Summary:

- Royal Caribbean has rebounded impressively post-Covid, showcasing strong financial health and impressive EPS growth, despite a significant debt load.

- The company’s valuation appears reasonable at 3x sales and 18x FWD net income, making it attractive compared to peers and the consumer discretionary sector.

- Looking forward, we expect that strong consumer demand into 2025 will power growing top and bottom-line results.

- We rate RCL a ‘Strong Buy’.

Aitormmfoto/iStock Editorial via Getty Images

We’ve never been big fans of cruise ships.

The packed boat, the sea sickness, the frequent stops – something about the experience has never quite clicked.

And yet, every year, the biggest cruise lines entertain millions of passengers who happily fork over thousands of dollars a head for the experience.

Because of this aversion, we’ve never really looked more deeply into the cruise line business, but today, we thought we’d dive into Royal Caribbean (NYSE:RCL), the largest public cruise operator (by market cap) globally.

After a more thorough examination of the company, we’re impressed.

The company is financially strong, and in relatively solid shape following the Covid mess. EPS growth has also been impressive.

While we’re a little concerned about the company’s massive debt load, balances have been moving in the right direction, and RCL’s GPOA remains fantastic for the industry.

With a robust-looking demand environment going into 2025, we like RCL’s prospects over the short, medium, and long term.

Today, we’ll look more deeply at RCL’s financials, evaluate the valuation, and explain why we’re ultimately so bullish on this best-in-class mega cap cruise operator.

Sound good? Let’s dive in.

RCL’s Financials

As always, let’s start with the financials.

RCL’s business is relatively simple.

First, the company invests into hard assets – enormous ships packed with entertainment that can ferry thousands of passengers across picturesque stretches of sea and coastline.

Second, the company charges for tickets and onboard extras, which form the basis of the company’s revenue.

Third, after subtracting out cruise-level costs, marketing, D&A and SG&A, you end up with the company’s operating income.

From there, it’s a balancing act of managing long-term debt, investing into new ships, and returning capital to shareholders.

Right now, the company is doing well, but it’s been a long road back to health following a stretch of trouble that was caused by the Covid pandemic.

After taking on debt to remain in business when bookings dropped to near-zero, the company has capitalized off pent-up travel demand, which – perhaps uniquely for cruise lines – hasn’t slowed down despite broader slowdowns in consumer sentiment and weakness in other travel operators.

On a straightforward basis, the company has ~$32 billion in net property, almost all of which is made up of the company’s 65 cruise ships separated across 5 brands.

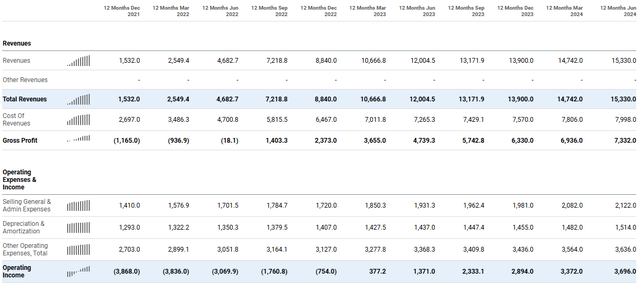

On this $32 billion in assets, over the last twelve months, RCL managed to produce $15.3 billion in sales and $7.3 billion in gross profit, which includes costs related to cruising & directly delivering the product to customers:

Seeking Alpha

This works out to an incredibly robust 22% GPOA, which indicates that RCL’s unit economics for investing into more cruise capacity is extremely strong.

On top of this has been a strong rebound in operating income, with a TTM swing from -$3.8 billion to +$3.6 billion over the last 3 years. This bounce back has largely been caused by expanding revenues above a fixed cost base that was established pre-pandemic and designed to have higher throughput, so it can be argued that operationally RCL is also ‘out of the hole’.

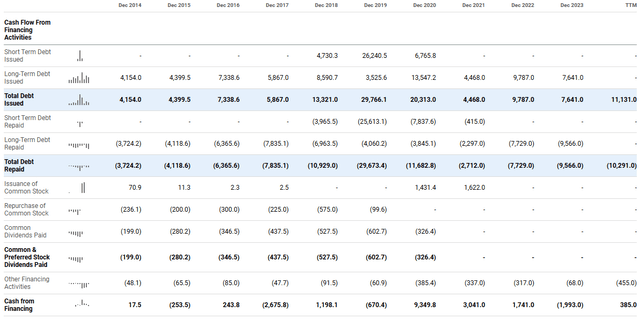

On the debt front, RCL did take out significant net debt in 2020, which has led to a higher-than-usual ongoing long-term debt load for RCL. However, a lot of this debt was financed at Covid rates, and as a result, we haven’t seen surging interest costs as a result of higher rates in 2022, 2023, and 2024:

Seeking Alpha

Interest Costs (Seeking Alpha)

All in all, RCL appears to be on the right track, and the company achieving a return to ‘Base Camp’ 18 months ahead of schedule emphasizes how well the company has done post-pandemic:

Less than two years ago, [we] announced Trifecta, a three-year financial performance program that created the pathway back to what we internally call base camp. We said we would deliver triple-digit adjusted EBITDA per APCD, double-digit adjusted earnings per share and return on invested capital in the teens.

