Summary:

- Roku’s near-term prospects reflect a mix of successes and challenges.

- The bull case revolves around Roku’s anticipated 15% EBITDA margins in 2024, supporting a premium valuation.

- According to my calculations, Roku is priced at 25x forward EBITDA.

hapabapa

Investment Thesis

Roku (NASDAQ:ROKU) is an attractive turnaround opportunity. The bull case is built on its ability to turn substantially and sustainably profitable in 2024. Here I discuss the pros and cons of this investment.

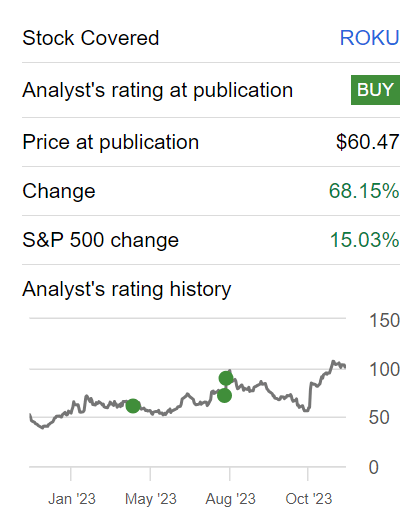

I recognize that I was bullish on Roku, before many investors were bullish, and show you the proof too.

Looking ahead, while I’m still bullish, I’m not as bullish as I once was, as I believe that the bulk of my bull case has already started to be reflected in the share price.

Simply put, at this juncture, the upside, while still attractive, is more muted than it used to be.

Rapid Recap,

Back in July, I concluded my bullish Roku article by saying,

[…] it’s essential to be mindful of the negative aspect of Roku’s investment, particularly regarding the company’s EBITDA margins.

Despite the risks, I maintain a positive outlook on Roku’s prospects, expecting the share price to progress higher to reflect the company’s continued growth potential.

To be clear, I’ve been on Roku throughout 2023, as you can see below.

Author’s work on ROKU

In hindsight, my call was a very strong performer, easily beating the S&P500. And while I don’t find Roku as attractive as I previously did, I do find that there’s still some upside potential left in this name.

Roku’s Near-Term Prospects

Roku’s near-term prospects are marked by a mixed landscape of successes and challenges.

On the positive side, the company has experienced robust growth in active accounts, streaming hours, and platform revenue, showcasing its resilience and relevance in the evolving TV streaming market. The international markets, particularly in Latin America and Brazil, have emerged as significant contributors to net adds, positioning Roku as a dominant player in these regions.

However, the advertising environment remains a point of caution, with ongoing uncertainties in the macroeconomic landscape and specific challenges in advertising verticals like financial services and media & entertainment.

While Roku anticipates a similar growth trajectory in video ads, in the near-term Roku faces tough year-over-year comparisons in content distribution and media & entertainment.

Further, Roku recognizes the need for caution amid uncertainties, especially in the ad market, despite the solid rebound in video ads during the third quarter.

Given this context, let’s delve into Roku’s financials.

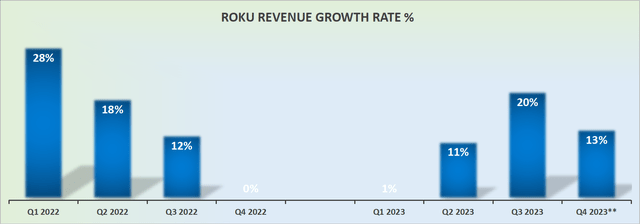

Revenue Growth Rates Moderate, What About 2024?

Roku’s Q4 outlook points to approximately 12% y/y. For this figure, I’ve taken management’s guidance of 10% revenue growth rates and added 3% on top of that, which is consistent with the size of Roku’s beat. Perhaps, Roku’s Q4 even sees around 14% CAGR in Q4. Whatever the final figure, this business is growing around the mid-teens.

Indeed, I don’t believe that many investors would expect to see Roku growing in the +20% CAGR again.

Therefore, following my reasoning, I suspect that in 2024 Roku could also be growing around the mid-teens.

On the one hand, that’s not particularly exciting growth. On the other hand, investors will be more than willing to pay for Roku if they believe that its growth prospects have finally stabilized.

As you know, what investors truly dislike, nearly as much as bad news, is uncertainty. If Roku can be counted on to deliver stable and mid-teens growth rates, then the business is worth a premium valuation.

ROKU Stock Valuation — 25x EBITDA

The bull case for Roku is built around its EBITDA prospects in 2024. What sort of EBITDA margin can this business deliver in 2024, once it has completed its efforts to reduce its cost structure and operates with its leaner headcount?

Can Roku deliver about 15% EBITDA margins by the time it exits Q4 2024? Recall, that during the pandemic, when Roku’s platform was in very high demand, Roku was able to deliver 18% EBITDA margins at one point.

Therefore, I believe that around 15% EBITDA as a forward run-rate could be achieved, particularly when management has fully deployed all its efforts to improve its underlying profitability, given that Roku’s attempts at growing its revenues appear to be delivering poor ROIs.

With this framework in mind, I suspect that somewhere around $550 million of EBITDA by the time Roku exits 2024 could be on the cards.

This would leave the stock priced at 25x EBITDA. A fair entry point for investors.

The Bottom Line

In conclusion, my outlook on Roku has evolved from an early and bullish stance to a more measured perspective, acknowledging that a substantial portion of the bull case has already been reflected in the share price.

While still optimistic about Roku’s near-term prospects, highlighted by robust growth in active accounts, my enthusiasm is tempered by the challenges in the advertising landscape and potential headwinds in specific verticals.

Turning to Roku’s financials, the mid-teens revenue growth rates anticipated for 2024 may not be as exhilarating as in previous years, but the stability and predictability they offer could translate into a premium valuation.

The focal point of the bull case lies in Roku’s EBITDA prospects, with a target of around 15% EBITDA margins by the end of 2024, positioning the stock at 25x EBITDA—a valuation deemed fair for potential investors.

As I reassess my position, the company’s ability to deliver on its profitability targets becomes crucial for sustaining investor confidence and maintaining an attractive valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.