Summary:

- Royal Caribbean Cruises is a top cruise operator, recovering strongly post-pandemic with a 100.5% return over the last 3 years.

- RCL’s premium pricing and strong brand have led to near-record net margins and revenues surpassing pre-pandemic levels, indicating robust growth.

- Despite significant debt, RCL’s solid financial management and favorable financing terms make its debt manageable, with a net debt to EBITDA ratio of 4.7.

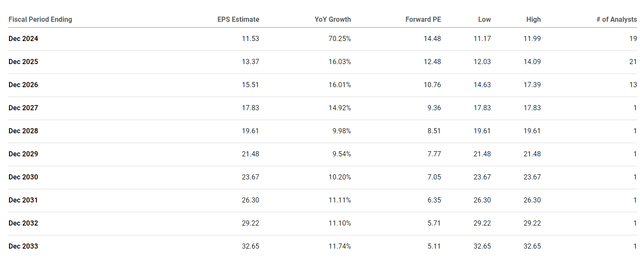

- RCL is undervalued at 15.02x forward GAAP earnings, with analysts expecting earnings per share to double over the next 5 years.

Alan Morris/iStock Editorial via Getty Images

There was no industry harder hit by the Pandemic than the cruise industry. While many sectors face solvency issues and obvious business challenges, the constant media coverage of people forced to live temporarily on ships before health officials would allow them to re-enter their ports of origin was unique.

The Royal Caribbean Cruises Ltd. (NYSE:RCL) is one of the best-known and largest cruise operators worldwide. RCL is also the most recognizable brand in the industry, despite being a somewhat smaller company as measured by cruise ships than Carnival Corporation & plc (CCL).

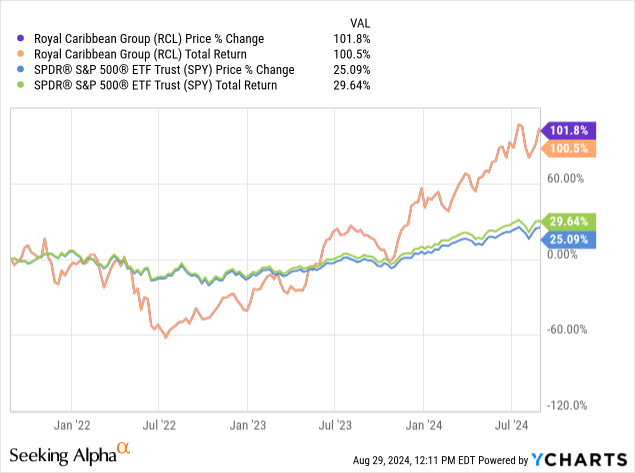

RCL’s stock was predictably hit hard during and in the immediate aftermath of the pandemic, but the company has recovered well.

The Royal Caribbean Cruises has offered investors total returns of 100.5% over the last 3 years, while the S&P 500 (SPY) has risen 29.64% during the same timeframe.

Today, I am initiating coverage of the Royal Caribbean Cruises with a buy. The company is the best-run cruise operator in the industry and RCL is able to charge premium prices for the corporation’s many different product offerings. The cruise operator should be able to sustainably grow earnings at a double-digit rate for some time, the long-term outlook for the industry is strong, and RCL’s recent earnings and bond offerings show that the company’s debt is more than manageable. The leading cruise operator looks undervalued using multiple metrics.

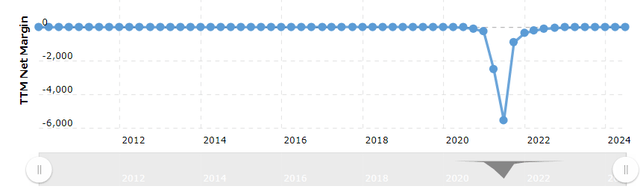

RCL is able to charge premium prices for the company’s many different standard and luxury cruise offerings, the company’s strong brand and impressive pricing power have enabled the cruise operator to reach near-record net margins just three years removed from the Pandemic. The average cost of a 7-day cruise ranges between $800 to $2000 a person, and the company also offers a variety of luxury options, including 9-month cruises with costs ranging between $54,000 to as much as $117,000 a person. The company’s current net margin of 16.31% is at the high end of the company’s 10-year range.

A Chart of RCL’s Net Margins (Macrotrends)

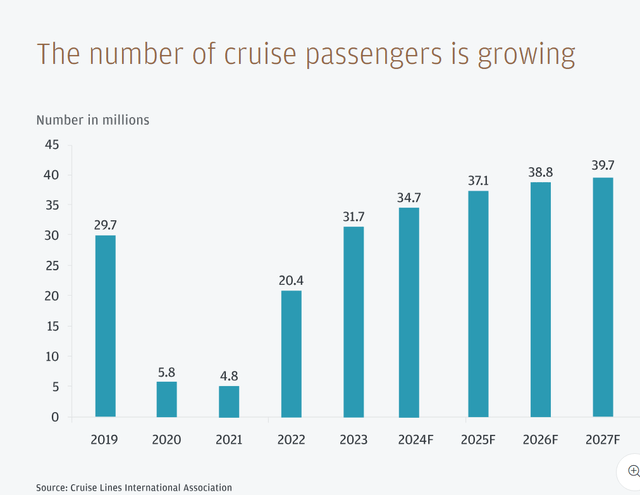

RCL caters to a higher-end customer and with many people at or near retirement in the US with significant disposable income, the demographics of America are very favorable for this company. The cruise industry is expected to grow by nearly 18% over just the next 2 years.

