Summary:

- Royal Caribbean Cruises has rebounded from pandemic challenges, surpassing pre-pandemic highs and benefiting from the resurgence in global cruise demand.

- The company is well-positioned with strategic growth, expanding fleet, and workforce to capitalize on higher yields and profitability in the cruise industry.

- With strong Q2 results, increased guidance, and a positive future outlook, Royal Caribbean offers promising potential for investors with a 53% upside potential by 2027.

KenWiedemann/iStock Unreleased via Getty Images

Introduction

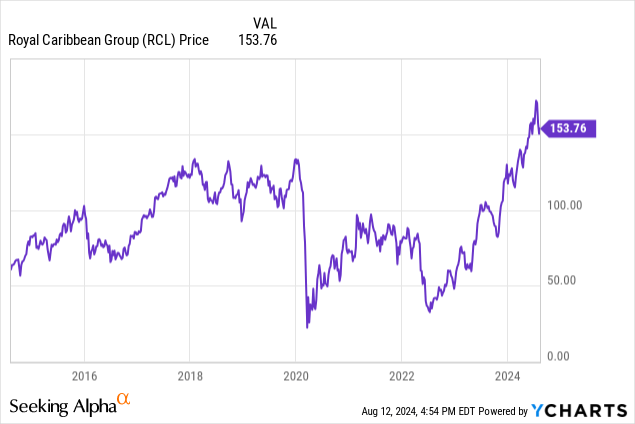

Royal Caribbean Cruises (NYSE:RCL) has sailed through turbulent waters over the past few years, facing the suspension of almost all operations during the Covid-19 pandemic. However, the global cruise industry has experienced a resurgence in demand, which only looks set to continue. Royal Caribbean, as one of the largest players in the market, looks set to benefit significantly from this renewed demand. With significantly lower debt levels than its rivals, it looks best placed to ride higher. Despite the share falling over 80% at the onset of the pandemic, the shares have now surpassed their pre-pandemic high. With the outlook bright, here’s why I believe it is time for investors to climb aboard.

Company Overview

Royal Caribbean Group, headquartered in Miami, Florida, is one of the world’s leading cruise companies. With roots tracing back to 1968, the company has grown as a result of acquisitions and joint ventures to become one of the largest cruise companies in the world. With operations globally and operating through its four brands: Royal Caribbean International, Celebrity Cruises, Silversea Cruises, and TUI Cruises, a joint venture, it serves millions of customers annually. It operates over 65 ships and is a dominant force in the global cruise industry, helping to meet the growing demand for cruises.

Growing Cruise Demand

The wind is blowing in Royal Caribbean’s favor. The cruise industry is experiencing a robust resurgence in demand, with the number of global cruise passengers hitting 31.7 million last year, surpassing pre-pandemic levels by 7%. Current projections indicate this will soar to reach nearly 40 million in 2027, underscoring the strong and growing demand for cruise vacations.

As cruise holidays continue to capture an increasing number of young travellers, compared to their traditionally older clientele, underlying demand is set to remain resilient with a wider customer base. JPMorgan (JPM) expects the cruise industry to continue capturing an increasing share of the global vacation market, reaching a 3.8% share in 2028. This growth, particularly in the value segment, helps mitigate potential headwinds from weaker consumer spending.

Royal Caribbean’s CEO Jason Liberty highlighted the exceptional demand for cruise vacations, stating:

Exceptional demand for our vacation experiences has accelerated our performance by generating significant yield growth over the past several years”.

To meet this surging demand, Royal Caribbean is expanding its fleet and workforce. The company plans to recruit approximately 10,000 workers this year as it adds three new ships. Royal Caribbean is actively engaging with tourism boards and port operators worldwide, including in the British Virgin Islands, St. Maarten, and the Gambia, to help plan their cruise operations.

One of the critical factors restricting this growth is the limited capacity expansion during the pandemic. Few cruise operators placed orders for new ships, which has effectively constrained supply. Although this constrains potential passenger growth, this move has enabled operators to significantly raise ticket prices, enhancing profitability. For instance, Royal Caribbeans’ net yield, representing the net revenue per passenger per cruise day, was up 13% in the 2nd quarter of 2024 compared to a year earlier.

Overall, the picture for Royal Caribbean is one of strong demand coupled with strategic growth, positioning the company to capitalize on higher yields and increased profitability. With limited supply and high demand driving up industry-wide prices, and new ships on the horizon, Royal Caribbean is well-positioned to lead the cruise industry’s continued resurgence.

Falling Debt

It is no secret that during the pandemic, cruise operators were forced to borrow heavily, on top of issuing highly dilutive equity at low prices. This has sapped investors’ confidence in these companies and resulted in higher interest costs, exacerbated by the recent increase in interest rates. At its peak, Royal Caribbean’s net debt grew from $11.5 billion at the end of 2019 to a high of $22.4 billion at the end of the third quarter of 2022. Since then, net debt has seen small decreases to reach $21.4 billion at the end of the latest quarter.

Things look slightly better on a net-debt to EBITDA ratio, where Royal Caribbean traded on a value of 3.5 times in 2019, which had risen to 4.7 times at the end of 2023. Compared to its competitors, Carnival (CCL), and Norwegian (NCLH), Royal Caribbean is the least leveraged of the three, with the lowest net-debt to EBITDA ratio. Additionally, debt makes up only around a third of its enterprise value, compared to 69% at Norwegian and 63% at Carnival.

With strong demand for cruises, this should translate into higher revenues, profits, and free cash flow enabling Royal Caribbean to continue on its deleveraging path, putting the company on a solid future footing.

