Summary:

- While RCL has outperformed the wider market, it was not able to escape the recent market correction surrounding high growth stocks.

- Even so, we are maintaining our Buy rating, attributed to the improved margin of safety to our long-term PT, accelerated profitable growth prospects, and reinstated dividends.

- With bookings still growing and demand remaining strong, it is unsurprising that RCL has already achieved its Trifecta Goals eighteen months early for the twelve months ending June 30, 2024.

- The growing customer deposit has also led to the raised FY2024 adj EPS guidance, as similarly observed in CCL’s robust earning results.

- With RCL still reasonably valued as the consensus raised their forward estimates, we believe that the stock remains a compelling Buy for growth and dividend oriented investors.

z1b

We previously covered Royal Caribbean Cruises (NYSE:RCL) in May 2024, discussing its excellent FQ1’24 earnings call and the raised FY2024 profitability guidance, with it further demonstrating its excellent reversal from the hyper-pandemic woes.

With the cruise company very likely to achieve its ambitious 2025 Trifecta goal in 2024 and the stock finally trading near to its historical valuations, we had reiterated our Buy rating at every dips.

Since then, RCL has continued to outperform the wider market at +24.2%, compared to the wider market at +9.6%, prior to the deep pullback in late June 2024.

The correction is well-warranted indeed, since the wider market has gotten overly exuberant surrounding high growth stocks, RCL included, attributed to the latter’s outperformance at +71% compared to the SPY at +24% on a 1Y basis prior to the recent correction.

Even so, we are maintaining our Buy rating for the RCL stock here, attributed to the improved margin of safety to our long-term price target, the accelerated profitable growth prospects, and the reinstated dividends. We shall discuss further.

RCL’s Investment Thesis Is Even More Compelling After The Recent Pullback

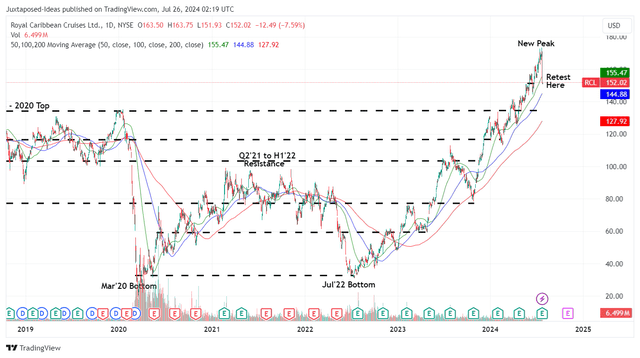

RCL 5Y Stock Price

Based on the price chart above, it is evident that RCL has had an extremely volatile four and a half years since the start of the COVID-19 pandemic, which decimated the travel/ cruise industry at its worst and the gradual reopening in 2022 triggering an unexpected pent up travel demand/ cruise boom.

With bookings still growing and demand remaining strong, it is unsurprising that the cruise company has already achieved its Trifecta Goals (adj EBITDA per APCD of at least $100, adj EPS of at least $10, and ROIC of 13% or higher) eighteen months early for the twelve months ending June 30, 2024.

For reference, RCL recently reported double beat FQ2’24 earnings call as well, with revenues of $4.11B (+10.4% QoQ/ +16.7% YoY), adj EBITDA of $1.55B (+32.4% QoQ/ +32.4% YoY), and adj EPS of $3.21 (+81.3% QoQ/ +76.3% YoY).

Much of the tailwinds are attributed to the higher load factors of 108% (+1 points QoQ/ +4 YoY) and expanding Net Yields of $269.61 (+9% QoQ/ +13.2% YoY/ +29% from FY2019 levels of $208.88).

Combined with the growing customer deposit at $6.2B (+3.3% QoQ/ +10.5% YoY), it is apparent that RCL continues to benefit from the promising travel trends, along with increased pre-cruise purchases/ onboard spending attributed to higher average prices.

Based on these developments, it is apparent that customer demand for cruising remains robust thus far, as similarly observed in its direct peer’s robust FQ2’24 earning results, Carnival Corporation (CCL).

The growing visibility into its near-term performance is also why the RCL management has offered an extremely optimistic FQ3’24 adj EPS guidance of $4.95 (+54.2% QoQ/ +28.5% YoY) while raising the FY2024 adj EPS guidance to $11.40 at midpoint (+68.3% YoY).

Readers must note that the latter has been consistently raised over the past two quarters, up by +18.7% from the original guidance of $9.60 (+41.8% YoY) offered in the FQ4’23 earnings call and by +5.5% from the raised guidance of $10.80 (+59.5% YoY) in the FQ1’24 earnings call.

With the crude oil spot prices still volatile from the ongoing geopolitical situation and sustained OPEC+ production cuts, we believe that the management’s ongoing fuel hedges at 61% (+7 points YoY) of estimated FY2024 consumption has also contributed to RCL’s lower expenses and robust profit guidance.

