Summary:

- RCL is a leading cruise line company poised for long-term growth with strong revenue growth and positive earnings results.

- The cruise line industry, including RCL, has rebounded post-pandemic and is expected to continue growing in the $1.9 trillion vacation sector.

- Based on fundamental analysis and valuation, estimated earnings per share are already priced in and concerns exist regarding ROIC and lower ROA compared to 2019.

Marina113/iStock Editorial via Getty Images

Investment Thesis

My investment goal is to identify great companies that are trading within a margin of safety allowing for a long-term compounding investment. With summer just around the corner and corporate America gearing up for their yearly vacations, it’s time to evaluate some of the companies that would benefit from spending on experiences and travel. Royal Caribbean Cruises Ltd. (NYSE:RCL) is an international cruise company that has returned over 80% to investors over the last year and has continued to perform well after their pandemic lows. Barring another pandemic, I believe RCL is the leading cruise line company in the industry and is set up to perform well as a long-term investment. Investors should evaluate their risk tolerance for an investment in this growing industry and consider RCL in any market declines if fundamentals continue improving as they have over recent quarters. Based on a fundamental analysis including a conservative discounted cash flow model based on estimated earnings per share, RCL trades at a fair valuation for future earnings, and I am designating this as a hold to cautious buy right now because I believe earnings are already priced in.

Company Outline

Royal Caribbean Cruises Ltd. (RCL) is focused on patron experience, destination vacations, and currently operates 65 ships worldwide through their owned brands and partnerships. RCL is categorized in the consumer discretionary sector and in the hotels, resorts, and cruise lines industry. This categorization is important to factor in when making comparisons to the sector median values. Royal Caribbean Cruises Ltd. has consistently provided positive earnings results over the last few quarters and has both beaten and raised earnings estimates over this time. In their recent earnings call, the company mentioned continued growth in their bookings that have outpaced expectations significantly and highlighted the consumer trend of spending on experiences. Through investments into Royal Caribbean Cruises Ltd. properties such as Perfect Day at CoCo Cay and the new Royal Beach Club in Cozumel, Mexico, the company offers unique experiences to customers which should provide a meaningful return to investors.

Cruise Line Industry

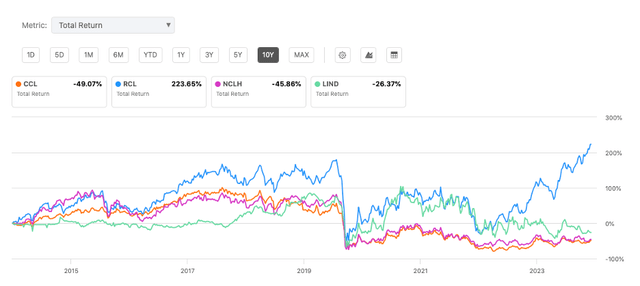

The cruise lines were hit hard during the pandemic, and the companies are still feeling the effects of the impacted two years with high debt levels and delayed projection. RCL has rebounded significantly since the pandemic lows and has returned over 200% to investors over the last decade. As described in their earnings call, the company anticipates continued growth in the $1.9 trillion dollar vacation sector with their industry-leading innovations in new ships such as the Icon of the Seas and innovations in new experiences. RCL has been the clear winner so far on a total return basis over the last ten years, far outpacing other cruise lines in the sector like Carnival Corporation & plc (CCL), Norwegian Cruise Line Holdings Ltd. (NCLH), and Lindblad Expeditions Holdings, Inc. (LIND). As you will see in the fundamental analysis, this may lead to some short-term price decline and reversion back closer to the industry averages over the short term, but this should open up the opportunity for investors to build a long-term position in the growing industry.

RCL Geographic Growth

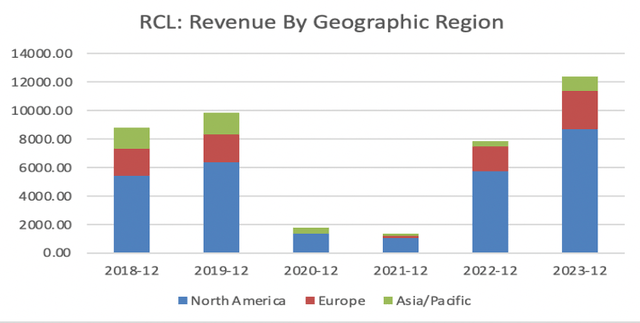

RCL has continued to not only beat their high expectations faster than anticipated but has also increased revenue over the last few years as they have recovered from the pandemic disruptions. Revenue from North America has grown by 61% compared to 2018 and ~36% compared to 2019. Moreover, revenue from Europe has also grown compared to 2018 and 2019, but the Asian/Pacific market has declined due to the continued closure of their ports. However, this market just opened up as described in their recent earnings call, and demand is strong enough in the Asian/Pacific market that a second ship was deployed. I expect revenue in this market will start to grow compared to 2018 and 2019 as the other markets have.

