Summary:

- Roku’s ad monetization strategy, partnerships with DSPs, and user engagement improvements are driving growth, with platform revenue up 11% and user metrics at record highs.

- Device sales surged ~39% in Q2, with potential for further growth during the holiday season, boosting both ad revenue and overall prospects.

- Valuation remains depressed despite strong performance, presenting a buy opportunity; Roku is expected to achieve 13-15% CAGR growth through CY25.

- Despite market skepticism, Roku’s consistent focus on ad strategies and partnerships positions it for significant upside, reaffirming my Buy rating.

Marvin Samuel Tolentino Pineda

Investment Thesis

Roku’s (NASDAQ:ROKU) management has been impressively building on the ad revenue catalysts that the company has unlocked over the past 15-18 months.

The company has been staying true to its 2024 initiatives to deliver growing adjusted EBITDA and positive free cash by developing tools, solutions, and product features that are closely aligned with harnessing the increasing strength of its ad platform.

Management’s three-pillar ad monetization strategy is showing strong signs of the company delivering growth based on added features to its Roku Home Screen, growing Roku-billed subscriptions, and scaling ad demand on Roku’s platform. The last pillar is of primary importance given its partnerships with leading DSPs such as The Trade Desk (NASDAQ:TTD).

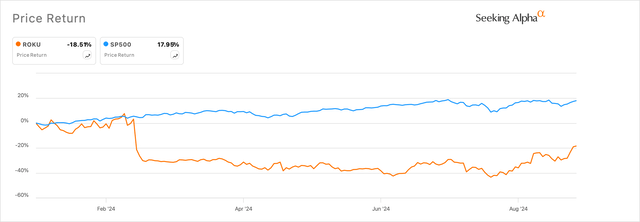

Roku’s stock is still down deep in the red but has emerged from correction territory as noted in Exhibit A. Of more importance is Roku’s diverging performance in the past month which shows the company’s stock pulling away from the market.

Exhibit A: Roku’s stock is still down deep in the red but has emerged from correction territory. (Seeking Alpha)

The valuation levels still appear depressed to me based on my analysis of the company’s valuation, and I will reiterate my Buy recommendation on the company.

Improving Ad Demand On Roku’s Platform Tied To Industry Partnerships, Product Updates

In a previous post on Roku, I explained why I expected momentum from Roku’s ad monetization strategies. I was impressed by the company’s focus on building out robust ad capabilities for its ad clients, scaling its ad demand by opening up its ad platform to DSPs such as Trade Desk, and adding features that kept its users engaged on Roku’s platform.

Since my post, Roku’s stock has gained an additional ~21%, and I believe management’s efforts will continue to grow top line and bottom line.

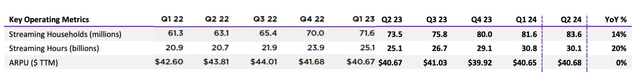

Starting with Roku’s user metrics, I observed that user dynamics are looking much better than the previous quarters, which led to Roku’s precipitous drop in growth.

Roku is now used by 83.6 million active accounts worldwide, another record while those accounts are streaming more TV hours on their respective Roku devices. Per Roku’s latest shareholder letter, Roku reported a 20% y/y increase in streamed hours with over 30 billion hours of TV streamed across Roku devices.

Exhibit B: Roku’s user metrics indicate stronger engagement across devices and accounts. (Company sources)

More importantly, the company’s consolidated trailing ARPU shows sequential improvement, preserving management’s efforts to arrest the decline in ARPU that can be observed through last year. Management attributes high user engagement as one of the reasons why Roku is able to get its ARPU back in growth mode.

As I noted in my previous coverage, Roku’s FAST (free ad-supported streaming television) channels were one of the reasons for engaged users. This can also be seen in the growing market share of Roku’s eponymous Roku Channel which continues to penetrate the Streaming TV market, now maintaining a 1.6% share of the streaming TV market, up from the 1.5% I noted in my last coverage. Roku recently expanded the programming content of its Roku Channel to also include a variety of live sports content. This is an added advantage for users to stay engaged, in my opinion, which should give a lift to the streaming hours metric I noted earlier.

