Summary:

- Roku’s dominant market position in the CTV ecosystem and its growing ad business makes it an attractive acquisition target within the next 12 months.

- Roku’s sequential ARPU growth and strong Q3 sales highlight improving unit economics, supporting a Buy rating despite potential market share risks.

- Potential suitors like Amazon, Walmart, and Netflix could offer a compelling acquisition premium, enhancing Roku’s valuation and benefiting shareholders.

- Despite acquisition speculations, Roku’s evolving ads business and market position warrant a projected sales multiple of ~3x 2025 sales, justifying continued optimism on a fundamental level.

RichVintage

Investment Thesis

Recently, American technology company Roku (NASDAQ:ROKU) has been the subject of equity research reports by a handful of sell-side equity research firms that have issued multiple reports expecting the San Jose, CA-based streaming device maker to be acquired within the next twelve months.

The thesis for these equity research reports surrounding Roku is intriguing given the strength of Roku’s platform in the CTV ecosystem and the rapidly growing pace of the broader RMN, or retail media networks, as the ad industry gets ready to usher in 2025.

What makes Roku stand out in the ecosystem is its dominant market position while it increasingly leverages that position to ramp up the pace of its ad business. The intersection of these unique strengths combined with Roku’s market cap has struggled to take off this year makes Roku’s valuation look enticing for potential suitors.

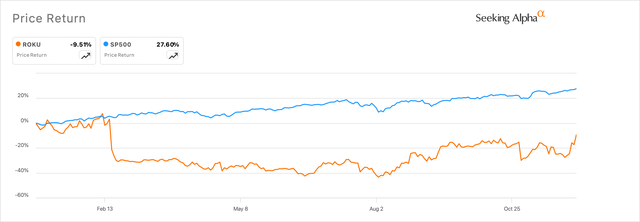

Exhibit A: Roku’s stock finally makes some headway in recovering its YTD losses for 2024. (Seeking Alpha)

Whether acquisitions take place or not, I believe Roku has taken the year to make some pivotal changes to its business and, finally, build out its ads business, which positions the company at an attractive valuation on an NTM basis.

I continue to recommend a Buy rating on Roku and explain how potential M&A will impact investors.

3 Big Catalysts In Roku’s Favor

In my previous research on Roku, I noted how Roku was making key changes to its platform, leading me to believe that user dynamics were looking much better than in the previous quarters. In addition, the buildout of its ad platform was looking very encouraging and was already having a favorable impact on unit economics on its platform, witnessed by sequential growth in ARPU.

Roku’s recent Q3 earnings report showed some of that momentum continued to build further as the unit economics of its streaming platform looked even better on a sequential basis, which is the first catalyst for Roku’s improving business fundamentals.

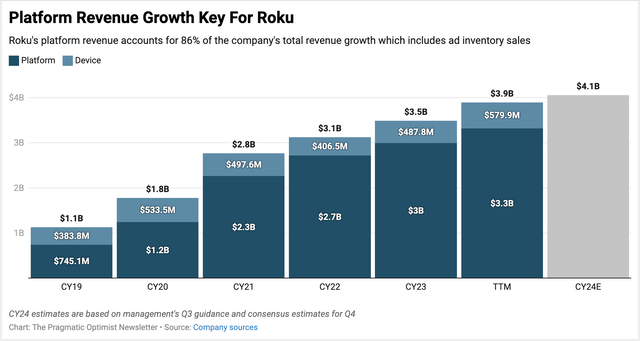

ARPU is one key indicator I use to assess Roku’s unit economics. Although ARPU was flat y/y at $41 of revenue per streaming user, the sequential lift in ARPU from $40.68 in the preceding quarter was encouraging. After Q4 22, Roku’s ARPU dropped to the ~40s level, denoting degrading platform unit economics. The improved economics also resulted in better-than-expected Q3 sales of $1.06 billion, beating estimates by ~$40 million. On a TTM basis, Roku is now clocking ~$3.9 billion in revenue and is on track to close out CY24 with $4.05 billion in revenue, growing at a 16.2% pace, per management’s projections.

Exhibit B: Roku’s TTM revenue is currently at $3.9 billion and on track to close 2024 growing at a 16.2% pace to deliver at least $4 billion in sales. (Company sources)

Roku’s Q3 report also notes that there are 85.5 million households that use a Roku device or their streaming platform for their streaming TV needs. This has grown at a ~13% pace over the previous year and also reiterates Roku as a dominant market player in the hardware streaming TV space.

