Summary:

- Carnival reported strong bookings, indicating sustained travel demand and growth potential beyond 2025.

- Royal Caribbean’s promising EPS growth highlight the cruise industry’s robust recovery and future profitability.

- Despite high debt levels, Royal Caribbean’s strategic investments and dividend initiation underscore its commitment to long-term growth and shareholder returns.

- The stock remains undervalued at just 11x 2026 EPS estimates.

Ceri Breeze/iStock Editorial via Getty Images

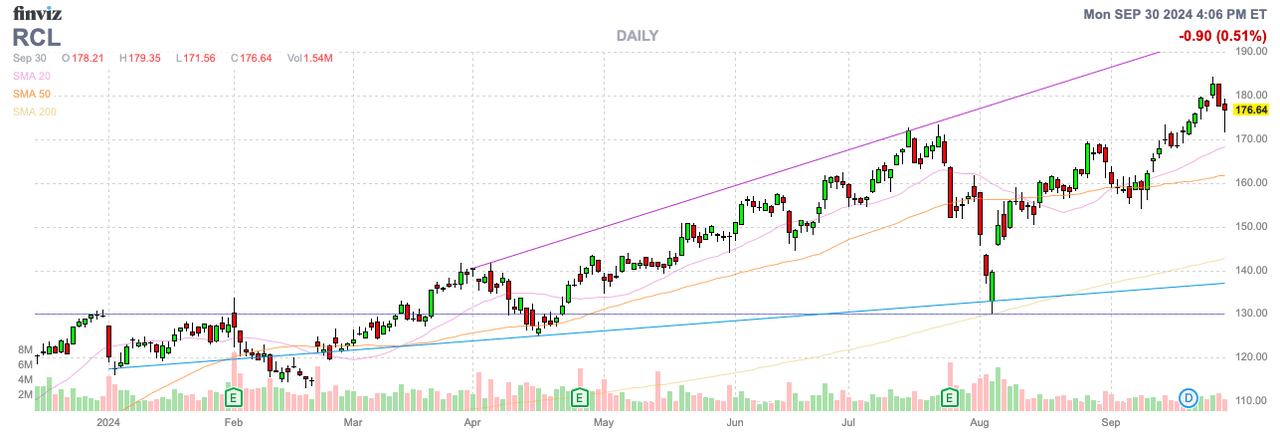

Carnival Corporation (CCL) just reported another strong quarter, setting up the good times to keep rolling for the cruise line sector. Royal Caribbean Cruises (NYSE:RCL) also faces a promising travel environment for years ahead. My investment thesis remains Bullish on the stock, even close to all-time highs above $170.

Source: Finviz

Signs Of Strong 2025/26

The general concern with cruise lines was that pent-up demand from COVID lockdowns would lead to a scenario where cruise travel peaks and trails off in future years. Instead, Carnival confirmed the trend for travel growth in 2025 and beyond remains strong, based on bookings reported with the FQ3’24 earnings report.

On the FQ3 earnings release, CEO Josh Weinstein made the following statement about bookings:

With nearly half of 2025 booked and less inventory remaining for sale than the prior year, we are leveraging strong demand to achieve record ticket pricing (in constant currency). Our brands continue to deliver robust bookings momentum, with all our brands ahead on price for 2025 sailings, based on the success of their demand generation efforts along with the exciting offerings and unparalleled experiences we consistently provide our guests. Likewise, 2026 is off to an unprecedented start, achieving record booking volumes in the last three months.

Carnival just reported a booming August quarter where revenue hit an all-time record topping the FY23 numbers by $1 billion. The cruise line still only produced an EPS of $1.27, roughly half of FQ3’29 levels, due to interest expenses on debt and share dilution.

More importantly, the cruise line even suggested the bookings over the last three months were stronger. Carnival has only seen bookings and on-board spending accelerating towards the end of 2024 with no signs of peaking.

JPMorgan analyst Matthew Boss supports the theory of the cruise value spread vs. land-based vacation alternatives reaching 25 to 30%, far above pre-COVID levels. Such a deep discount would continue to support the strong bookings in 2025 and beyond as vacationers look for cheaper travel alternatives.