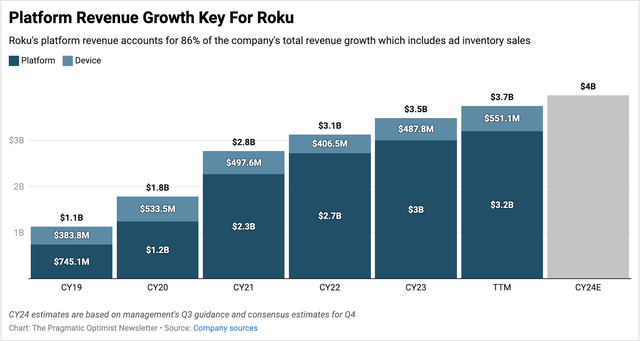

Roku is leveraging its high volume of engaged users to build more partnerships with multiple participants within the CTV ad network, which is already showing results. Per the latest Q2 report, platform revenue grew 11% to $824 million, and management expects platform revenue to grow sequentially this year, putting Roku on track to achieve mid-teens growth in CY24. This should set Roku up nicely to achieve mid-teens growth in CY25 as well, in my view.

Exhibit C: Roku’s revenue by revenue segments (Company sources)

My conviction comes from management’s consistent focus on its ad monetization strategies to increase ad demand on its platform. Partnerships have been key in this area as Roku ties up with DSPs across the ad network to scale ad demand. Roku has expanded its partnership with Trade Desk recently, adopting the latter’s UID2 (Unified ID 2.0), an ad-targeting solution.

I believe Trade Desk’s UID2 adoption would allow advertisers to target Roku’s highly engaged user base, as I had noted earlier. In addition, Roku is also partnering with Currys Connected Media, a large DSP in Europe that allows Curry’s partner brands to advertise on Roku’s platform, adding more runway for platform revenue to scale from Roku’s current levels.

Valuation Indicates Unfair Skepticism In Roku

Given the improvements that management has demonstrated, I believe Roku can now achieve 13-15% CAGR growth through CY25. The improved outlook also puts Roku on track to post six straight quarters of adjusted EBITDA.

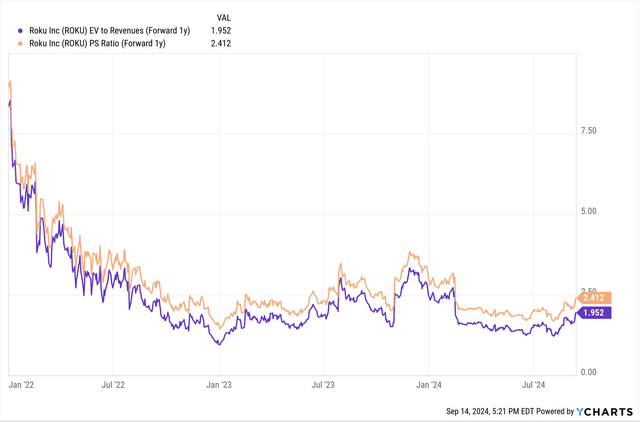

Markets are still quite skeptical of Roku’s forward growth prospects while pricing Roku at 2.4x 2025 revenues or 2x on an EV/forward sales basis.

Exhibit D: Roku’s forward sales valuation indicates Roku is undervalued (yCharts)

Compared to Roku, the S&P 500 trades at 3x forward sales and is expected to grow revenues by 6% through CY25, implying a discount in valuation for Roku.

My prior expectations for Roku were to value the company at 4-5x forward sales, which still indicates significant room for expansion in Roku’s sales multiples.

Risks & Other Factors To Know

I had noted competition as one of the factors that could affect the sale of Roku’s devices, both sticks and branded TVs. TV and device OEMs have been a threat in the past in a market that appeared to be saturated.

However, that looks to be changing as Roku continued its impressive run in device revenue, with sales from devices increasing ~39% in Q2. This was a very strong increase, and as we approach the all-important holiday season, it will be important for Roku to sustain these device sale trends.

eMarketer believes US retail sales will be led by ecommerce and is expected to grow in the mid-single digits, surpassing last year’s growth. If this actually plays out, expect Roku to run with higher device sales, followed by an improved ad outlook boosting the company’s prospects. Conversely, investors can expect headwinds if retail spending in the upcoming holiday season remains at last year’s pressure levels.

Takeaways

Roku continues to offer moderate/high levels of risk/reward as markets head into the final quarter of CY24 next month. Improved performance by the company in its platform segment buoyed by ad spending has changed some of the sentiment against Roku.

But valuation levels still appear depressed, pointing to a strong upside this year. I reiterate my Buy rating on Roku.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.