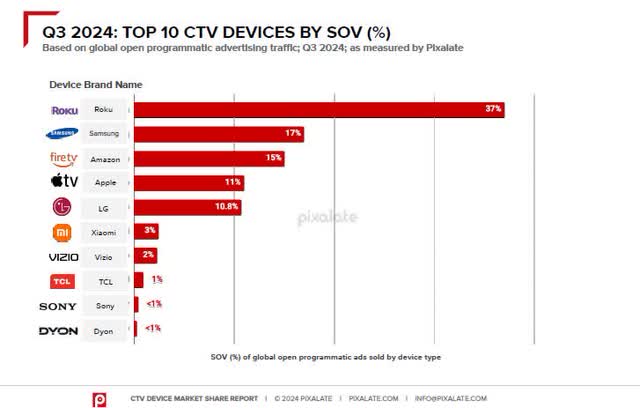

Recent market research published by Pixalate indicates that Roku continues to hold a dominant share of the CTV device ecosystems market. Pixalate (via StreamTV Insider) observes that:

Roku was No. 1 across CTV device ecosystems with a 37% “share of voice” (SOV)-meaning that percentage of all open programmatic CTV ads in Q3, as measured by the company, were delivered to Roku devices.

Exhibit C: Roku continues to hold market leadership in the CTV device ecosystems with a 37% market share. (Pixalate via StreamTV Insider)

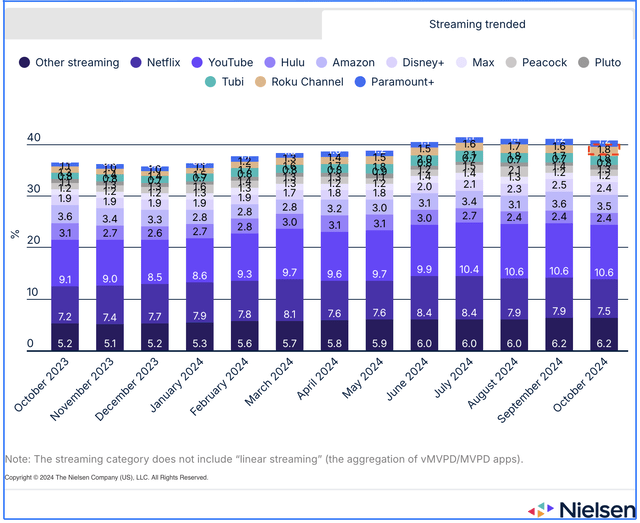

Roku’s market leadership in this space is the second major catalyst that is favoring Roku’s business. Additionally, Roku is expanding its share in the streaming TV space as well, which augments nicely into its growth prospects. Per Nielsen’s Gauge report, Roku’s eponymous Roku Channel now holds a 1.8% share in the broadcast streaming TV market, having penetrated the market by an additional 80bp over the previous year.

Exhibit D: Roku’s namesake free channel is expanding its share in the broadcast streaming TV space with a 1.8% share. (Nielsen Gauge)

Updates on market shares in both the abovementioned markets are important catalysts that form a good segue into Roku’s third catalyst-ads.

I have noted previously how Roku’s development of its direct and programmatic video advertising products was shaping up well. Since this is an emerging opportunity for Roku as they finally leverage their dominant market position in the streaming TV device market, the company still shies away from divulging specifics. But on the Q3 call, Roku’s management noted:

Third quarter advertising activities accelerated from second quarter nicely in the third quarter. The year-on-year growth of advertising activities across the Roku platform, excluding M&E, as Dan said earlier, outperformed both the overall ad market and the OTT ad market in the U.S. So we feel really good about that.

Roku is building out its ad capabilities by offering various types of ad products and opening up its extensive ad inventory through partnerships with ad technology partners. One of the most noticeable partners is Trade Desk (TTD), with whom Roku had extended the partnership earlier this year.

Naturally, many equity research reports have speculated that Trade Desk could be a potential suitor to acquire Roku due to business synergies. Further, RMNs, or Retail Media Networks, should continue to put up a strong show with ad budgets staying elevated in this ad category buoyed by robust ad spending in CTV ads.

However, I do not believe this to be the case because Trade Desk is a likely suitor as the company’s management adopts an M&A strategy that usually favors buying smaller companies. Moreover, I do not believe Trade Desk’s current balance sheet structure allows the company to expand its cash reserves to acquire Roku.

Roku Stock’s Valuation Premium Is Still Discounted – Are Suitors Watching?

