Summary:

- Roku is broadening its advertising reach with its new partnership with The Trade Desk, allowing Roku to be included in omnichannel advertisement strategies.

- Roku’s branded TVs may narrow device losses in future periods as production scales.

- Marketing budget forecasts are mixed for CY24 and may remain flat-to-down in 2025 due to economic pressures.

JHVEPhoto/iStock Editorial via Getty Images

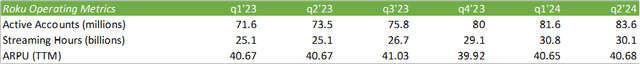

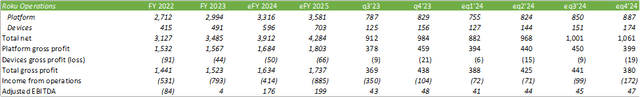

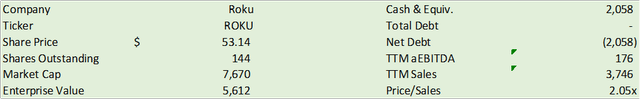

Roku, Inc. (NASDAQ:ROKU) reported their q2’24 earnings on August 1, 2024, with both top and bottom-line beats with revenue coming in at $967mm and GAAP EPS of -$0.25/share. The firm grew their active accounts by 14% on a year-over-year basis to 83.6mm in q2’24 with a 20% increase in streaming hours to 30.10b. As a result of this growth, Roku realized a flat year-over-year ARPU of $40.68/user. Though the firm realized two sequential quarters of flat year-over-year ARPU growth, this remains an improvement from the annual decline Roku realized in FY23. Given the recent sell-off and moderation of ROKU shares’ valuation of 2.05x TTM price/sales, I believe ROKU shares have returned to a reasonable price for building a position. I am upgrading my rating for ROKU shares to a BUY with a price target of $64.12/share.

Be sure to review my previous coverage on Roku here:

Roku Takes International Expansion And Loses ARPU

Roku: Low/Slow Top Line Growth Means Widening Loss

Roku Operations

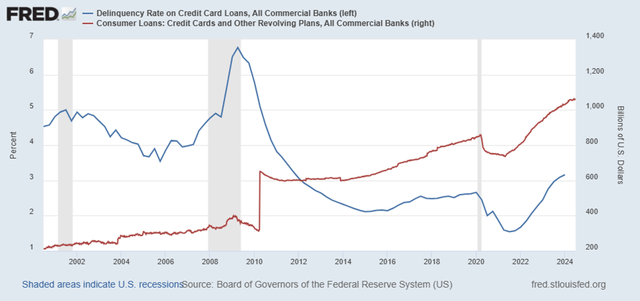

Starting with the device segment, Roku experienced exceptionally strong revenue growth of 39% in q2’24. This was paired with an improved seasonal margin of -11% vs. a q2’23 margin of -17%. Device gross margin may improve in the coming periods as Roku expands their retail reach for Roku-branded devices, which allows the firm to have more control over the costs, pricing, and overall revenue stream. What cautions me relating to device growth is that retailers like Best Buy Co., Inc. (BBY) are realizing lower unit volumes and ASPs, which may be suggestive of two things. The first is that volume sales decline is driving down prices as older models are discounted in an attempt to move more volume. The second is that consumers are spending less on discretionary items as a result of higher inflationary pressures, a topic I discuss in consumer device semiconductor designer QUALCOMM Incorporated (QCOM). Given that consumer credit and delinquencies are rising in tandem, I suspect consumer spending habits will likely moderate and focus more heavily on day-to-day expenses vs. big ticket items like a new TV.

As it pertains to Roku’s overall strategy, I do not believe TV sales will be the growth driver for Roku as TVs act as the “land” aspect in their “land and expand” strategy. Looking at growth one level deeper, streaming hours continue to grow above 20% on a year-over-year basis.

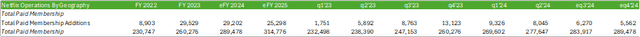

Using Netflix, Inc. (NFLX) as a proxy for streaming, total paid membership continues to grow both in the US and internationally as the firm expands into lower-tiered, ad-supported subscription offerings. The one caveat is that Netflix has yet to scale their advertising presence for the lower tiers to be accretive to ARPU. Though this isn’t necessarily a challenge Roku faces directly, I believe that the subscription growth alone is a positive factor for Roku’s streaming hours and ability to appeal to advertisers.