Today, I’m delighted to share that we have achieved all three Trifecta goals on a trailing 12-month basis, 18 months ahead of the schedule.

With respect to how the company is doing more recently, in Q2, management talked a bit about the robust, ongoing demand environment, which may be surprising given the current state of consumer sentiment:

We have seen an incredibly robust booking and pricing environment across all our key itineraries, which is not only setting us up for success in the future periods, but also contributed to the outperformance in the second quarter.

This, coupled with continued strength in onboard spend, which is heavily influenced by our pre-cruise commercial engine, drove the revenue and earnings outperformance for the quarter.

The North American consumer who represents approximately 80% of our sourcing this year continues to be robust, driving strong yield growth across all key products. In addition to strength in the Caribbean, European and Alaska summer itineraries are performing exceptionally well, and we have experienced greater pricing power than expected since our last earnings call, leading to increased expectations for yield growth.

This sentiment was echoed on the recent Q3 Carnival (CCL) earnings call a few weeks ago, and as a result, we’re bullish going into RCL’s upcoming Q3 release:

Strong demand enabled us to increase our full year yield guidance for the third time this year.

Looking forward, the momentum continues as we actively manage the demand curve. At this point in time, 2025 is a[t] historical highs on both occupancy and price. All core deployments are at higher prices than the prior year. Every brand in our portfolio is well booked at higher pricing in 2025…

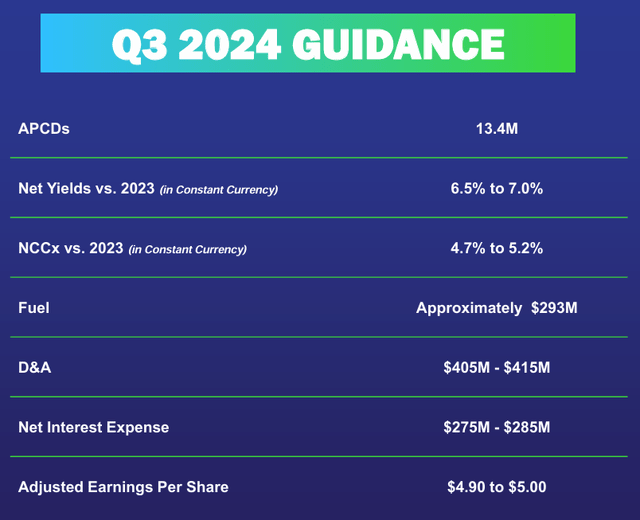

For Q3, RCL management have projected EPS in the $4.90 – $5.00 range, but given that demand for cruises still appears to be strong, we think the release will likely top this growth:

IR

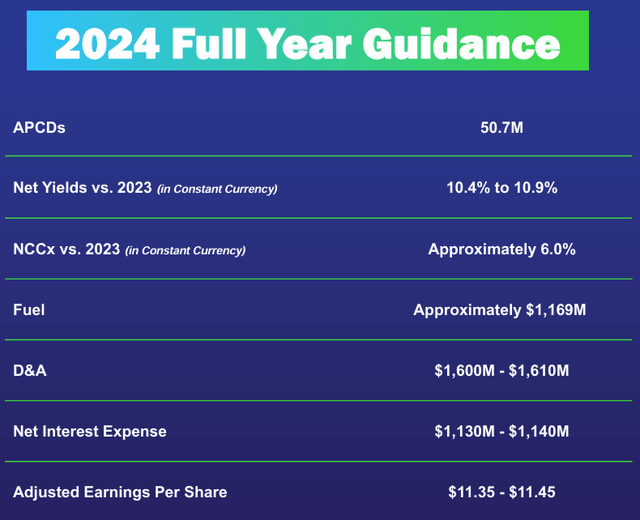

For FY ’24 guidance, management has guided to $11.35 – $11.45, but again, given how this was increased in April, and then again in June, we think this will get boosted once more in October:

IR

Theoretically, RCL is once again operating at pre-pandemic levels in terms of gross profitability, which means that future EPS growth will be contingent on higher revenues facilitated by pricing power and higher cruise capacity.

That said, given the robustness of the demand environment, we think the short and medium term outlook for RCL appears strong, and we’re bullish on the company’s organic results headed into Q3.

RCL’s Valuation

But is the stock a ‘Buy’?

Sure – the company has done well coming out of Covid, and ROA and profitability has come roaring back, giving the company adequate capital to re-invest, reward shareholders, and pay down debt.

However, if the stock is too expensive, then we’d prefer to wait for a significant dip for the opportunity to buy it.