As observed in my previous reports, I had expected Roku to project higher revenues in the upcoming Q4 quarter, and I was hoping management would guide up 2024 revenues in excess of $4.1 billion. But with that strength lacking in their projections, I am downsizing my expectations and now see Roku growing its revenues by ~12-13% next year, in line with the broader market.

While penetration in the US streaming ecosystem markets now appears saturated, its dominant market share will be a huge boon for Roku to continue its ad product rollout, which should aid in higher-margin revenue. In addition, Roku is growing quickly in emerging markets like Mexico.

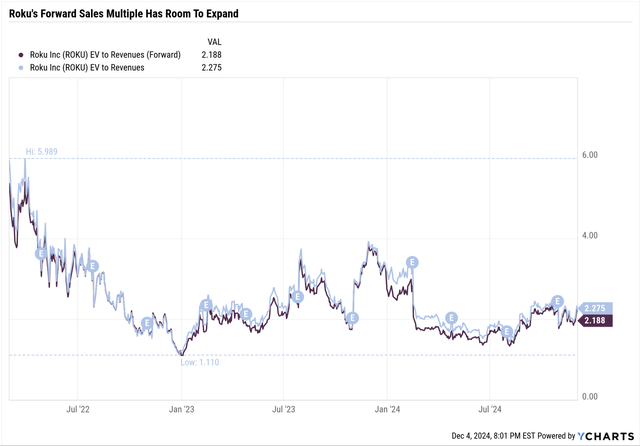

The combination of these factors should support the narrative for low-mid teens growth next year. However, given that growth assumption for next year, the company trades at an EV/Forward Sales multiple of <2x 2025 sales expectations. This is still cheap for retail investors, given that the broader market is trading at just under 3x forward sales.

This still gives Roku’s sales multiple enough room to expand over the next twelve months. I believe Roku should be trading at a ~2.8x 2025 sales on an EV/Sales basis, which denotes a 40% upside from current levels.

Exhibit E: Roku still looks undervalued as it trades at under 2x 2025 sales (YCharts)

Given this outlook, it could also appear likely that Roku could be bought over by a direct peer such as Amazon (AMZN), which is looking to expand its blistering ad growth. A potential Roku acquisition could leapfrog Amazon as the #1 CTV device ecosystem player by at least a double-digit margin.

But with Walmart (WMT) having similar aspirations too, the discount retailer might look to add on to its Vizio acquisition to expand its RMN ad aspirations. Netflix (NFLX) is the other likely suitor in my opinion that not only is trying to build out similar ad capabilities but also enjoys a close relationship with Anthony Wood, Roku’s CEO and Founder.

These three companies are the most likely suitors that have the cash to spend on Roku and offer the company a compelling acquisition premium that I expect to be in excess of 3x 2025 sales to acquire the company.

Risks & Other Factors To Be Aware Of

While Roku continues to have a dominant market share in the CTV device ecosystems with a 37% share, I also observe that Roku’s share has actually fallen, particularly in North America versus previous quarters. Apple’s Apple TV (AAPL), LG Electronics’ LG TV, and Amazon’s Fire TV have gained share in the meantime. If this trend continues and is coupled with no significant improvement in Roku’s revenues over the next couple of quarters, I will be forced to downgrade Roku to a Hold on its evolving business dynamics.

Alternatively, a potential acquisition would also be in the best interest of its shareholders if Roku continues to erode any part of its current market share in the CTV device ecosystems.

For an acquisition to eventually materialize, the potential suitor would have to convince Roku’s Anthony Wood, who remains the company’s largest shareholder & decision maker, holding at least a 10% stake in Roku.

Finally, investors should note that this is not the first time Roku has been involved in such kind of speculation involving an acquisition. In 2019, Roku was the subject of a takeover speculation by the same equity research firm that has again issued similar takeover reports this week. In 2022, Netflix was rumored to acquire Roku. So it is equally likely that the most recent reports speculating Roku being taken over might not likely materialize in a formal deal.

Takeaway

For now, I am optimistic about Roku’s prospects despite certain risks lurking on the horizon in terms of its market share in the CTV device ecosystems market. At current projected mid-teen growth rates, Roku still has enough runway to warrant a sales multiple of ~3x 2025 sales.

Given Roku’s position in the CTV device ecosystem space and its evolving ads business, the company is well-positioned to attract suitors with similar synergies in CTV and RMN. This outcome would also be in the best interest of Roku’s shareholders with a valuation premium that is likely to greatly exceed 3x 2025 sales.

I continue to stay positive on Roku and reiterate my Buy rating on the company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.