Q2 2024 Results

On July 25th, Royal Caribbean released its results for the second quarter of 2024. These results significantly surpassed expectations and highlighted the company’s continued strong recovery and growth post-pandemic. Revenue for the quarter came in at $4.11 billion, a 16.8% increase year-on-year and beating Wall Street’s consensus by $60 million. This surge was driven by strong demand for the company’s cruises, coupled with strong onboard spending.

Gross margin yields saw an uptick, rising by 24.2%, whereas net yield increased by 13.3%. Adjusted net income during the quarter came in at $882 million, a substantial increase from $492 million in the same period last year. This translated to an adjusted EPS of $3.21, vastly surpassing the consensus estimate of $2.75, but also a considerable improvement from $1.82 per share a year ago.

In light of the strong Q2 results and favorable market conditions, Royal Caribbean raised its full-year guidance to a range of $11.25-$11.45 a share, reflecting a 68% year-on-year growth rate, and above the consensus of $11.07 per share. Additionally, the company reinstated its quarterly dividend at $0.40 per share, marking the first dividend payment since it was halted in 2020 due to the pandemic.

This quarter also saw the company achieve its Trifecta goals, a three-year initiative to drive performance across the business. These goals were achieved 18 months ahead of schedule, with triple-digit adjusted EBITDA per available passenger cruise day, a return on invested capital in the teens, and double-digit adjusted EBITDA. This was achieved this quarter, in part due to the high demand for cruises, particularly for Europe and Alaska.

Overall, Royal Caribbean produced a positive set of results. These reinforce Royal Caribbean’s strong position in the cruise industry, with the company well positioned to continue capitalizing on the growing demand for cruise vacations and delivering substantial shareholder returns.

Valuation

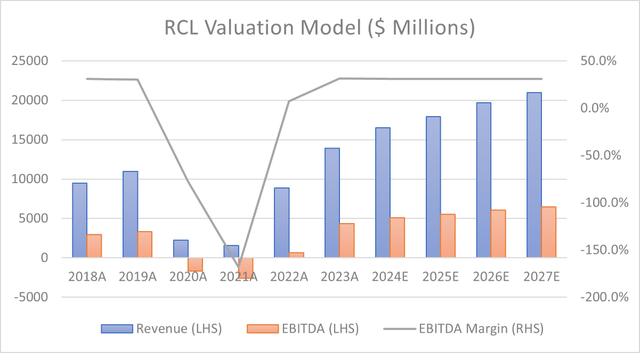

To value Royal Caribbean, I employed an EV/EBITDA methodology for the period to 2027. I assumed the share count would remain constant at 257.4 million shares and for purposes of simplicity, I assumed cash and debt levels remain constant.

For future revenue, I used analyst estimates on Seeking Alpha, given their comprehensive industry insight and knowledge of market trends. To determine an appropriate EBITDA margin, I took the average of the 2018, 2019, and 2023 financial years, ensuring that any pandemic effects were largely excluded. This resulted in an EBITDA margin of 30.8% being used.

Created and calculated by the author based on Royal Caribbean Cruises’ Financial Data found on Seeking Alpha and the author’s projections

To determine an exit multiple, I took the average of the multiple in the years of 2014 to 2019. This ensures that any pandemic effects are excluded. Although RCL’s debt levels have changed over the period, given the strong positive outlook, I believe it is appropriate for the stock to trade at least at its pre-pandemic average. This gave an EV/EBITDA exit multiple of 12.7, only slightly higher than the 11.83 multiply the shares currently trade at.

Performing the calculations implies a market cap of $60.7 billion at the end of 2027. With 257.4 million shares outstanding, this gives a price target per share of $235.90, an upside of 53% from the current share price for a CAGR of 14% over the next 39 months.

Risks

When investing in cruise ship companies like Royal Caribbean, there are three main risks I believe it is important to consider.

Firstly, the impact of the economic cycle on cruise companies. Cruise companies are incredibly sensitive to the economic cycle. During recessions and economic slowdowns, discretionary spending on travel tends to decline significantly, leading to lower bookings and revenue. With high fixed costs, this demand reduction significantly impacts cruise lines profitability. Although the US economy is still growing, I believe it is important for investors to continue to look out for the signs of a slowdown.

Secondly, the fuel price. Fuel prices, and in particular marine bunker fuel prices, are a significant cost for cruise operators. In 2023 fuel represented 15% of all cruise operating expenses at Royal Caribbean. Although oil prices have been fairly stable the past few months and decreased slightly since last year, any increase in oil prices will reflect in higher operating expenses. This risk can be partially mitigated by hedging; however, this would not fully insulate the company from a longer-term rise in the fuel price.

Lastly, health and safety concerns. During the Covid-19 pandemic, the vulnerability of cruise ships to infection outbreaks was shown. Although this has now passed and demand has rebounded, future pandemics could severely knock demand for cruises. Even if minor compared to the Covid-19 pandemic, quarantine measures and bad publicity could severely decrease consumer demand for cruises, negatively impacting bookings and operations.

Conclusion

In conclusion, Royal Caribbean Cruises stands poised to capitalize on the surging demand for cruise holidays. With a strong recovery from the pandemic challenges, the company has surpassed its pre-pandemic highs and continues to expand to meet growing demand. Coupled with robust earnings growth and a better debt profile than its competitors, Royal Caribbean offers promising potential for investors to ride the wave of the cruise industry’s resurgence. Given these factors, I assign the shares a “Buy” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.