RCL: Revenue by geographic regions (North America, Europe, and Asia/Pacific) since 2018. (GuruFocus)

Fundamental Analysis

RCL is currently trading at a trailing twelve-month non-GAAP price to earnings ratio (PE) of 17.79, a forward PE of 14.07, and price to sales ratio of 2.69 and 2.43 respectively. Including the years this company was affected by the pandemic, this price to sales (PS) ratio is about 85% lower than the 5-year average PS ratio of the company. Comparing to sector medians, the price to sales ratio is significantly higher than the sector and significantly higher than other cruise lines.

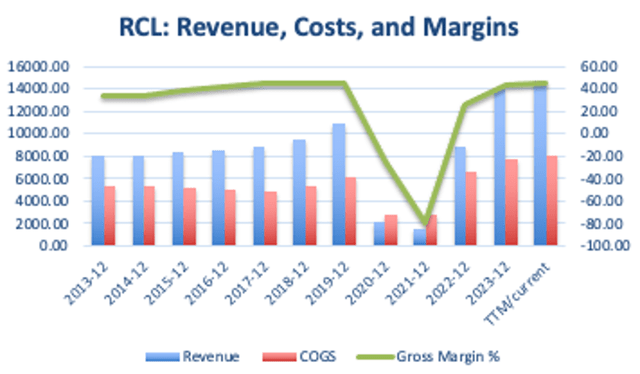

Compared to the current revenue, RCL has increased their revenue by 85% since 2013, and 35% since 2019. As shown above, the US remains the strongest consumer market for RCL, but other areas should continue to grow as well. Gross margins have remained around 40% now that the company is back in stride after the pandemic slow down. Costs are also 33% higher now than they were in 2019, and RCL had explained in the last few earnings calls that they are experiencing increased fuel costs and dry-docking costs.

RCL: Revenue, costs of goods sold (COGS), and gross margins since 2013. (GuruFocus)

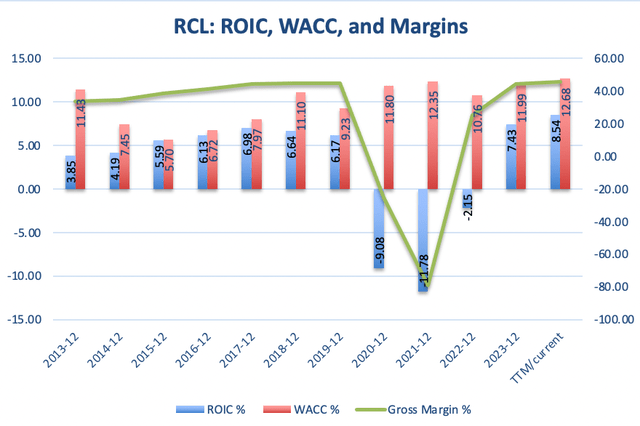

In value investing, investors should pay attention to return on invested capital (ROIC) and weighted cost of capital (WACC) as key fundamentals in their analysis. As you will see below, one concern I have, and investors should pay attention to, is the ROIC-WACC ratio. As it currently stands, RCL has a negative ROIC-WACC ratio, and this discrepancy is larger now than it was in 2019. RCL was significantly affected by the pandemic with very negative ROIC, and this is likely to affect the company moving forward as they need to pay off or restructure their debt. However, as ROIC and WACC are just one comparison to look at when considering a growing company, and a company investing in as many new assets as RCL to continue their growth. We will expand this by looking at return on equity.