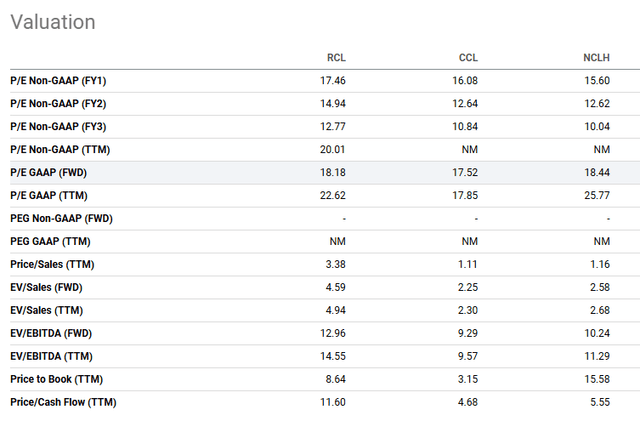

Thankfully, RCL seems reasonably priced at around 3x sales and 22x net income.

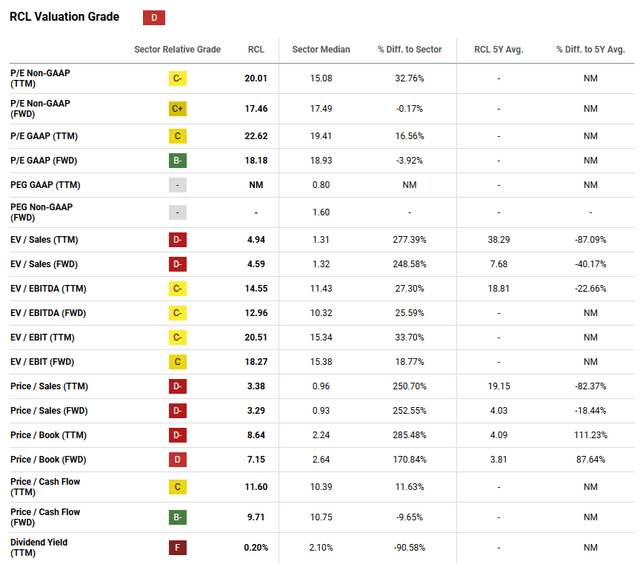

Sure, Seeking Alpha’s quant rating system thinks that RCL is a bit pricey, but this is mostly due to how quickly TTM results have come ‘roaring back’. As a result, they undercount some of the ‘meat’ in EPS that we will likely see over the NTM:

Seeking Alpha

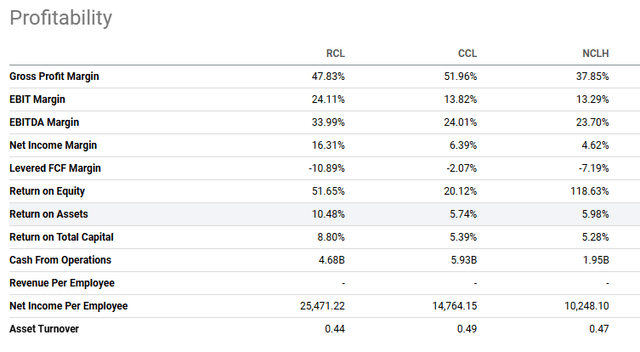

With a FWD GAAP P/E of 18x looking ahead, and given the company’s strong ROA and profitability comps, RCL appears well priced against competitors and the consumer discretionary (XLY) sector at large:

Seeking Alpha

Seeking Alpha

As a result, we think the shares appear highly attractive on both an organic results & valuation basis.

Risks

While we are bullish on RCL, there are some risks to consider.

First off, the company’s shares are hot – perhaps too hot.

Looking at RCL on a weekly chart reveals a very strong price trend over the last two years, which may be a bit ‘overbought’:

TradingView

As you can see, RCL’s weekly RSI indicator comes in at around ~75, which is quite strong. To remedy this, over the short term, the price may correct lower, or the price may trade sideways for some time to digest the recent move from $132 in August through $203 today. Any way you slice it, the stock appears overbought going into earnings, which

Second, RCL’s Q3 earnings release is right around the corner, which will no doubt bring volatility into the stock.

Given that we only get new fundamental data 4 times a year, this tent-pole data release will tell us a lot about how RCL is faring, especially when it comes to the consumer environment.

If management doesn’t sound as bullish as CCL’s did two weeks ago, then it could be an issue for the stock.

Finally, RCL remains exposed to macro risks, like interest rates, consumer spending, and black swan events like Covid. There isn’t much to be done about these from a risk management perspective, but if any of them flare up, it could cause the stock to re-rate lower.

Summary

Overall, though, we really like where RCL is on a fundamental basis. The company is back to a strong operating position, ROA is best-in-class, and consumer demand into 2025 is projected to be strong.

On top of that, shares appear reasonably priced.

While there are risks around the overheated technicals and the upcoming earnings report, we think that they shouldn’t dissuade you from a long-term entry into this profit machine.

As a result, we rate RCL a ‘Strong Buy’.

Cheers!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.