sacrifice margins in favor of a high growth cadence as well, as seen by its cash burn rate of approximately $600M annually.

For now, based on the ROKU management’s commentary in the recent FQ2’23 earnings call, we may see its advertising revenues accelerate from here as some ad verticals improve and recover, corroborating with YouTube’s (GOOG) excellent results.

This development may have been aided by the ongoing SAG-AFTRA/ WGA strikes as well, since TV ad buyers have recently flocked to YouTube ads, as reflected by the dramatic expansion in its revenue growth to $7.66B (+14.4% QoQ/ +4.3% YoY) for the latest quarter.

With nearly 20% of Connected TV spend diverted to YouTube, as ROKU similarly records expanding Platform Revenues of $743.83M (+17.2% QoQ/ +11.1% YoY) in FQ2’23, we may see their advertising revenues further expand in the upcoming quarter.

Based on Insider Intelligence, the global Connected TV ad spend is also expected to grow tremendously by +13.2% YoY to $25.9B, while expanding at a CAGR of +10.45 through 2028.

This may be further aided by the sustained cord cutting since the pandemic, with nearly “45% of YouTube viewing in the US already taking place on TV screens.” This trend has obviously contributed to the robust demand for ROKU devices as well, as observed in its Device Revenues of $209.72M (+13.2% YoY) YTD.

The company has also partnered with Shopify (SHOP), one of the largest headless e-commerce SaaS with a leading market share of 28.22% in the US, to bring e-commerce checkout through Roku Action Ads since July 2023. This strategy may potentially boost its advertising ads from FQ3’23 onwards, contributing to the expansion of its Platform segment.

Therefore, while ROKU may not report sustained profitability yet, we are not overly concerned, since its Platform segment has been recording positive gross margins of 53.2% (+0.6 points QoQ/ -2.7 YoY), aided by the early return in ad-spending. This is despite the pullback in the Device segment, with gross margins of -16.9% (-20.2 points QoQ/ +3.1 YoY) in FQ2’23.

The management has also been competently keeping operating expenses stable at $504.23M (-8.3% QoQ/ +8.2% YoY) in the latest quarter, with narrowing operating margins of -14.8% (+13.8 points QoQ/ -0.4 YoY).

Despite its lack of GAAP EBIT profitability, ROKU investors need not fret, since its balance sheet remains healthy with cash/ equivalents of $1.79B (+7.1% QoQ/ -12.6% YoY) and practically zero debt by the latest quarter.

However, we must also point out its declining monetization cadence, with stagnant TTM Average Revenue Per User of $40.67 (inline QoQ/ -7.1% YoY), temporarily balanced by its expanding active accounts of 73.5M (+2.6% QoQ/ +16.4% YoY) in FQ2’23.

It appears that ROKU’s streaming offerings may have peaked as well, with stagnant engagement and streaming hours of 25.1B (inline QoQ/ +21.2% YoY), despite the higher active accounts.

It remains to be seen if its FY2024 target of positive adj EBITDA is achievable, since its FQ3’23 adj EBITDA margin guidance proves to be underwhelming at -6.1% (-4 points QoQ/ -1.6 YoY), compared to FQ2’23 levels of -2.1% (+7.2 points QoQ/ -0.5 YoY).

Therefore, we believe that ROKU investors may need to temper their expectations in the meantime, with GAAP profitability remaining a long-term dream.

In addition, with Netflix (NFLX) and Disney (DIS) also launching ad-supported tiers since end 2022, naturally intensifying the CTV ad market competition, it remains to be seen how much ad spending may eventually flow to ROKU in the long term.

So, Is ROKU Stock A Buy, Sell, or Hold?

The only saving grace to the ROKU investment thesis, is its market leading share in the CTV device market and its vertically integrated device/ software platform, providing consumers with access to different streaming players.

Then again, due to its lack of profitability and niche offering, it is not easy to value the stock, with its current trading at NTM EV/ Revenues of 2.83x, compared to its 1Y mean of 2.23x and pre-pandemic mean of 9.29x.

While ROKU may appear to be cheap based on its historical valuation, it is still expensive compared to its media sector median NTM EV/ Revenues of 1.76x, SaaS sector median of 0.91x, and household durables sector median of 0.92x.

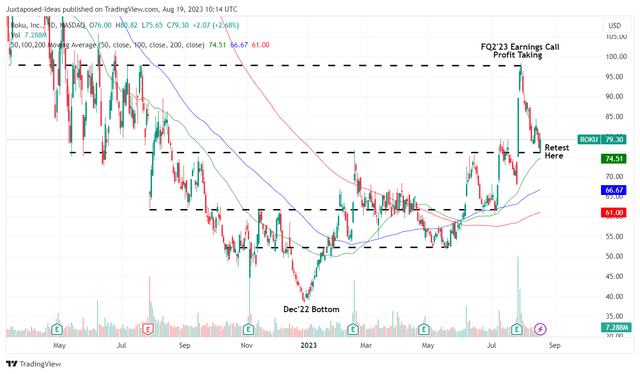

ROKU 1Y Stock Price

Trading View

Combined with the recent run up/ profit taking after the FQ2’23 earning call and elevated short interest of 9.25% at the time of writing, it appears that the ROKU stock may remain volatile for a little longer, with it currently retesting its previous Jun/ July 2023 support levels.

As a result of its mixed prospects, we prefer to err on the side of caution and rate ROKU as a Hold (Neutral) here.

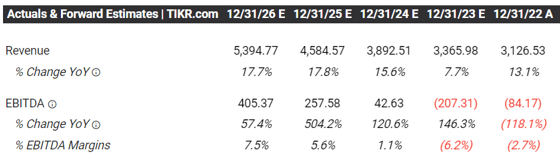

Consensus Adj EBITDA Projection

Tikr Terminal

Investors must also note the ROKU stock’s baked in premium, with an estimated forward EV/ EBITDA valuation of 27.6x against the sector median of 8.33x, based on the consensus FY2026 adj EBITDA projection of $405.37M, current share count of 141.03M, and current share prices of $79.30.

Therefore, patience may be a more prudent strategy for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.