Expected Growth Rates in the Cruise Industry (Cruise Lines International Association)

The number of people taking cruises in 2023 also rebounded to levels higher than those seen before the Pandemic, this industry has successfully repaired the image of the sector. RCL’s revenues have also already exceeded pre-pandemic levels as well. The company earned $13.9 billion in 2023, easily surpassing revenue of $10.951 billion in 2019. While some of the company’s recent earnings likely came from pent-up demand, with RCL’s 2023 earnings coming in below 2024 levels, the cruise industry is expected to grow by nearly 20% in just the next 3 years, and management is also still bringing new ships online to the company’s fairly small fleet of 28 ships.

A Chart of RCL’s Revenues (Macrotrends)

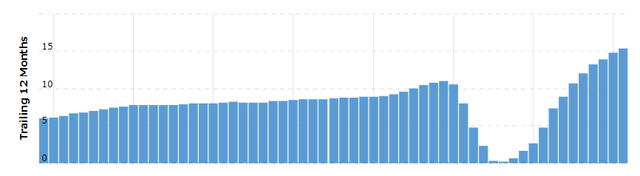

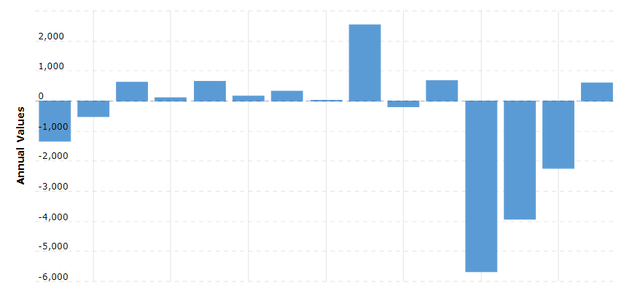

RCL has also managed the company’s balance sheet very well despite having to take on a significant amount of high-interest debt during the Pandemic. Even though the company has a long-term debt of $19.78 billion and a total debt of nearly $21.77 billion, the cruise operator’s net debt to EBITDA ratio is a solid 4.7. While the company is still leveraged with interest coverage at nearly 2.1, RCL has also been able to recently obtain financing at very appealing rates. The company just closed an unsecured debt offering of $2 billion in notes due in 2033 at 6%. The cruise operator also continues to grow earnings and revenues at a double-digit rate, with revenues of $13.9 billion in 2023 nearly 30 percent above pre-pandemic levels. The company’s consistent and substantive growth should offset modest free cash flow generation of 20% of EBIT in 2023. RCL’s free cash flow levels have been rising for 4 consecutive years as well.

A Chart of RCL’s Free Cash Flow (Macrotrends)

Management used the money to refinance higher-interest debt that is due in 2029 and 2030. RCL closed an unsecured $3.5 billion dollar credit facility with JPMorgan Chase & Co. (JPM) at the end of 2023 as well. The banks and credit markets are clearly willing to lend to RCL at appealing levels even in a high-rate environment where the growth outlook remains weak.

This is why Royal Caribbean Cruises looks undervalued at 15.02x expected forward GAAP earnings and 11.34x projected forward EBITDA. Some analysts expect RCL to be able to double earnings per share over the 5 years, and revenues over the next 7 years. While the cruise operator likely did benefit from pent-up demand in 2023, RCL also continues to add to the company’s relatively small fleet of 28 ships, with new ships coming online this year and in 2025, and the overall sector is expected to grow by nearly 20% in just the next 3 years. RCL’s core customer is also at the higher end, so the company should be able to continue to raise prices without seeing significant demand erosion.

The likely rate cuts that should occur with the growth outlook in the US and abroad weakening should help the company refinance the significant but clearly manageable debt the cruise operator has.

RCL Revenue Estimates (Seeking Alpha)

All investments have risks, and there are signs of an economic slowdown with retail spending slowing and the first quarter jobs report revised down. Still. While a significant and extended slowdown would obviously negatively impact RCL, the company targets a higher-end customer with more disposable income, and recent retail spending data suggests the economy is likely to avoid a severe recession. Also, if inflation were to begin to accelerate again, the Fed would likely be forced to pause the plan to cut rates, and that would put pressure on this cruise operator’s significant debt. Still, these scenarios remain unlikely.

The best investments are often made in times of turmoil and uncertainty. While allocating capital in a strong economic environment is usually fairly easy, the best opportunities often come when fear and uncertainty are elevated. While Royal Caribbean was as hard hit as any company during the pandemic, the company is very well positioned now for what should be a period of significant and prolonged growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.