RCL: Return on invested capital, weighted cost of capital, and gross margins since 2013. (GuruFocus)

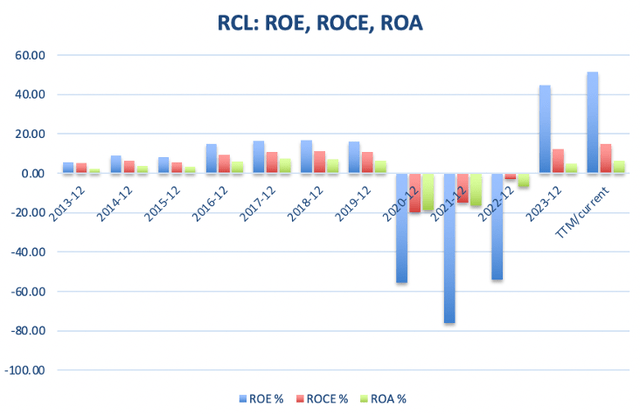

Return on Equity

RCL’s return on equity has grown significantly in recent years, by as much as 218% since 2019, which indicates that management has continued to make smart decisions with their investments to provide value for investors. We can also see a slight increase in return on capital employed compared to 2019 of about 37%. However, return on assets is still slightly below 2019 by 4% and this is something investors should take note of if return on assets does not continue to grow. If it continues to decline, this may indicate some of their newer ships are not producing the returns they expected based on the price they paid to build the ship or that their exclusive locations are not as popular as expected.

RCL: Return on equity, return on capital employed, and return on assets, since 2013. (GuruFocus)

Fair Value

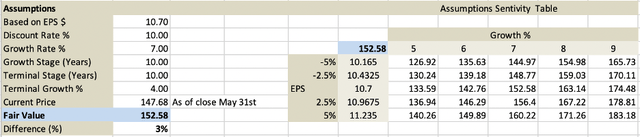

Using a discounted cash flow model (DCF) based on earnings per share and an estimated growth rate of 7% over the next 10 years, and 4% for the 10 years after that, I calculated fair value for RCL to be around $152.58 per share. Given this, the company is currently trading around fair value of their expected earnings of $10.70 per share. This indicates that their EPS estimate for the rest of this year is already priced in at this point, and investors should take note of the short-term valuation before starting a position or adding to their current position. Given that this model is factoring in a 10% discount as well to attempt and create a margin of safety, some short-term price decline may be a time to consider starting a position given the larger margin of safety with expected EPS.

RCL DCF Model based on estimated earnings per share discussed during recent earnings call. (Author’s Calculations)

Concerns About Investing in RCL

My concerns based on fundamental analysis are that investors should pay attention to key fundamentals that currently do not represent the company as a buying opportunity, such as ROIC and lower ROA than in 2019. With a negative ROIC-WACC ratio, this indicates there may be increased risks with the company’s investments if they do not start generating more revenue to account for the increases in costs. Additionally, this shows they are currently losing money on investments they are making on average rather than providing a return on capital.

RCL is also trading at fair valuation compared to their expected earnings per share of $10.70, if they do not hit this mark then the shares will be significantly impacted from the prices they are now. This is not as much of a concern because they have been able to successfully meet their high marks in the past, but, there is a recent news article about price cuts to some of the summer cruises do to lower demand than expected. If this is the case, investors should watch out for a decline in foot traffic as this will have an impact on earnings next quarter, and thus would put pressure on the current fair valuation estimate.

Limitations to Investment Thesis

This valuation model above is conservative, assuming a 10% discount rate to account for the unpredictability of the macroeconomy over the short term and to attempt and build in a margin of safety. Additionally, as the company has shown, RCL has consistently beat their high expectations in good economic times and has continued to raise the bar over the last few quarters. If they returned just 5% higher earnings per share rather than the estimated $10.7, they would be closer to fair value at $160 per share. Moreover, as valuation models are based on assumptions, and businesses are dynamic, changes in the economic environment or changes in the underlying assumptions would change the outcome.

Conclusion

Based on the fundamental analysis above, I am designating RCL as a hold to cautious buy right now because I believe future estimated earnings per share are already priced into this company, however, they have a history of outperforming their estimates. As a conservative value investor, I miss out on opportunities that do not meet my strict fundamental framework criteria. With RCL having lower ROIC than WACC and assuming the company meets their target earnings per share of $10.70 for the DCF model, this company trades at a premium that I would not invest in right now. However, the story of the company and history of success in this growing industry represents potential as a long-term investment, even at a premium price. Investors should be cautious at this price as it may lead to higher risk of loss of capital as there is a limited margin of safety if the company fails to meet their outlook. If foot traffic were to decrease and have any decline in revenue, this company may be significantly affected in the short term given the premium price.

In summary, given the fundamental analysis above and the key areas of concern, I am designating this company as a hold at this price. This analysis is solely my research and contains my opinions about the company. Investors should do their own research before making any investment decisions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.