Growth Mode

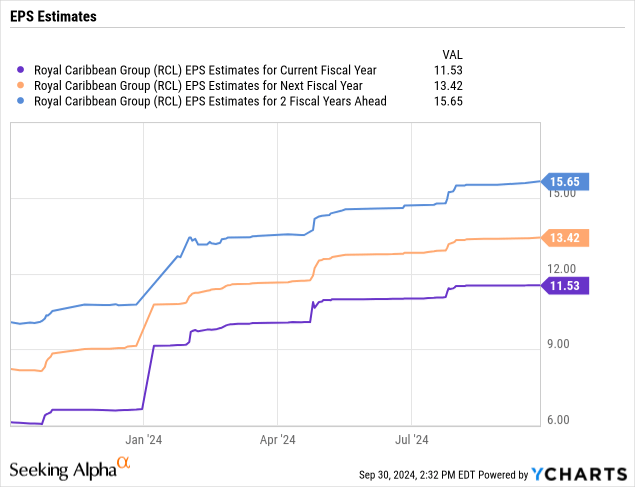

Royal Caribbean already reported booming results for the first half of the year. The cruise line produced a combined EPS of nearly $5 and guided to a 2024 EPS of $11.40.

The Carnival numbers support the thesis that EPS estimates aren’t anywhere close to a peak. The Royal Caribbean consensus estimates for 15% EPS growth over the next few years appears logical now.

The current consensus numbers have FY26 EPS numbers reaching $15.65. The stock only trades at 11x this target, in what once appeared concerning, with the stock already surging pass the pre-COVID peak below $140.

As constantly covered in the recovery from the COVID days, the cruise lines have a lot of debt to payoff and automatically boost EPS. Interest rates are already set for a cut, with the Fed reducing interest rates starting with the first 50 bps cut.

Royal Caribbean just repaid debts from 2020 and 2021 with restrictions on capital returns, and started a dividend. The cruise line now pays an annual dividend of $1.60 providing a yield of nearly 1%.

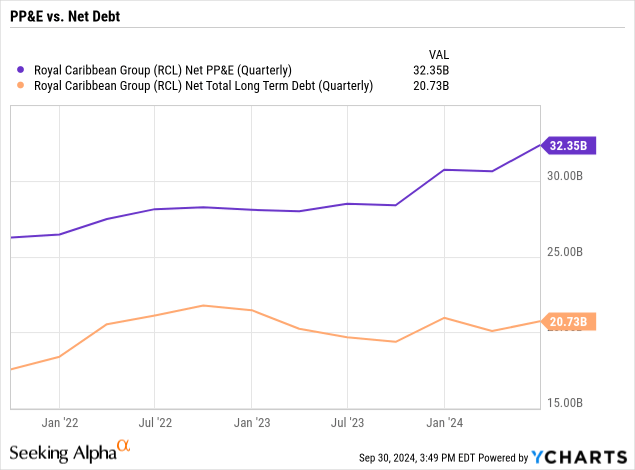

The company still has ~$21 billion in debt after producing $2.9 billion in operating cash flow in the first half, though the purchases of equipment hit $2.4 billion. The free cash flow was limited, but Royal Caribbean cut debt levels while boosting PP&E providing an ~$11.5 billion difference.

While investors will definitely want to keep an eye on net debt levels, a big difference has to be noted between debt levels due to generating losses and those from buying new ships. The cruise line took delivery of Utopia of the Seas and Silver Ray during the last quarter.

With 281 million shares outstanding, Royal Caribbean will spend up to $450 million in annual dividend payouts. The preference would be for the cruise line to repay more debt before paying out dividends.

Either way, the stock remains exceptionally cheap while producing substantial cash flows now to buy new cruise ships, repay debt and return capital to shareholders. The cruise line currently pays nearly $300 million in quarterly interest expenses, and further cutting these expenses would be more ideal.

Takeaway

The key investor takeaway is that Royal Caribbean appears to be correctly investing for the future. The booking curve continues to expand, and the stock is cheap for the opportunity ahead.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market to end Q3, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.