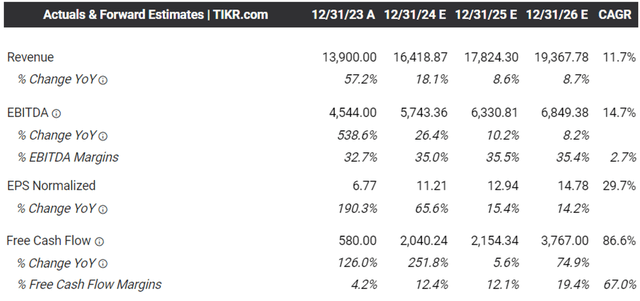

The Consensus Forward Estimates

And this is the reason why the consensus have moderately raised their forward estimates, with RCL expected to generate an accelerated top/ bottom-line growth at a CAGR of +11.7%/ +29.7% through FY2026.

This is compared to the previous estimates of +10.7%/ +23.7% and historical growth at +7.3%/ +1.5% between FY2016 and FY2023, respectively, with FY2024’s top/ bottom-line performance slated to well exceed its pre-pandemic FY2019 levels.

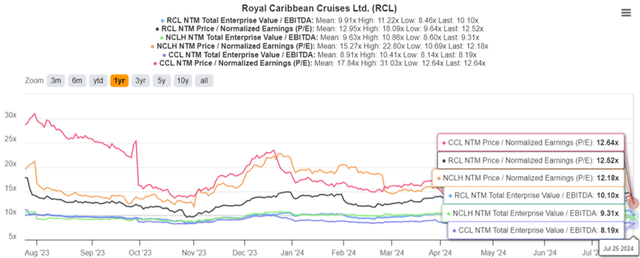

RCL Valuations

As a result, we believe that the recent correction offers opportunistic investors with the chance to dollar cost average and/ or establish new positions, attributed to RCL’s moderated FWD EV/ EBITDA valuations of 10.10x and FWD P/E valuations of 12.52x.

This is compared to the sector median of 9.65x/ 15.18x and its 3Y pre-pandemic mean of 10.85x/ 13.05x, respectively.

This is especially when comparing RCL’s growth rates to its peers, such as CCL at FWD EV/ EBITDA valuations of 8.19x with adj EBITDA growth at a CAGR of +16.5% through FY2026 and Norwegian Cruise Line Holdings (NCLH) at 9.31x/ +16.5%, respectively, implying that the former is still reasonably valued at current levels.

Based on RCL’s drastically healthier balance sheet at a net-debt-to-EBITDA ratio of 3.30x in FQ2’24 against the 7.07x recorded in FQ1’23, compared to CCL at 5.81x/ 16.89x and NCLH at 7.04x/ 13.05x, respectively, we believe that the former remains fairly valued here.

So, Is RCL Stock A Buy, Sell, or Hold?

RCL 5Y Stock Price

For now, RCL has drastically pulled back from the recent peak of $170s despite the recent FQ2’24 double beat earnings call and the reinstated dividend, attributed to the sudden reversal in market sentiments.

For context, we had offered a fair value estimate of $113.40 in our last article, based on the LTM adj EPS of $8.69 then and the FWD P/E valuations of 13.06x (with it nearing the 3Y pre-pandemic mean of 13.05x). This is on top of the long-term price target of $184.90, based on the consensus FY2026 adj EPS estimates of $14.16.

Based on RCL’s LTM adj EPS of $10.08 (+15.9%) and the same FWD P/E of 13.06x, we are looking at an updated fair value estimate of $131.60, with a slight premium in stock prices still observed despite the recent correction.

However, readers need not fret, since this pullback has been a gift with it offering interested investors with an expanded upside potential of +26.9% to our updated long-term price target of $193.00, based on the consensus’ raised FY2026 adj EPS estimates of $14.78 (+4.3% YoY).

While RCL’s recently reinstated quarterly dividend of $0.40 per share pales in comparison to its 2019 levels of $0.78, we believe that long-term shareholders will be happy to welcome the missing dividend since the start of the COVID-19 pandemic in March 2020.

This already allows long-term shareholders to DRIP and accumulate additional shares on a quarterly basis, despite the relatively low forward dividend yields of 1.05% at the time of writing, compared to its 2019 average of 2.7% and the US Treasury Yields of between 4.14% and 5.29%.

As a result of the still attractive risk/ reward ratio at current levels, we are maintaining our Buy rating.

Risk Warning

It goes without saying that with the stock market entering a mixed Q2’24 earnings season, that there may be further volatility in the near-term as we also enter the typically tough August month.

Interested investors may consider observing RCL’s movement for a little longer before adding according to their dollar cost averages and risk appetite. Even so, they should also size their portfolios accordingly, since the stock continues to face elevated short interest of 6.97% at the time of writing, with more profit taking likely in the near-term.

At the same time, readers must note that we are entering the second half of the year, with cruises typically less popular during winter months, with occupancy and net yields potentially lower in Q4’24. As a result, readers may want to temper their near-term expectations attributed to the seasonal cruising behavior.

Lastly, with June 2024 CPI still elevated and remaining well above the Fed’s target rate of 2%, it is uncertain if the Fed pivot may occur as expected in the September 2024 FOMC meeting. Assuming that interest rates remain high for longer, we may see discretionary spending further tighten – impacting RCL’s intermediate term prospects.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.