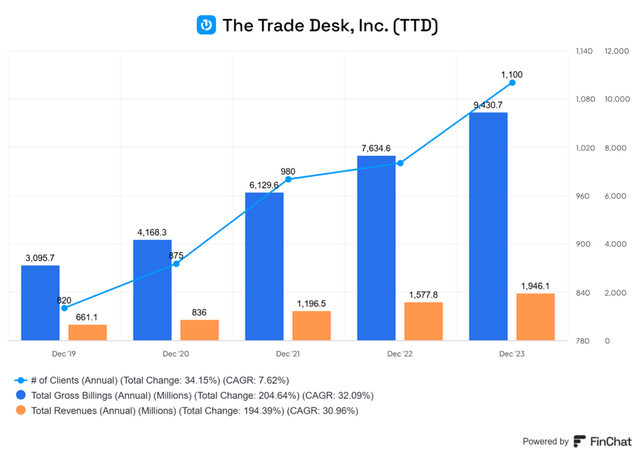

One factor that came up on their q2’24 earnings call was that Roku has diversified their advertisement streams from their internally-developed marketplace to competing marketplaces, such as The Trade Desk, Inc. (TTD).

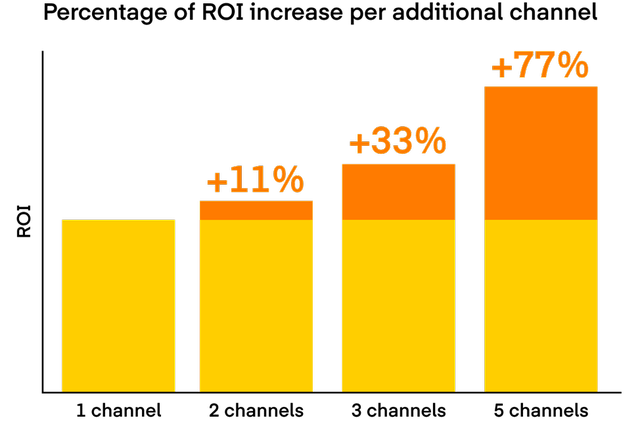

Though I believe diversifying their ad revenue presence away from strictly their internal marketplace may signal growth challenges, I do believe it will play a crucial role in Roku’s ability to a broader customer base to a certain degree. My thought process on the matter is that advertisers will need to go directly to Roku in order to place an advertisement on their platform. With diversified advertising streams, Roku can generate business indirectly through The Trade Desk’s omnichannel platform. This means that an advertiser can build out their advertising budget on a single platform as opposed to having to seek out Roku directly, making the budgeting process more likely to involve Roku. This outsourced methodology may also help Roku scale operations without the need to increase their opex and may result in stronger margins in future periods. In addition to cost management, I anticipate outsourcing part of ad sourcing will be accretive to revenue as part of The Trade Desk’s call-to-action. The firm boasts scaled improvements to ROI as advertisers diversify across multiple channels. Allowing for advertisements placed on Roku’s platform to be analyzed in a side-by-side comparison with other channels will either be an outstanding benefit to Roku or be its own detriment. I believe more light will be shed on the matter in eFY25 as firms compare ROIs between Roku and other channels.

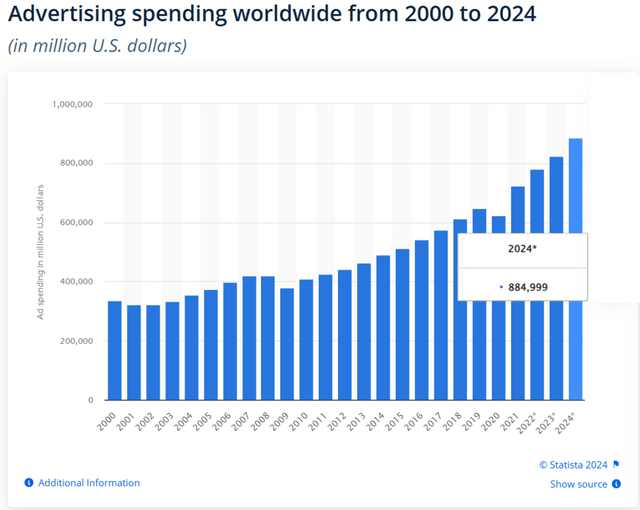

As for advertising spend, Dentsu forecasts 24.2% year-over-year growth in advertising spend in the connected TV space. I believe much of this growth will be driven by the transition from linear TV spend to streaming, especially as Netflix expands their advertising presence. This expectation in part is driven by the research firm’s forecast for television’s share of total advertisement spend from 23.1% in 2023 to 22.5% in 2024.

Gartner shared less optimistic figures for the 2024 forecast for marketing spend. The research firm found that marketing budgets have dropped from an average of 9.1% of company revenue in 2023 to 7.7% in 2024 on the back of consecutive annual declines post-C19. This decline could be exasperated if the global economy were to fall into a recession as budgetary constraints take hold on advertising spend. Statista forecasts 2024 to be a growth year for total global advertising spend. Given the mixed forecasts across platforms, I anticipate advertisement revenue will moderate into the end of eFY24 for Roku and may become more pressured into eFY25 as economic growth moderates. Given the 2.5% growth in retail spend for June 2024, I do not expect a decline in advertisement spend in the near term.

Roku Financials

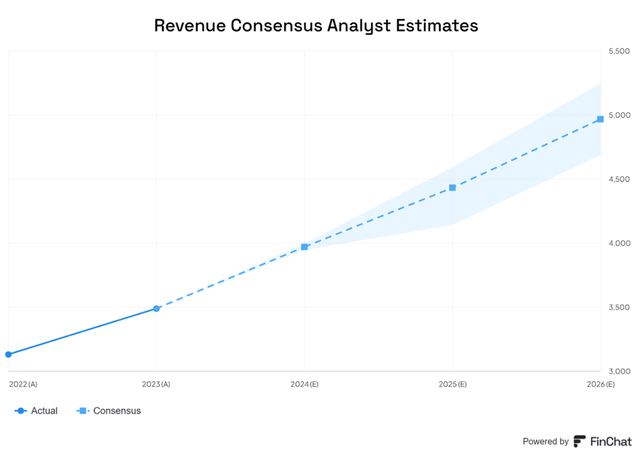

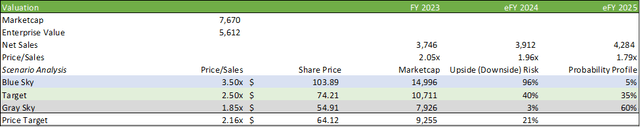

Looking at financials, I believe Roku will realize a 12% growth in net sales for eFY24 with sales moderating to 7% growth in eFY25. I anticipate device sales will be supported by Roku’s branded TVs; however, I do anticipate the segment will be faced with a more challenging gross margin as I do not anticipate scaling will take effect for some time as consumers remain pressured by inflation, resulting in fewer units sold. I believe the decline in total units sold will be offset by stronger revenue accretion from branded TVs.

I anticipate platform revenue to grow by 11% in eFY24 and 8% in eFY25 as the firm diversifies their advertising platforms. Though I anticipate marketing budgets to remain under pressure over the next few years as the economy undergoes some pressure on growth, I believe customers’ transition of advertisement dollars from traditional linear TV to SVOD will benefit Roku’s overall growth strategy. Given this diversified approach, I believe the platform margin may compress slightly as revenue will be shared with the third-party platform.

Valuation & Shareholder Value

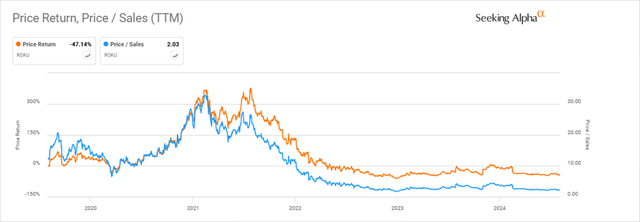

Roku’s trading multiple has remained in sharp decline over the last three years since the tech mania in 2021. I believe the moderation of Roku’s trading multiple is in part due to revenue growth as the shares trade at a more reasonable price.

Taking this factor into consideration, I believe shares may be at an approachable price given my revenue forecast through eFY25, now trading at 1.79x eFY25 price/sales. Using a probability matrix based on historical premiums, I believe ROKU shares should be priced at $64.12/share at 2.16x eFY25 price/earnings, leading me to upgrade my rating to a BUY.

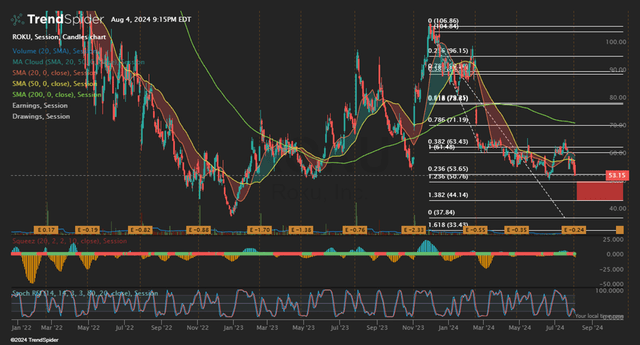

Looking at ROKU from a tactical perspective, I anticipate the selling to continue into the range of $44-50/share before completing the retracement. From there, I believe shares will realize a return to growth and reach my price target of $64.12/share.

Given the current market conditions, the sell-off of ROKU shares may be extended, and additional selling may be driven by macroeconomic data. A lower-than-expected retail sales print may put downward pressure on shares. CPI may also pose challenges to consumer spending habits as higher day-to-day cost of living supersede discretionary spending.

The broader risk-off theme will likely pressure shares to the downside as the tech rally appears to be taking a breather. There’s no telling exactly how long the selling will continue; however, I suspect that the sell-off may compound due to fears of a deeper sell-off. Given ROKU’s valuation, I believe a deeper sell-off will only make the shares more appealing. My recommendation is to patiently wait out a deeper decline and to start averaging into a position in the mid-to-high-$40s.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.